governmental accounting and auditing courses

Anuncio

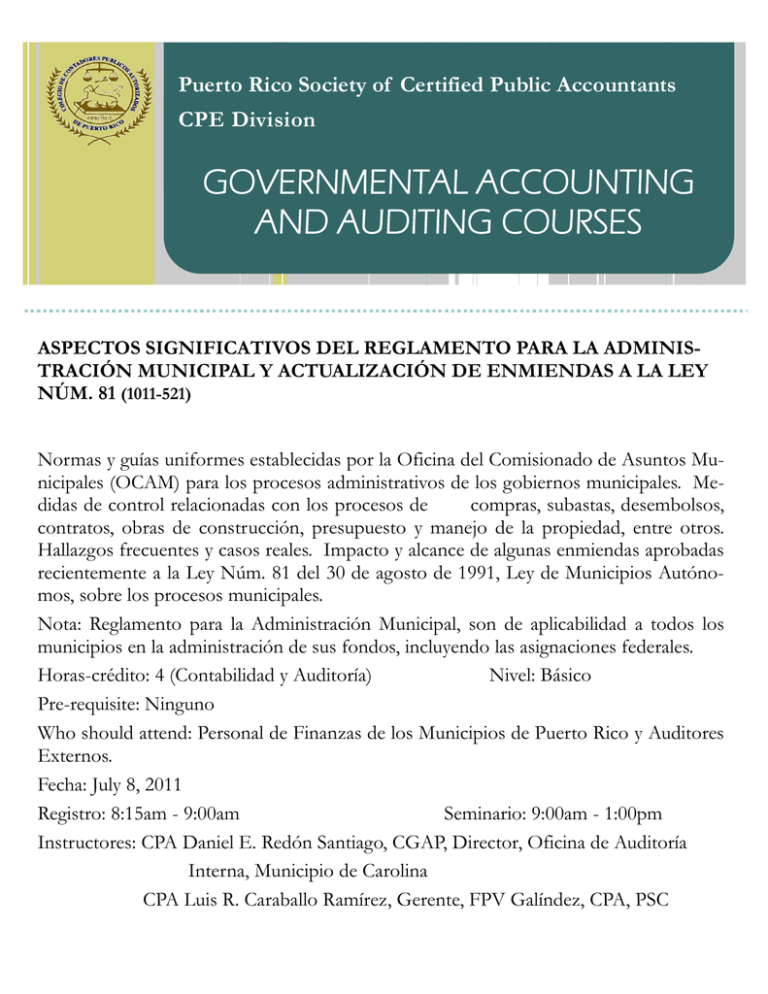

Puerto Rico Society of Certified Public Accountants CPE Division GOVERNMENTAL ACCOUNTING AND AUDITING COURSES ASPECTOS SIGNIFICATIVOS DEL REGLAMENTO PARA LA ADMINISTRACIÓN MUNICIPAL Y ACTUALIZACIÓN DE ENMIENDAS A LA LEY NÚM. 81 (1011-521) Normas y guías uniformes establecidas por la Oficina del Comisionado de Asuntos Municipales (OCAM) para los procesos administrativos de los gobiernos municipales. Medidas de control relacionadas con los procesos de compras, subastas, desembolsos, contratos, obras de construcción, presupuesto y manejo de la propiedad, entre otros. Hallazgos frecuentes y casos reales. Impacto y alcance de algunas enmiendas aprobadas recientemente a la Ley Núm. 81 del 30 de agosto de 1991, Ley de Municipios Autónomos, sobre los procesos municipales. Nota: Reglamento para la Administración Municipal, son de aplicabilidad a todos los municipios en la administración de sus fondos, incluyendo las asignaciones federales. Horas-crédito: 4 (Contabilidad y Auditoría) Nivel: Básico Pre-requisite: Ninguno Who should attend: Personal de Finanzas de los Municipios de Puerto Rico y Auditores Externos. Fecha: July 8, 2011 Registro: 8:15am - 9:00am Seminario: 9:00am - 1:00pm Instructores: CPA Daniel E. Redón Santiago, CGAP, Director, Oficina de Auditoría Interna, Municipio de Carolina CPA Luis R. Caraballo Ramírez, Gerente, FPV Galíndez, CPA, PSC GAA UPDATE: > YELLOW BOOK , SINGLE AUDIT AND RECENT RELATED ISSUES (1112-001) Overview of recent developments in Single Audit and Changes in Yellow Book. A-133 reporting. CPE Credits: 8 (Accounting and Auditing) Level: Intermediate Who should attend: This course is recommended for professionals in the State & Local Government, Higher Education and Not-for-profit Healthcare practices who perform audits under A-133 regulations. Date: August 5, 2011 Registration: 8:15am - 8:45am Seminar: 8:45am - 5:15pm Instructors: Edwin E. Torres Castro, CPA, Partner, PKF, LLP José E. Díaz Martínez, CPA, Partner, Díaz Martínez, CPA, PSC > GASB UPDATE (1112-003) Recent GASB Pronouncements and how these may impact client’s financial statements. Current related exposure drafts. Recent changes to the AICPA’s Audit and Accounting Guide. CPE Credits: 4 (Accounting and Auditing) Level: Intermediate / Advanced Who should attend: Professionals with a fundamental understanding of governmental accounting. Date: September 9, 2011 Registration: 8:15am - 9:00am Seminar: 9:00am - 1:00pm Instructors: Iván Negrón Ramos, CPA, Manager, Deloitte & Touche, LLP José Sierra Martínez, CPA, Senior Manager, Deloitte & Touche, LLP TECHNIQUES FOR EFFECTIVE AND EFFICIENT MONITORING OF SUB-RECIPIENTS FEDERAL FINANCIAL ASSISTANCE PROGRAMS (1112-002) Seminar designed for administrators of federal financial assistance programs at all municipalities and governmental agencies that are responsible for overseeing the use and administration of federal funds by sub-recipients. The course will address several matters that external auditors for Single Audits and the Office of Inspector General from each federal agency usually expect these organizations to do. CPE Credits: 6 (Accounting and Auditing) Level: Intermediate Pre-requisite: At least one year experience in governmental auditing. Who should attend: External auditors of entities subject to the Single Audit Act with at least one year of