Sample Test - HCC Learning Web

Anuncio

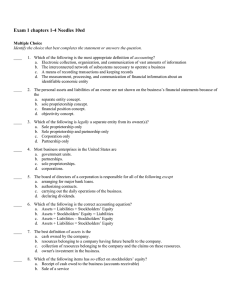

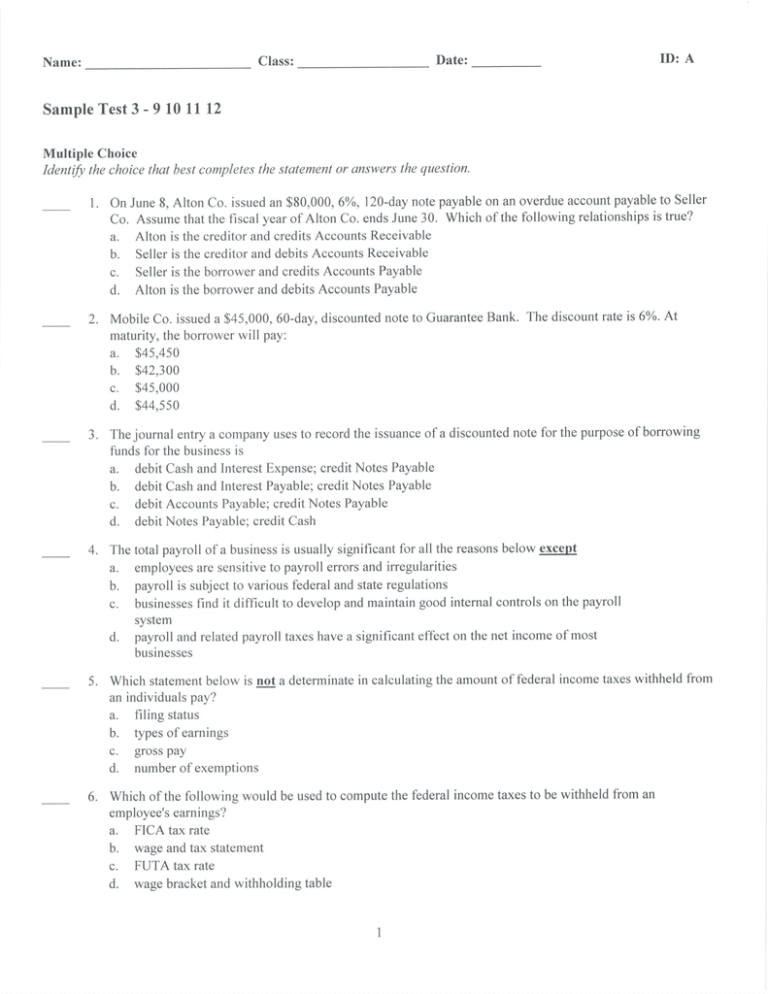

Class: Name: Date: ID: A SampleTest3-910Ll.12 Multiple Choice Identifi the choice that best completesthe statementor answersthe question. 1. On June8, Alton Co. issuedan $80,000,6%o,120-daynote payableon an overdueaccountpayableto Seller Co. Assumethat the fiscal year of Alton Co. endsJune30. Which of the following relationshipsis true? a. Alton is the creditor and creditsAccountsReceivable b. Seller is the creditor and debitsAccountsReceivable c. Seller is the borrower and creditsAccountsPayable d. Alton is the borrower and debitsAccountsPayable 2. Mobile Co. issueda $45,000,60-day,discountednote to GuaranteeBank. The discountrate is 6%. At maturity,the borrower will pay: a. $45,450 b. $42,300 c. $45,000 d. $44,550 3 . Thej ournal entry a companyusesto recordthe issuanceof a discountednote for the purposeof borrowing funds for the businessis a. debit Cashand InterestExpense;credit Notes Payable b. debit Cashand InterestPayable;credit Notes Payable c. debit AccountsPayable;credit Notes Payable d. debit Notes Payable;credit Cash 4. The total payroll of a businessis usually significantfor all the reasonsbelow exceDt a. employeesare sensitiveto payroll errorsand irregularities b. payroll is subject to various federal and stateregulations find it difficult to developand maintaingood internal controls on the payroll c. businesses system d. payroll and relatedpayrolltaxes have a significanteffect on the net income of most businesses 5. Which statementbelow is not a determinatein calculatingthe amountof federal incometaxeswithheld from an individualspay? a. filing status b. types of earnings c. grosspay d. numberof exemptions 6. Which of the following would be usedto computethe federalincometaxesto be withheld from an employee'searnings? a. FICA tax rate b. wage and tax statement c. FUTA tax rate d. wage bracketand withholding table ID: A Name: 7. For which of the following taxes is thereno ceiling on the amountof employeeannualearningssubjectto the tax? a. only Social Securitytax b. only Medicaretax c. only unemploymentcompensationtax d. none ofthe above 8. An employeereceivesan hourly rate of $30, with time and a half for all hours worked in excessof 40 during a week. Payroll data for the current week are as follows: hours worked,46; federalincometax withheld, $300; cumulativeearningsfor year prior to currentweek, $90,700;social securitytax rate, 6.IYoon maximum of $100,000;and Medicaretax rate,l.5o/oon all earnings. What is the net amountto be paid the employee? a. $1,470 b. $1,059.75 c. $1,381.80 d. $1,249.50 9. Payrolltaxesleviedagainstemployeesbecomeliabilities a. the first of the following month b. at the time the payroll is paid c. when earnedby the employee d. at the end ofan accountingperiod 10. Which of the following are included in the employer'spayroll taxes? a. SUTA taxes b. FUTA taxes c. FICA taxes d. all ofthe above 11. Eachyear there is a ceiling for the amountthat is subjectto all of the following except a. Social securitytax