Monthly Bulletin

Anuncio

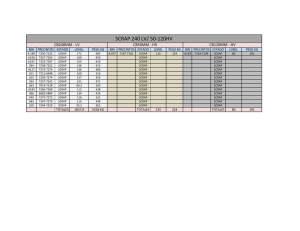

MONTHLY BULLETIN ABOUT CENTRAL GOVERNMENT DEBT MARKETS Baa2 / BBB+ / BBB+ / AL Núm. 263 October 2016 MARKET OVERVIEW CENTRAL GOVERNMENT FINANCING PROGRAM [JANUARY-OCTOBER 2016] Effective amounts in billion Euros 250 221.3 Annual Forecast 191.4 200 Execution 160,000 50 35.0 140,000 120.3 100,000 107.0 84.3 2 60,000 1 40,000 24.2 20,000 Letras del Tesoro Issuance (*) Includes foreign currency issues and other debts Source: General Secretariat of the Treasury and Financial Policy Bonos & Obligaciones Issuance (*) 0 0 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040 2041 2042 2043 2044 2045 2046 2064 2066 Total Net Issuance October 31, 2015 September 30, 2016 October 31, 2016 3 80,000 0 Total Gross Issuance % 4 Letras Bonos and Obligaciones Foreign Currency Other Debt 120,000 100 5 Nominal amounts in million Euros 180,000 150 101.0 SPANISH CENTRAL GOVERNMENT YIELD CURVE ANNUAL DEBT REDEMPTIONS (*) 0.25 0.5 1 3 5 10 15 -1 (*) Year 2016: Redemptions November-December Source: General Secretariat of the Treasury and Financial Policy 30 Years Source: Bloomberg ACUTIONS OCTOBER AUCTION RESULTS 5-year 5-year 10-year Nominal amounts in million Euros % Bonos Bonos Obl. Obl. 10,000 4 €i0,30% 0,75% 1,30% 4,20% 11/30/2021 7/30/2021 10/31/2026 1/31/2037 October 6 October 6 October 6 October 6 October 11 October 11 October 18 October 18 October 20 October 20 October 20 1,459.0 2,449.2 2,822.3 1,485.8 2,931.8 8,657.9 2,656.1 5,070.1 3,123.5 3,133.3 2,000.6 1,459.0 2,413.7 2,822.3 1,293.1 2,931.8 8,086.7 2,656.1 5,070.1 2,957.0 2,812.7 1,760.0 Second round - 35.4 - 192.8 - 571.2 - - 166.5 320.6 240.6 Amount allotted 752.0 1,634.2 1,542.3 1,094.8 550.0 5,252.2 405.0 2,255.0 1,320.2 1,801.3 1,366.6 Auction (2) 752.0 1,598.7 1,542.3 902.1 550.0 4,681.0 405.0 2,255.0 1,153.8 1,480.7 1,126.0 - 35.4 - 192.8 - 571.2 - - 166.5 320.6 240.6 Stop-out price (excoupon)(*) 104.680 103.090 102.020 140.860 - - - - 100.830 144.740 120.400 Stop-out price BID (1st ROUND + 2nd ROUND) ALLOTED (1st ROUND + 2nd ROUND) ALLOTED (2nd ROUND) STOP-OUT-RATE (%) AVERAGE RATE (%) 8,000 Auction date 2.699 3 Auction (1) 2.688 1.783 6,000 1.052 4,000 -0.122 1.770 1 1.072 0 0.088 -0.594 Source: General Secretariat of the Treasury and Financial Policy O 3,45% 7/30/2066 October 20 O 4,20% 1/31/2037 October 6 O 1,30% 10/31/2026 October 6 O 5,90% 7/30/2026 October 20 -0.620 B €i0,30% 11/30/2021 October 6 L12 10/13/2017 October 11 L9 7/14/2017 October 18 L6 4/7/2017 October 11 0 L3 1/20/2017 October 18 -0.248 -0.387 -0.326 -0.299 -0.116 2 0.104 B 0,75% 7/30/2021 October 6 -0.245 -0.386 -0.325 -0.296 B 0,25% 1/31/2019 October 20 2,000 1.043 1.086 Amount bid -1 Second round 6-month 12-month 3-month 9-month 3-year Letras Letras Letras Letras Bonos Obl. Obl. 0,25% 5,90% 3,45% 1/31/2019 7/30/2026 7/30/2066 4/7/2017 10/13/2017 1/20/2017 7/14/2017 50-year 104.852 103.240 102.290 143.770 100.159 100.249 100.098 100.220 