Proposed Tax Reform in Mexico considers CbC Requirements

Anuncio

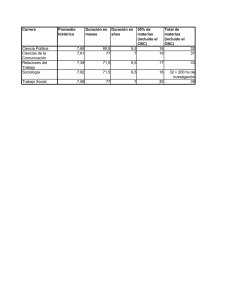

EY TAX Flash Proposed Tax Reform in Mexico considers CbC Requirements On September 8th, a Tax Reform Package including significant transfer pricing disclosure and documentation requirements was presented to the Mexican Congress for review and approval. The proposed transfer pricing provisions included in the reform package consider the main elements of the Guidance on Transfer Pricing documentation and Country-by-Country (CbC) Reporting issued by the OCDE in 2014 to address Action 13 of its BEPS Project. If the proposed requirements are approved as proposed, Mexico would become the fourth country, after the United Kingdom, Spain, and Australia with specific CbC provisions in its tax legislation. The new requirements contemplate an annual obligation for Mexican corporate taxpayers and permanent establishments to file three new information returns; namely, a master information return, a local information return, and a CbC information return. The filing of the CbC information return would be required only from corporations that qualify as Mexican multinational holding companies or those that are designated by the parent company of a foreign multinational group as responsible for filing the CbC Report. These information returns would be required starting in FY 2016 and would be due for the first time by December 31st, 2017. Although it is not yet clear whether the filing of the proposed information returns would be established as a requirement for the deduction of the corresponding payments to foreign related parties, it would be important to consider that current tax legislation in Mexico establishes that the timely and accurate filing of transfer pricing information returns is a pre-requisite for deducting the corresponding amounts. It would also be essential to consider that the tax reform proposal to Congress clearly establishes that failure to file the proposed information returns would be penalized by disqualifying the taxpayer from entering into contracts with the Mexican public sector. For additional information with respect to this alert, please contact the following professionals: Jorge Castellón jorge.castellon@mx.ey.com Mónica Cerda monica.cerda@mx.ey.com Alma Gutiérrez alma.gutierrez@mx.ey.com EY Aseguramiento | Asesoría | Fiscal | Transacciones Acerca de los Servicios Fiscales de EY Su negocio sólo alcanzará su verdadero potencial si lo construye sobre sólidos cimientos y lo acrecienta de manera sostenible. En EY creemos que cumplir con sus obligaciones fiscales de manera responsable y proactiva puede marcar una diferencia fundamental. Por lo tanto, nuestros 25,000 talentosos profesionales de impuestos, en más de 135 países, le ofrecen conocimiento técnico, experiencia en negocios, metodologías congruentes y un firme compromiso de brindar un servicio de calidad, en el lugar del mundo dondequiera usted se encuentre y sin importar el servicio fiscal que necesite. Así es como EY marca la diferencia. Ricardo González ricardo.gonzalezmtz@mx.ey.com Gabriel Lambarri gabriel.lambarri@mx.ey.com Para mayor información visite www.ey.com/mx Alberto Peña alberto.pena@mx.ey.com © 2015 Mancera, S.C. Integrante de EY Global Derechos reservados Enrique González enrique.gonzalezcruz@mx.ey.com EY se refiere a la organización global de firmas miembro conocida como EY Global Limited, en la que cada una de ellas actúa como una entidad legal separada. EY Global Limited no provee servicios a clientes. Koen van’ t Hek koen.van-t-hek@mx.ey.com Este boletín ha sido preparado cuidadosamente por los profesionales de EY, contiene comentarios de carácter general sobre la aplicación de las normas fiscales, sin que en ningún momento, deba considerarse como asesoría profesional sobre el caso concreto. Por tal motivo, no se recomienda tomar medidas basadas en dicha información sin que exista la debida asesoría profesional previa. Asímismo, aunque procuramos brindarle información veráz y oportuna, no garantizamos que la contenida en este documento sea vigente y correcta al momento que se reciba o consulte, o que continuará siendo válida en el futuro; por lo que EY no se responsabiliza de eventuales errores o inexactitudes que este documento pudiera contener. Derechos reservados en trámite. Document EY - Méxicotitle Additional text