b. Federalincometax c. federalunemploymenttax d. stateunemploymenttax 12. Most employersare levied a tax on payrolls for a. salestax b. medical insurancepremiums c. federalunemploymentcompensationtax d. union dues 13. Payroll entriesare madewith data from the a. wage and tax statement b. employee'searningrecord c. employer'squarterlyfederaltax return d. payroll register ID: A Name: 14. The employeeearningsrecord would containwhich column that the payroll registerwould probablynot contain? a. deductions b. payment c. earnings d. cumulativeearnings 15. The following totals for the month of Junewere taken from the payroll registerof Arcon Company: Salariesexpense Socialsecurityand Medicare Taxeswithheld IncomeTaxeswithheld RetirementSavinss $13,000 975 2,600 500 Salariessubjectto federal and stateunemployment taxesof6.2 percent 4,000 The entry to recordthe accrualof employer'spayrolltaxes would include a a. debit to Payroll TaxesExpensefor $1,223 b. creditto SocialSecurityand MedicareTax Payablefor $1,950 c. debit to Payroll Taxes Expensefor $248 d. Debit to Payroll Tax Expensefor $975 16. The following totals for the month of April were takenfrom the payroll registerof Magnum Company. $ I 0,000 Salaries 850 FICA taxeswithheld 2,000 Incometaxeswithheld 450 Medical insurancedeductions 420 Unemployment Taxes The entry to record accrualof employer'spayroll taxeswould include a a. debitto PayrollTax Expensefor $1,270. b. credit to FICA Taxes Payablefor $ 1,700. c. credit to Payroll Tax Expensefor $420. d. debitto PayrollTax Expensefor $2,120. 17. Assumethat social securitytaxesare payableat a 6ohrate on the first $ 100,000of earningsand medicare taxesare payableat a 1.5Yorate with no maximum earnings,and that federaland stateunemployment compensationtaxes total4.6%oon the first $7,000of earnings. If an employee,GeorgeJones,earns$2,500 earningsbeforethis week were $6,800,what is the total payroll for the currentweek and Jones'year-to-date taxesrelatedto the current week? a. $187.50 b . $1 9 6 . 7 0 c. $344.50 d. noneofthe above ID: A Name: 18. A disadvantageofthe corporateform ofbusinessentity is a. mutual agencyfor stockholders b. unlimited liability for stockholders c. corporationsare subjectto more governmentalregulations d. the easeof transferof ownership 19. Which one of the following would no! be consideredan advantageof the corporateform of organization? a. Governmentregulation b. Separatelegal existence c. Continuouslife d. Limited liability of stockholders 20. The ability of a corporationto obtain capital is a. lessthan a partnership. b. aboutthe sameas a partnership. c. restrictedbecauseof the limited life of the corporation. d. enhancedbecauseof limited liability and easeof sharetransferability. sectionof the 21. Which of the following accountsbelow is reportedin the paid-in capital/stockholders'equity corporatebalancesheet? a. Cash b. StockDividends c. OrganizationalExpenses d. PreferredStock 22. Menitt Companyacquireda building valuedat $190,000for propertytax purposesin exchangefor 12,000 sharesof its $5 par common stock. The stock is widely tradedand selling for $ 15 per share.At what amount shouldthe building be recordedby Menitt Company? a. $60,000 b . $1 8 0 , 0 0 0 c. $ 190,000 d. $10,000 23. The authorizedstock ofa corporation a. must be recordedin a formal accountingentry. b. only reflectsthe initial capital needsof the company. c. is indicatedin its by-laws. d. is indicatedin its charter. 