101.020 146.150 121.220 Stop-out rate (%) -0.594 0.104 1.086 1.783 -0.325 -0.245 -0.386 -0.296 -0.116 1.052 2.699 Weighted average rate (%) -0.620 0.088 1.072 1.770 -0.326 -0.248 -0.387 -0.299 -0.122 1.043 2.688 Previous stop-out rate (%) -0.087 0.163 1.138 2.537 -0.258 -0.197 -0.421 -0.269 -0.085 1.086 3.493 Bid to cover ratio (1)/(2) 1.94 1.51 1.83 1.43 5.33 1.73 6.56 2.25 2.56 1.90 1.56 (*) Ex-coupon and ex-inflation MONTHLY BULLETIN nº 263 October 2016. Note: Data compiled as at 10/31/2016, unless otherwise specified CENTRAL GOVERNMENT DEBT OCTOBER 2016 MONTHLY BULLETIN ABOUT CENTRAL GOVERNMENT DEBT MARKETS Núm. 263 October 2016 TURNOVER CENTRAL GOVERNMENT TURNOVER EVOLUTION TURNOVER SEPTEMBER 2016 Daily average in million Euros 13.25% vs AUGUST 2016 90,000 2014 80,000 2015 10.07% vs SEPTEMBER 2015 2016 DISTRIBUTION BY COUNTERPARTY Daily average as at 09/30/2016 70,000 60,000 41.72% Transactions between Account Holders: 19,046 mill euros 50,000 40,000 DISTRIBUTION BY TRANSACTION TYPE Daily average as at 09/30/2016 48.14% Outright transactions: 23,061 mill Euros Transactions with Third parties: 20,522 mill euros 30,000 20,000 10,000 Repo transactions: 16,508 mill Euros 51.86% 0 58.28% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Source: Bank of Spain OUTRIGHT TRANSACTIONS IN BONDS AND OBLIGACIONES BETWEEN ACCOUNT HOLDERS OUTRIGHT TRANSACTIONS IN LETRAS BETWEEN ACCOUNT HOLDERS Nominal amounts in million Euros Nominal amounts in million Euros STRIPPING ACTIVITY Nominal amounts in million Euros 80,000 160,000 Electronic market Second tier 140,000 120,000 60,000 100,000 50,000 80,000 40,000 60,000 30,000 40,000 20,000 20,000 10,000 0 O15 N Fuente: Bank Source: Bancoofde Spain España D E F M A M J J A S16 Electronic market 70,000 Second tier 4,000 Reconstitution Gross stripping Strips outstanding (right-hand scale) 3,000 60,000 2,000 40,000 1,000 20,000 0 0 O15 N D J F M A M J Source: Bank of Spain MONTHLY BULLETIN nº 263 October 2016. Note: Data compiled as at 10/31/2016, unless otherwise specified J A S16 80,000 0 O15 N D J F M A M J J A S16 Source: Bank of Spain CENTRAL GOVERNMENT DEBT OCTOBER 2016 2 MONTHLY BULLETIN ABOUT CENTRAL GOVERNMENT DEBT MARKETS Núm. 263 October 2016 DEBT PORTFOLIO BONOS AND OBLIGACIONES DEL ESTADO 6.5 6.45 6.0 5.5 2015 *2016 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 5.0 (*) As at 10/31/2016 Source: General Secretariat of the Treasury and Financial Policy INTERNATIONAL ISSUES FOREING CURRENCY Security Notas Notas Notas Notas Notas Notas Total Millions Coupon Maturity Next coupon Annual % date payment coupons Outstanding € Eqv. US$ Eqv. 124I2 B 2,10 04/30/17 21,582.3 103.0 21,838.0 12,865.6 12783 O 5,50 07/30/17 20,085.8 1,029.2 20,983.6 12,671.0 123R5 B 4,75 (**) 09/30/17 3,902.3 -- 126V0 B 0,50 10/31/17 16,810.3 22.0 16,936.3 9,837.6 123Q7 B 4,50 01/31/18 19,491.9 842.9 20,617.1 12,292.3 127D6 B 0,25 04/30/18 16,824.6 -- 16,943.4 11,592.4 121A5 O 4,10 07/30/18 20,813.4 894.5 22,385.1 