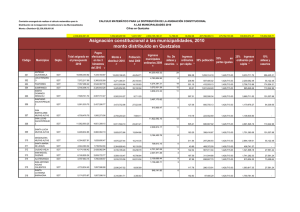

monto distribuido en Quetzales Asignación

Anuncio

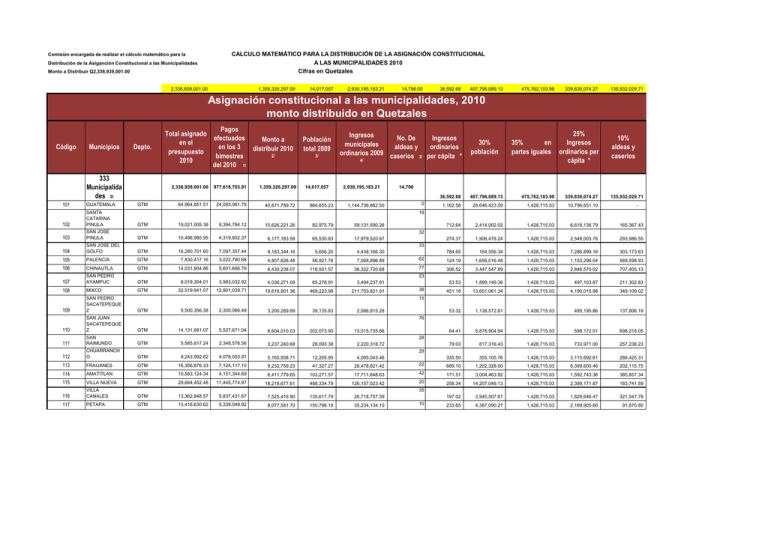

CALCULO MATEMÁTICO PARA LA DISTRIBUCIÓN DE LA ASIGNACIÓN CONSTITUCIONAL A LAS MUNICIPALIDADES 2010 Cifras en Quetzales Comisión encargada de realizar el cálculo matemático para la Distribución de la Asiganción Constitucional a las Municipalidades Monto a Distribuir Q2,336,939,001.00 2,336,939,001.00 2336939001 977,618,703.91 2,336,939,001.00 1,359,320,297.09 1,359,320,297.09 14,017,057 2,930,195,183.21 14,796.00 36,592.68 407,796,089.13 475,762,103.98 339,830,074.27 135,932,029.71 407,796,089.13 475,762,103.98 339,830,074.27 135,932,029.71 Asignación constitucional a las municipalidades, 2010 monto distribuido en Quetzales Código Municipios Depto. 333 Municipalida des 0/ Pagos Total asignado efectuados Monto a en el en los 3 distribuir 2010 presupuesto 2/ bimestres 2010 del 2010 1/ 2,336,939,001.00 977,618,703.91 1,359,320,297.09 64,964,851.51 24,093,061.79 40,871,789.72 Población total 2009 3/ 14,017,057 Ingresos No. De Ingresos municipales aldeas y ordinarios ordinarios 2009 caserios 3/ per cápita * 2,930,195,183.21 10% aldeas y caserios 36,592.68 407,796,089.13 475,762,103.98 339,830,074.27 1,162.58 28,646,423.59 1,428,715.03 10,796,651.10 712.64 2,414,002.02 1,428,715.03 6,618,136.79 165,367.43 274.37 1,906,478.24 1,428,715.03 2,548,003.76 293,986.55 784.65 164,556.34 1,428,715.03 7,286,899.16 303,173.63 124.19 1,656,016.48 1,428,715.03 1,153,296.04 569,598.93 306.52 3,447,547.89 1,428,715.03 2,846,570.02 707,405.13 53.53 1,899,149.36 1,428,715.03 497,103.87 211,302.83 451.18 13,651,061.34 1,428,715.03 4,190,015.98 349,109.02 53.32 1,138,572.81 1,428,715.03 495,195.86 137,806.19 64.41 5,878,904.94 1,428,715.03 598,172.01 698,218.05 79.03 817,316.43 1,428,715.03 733,971.00 257,238.23 335.50 355,105.76 1,428,715.03 3,115,692.61 266,425.31 689.10 1,202,328.00 1,428,715.03 6,399,600.46 202,115.75 42 171.51 3,004,463.92 1,428,715.03 1,592,743.36 385,857.34 20 258.34 14,207,049.13 1,428,715.03 2,399,171.87 183,741.59 197.02 3,945,507.61 1,428,715.03 1,829,646.47 321,547.79 233.65 4,387,090.27 1,428,715.03 2,169,905.60 91,870.80 102 SANTA CATARINA PINULA GTM 19,021,005.38 8,394,784.12 10,626,221.26 82,975.79 59,131,590.26 103 SAN JOSE PINULA GTM 10,496,985.95 4,319,802.37 6,177,183.58 65,530.83 17,979,520.67 104 SAN JOSE DEL GOLFO GTM 16,280,701.60 7,097,357.44 9,183,344.16 5,656.25 4,438,166.30 105 PALENCIA GTM 7,830,417.16 3,022,790.68 4,807,626.48 56,921.78 7,068,896.89 62 106 CHINAUTLA GTM 14,031,904.86 5,601,666.79 8,430,238.07 118,501.57 36,322,720.68 77 107 SAN PEDRO AYAMPUC GTM 8,019,304.01 3,983,032.92 4,036,271.09 65,278.91 3,494,237.81 108 MIXCO GTM 32,519,941.07 12,901,039.71 19,618,901.36 469,223.98 211,703,621.91 109 SAN PEDRO SACATEPEQUE Z 110 SAN JUAN SACATEPEQUE Z GTM 14,131,681.07 5,527,671.04 8,604,010.03 202,073.90 13,015,735.66 111 SAN RAIMUNDO GTM 5,585,817.24 2,348,576.56 3,237,240.68 28,093.38 2,220,318.72 112 CHUARRANCH O GTM 9,243,992.62 4,078,053.91 5,165,938.71 12,205.95 4,095,043.46 113 FRAIJANES GTM 16,356,876.33 7,124,117.10 9,232,759.23 41,327.27 28,478,821.42 22 114 AMATITLAN GTM 10,563,124.34 4,151,344.69 6,411,779.65 103,271.57 17,711,648.63 115 VILLA NUEVA GTM 29,664,452.48 11,445,774.87 18,218,677.61 488,334.79 126,157,023.42 116 VILLA CANALES GTM 13,362,848.57 5,837,431.67 7,525,416.90 135,617.79 26,718,757.59 117 PETAPA GTM 13,416,630.62 5,339,048.92 8,077,581.70 150,796.18 35,234,134.10 1,144,736,862.50 25% Ingresos ordinarios per cápita * 14,796 GUATEMALA 984,655.23 35% en partes iguales 4/ 101 GTM 30% población 0 135,932,029.71 - 18 32 33 23 38 15 GTM 5,500,356.38 2,300,066.49 3,200,289.89 39,135.83 2,086,815.28 76 28 29 35 10