24. If commonstock is issuedfor an amountgreaterthan par value,the excessshouldbe creditedto a. RetainedEarninss. b. Cash. c. Legal Capital. d. Paid-in Capital in Excessof Par Value. ID: A Name: 25. Nexis Corp. issues1,000sharesof $ 15 par value commonstock at $25 per share. When the transactionis recorded,creditsare madeto: a. CommonStock$15,000and Paid-inCapitalin Excessof Par Value $10,000, b. CommonStock$25,000and RetainedEarnings$15,000. c. CommonStock$15,000and Paid-inCapitalin Excessof StatedValue $10,000. d. CommonStock$25,000. 26. On Januaryl, 20xx, SwensonCorporationhad 40,000sharesof $10 par value common stock issuedand outstanding.All 40,000 shareshad been issuedin a prior period at $20.00per share. On Februaryl,20xx, Swensonpurchased3,000 sharesoftreasury stock for $21 per shareand later sold the treasurysharesfor $24 per shareon March l, 20xx. The j ournal entry to record the purchaseof the treasuryshareson February I , 20xx, would includea a. credit to TreasuryStock for $63,000. b. debit to TreasuryStock for $63,000. c. debitto a lossaccountfor $9,000 d. credit to a gain accountfor $9,000. 27. The dateon which a cashdividend becomesa binding legal obligation is on the a. declarationdate. b. dateofrecord. c. paymentdate. d. last day ofthe fiscal year end. 28. How is treasurystock shown on the balancesheet? a. as an asset b. as a decreasein stockholders'equity c. as an increasein stockholders'equity d. treasurystock is not shown on the balancesheet 29. The excessofsales price oftreasury stock over its cost shouldbe creditedto a. TreasuryStock Receivable b. Premiumon Capital Stock c. Paid-InCapital from Saleof TreasuryStock d. lncome from Sale of TreasuryStock 30. A corporationpurchased1,000sharesof its $5 par commonstock at $ 10 and subsequentlysold 500 of the sharesat $20. What is the amount of revenue realizedfrom the sale? a. $0 b. $5,000 c. $2,500 d. $10,000 31. In which sectionof the balancesheetwould TreasuryStockbe reported? a. Fixed assets b. Long-termliabilities c. Stockholders'equity d. Intansibleassets ID: A Name: 32. In which sectionof the financial statementswould Paid-InCapital from Saleof TreasuryStockbe reported? a. other expenseon income statement b. intangibleasseton balancesheet c. stockholders'equityon balancesheet d. other incomeon income statement sectionof the balancesheet? 