14,145.9 124B7 B 3,75 10/31/18 20,417.5 587.2 22,047.9 9,748.3 128A0 B 0,25 (**) 01/31/19 14,950.9 -- 15,045.3 11,358.2 124V5 B 2,75 04/30/19 22,405.2 49.8 23,953.4 13,000.0 121L2 O 4,60 07/30/19 20,758.4 779.7 23,365.6 12,985.5 121O6 O 4,30 126W8 B€i 0,55% (**)(1) 126C0 B 1,40 10/31/19 11/30/19 01/31/20 122D7 O 4,00 04/30/20 21,161.1 8,973.5 21,243.0 23,365.0 1,033.1 -67.6 1,083.6 23,859.4 9,358.7 22,177.7 26,654.6 12,325.0 5,728.4 15,125.9 14,791.4 127H7 B 1,15 07/30/20 17,457.6 -- 18,164.6 11,420.7 122T3 O 4,85 10/31/20 18,387.2 2,259.7 21,863.0 11,734.5 123B9 O 5,50 04/30/21 24,001.9 2,500.0 29,736.2 16,776.8 128B8 B 0,75(**) 07/30/21 16,842.8 -- 17,271.5 9,634.5 128D4 B€i 0,30% (**)(1) 11/30/21 2,975.1 -- 3,110.2 1,719.4 123K0 O 5,85 01/31/22 22,927.1 3,032.3 29,579.4 15,944.2 123U9 O 5,40 01/31/23 21,666.7 498.2 28,206.3 13,767.3 123X3 O 4,40 10/31/23 20,107.6 799.2 25,229.8 9,557.4 121G2 O 4,80 01/31/24 16,868.9 571.2 21,684.2 8,716.3 124W3 O 3,80 04/30/24 21,185.8 974.9 25,797.1 14,515.2 126B2 O 2,75 10/31/24 23,500.0 1,221.4 27,488.0 14,890.8 126A4 O€i 1,80 (**)(1) 11/30/24 10,096.3 -- 11,700.3 5,011.0 126Z1 O 1,60 04/30/25 19,795.1 143.2 20,870.2 8,988.7 122E5 O 4,65 07/30/25 21,731.5 2,156.0 28,400.1 11,538.0 127G9 O 2,15 10/31/25 20,665.9 -- 22,626.1 10,746.4 127Z9 O 1,95 04/30/26 19,626.6 3.6 20,946.5 8,821.9 ES0L01611182 11/18/16 123C7 O 5,90 07/30/26 17,100.1 933.5 24,453.1 10,341.5 ES0L01612099 12/09/16 128H5 O 1,30 (**) 10/31/26 10,298.6 -- 10,332.2 5,792.8 ES0L01701207 124C5 O 5,15 10/31/28 13,672.5 3.1 19,217.8 6,609.8 11868 O 6,00 01/31/29 22,123.3 3,524.9 33,590.9 127A2 O 1,95 07/30/30 18,024.0 20.0 127C8 O€i 1,00 (**)(1) 11/30/30 5,028.7 60% 50% 40% 30% 20% 10% 2015 Non-residents Spanish official institutions Households & non-financials Pension & Mutual Funds Insurance Companies Bank of Spain Resident Credit Institutions (*) As at 09/30/2016 LETRAS DEL TESORO Nominal amounts in million Euros as at 10/31/2016. Market value Third parties holdings 8,305.5 8,307.2 7,465.1 7,035.9 7,038.9 6,536.3 01/20/17 8,282.4 8,289.0 7,189.7 ES0L01702171 02/17/17 6,971.5 6,978.4 5,735.8 12,628.3 ES0L01703104 03/10/17 8,458.7 8,468.7 7,413.7 18,790.9 8,622.9 ES0L01704078 04/07/17 7,137.2 7,146.2 5,175.9 -- 5,329.9 3,119.2 ES0L01705125 05/12/17 7,318.9 7,331.0 6,247.9 Security Maturity Outstanding date volume 20.000 Y(*) 3.133 04/17/17 04/17/17 1 174.0 190.4 12411 O 5,75 07/30/32 19,428.5 3,093.5 30,598.0 10,787.6 ES0L01706164 06/16/17 6,827.2 6,838.9 5,558.6 20.000 Y(*) 3.100 04/21/17 04/21/17 1 174.0 190.4 12932 O 4,20 01/31/37 18,325.3 3,649.3 27,518.0 11,541.8 ES0L01707147 07/14/17 6,687.8 6,700.6 5,594.3 20.000 Y(*) 2.915 12/02/30 12/02/16 2 174.0 190.4 120N0 O 4,90 07/30/40 15,402.3 2,394.1 23,219.0 8,081.5 ES0L01708186 08/18/17 4,282.8 4,292.0 3,651.4 2.000 $(*) 4.000 03/06/18 03/06/17 1 1,827.2 2,000.0 121S7 O 4,70 07/30/41 14,394.8 6,035.8 21,184.1 7,704.0 ES0L01709150 09/15/17 4,477.2 4,487.0 2,967.8 300 $(*) 5.010 