obs DX E PW PX PZ Y

Anuncio

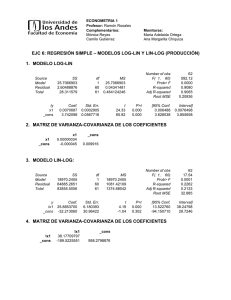

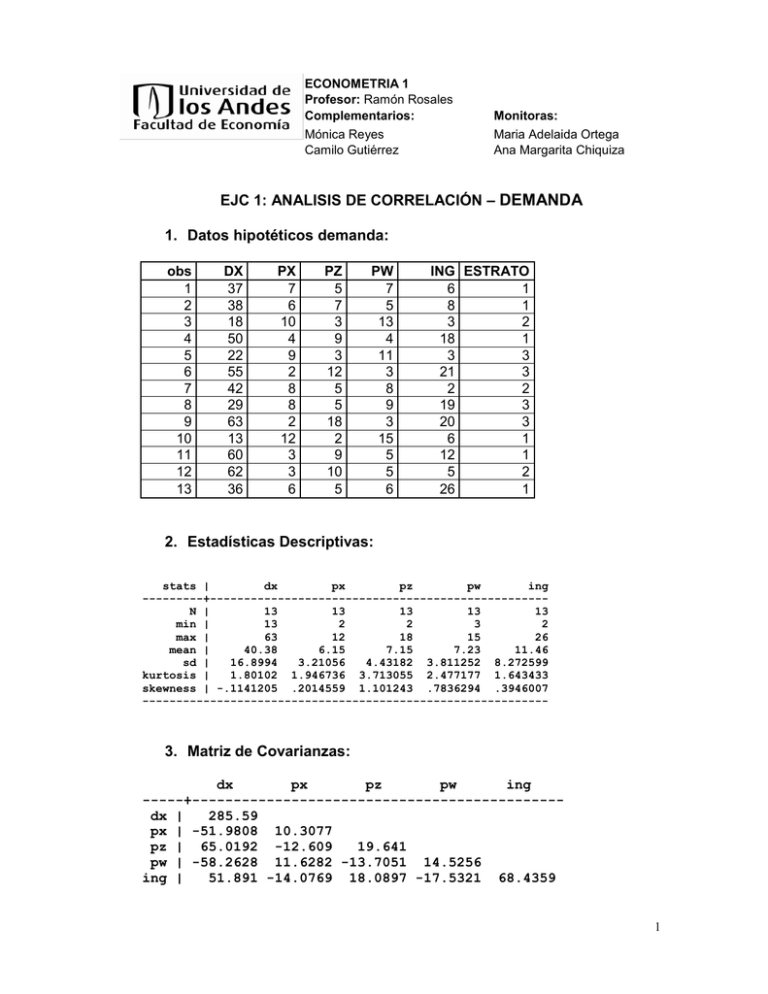

ECONOMETRIA 1 Profesor: Ramón Rosales Complementarios: Mónica Reyes Camilo Gutiérrez Monitoras: Maria Adelaida Ortega Ana Margarita Chiquiza EJC 1: ANALISIS DE CORRELACIÓN – DEMANDA 1. Datos hipotéticos demanda: obs 1 2 3 4 5 6 7 8 9 10 11 12 13 DX 37 38 18 50 22 55 42 29 63 13 60 62 36 PX 7 6 10 4 9 2 8 8 2 12 3 3 6 PZ 5 7 3 9 3 12 5 5 18 2 9 10 5 PW 7 5 13 4 11 3 8 9 3 15 5 5 6 ING ESTRATO 6 1 8 1 3 2 18 1 3 3 21 3 2 2 19 3 20 3 6 1 12 1 5 2 26 1 2. Estadísticas Descriptivas: stats | dx px pz pw ing ---------+-------------------------------------------------N | 13 13 13 13 13 min | 13 2 2 3 2 max | 63 12 18 15 26 mean | 40.38 6.15 7.15 7.23 11.46 sd | 16.8994 3.21056 4.43182 3.811252 8.272599 kurtosis | 1.80102 1.946736 3.713055 2.477177 1.643433 skewness | -.1141205 .2014559 1.101243 .7836294 .3946007 ------------------------------------------------------------ 3. Matriz de Covarianzas: dx px pz pw ing -----+--------------------------------------------dx | 285.59 px | -51.9808 10.3077 pz | 65.0192 -12.609 19.641 pw | -58.2628 11.6282 -13.7051 14.5256 ing | 51.891 -14.0769 18.0897 -17.5321 68.4359 1 4. Matriz de Correlación: | dx px pz pw ing -------------+--------------------------------------------dx | 1.0000 px | -0.9581 1.0000 pz | 0.8681 -0.8862 1.0000 pw | -0.9046 0.9503 -0.8114 1.0000 ing | 0.3712 -0.5300 0.4934 -0.5561 1.0000 5. Diagrama de Dispersión: 12 10 PX 8 6 4 2 60 50 40 30 20 10 DX 2