alpha structured products - Productos Cotizados de Societe Generale

Anuncio

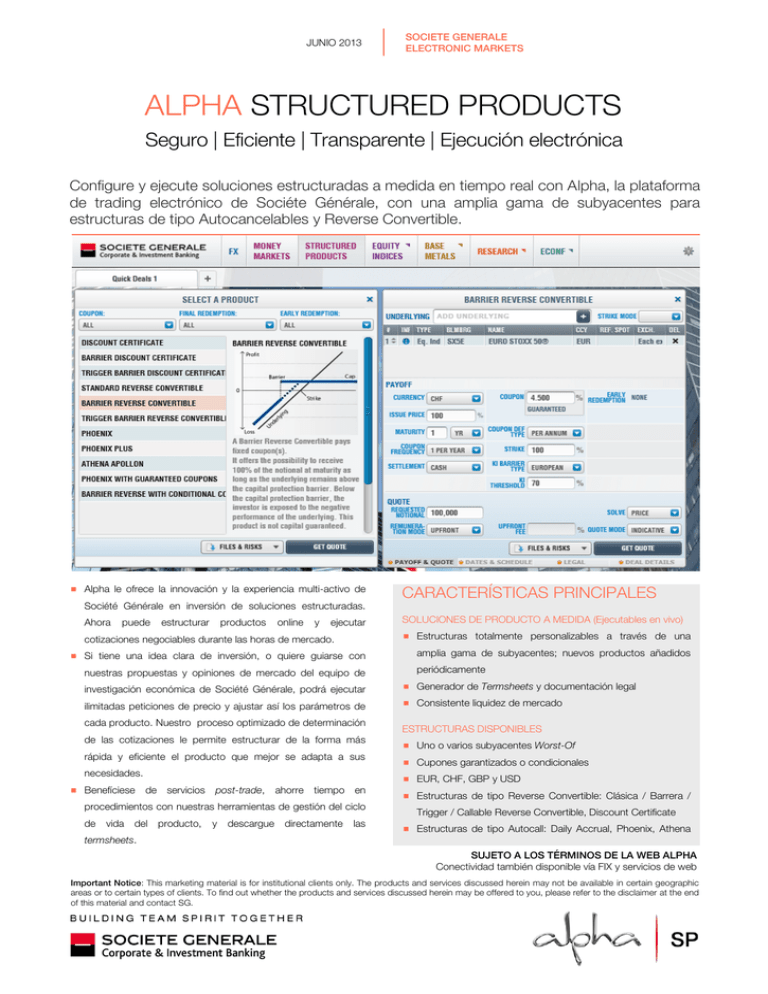

JUNIO 2013 SOCIETE GENERALE ELECTRONIC MARKETS ALPHA STRUCTURED PRODUCTS Seguro | Eficiente | Transparente | Ejecución electrónica Configure y ejecute soluciones estructuradas a medida en tiempo real con Alpha, la plataforma de trading electrónico de Sociéte Générale, con una amplia gama de subyacentes para estructuras de tipo Autocancelables y Reverse Convertible. Alpha le ofrece la innovación y la experiencia multi-activo de CARACTERÍSTICAS PRINCIPALES Société Générale en inversión de soluciones estructuradas. Ahora puede estructurar productos online y ejecutar SOLUCIONES DE PRODUCTO A MEDIDA (Ejecutables en vivo) Estructuras totalmente personalizables a través de una cotizaciones negociables durante las horas de mercado. Si tiene una idea clara de inversión, o quiere guiarse con nuestras propuestas y opiniones de mercado del equipo de amplia gama de subyacentes; nuevos productos añadidos periódicamente investigación económica de Société Générale, podrá ejecutar Generador de Termsheets y documentación legal ilimitadas peticiones de precio y ajustar así los parámetros de Consistente liquidez de mercado cada producto. Nuestro proceso optimizado de determinación de las cotizaciones le permite estructurar de la forma más rápida y eficiente el producto que mejor se adapta a sus necesidades. Benefíciese vida Uno o varios subyacentes Worst-Of Cupones garantizados o condicionales EUR, CHF, GBP y USD de servicios post-trade, ahorre tiempo en procedimientos con nuestras herramientas de gestión del ciclo de ESTRUCTURAS DISPONIBLES del producto, y descargue directamente las Estructuras de tipo Reverse Convertible: Clásica / Barrera / Trigger / Callable Reverse Convertible, Discount Certificate Estructuras de tipo Autocall: Daily Accrual, Phoenix, Athena termsheets. SUJETO A LOS TÉRMINOS DE LA WEB ALPHA Conectividad también disponible vía FIX y servicios de web Important Notice: This marketing material is for institutional clients only. The products and services discussed herein may not be available in certain geographic areas or to certain types of clients. To find out whether the products and services discussed herein may be offered to you, please refer to the disclaimer at the end of this material and contact SG. El concepto “Click and trade” a través de una amplia gama de subyacentes para productos de tipo Autocancelables y Reverse Convertible. PARA MÁS INFORMACIÓN SOBRE ESTE SERVICIO, CONTÁCTENOS: EMEA +33 1 4213 8600 AMERICAS +1 212 278 6022 ASIA PACIFIC +852 2166 5707 alpha@sgcib.com alphainfo.socgen.com This document is for institutional clients only. It is not directed at retail clients. IMPORTANT DISCLAIMER: This document has been prepared by the Corporate and Investment Bank Division of Societe Generale (“SG”). Societe Generale is a French credit institution (bank) authorised by the Autorité de Contrôle Prudentiel (the French Prudential Control Authority). This document only promotes certain electronic execution services (the “Services”) that may be made available by SG to certain clients. Certain products are referred to in this document for the sole purpose of illustrating how the Services operate. As a consequence, this document does not constitute an offer, or an invitation to make an offer, from SG to purchase or sell a product. This document is of a commercial and not of a regulatory nature . The contents of this document are