Premium Consumer Research Report

Anuncio

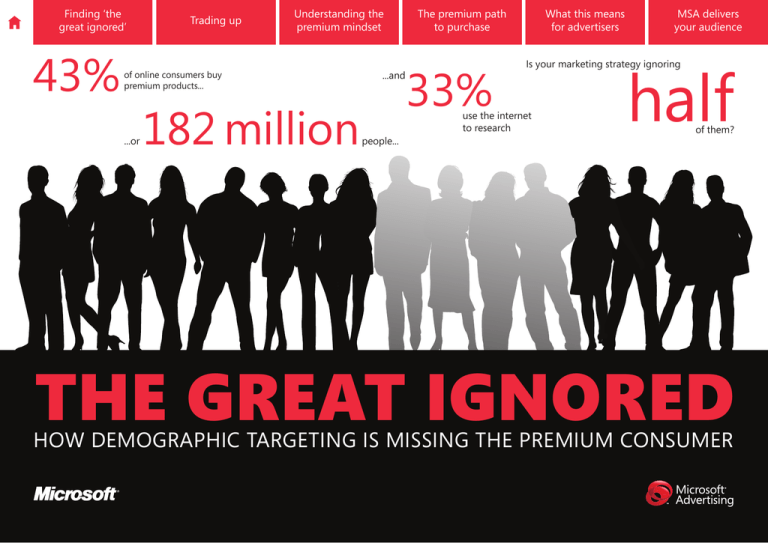

Finding ‘the great ignored’ 43% Trading up Understanding the premium mindset of online consumers buy premium products... ...or 182 million ...and The premium path to purchase 33% What this means for advertisers half Is your marketing strategy ignoring use the internet to research people... MSA delivers your audience of them? THE GREAT IGNORED how demographic targeting is missing the premium consumer Trading up Understanding the premium mindset Premium consumers are not necessarily wealthy. Think about those teenagers with iPhones or the couple whose cars cost almost as much as their house. It’s not as simple as basic demographics. They’re harder to spot. In fact only half can be picked up through standard demographic profiling. Only 1 in 4 earn €50k or more per year. To find them you’re going to need a more sophisticated approach. They’re more common than you think with over 40 per cent of consumers buying premium at some point. It’s a group that’s growing too, as savvy consumers trade up to premium products in sectors they care about. Our research shows that people tend to be premium in a handful of categories where they see value in spending more, perhaps saving money in other areas to afford it. Some might even buy luxury in one or two areas. As you can see, they’re a complex group! The premium path to purchase What this means for advertisers MSA delivers your audience The average household income of a premium consumer is €39,000. More than 50% would not be classed as affluent using traditional demographic targeting. Why is this significant? Because advertisers have traditionally considered premium consumers to be affluent and have assumed that by talking to a specific audience (ABC1s for example) they would reach their target consumer. However, doing this misses a very large group, in fact 54 per cent who might be buying premium in a particular category. We call them the great ignored. 54% It’s a mindset, not demographics. Patricia Consonni, MRM Worldwide, Italy 46% Standard Luxury Hidden affluent “The great ignored” Demographically affluent Demographics won’t cut it You need to know how they think Source: A Cut Above the Rest research, 2010 Finding ‘the great ignored’ Finding ‘the great ignored’ Trading up Understanding the premium mindset The premium path to purchase In some ways it’s easier to define premium by explaining what it isn’t. For starters, it isn’t luxury. Luxury items generally command a price premium of at least 50 per cent over mid-market goods, whereas premium occupies a space between mid-market (meaning standard or mainsteam) and luxury that is generally between 20 and 50 per cent higher in cost. And it’s a growing sector with 43 per cent of online consumers already buying premium at some point. What this means for advertisers MSA delivers your audience 43% of online Europeans buy premium. There are 182 million premium consumers in Europe. So premium is a purchase that is, for the ordinary consumer, ‘a stretch above the normal but still affordable’. Take a television set for example; the mid-market purchase might be an LG for €350, the premium purchase a Sony Bravia for €450, and the luxury purchase, a Bang & Olufsen state of the art set for around €2,000. For a car, the equivalent might be a Ford Mondeo at €20,000, a BMW 318 at €24,000, and a Bentley at €140,000. I’m not a big spender but, what I will do, is save up and buy the very best quality I can. In the past, it was largely assumed that people who purchase premium products were demographically affluent, but this is inaccurate. Brands that only use traditional demographic targeting to reach this audience segment would miss more than 50% of consumers who are buying premium, as they wouldn’t be classified as ‘affluent’. Standard Although many brands believe they offer a premium product or service, not much is really understood about the premium consumer. The group’s existence is often ignored, with the world seen as simply luxury and everything else. This is why Microsoft commissioned the ‘Cut Above the Rest’ research study, summarised here and available in full from your local Microsoft Advertising team. Luxury Premium PREMIUM IS NOT LUXURY And not affluent either Source: A Cut Above the Rest research, 2010 Mark, 40, UK Trading up Understanding the premium mindset Where mid-market is mostly rational, and luxury is predominantly emotional, premium sits between the two and the purchase, based