11/21/44 11/21/16 1 274.1 300.0 124H4 O 5,15 10/31/44 11,750.4 656.4 18,695.8 7,004.6 ES0L01710133 10/13/17 5,252.2 5,264.1 3,511.9 200 ₤(*) 5.250 04/06/29 04/06/17 1 222.1 243.1 128C6 O 2,90(**) 10/31/46 8,216.4 -- 9,322.1 5,567.9 2,845.2 3,114.4 126D8 O 4,00 (**) 10/31/64 1,000.0 -- 1,437.6 468.3 128E2 O 3,45 (**) 07/30/66 4,366.6 -- 5,196.3 2,762.6 909,412 455,827 (*) Swapped Source: General Secretariat of the Treasury and Financial Policy Total 771,206 41,959 *2016 2014 0% 2013 218.0 2012 -- 70% 2011 6.92 Years 80% 21,453.4 2010 7.0 12,325.8 01/31/17 2009 AVERAGE LIFE OF THE DEBT PORTFOLIO 21,686.4 120J8 O 3,80 2008 (*) Includes loans and assumed debt in euros and euro-legacy currencies 996.5 90% 2007 (84.1%) Third parties holdings 2006 Int'l issues in Euro-legacy currencies & Foreign currency debt Market value stripped principals) 2005 Non-marketable Debt & others (*) (stripped principals are included) 2004 Bonos and Oblig. del Estado Maturity date 2003 (9.1%) Security Registered holdings of non stripped Central Government Debt 100% 2002 Letras del Tesoro Outstandin Stripped g volume volume (only 2001 (0.4%) (6.4%) DISTRIBUTION BY HOLDERS Nominal amounts in million Euros as at 10/31/2016, except non resident holdings. 2000 CENTRAL GOVERNMENT OUTSTANDING DEBT Total 81,037 81,142 67,048 Duration of outstanding Letras (in years): 0,44 Duration of outstanding strippable debt (in years): 6,36 (**) As at 10/31/2016 the stripping has not been authorised (1) Updated by inflation as at 10/31/2016 MONTHLY BULLETIN nº 263 October 2016. Note: Data compiled as at 10/31/2016, unless otherwise specified CENTRAL GOVERNMENT DEBT OCTOBER 2016 3 MONTHLY BULLETIN ABOUT CENTRAL GOVERNMENT DEBT MARKETS Núm. 263 October 2016 TECHNICAL CHARACTERISTICS OF SPANISH CENTRAL GOVERNMENT DEBT MAIN FEATURES OF LETRAS DEL TESORO, BONOSANDY OBLIGACIONES DEL ESTADO 3, 6, 9 & 12-month Letras Face value Interest Method of issuance Minimum bid Final date for bids: Market members Non members Settlement date Payment date Market members Non members 10, 15, 30-year Obligaciones € 1,000 At a discount Annual coupon Auction Auction € 1,000 € 1,000 Auction date Auction date One trading day before the auction One trading day before the auction Three trading days after the auction Three trading days after the auction Settlement date Settlement date One trading day before settlement One trading day before settlement - Personal income The yield (difference between the transfer/redemption and (1) acquisition/subscription price) is taxed as savings income at a rate of 19.5% and no withholding tax is applied. The coupon is taxed as savings at 19.5%(1). A withholding tax of 19.5% is applied. The yield (difference between the transfer/redemption and acquisition/subscription price) is taxed as savings at 19.5%(1) and no withholding tax is applied, except in the "coupon washing" case. - Corporate income tax Yield of all Treasury securities is taxed according to the "accrued