given for purely indicative purposes and have no contractual value. The Services are intended solely for use by institutional clients with adequate resources and a thorough understanding of how the Services operate and of how to manage the financial risks related to their use. SG assumes no liability for executions resulting from your use of the Services. The products referred to herein for illustrative purposes may not be suitable for all investors. Such products may involve numerous risks, including, among others, market, counterparty default and liquidity risk. Investors must make their own investment decisions (using their own independent legal, financial, tax, accounting advisors as they may choose) based upon their specific financial situation and investment objectives. Neither SG nor any entity of the Societe Generale Group are acting as an advisor or in an advisory capacity to any recipient of this document. Notice to US Investors: Under SEC Rule 15a-6, any US person wishing to discuss this document or utilize the services or products referred to herein should do so with or through SG Americas Securities LLC to conform with the requirements of US securities law. SG Americas Securities LLC, 1221 Avenue of the Americas, New York, NY 10020 (212) 278-6000, is a member of SIPC, NYSE and FINRA. Notice to Singapore investors: This document may only be provided to accredited investors, expert investors and institutional investors, as defined in Section 4A of the Securities and Futures Act. Any such investor wishing to discuss this document or effect transactions in any securities or product referred to herein should do so with or through MAS licensed representatives of Societe Generale, Singapore Branch. Notice to Swiss Investors: This document may be distributed, directly or indirectly, in or from Switzerland exclusively to 1) Qualified Investors as defined in article 10 of the Swiss Collective Investment Scheme Act (“CISA”) and related provisions of the Collective Investment Scheme Ordinance or 2) independent asset managers in Switzerland regulated by FINMA or a self regulatory authority recognised by FINMA, and in strict compliance with applicable Swiss law and regulations. Notice to Japanese Investors: This document is prepared by Societe Generale, Tokyo Branch and its affiliates (collectively, “SGTB”) and may only be provided to Qualified Institutional Investors as defined in Article 2, Paragraph 3 of the Financial Instruments and Exchange Act of Japan and Article10 of Cabinet Office Ordinance on Definitions Provided in Article 2 of the Financial Instruments and Exchange Act of Japan. This document is issued in the U.K. by the London Branch of Societe Generale. Societe Generale is a French credit institution (bank) authorised by the Autorité de Contrôle Prudentiel (the French Prudential Control Authority) and the Prudential Regulation Authority and subject to limited regulation by the Financial Conduct Authority and Prudential Regulation Authority. Details about the extent of our authorisation and regulation by the Prudential Regulation Authority, and regulation by the Financial Conduct Authority are available from us on request. Your access to the Services is subject to various conditions and restrictions (geographical location, client type). SG retains full discretion to grant you access to the Services. Please contact SG to find out whether the Services may be made available to you. Copyright: the Societe Generale Group 2013. All rights reserved.