G ru p o P ro seg u r – R esu lts 1 H alf 200 9

Anuncio

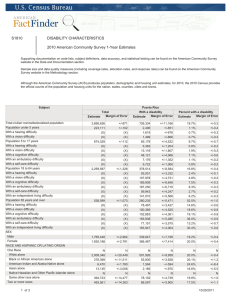

Grupo Prosegur – Results 1st Half 2009 Madrid, 30th July 2009 Growth +3.9% 1,025.3 Executive summary In Million Euros Sales Sales 987.3 1H 2009 Profitability +5.4% 10.1% 103.5 9.9% 1H 2009 98.2 EBITA/ EBITA/EBIT EBIT Margin 1H 2008 Total Growth Maintaining levels of profitability achieving double-digit 1H 2008 Strong growth trend, mainly due to the organic growth: margins. The EBITA margin has improved by 0.2 percentage points compared to 1H 2008 (+1.9%) with the following breakdown : +4.7% “Pure” organic growth - 2.7% due to negative impact of exchange rates 2 Overview of Grupo Prosegur 1H 2009 financial results In Million Euros Taxes % Margin Profit Before Taxes Financial Results % Margin EBIT Depreciation % Margin EBITDA Sales 0.2 62.0 -29.2 9.2% 91.1 -7.0 9.9% 98.2 -25.0 12.5% 123.2 987.3 1H 2008 64.7 0.4 64.3 -32.2 9.4% 96.5 -7.0 10.1% 103.5 -28.9 12.9% 132.4 1,025.3 1H 2009 +7.5% +3.9% Var. Profit and Loss Account Net Profit 62.1 6.3% +4.2% +3.8% +5.9% +5.4% Net Consolidated Profit 6.3% Minority Interests % Margin 3 Sales analysis In Million Euros Depreciati on % Margin EBITDA Sales 98.2 -25.0 12.5% 123.2 987.3 1H 2008 10.1% 103.5 -28.9 12.9% 132.4 1,025.3 1H 2009 +7.5% +3.9% Var. Profit and Loss Account EBIT 9.9% +4.2% +3.8%. +5.9% +5.4% % Margin 9.4% -7.0 9.2% -32.2 -7.0 -29.2 64.3 Financial R esults % Margin 62.0 0.4 96.5 Taxes 0.2 64.7 91.1 Net Profit 62.1 6.3% Profit Before Taxes Net Consolidated Profit 6.3% Minority Interests % Margin Total +3.9% Organic +1.9% 1H 2009 1.006,5 + 18.8 1.025.3 Breakdown of sales growth 987.3 1H 2008 Sales from acquisitions: • Valtis – France • Giasa – Argentina • Ryes – Mexico • Setha – Brazil • Centuria – Brazil • Telemergencia and Punta Systems – Prosegur Activa The “pure” organic growth was +4.7%, having the exchanges rates a negative impact of -2.7% 4 Operating margin analysis In Million Euros Taxes % Margin Profit Before Taxes Financial R esults % Margin EBIT Depreciati on % Margin EBITDA Sales 0.2 62.0 -29.2 9.2% 91.1 -7.0 9.9% 98.2 -25.0 12.5% 123.2 987.3 1H 2008 64.7 0.4 64.3 -32.2 9.4% 96.5 -7.0 10.1% 103.5 -28.9 12.9% 132.4 1,025.3 1H 2009 +7.5% +3.9% Var. Profit and Loss Account Net Profit 62.1 6.3% +4.2% +3.8%. +5.9% +5.4% Net Consolidated Profit 6.3% Minority Interests % Margin 9.5% 10.3% 10.2% Evolution of EBITA margin 10.4% 1Q 2008 2Q 2008 3Q 2008 4Q 2008 10.7% 1Q 2009 9.5% 2Q 2009 5 % Margin Profit Before Taxes Financial R esults % Margin EBIT Depreciati on % Margin EBITDA Sales 62.0 -29.2 9.2% 91.1 -7.0 9.9% 98.2 -25.0 12.5% 123.2 987.3 1H 2008 0.4 64.3 -32.2 9.4% 96.5 -7.0 10.1% 103.5 -28.9 12.9% 132.4 1,025.3 1H 2009 +7.5% +3.9% Var. +5.9% +3.8%. +4.2% • Tax rates have increased by 1.4 percentage points, moving from 32.0% in 1H 2008 to 33.4% in the current financial year Overview of tax charges • The adjustments to foreign exchange rates and derivatives contracted by the Group in order to neutralize the impact of fluctuations in exchange rates and interest rates had a total net impact of € -0.8 million • The pure financial expenses reached € 6.2 million (vs. € 10.1million) which implies a decrease