not just on price but on desire for something better than average, involves decisions on both levels. And they’re selective, paying more for something in a specific category or trading up in an area that interests them whilst remaining decidedly midmarket in other areas. Those who buy Sony TVs over LG, or pay a premium for organic food, do so because they can see a distinct benefit in performance, features, quality and other factors. Reputation plays a role, but it acts as an indicator of the brand values rather than a simple emotional driver (which means brand advertising alone is not enough). Mid market doesn’t have to justify itself (it’s the average price), nor does luxury (that’s the definition of luxury) – but premium needs to demonstrate values that appeal to the rational and emotional. Premium buyers take time to reach their decision, weighing up the rational benefits while using the emotional cues to shortcut the decision process. The premium path to purchase What this means for advertisers MSA delivers your audience 73% of premium buyers admit to ‘doing a lot of research’ about a purchase. 54% of premium TV buyers use the internet to inform a purchase. Brand is only worth it when it is supported by high quality... the name itself is not enough. Michele, 45, France Premium buyers therefore need to be engaged throughout the sales cycle. To do that, you need an integrated media plan, where providing information to support decisions is pivotal in guiding consumers to your product or service. They need to see the tangible benefits delivered in order to weigh up your product against a mid-market alternative. Appeal to their rational mindset and they’ll be inclined to pay more. I’m fairly prudent at heart, I don’t like wasting money. Every penny I spend I like to know is well spent, which is why I tend to do a lot of research before I buy. Mark, 40, UK It’s a rational choice So you need to show your value Source: A Cut Above the Rest research, 2010 Finding ‘the great ignored’ Trading up Premium buyers get their awareness of your product the way everyone else does – from your brand. But the premium customer researches brands to ensure that the one they want is the best for them – and overwhelmingly, use the internet to do it. The premium customer isn’t all about rational decisions – they have a feelgood factor as well – and it comes from buying the best. Understanding the premium mindset The premium path to purchase What this means for advertisers MSA delivers your audience Research, research, research. If you haven’t got the message, the premium purchase path is based largely, though never exclusively, on research. And there’s no better place to conduct research than online. Premium consumers are a sociable group and they like to share their expertise, making social media a big part of the path to purchase as they seek out opinions or become advocates themselves. Our research shows that advertisers should not focus on what makes premium consumers different, but on what makes them the same. Not income, age, or sex, but purchasing behaviour. All premium consumers purchase products in a very similar way, whether they are demographically affluent or not. Their interest may be attracted by your brand image, either offline or online, or via word of mouth from friends and family online or in person, but they’ll look beyond the surface before making that decision to pay more for your product. This initial phase is followed up with a research phase in which all premium consumers seek to find out as much as they can about the product before buying it. This is because they want value, in addition to the ‘feel good factor’ about that brand that was initially sparked in phase one. It is absolutely essential that brands get this right, as it holds the key to the premium consumer’s mind-set and wallet. All premium consumers purchase products in a similar way. Research is key to influencing decisions. Steer the most likely customers to find the knowledge that your product’s a cut above the rest, and give them the feelgood factor that buying the best confers – and you’re much closer to ensuring a sale. I go on the internet, look for the product, look at the price, I look at customer reviews and blogs, I look at technical specs; I do everything on the internet. Marcel, 28, Germany Online research is key But you need to support your offline activity too Source: A Cut Above the Rest research, 2010 Finding ‘the great ignored’ Trading up Understanding the premium mindset The