experience. Date: August 11, 2011 Registration: 8:15am - 9:00am Seminar: 9:00am - 4:00pm Instructors: Henry Flores Neris, CPA, Manager, Parissi, PSC Raymond Rivera Pacheco, CPA, Manager, Parissi, PSC INDEPENDENCE RULES FOR SINGLE AUDITS (1112-004) Single Audit and its evolution, applicability and objectives. Review of the independence requirements under GAAS, Yellow Book and other government regulations. Independence of principal and other auditors of governmental financial statements. Determining the ability to be principal auditor. Principal auditor’s responsibilities. Integrity and objectivity. Situations which may result in independence violations. CPE Credits: 4 (Accounting and Auditing) Level: Intermediate Pre-requisite: Overview of Single Audit or equivalent course. Who should attend: External auditors of entities subject to the Single Audit Act. Date: September 15, 2011 Registration: 8:15am - 9:00am Seminar: 9:00am - 1:00pm Instructors: Luis A. Martínez Renta, CPA, CVA, CFE, Partner, Zayas Morazzani & Co. Ingrid Bithorn Morillo, CPA, Sole Practitioner MUNICIPALITIES ACCOUNTING AND AUDIT WORKSHOP (1112-005) State and Local Governmental accounting and reporting; the foundation and compliance with Law No. 1 for the Municipalities of PR; fund accounting and fund relationship; general fund, special revenue fund, capital project fund, debt service fund, proprietary fund, internal service fund, trust and agency fund. Budgeting, budgetary accounting and reporting; revenue and expenditures accounting - governmental funds; general capital assets and capital assets impairments; general long-term debt. Financial reporting: the basic financial statements and required supplementary information; deriving governmental-wide financial statement and required reconciliations. CPE Credits: 24 (Accounting and Auditing) Duration: 3 days Level: Intermediate Pre-requisite: Six month experience in Governmental Accounting and Reporting. Date: October 21 & 28 & November 4, 2011 Registration: 8:15am - 8:45am Seminar: 8:45am - 5:15pm Instructor: Luis R. Caraballo Ramírez, CPA, Manager, FPV Galíndez, CPA, PSC Governmental Accounting and Auditing Enrollment Form Individual Courses CPA & Foundation (1) Others Prices as of June 1, 2011 (1) 1011-515 (16 crs.) 185 215 1011-516 (8 crs.) 110 130 1011-517 (8 crs.) 110 130 1011-518 (4 crs.) 55 68 1011-519 (4 crs.) 55 68 1011-520 (8 crs.) 110 130 1011-521 (4 crs.) 55 68 1112-001 (8 crs.) 110 130 1112-002 (6 crs.) 82 94 1112-003 (4 crs.) 55 68 1112-004 (4 crs.) 55 68 1112-005 (24 crs.) 260 285 Special Offer When you enroll in 106 - 86 crs. you will receive 20% discount. Membership in good standing Other Discounts Additional Charges 85 - 70 Credits 15 % Less 69 - 40 Credits 10 % Less Registration and payments received the same day of the course $8pp 39 - 24 Credits 5 % Less Note Amount to be payed: Add your courses’ prices, subtract Discounts will be revised and adjusted when a participant cancels enrollment in a course. the corresponding discount, and round to highest dollar. Name Lic. CPA Foundation Member Other Address Firm/Agency Telephone Form of payment: Credit Card Number Fax E-mail Check No. __________ $_________ Cash $_________ Visa American Express MasterCard Expiration Date Return to: Colegio de CPA, Edif. Capital Center 1, 239 Ave. Arterial Hostos, Ste. 1401, Hato Rey, PR 00918-1400 Tel.: (787) 622-0900 Fax: (787) 756-8111 E-mail: cisec@colegiocpa.com