33. Which of the following amountsshouldbe disclosedin the stockholders'equity a. the numberof sharesof common stock outstanding b. the numberof sharesof common stock issued c. the numberof sharesof common stock authorized d. all ofthe above 34. Retainedearnings a. is the sameas contributedcapital b. cannothave a debit balance c. changesare summarizedin the retainedearningsstatement d. over time will have a direct relationshipwith the amountof cashon hand if the corporationis profitable 35. Which of the following would result in a credit to retainedearnings? a. a net loss for the period of an expensein a prior period b. an understatement c. d. a stocksplit of a revenuein the prior period an understatement 36. Investorswho are most interestedin the dividendyield are thosewho invest for a. marketprice appreciation b. currentincome flow c. both marketprice appreciationand current incomeflow d. neithermarket price appreciationor currentincomeflow 37. Dividend yield is most often computedon a. all common stock b. all preferredstock c. both common and preferredstock d. only common stock sold abovepar 38. A corporationhas 50,000 sharesof$28 par value stock outstandingthat has a currentmarketvalue of$150. If the corporationissuesa 4-for-l stock split, the marketvalue of the stock will fall to approximately a. $7 b. $112 c. $37.50 d. $600 Name: ID: A 39. Which of the following statementsis not true about a 2-for-l split? a. Par value per shareis reducedto half of what it was beforethe split. b. Total contributedcapital increases. c. The marketprice will probably decrease. d. A stockholderwith ten sharesbeforethe split owns twenty sharesafter the split. 40. A corporationhas 50,000 sharesof $25 par value stock outstandingthat has a currentmarketvalue of $150. lf the corporationissuesa 5-for-1 stock split, the marketvalue of the stock will fall to approximately: a. $25 b. no chansed c. $) d. $30 41. Which of the following is not one of the four basicfinancial statements? a. balancesheet b. statementof cashflows c. statementof changesin financial position d. incomestatement 42. A ten-yearbond was issuedat par for $250,000cash. This transactionshouldbe shown on a statementof cashflows under a. investingactivities b. financingactivities c. noncashinvestingand financing activities d. operatingactivities 43. The statementof cashflows may be usedby managementto a. assess the liquidity of the business b. assessthe major policy decisionsinvolving investmentsand financing c. determinedividendpolicy d. do all ofthe above 44. Cashdividendsof $85,000were declaredduringthe year. Cashdividendspayablewere $10,000and $15,000at the beginningand end of the year, respectively.The amountof cashfor the paymentof dividends duringtheyear is a. $90,000 b. $80,000 c. $95,000 d. $75,000 45. In calculatingcashflows from operatingactivitiesusing the indirect method,a gain on the saleof equipment is a. addedto net income. b. deductedfrom net income. c. ignoredbecauseit doesnot affect cash. d. not reportedon a statementof cashflows. ID: A SampleTest3 - 9 10 ll 12 AnswerSection MULTIPLE CHOICE DIF: Easy L ANS: D PTS: 1 NAT: AACSBAnalyticIAICPA FN-Measurement DIF: Moderate PTS: I 2. ANS: C NAT: AACSBAnalyticI AICPA FN-Measurement DIF: Easv PTS: I 3. ANS: A NAT: AACSBAnalyticI AICPA FN-Measurement DIF: Easv PTS: I 4. ANS: C NAT: AACSBAnalyticI AICPA FN-Measurement DIF: Easy PTS: 1 5. ANS: B NAT: AACSBAnalyticIAICPA BB-Legal DIF: Easv PTS: I 6. ANS: D NAT: AACSBAnalyticIAICPA BB-Legal DIF: Easv PTS: I 7. ANS: B NAT: