guide to exporting equipment and obtaining your iva

Anuncio

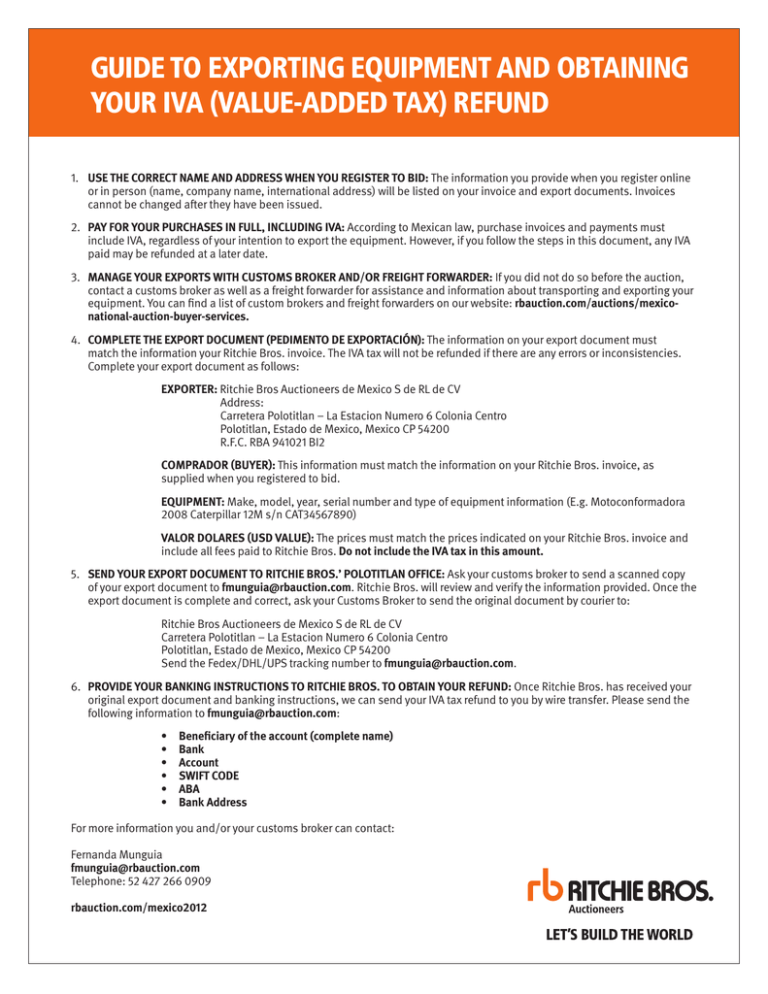

GUIDE TO EXPORTING EQUIPMENT AND OBTAINING YOUR IVA (VALUE-ADDED TAX) REFUND 1. USE THE CORRECT NAME AND ADDRESS WHEN YOU REGISTER TO BID: The information you provide when you register online or in person (name, company name, international address) will be listed on your invoice and export documents. Invoices cannot be changed after they have been issued. 2. PAY FOR YOUR PURCHASES IN FULL, INCLUDING IVA: According to Mexican law, purchase invoices and payments must include IVA, regardless of your intention to export the equipment. However, if you follow the steps in this document, any IVA paid may be refunded at a later date. 3. MANAGE YOUR EXPORTS WITH CUSTOMS BROKER AND/OR FREIGHT FORWARDER: If you did not do so before the auction, contact a customs broker as well as a freight forwarder for assistance and information about transporting and exporting your equipment. You can find a list of custom brokers and freight forwarders on our website: rbauction.com/auctions/mexiconational-auction-buyer-services. 4. COMPLETE THE EXPORT DOCUMENT (PEDIMENTO DE EXPORTACIÓN): The information on your export document must match the information your Ritchie Bros. invoice. The IVA tax will not be refunded if there are any errors or inconsistencies. Complete your export document as follows: EXPORTER: Ritchie Bros Auctioneers de Mexico S de RL de CV Address: Carretera Polotitlan – La Estacion Numero 6 Colonia Centro Polotitlan, Estado de Mexico, Mexico CP 54200 R.F.C. RBA 941021 BI2 COMPRADOR (BUYER): This information must match the information on your Ritchie Bros. invoice, as supplied when you registered to bid. EQUIPMENT: Make, model, year, serial number and type of equipment information (E.g. Motoconformadora 2008 Caterpillar 12M s/n CAT34567890) VALOR DOLARES (USD VALUE): The prices must match the prices indicated on your Ritchie Bros. invoice and include all fees paid to Ritchie Bros. Do not include the IVA tax in this amount. 5. SEND YOUR EXPORT DOCUMENT TO RITCHIE BROS.’ POLOTITLAN OFFICE: Ask your customs broker to send a scanned copy of your export document to fmunguia@rbauction.com. Ritchie Bros. will review and verify the information provided. Once the export document is complete and correct, ask your Customs Broker to send the original document by courier to: Ritchie Bros Auctioneers de Mexico S de RL de CV Carretera Polotitlan – La Estacion Numero 6 Colonia Centro Polotitlan, Estado de Mexico, Mexico CP 54200 Send the Fedex/DHL/UPS tracking number to fmunguia@rbauction.com. 6. PROVIDE YOUR BANKING INSTRUCTIONS TO RITCHIE BROS. TO OBTAIN YOUR REFUND: Once Ritchie Bros. has received your original export document and banking instructions, we can send your IVA tax refund to you by wire transfer. Please send the following information to fmunguia@rbauction.com: • • • • • • Beneficiary of the account (complete name) Bank Account SWIFT CODE ABA Bank Address For more information you and/or your customs broker can contact: Fernanda Munguia fmunguia@rbauction.com Telephone: 52 427 266 0909 rbauction.com/mexico2012