interest" principle and no withholding tax is applied with the exception of "coupon washing" cases to which will be applied a withholding tax of 19.5% Residents Taxation 3 & 5-year Bonos € 1,000 Income obtained from Spanish Debt instruments by non-resident individuals or by legal entities that do no operate through a permanent establishment in Spain, will not be subject to tax in Spain. Non residents (1) Rising to 21.5% on the portion of taxable income between €6,000 and €50,000 and to 23.5% on the portion of taxable income over €50,000 Source: General Secretariat of the Treasury and Financial Policy PRIMARY DEALERS (PD) AND REFERENCE PAGES FOR SPANISH GOVERNMENT DEBT ENTITY BANCO COOPERATIVO ESPAÑOL BANKINTER BARCLAYS BANK BBVA B.N.P. PARIBAS BANKIA CAIXABANK CRÉDIT AGRICOLE CIB CECA CITIGROUP GLOBAL MARKETS DANSKE BANK, A/S TYPE OF BONDS AND PRIMARY STRIPS MARKET DEALER (PD) Letras PD Bonos, Obligaciones and Letras PD Bonos, Obligaciones and Letras PD Bonos, Obligaciones and Letras PD Bonos, Obligaciones and Letras PD Bonos, Obligaciones and Letras PD Bonos, Obligaciones and Letras PD Bonos, Obligaciones and Letras PD Bonos, Obligaciones and Letras PD Bonos, Obligaciones and Letras PD Bonos, Obligaciones and Letras PD LETRAS MARKET BLOOMBERG PAGE REUTERS PAGE 91-595-67-33 91-339-78-42 91-339-78-42 BKT 44 203 134 9798 44 207 773 6419 BXEG 91-537-82-37 91-537-82-85 BBGX 33 142 987 283 44 207 595 8771 BPEG 91-423-50-21 91-423-50-21 BKIA 93-404-63-05 93-404-63-05 44 207 214 6125 44 207 214 7466 ENTIDAD TIPO DE CM DEUTSCHE BANK Bonos, Obligaciones and Letras PD Bonos, Obligaciones and Letras PD Bonos, Obligaciones and Letras PD Bonos, Obligaciones and Letras PD Bonos, Obligaciones and Letras PD Bonos, Obligaciones and Letras PD Bonos and Obligaciones PD Bonos, Obligaciones and Letras PD Bonos, Obligaciones and Letras PD Bonos, Obligaciones and Letras PD Bonos, Obligaciones and Letras PD COMMERZBANK BARCEGB GOLDMAN SACHS INTERNATIONAL HSBC FRANCE 0#E4TSY=BPGL JP MORGAN SECURITIES CAIXA CAIXA NOMURA CALY CALYON BANCO SANTANDER NATIXIS 91-596-57-14 91-596-57-14 CECA CECA ROYAL BANK OF SCOTLAND 44 207 986 9343 44 207 986 9143 CGEG SSBEURO01 SOCIÉTÉ GÉNÉRALE 45 33 64 81 23 45 33 64 81 23 DM MORGAN STANLEY & CO. INTERNATIONAL PLC BOLETÍN MENSUAL nº 263 Octubre 2016. Nota: los datos de este boletín están actualizados al 31/10/2016, salvo indicación en contrario Baa2 / BBB+ / BBB+ / AL MERCADO DE MERCADO DE BONOS, OBLIGACIONES Y LETRAS STRIPS PÁGINA EN BLOOMBERG 44 207 545 4539 49 69 9103 2853 DABB 44 20 7475 1216 49 69 1362 7029 DRESDNER 44 207 552 0380 44 207 552 8868 GSGB 33 140 702 514 33 153 670 514 HSED 16 44 207 134 1414 44 207 134 1414 JPEX 33 158 558 096 33 158 558 200 44 207 103 56 09 PÁGINA EN REUTERS EUROGOV HSBCBONO1 HSBCBONO2 NXIG4 NOMX NOEB BSGB BSST 44 207 085 1872 RBSS ABNSPAST01 44 207 676 7384 SXGV SGGOVT 44 207 677 9335 MSEG MSXL 91-257-20-40 91-257-20-65 44 207 085 2628 33 142 133 139 44 207 425 6247 JUNIO 2015 DEUDA DEL ESTADO 1