AACSBAnalyticIAICPA BB-Legal DIF: Moderate PTS: I 8. ANS: B NAT: AACSBAnalyticI AICPA FN-Measurement DIF: Easv PTS: I 9. ANS: B NAT: AACSBAnalyticI AICPA FN-Measurement DIF: Easy PTS: 1 10. ANS: D NAT: AACSBAnalyticIAICPA BB-Legal DIF: Easv PTS: I ll. ANS: B NAT: AACSBAnalyticIAICPA BB-Legal DIF: Easy PTS: I 12. ANS: C NAT: AACSBAnalyticI AICPABB-Legal DIF: Easy PTS: I 13. ANS: D FN-Measurement AACSB Analyic NAT: IAICPA DIF: Easy PTS: I 14. ANS: D NAT: AACSBAnalyticIAICPA FN-Measurement DIF: Moderate PTS: I 15. ANS: A NAT: AACSBAnalyticI AICPA FN-Measurement DIF: Moderate PTS: I 16. ANS: A NAT: AACSBAnalyticIAICPA FN-Measurement DIF: Moderate PTS: I 17. ANS: B NAT: AACSBAnalyticI AICPA FN-Measurement DIF: EasY PTS: I 18. ANS: C BB-Industry AICPA NAT: AACSBAnalyticI DIF: EasY PTS: I 19. ANS: A NAT: AACSBAnalyticI AICPA BB-Legal DIF: EasY PTS: I 20. ANS: D NAT: AACSBAnalyticI AICPA BB-Industry OBJ: 11-01 OBJ: 11-01 OBJ: ll-01 OBJ: 11-02 OBJ: ll-02 OBJ: ll-02 OBJ: 11-02 OBJ: 1l-02 OBJ: ll-02 OBJ: ll-02 OBJ: ll-02 OBJ: 11-02 OBJ: 11-03 OBJ: 11-03 OBJ: 11-03 OBJ: ll-03 OBJ: ll-03 OBJ: 13-01 OBJ: 13-01 OBJ: 13-01 ID: A 21. ANS: D PTS: I DIF: Easy NAT: AACSBAnalyticI AICPA FN-Measurement 22. ANS: B PTS: 1 DIF: Easy NAT: AACSBAnalyticI AICPA FN-Measurement 23. ANS: D PTS: I DIF: Easy NAT: AACSBAnalyticIAICPA BB-Legal 24. ANS: D PTS: I DIF: Easy NAT: AACSBAnalyticI AICPA FN-Measurement 25. ANS: A PTS: 1 DIF: Easy NAT: AACSBAnalyticIAICPA FN-Measurement 26. ANS: B PTS: I DIF: Moderate NAT: AACSBAnalyticI AICPA FN-Measurement 27. ANS: A PTS: I DIF: Easy NAT: AACSBAnalyticIAICPA BB-Legal 28. ANS: B PTS: I DIF: Easy NAT: AACSBAnalyticI AICPA FN-Measurement 29. ANS: C PTS: I DIF: Easy NAT: AACSBAnalyticIAICPA FN-Measurement DIF: Easy 30. ANS: A PTS: I NAT: AACSBAnaly'ticI AICPA FN-Measurement 31. ANS: C PTS: 1 DIF: Easy NAT: AACSBAnalyticIAICPA FN-Measurement DIF: Easy 32. ANS: C PTS: 1 NAT: AACSBAnalyticIAICPA FN-Measurement 33. ANS: D PTS: I DIF: Easy NAT: AACSBAnalyticIAICPA FN-Measurement 34. ANS: C PTS: I DIF: Easy NAT: AACSBAnalyticIAICPA FN-Measurement 35. ANS: D PTS: I DIF: Easy NAT: AACSBAnalyticI AICPA FN-Measurement 36. ANS: B PTS: I DIF: Easy NAT: AACSBAnalyticIAICPA BB-Industry DIF: Easy 37. ANS: A PTS: I NAT: AACSBAnalyticIAICPA FN-Measurement 38. ANS: C PTS: 1 DIF: Easy NAT: AACSBAnalyticIAICPA FN-Measurement PTS: I DIF: Moderate 39. ANS: B NAT: AACSBAnalyticIAICPA FN-Measurement PTS: I DIF: Moderate 40. ANS: D NAT: AACSBAnallic I AICPA FN-Measurement 41. ANS: C PTS: I DIF: Easy NAT: AACSBAnalyticIAICPA FN-Reporting DIF: Easy 42. ANS: B PTS: I NAT: AACSBAnalyticIAICPA FN-Measurement DIF: Easy 43. ANS: A PTS: I NAT: AACSBAnalvticIAICPA FN-Measurement OBJ: 13-03 OBJ: 13-03 OBJ: 13-03 OBJ: 13-03 OBJ: 13-03 OBJ: 13-03 OBJ: 13-04 OBJ: 13-05 OBJ: 13-05 OBJ: 13-05 OBJ: 13-05 OBJ: 13-05 OBJ: 13-06 OBJ: 13-06 OBJ: 13-06 OBJ: 13-06 OBJ: 13-06 OBJ: 13-07 OBJ: 13-07 OBJ: 13-07 OBJ: 16-01 OBJ: 16-01 OBJ: 16-01 ID: A 44. ANS: NAT: 45. ANS: NAT: PTS: I DIF: Easy B AACSBAnalyticIAICPA FN-Measurement B PTS: 1 DIF: Moderate AACSBAnalvticI AICPAFN-Measurement OBJ: 16-02 OBJ: 16-02