of € 3.9 million compared to 1H2008. This decrease is due to the reduction of the average cost of debt during the first half of 2009 In the first half of 2009, the Group's net financial expenses reached the amount of € 7.0 million, the same as in the first half of 2008. The financial expenses breakdown is as follows: Overview of Financial Results Financial and Tax results analysis In Million Euros Taxes 0.2 64.7 Profit and Loss Account Net Profit 62.1 6.3% +5.4% Net Consolidated Profit 6.3% Minority Interests % Margin 6 Non Current Assets Tangible fixed assets Goodwill Intangible asset s Available-for-sale financial assets and others Assets due to deferred tax 1,442.5 732.0 24.4 492.8 0.4 7.3 207.1 710.5 281.7 270.5 75.9 34.5 47.9 423.0 37.0 -40.2 425.6 0.6 1,484.9 703.1 26.3 523.1 0.4 153.3 781.8 310.0 304.3 79.5 35.7 52.3 Abridged balance sheet In Million Euros Current Assets Inventories Customers and other receivables Available-for-sale non current asset s Derivative financial instruments Cash equivalents and other financial asset s 424.6 37.0 -29.4 416.0 1.0 379.9 169.1 0.8 210.0 30/06/2009 Net Equity Share capital Treasury share Accumulated difference and others reserve s Minority interests 403.5 222.5 0.3 180.7 682.0 153.8 1.2 446.8 80.2 31/12/2008 Non Current Assets Long term bank loans Derivative financial instruments Other non current assets 614.4 133.1 1.5 387.0 92.8 1,484.9 ASSETS Current Liabilities Short term bank loans Derivative financial instruments Suppliers and other payables Other current liabilities 1,442.5 TO TAL NE T EQUITY AND LIABILITIES 7 52.0 5.3% 1H 2008 147 Sep. 08 Dec. 08 143 37.6 3.7% 1H 2009 172 Mar. 09 Jun. 09 171 Portugal: € 137 million in 1H 2009 securitization of the client portfolio in Spain and million. This value includes the effect of the The company's net banking debt amounted € 171 /building million of extraordinary investments in land Note: The 1H2008 Capex figure includes € 12 continuous innovation objective of searching for operational excellence and Maintenance of a strong investment policy w ith the Investments and Net Banking Debt evolution In Million Euros Capex Capex % over sales Jun. 08 154 Net NetBanking BankingDebt Debt 195 Mar. 08 8 1,025.3 + Sales EBIT Sales +3.3% 964.4 9.1% 87,5 9.3% 1H 2009 86.5 1H 2008 21.5% 11.6 54.1 1H 2009 26.3% 16.0 60.9 +12.7% Residential Security Services Margin 933.3 Corporate Security Services Breakdown of Grupo Prosegur results by business areas In Million Euros +3.9% +5.4% 10.1% 103.5 9.9% 1H 2009 98.2 987.3 Total Grupo Prosegur Sales EBIT Margin 1H 2008 EBIT Margin 1H 2008 9 Corporate Security Services 10 964.4 + Europe Sales EBIT Margin LatAm 34.5 5.9% 34.1 -1.4% 5.9% 1H 2009 576.5 576.5 1H 2008 +11.2% 53.4 388.0 51.8 13.8% 348.8 EBIT 14.9% 1H 2009 Sales 584.4 Breakdown of 1H 2009 Corporate Security Services results by geographic regions In Million Euros +3.3% +1.2% 9.1% 87.5 9.3% 1H 2009 86.5 933.3 Total 1H 2009 Corporate Security Services Sales EBIT Margin 1H 2008 Margin 1H 2008 11 Total Europe 584.4 1H 2008 -3.6% 441.2 -1.4% 576.5 1H 2009 4.2 Total Growth +2.4% 4.3 Note: Romania consolidates at 50% Romania Corporate Security Services: European Revenues 63.1 +10.3% Total sales. In Million Euros +3.8% 67.8 57.2 France Portugal 65.3 Spain 457.7 12 +3.6% 15.5 Total LatAm 348.8 +11.2% 1H 2008 388.0 1H 2009 Brazil 172.1 174.3 Total Growth Note: The growth is +13.3% without considering the exchange rate effect Argentina Area* +27.6% 126.9 Note: The growth is +28.8% without considering the exchange rate effect 99.4 +1.3% Corporate Security Services: Latin-American Revenues 7.6 +238.7% Total sales. In Million Euros Mexico 2.2 27.7 +26.1% Note: The growth is +14.4% without considering the exchange rate effect 14.9 Note: The growth is +285% without considering the exchange rate effect Colombia Peru 22.0 36.0 -5.6% Note: The growth is +19.6% without considering the exchange rate effect Chile 38.2 Note: The growth is +3.2% without considering the exchange rate effect * Argentina, Uruguay and Paraguay 13 Slight deterioration of volumes in Spain, not significant in any of the particular businesse s Good performance in Portugal and France, which includes the positive effect of Valtis Revenues increase in Romania by € 0.1 million • Even after the strong negative impact of the exchange rates in Brazil, Argentina, Chile and Colombia, the region has achieved a doubledigit growth in sales LatAm • 1H 2009 margins have shown a slight deterioration in the region. The higher turnover of business in Mexico has been accompanied by higher negative results Brazil Country Jan. 2009 Jan. 2009 Date of Acquisition Corporate Alarms Monitoring (banking sector) Guarding Services Electronic Systems Activ ity ~ 7.8M € ~ 3.3M € ~ 9M € Rev enues 127 580 100 Nº Employees Within the Group's strategy of combining organic and inorganic growth, a number of acquisitions has been executed in 1H 2009 and July 2009 which strengthen our presence in the current markets Acquisitions in the First Half of 2009 and July 2009 (only Corporate Security Services) Margins have been stable in all countries across the region – – – from H1 2008. This is due to: Region sales have dropped 1.4% in 1H 2009, compared to those Europe 1H Highlights of the period • • • Setha Brazil (State of Espiritu Santo) Jan. 2009 250 Company Centuria Argentina ~ 16M € Giasa Valuables Transport and Cash Management France Feb. 2009 Valtis 4,400 Jun. 2009 ~ 31M € Peru Guarding Services Orus, S.A Electronic Systems: fire protection 85 Jun. 2009 ~ 5M € Segmatic Valuables Transport, Cash Management and Guarding Services 6,700 Jul. 2009 ~ 81M € Chile Brazil (not consolidated in 1H 2009) Norsergel 14 Residential Security Services 15 +12.7% +37.9% 60.9 26.3% 16.0 21.5% 1H 2009 297,100 230,466 1H 2008 11.6 54.1 – Total Growth Chile and Punta Systems in Uruguay And EBIT margins due to the strategy of sustainable growth combined with high profitability Seguridad Electrónica S.A in Peru. This acquisition means that Prosegur is present in 6 countries • On June 24th 2009, the Group acquired the100% of Orus – Connections and sales, including the positive effect from incorporating the Telemergencia business in • Strong growth in Prosegur Activa’s business both in: Highlights of the period Residential Security Services 1H 2009 results analysis In Million Euros Sales Sales EBIT EBIT Margin Connections 1H 08 1H 09 16