premium audience is a tangible group, and offers real opportunities for advertisers who are not currently targeting this sizable audience segment. It’s clear that an integrated offline and online branding campaign can play a significant role in prompting a purchase for a premium product buyer, and so marketers need to be sure to get this right. In addition, the use of social networking is key, tapping into the importance of word-of-mouth. However, advertisers also need to ensure they are doing enough in the second ‘research’ phase of the purchase cycle too. Building a brand presence in online channels such as instant messaging, email and social media, and linking through to useful information is an essential part of the process. So, in summary, brands need to look beyond demographics to find the majority of the premium consumer group, creating campaigns that explain the tangible value offered by their brand. It’s not enough just to advertise product or image, instead requiring a more consultative approach based on the provision of key information. Online consumers need to realise that a product is ‘a cut above the rest’. The premium path to purchase What this means for advertisers MSA delivers your audience A premium brand can’t rely on brand advertising alone – the image a consumer has of the brand is built on many long term and short term differentials. In today’s marketing environment, this means that readiness of brand and product information, social networking presence, point-of-sale sales knowledge and post sales service (to name just a few) are crucial elements of the brand strategy. Toby Shaw, Brand Manager, Sony Electronics • Premium is a big market (with over 40% of consumers buying premium at some point). • But don’t confuse premium with affluence - over half of premium buyers are not affluent. • Premium products have a tangible benefit – it’s worth spending more. • The purchasing decision is primarily rational, supported by emotional factors. • Information is king – premium consumers do their homework before buying. • Online is the obvious place to reach premium buyers, as part of a blended campaign. You need to use the right tools And understand your audience Source: A Cut Above the Rest research, 2010 Finding ‘the great ignored’ Finding ‘the great ignored’ H To 123 otm p m u ai ail ser l em se s * rv ice Trading up Messenger* 122m users Market leader Understanding the premium mindset 11 M 4 S #1 m u N po ser rta s * l The premium path to purchase What this means for advertisers B 75m ing use rs * MSA delivers your audience Microsoft Media Network Xbox live 36m users* 300 top global websites * figures show monthly European users Microsoft Advertising is recognised as having a truly premium network, with notable inventory that people know and trust. Our quality is second to none, with premium properties such as MSN, Windows Live Messenger and Hotmail, as well as over 300 premium sites across our Media Network. And with 167 million unique users, we bring breadth as well as quality. Our market-leading support goes beyond inventory, featuring full targeting solutions to reach and deliver the audience you need. Our wealth of audience insight will help you understand how, where, why and when your customers purchase. We have the social networking and targeting tools to reach the right eyeballs at the right times, and Rich Media solutions to really engage with consumers on sites they love and trust. And with our profile, behavioural and remessaging targeting tools, we can help you identify your target audience, continue the conversation, extend campaign reach, and drive purchases. In short, Microsoft Advertising lets advertisers safely reach the audience they need, across premium inventory, using a wide range of targeting solutions. Success Stories Innovative menswear e-tailer Poshcuffs have achieved great success driving sales using Microsoft’s targeting solutions to reach a premium male audience. Read more... Premium skincare brand Nivea increased purchase intent by 34% by intelligently targeting its audience, with help from Microsoft. Read more... When BMW wanted to launch the new X1 to a discerning audience, they turned to Microsoft Advertising, resulting in 8% increase in brand awareness and 10% increase in intent to buy. Read more... Travel and leisure retailer lastminute used Microsoft Advertising’s targeting solutions and achieved stunning results – over 100% increase in conversions and 6,300 new purchases. Read more... Your trusted partner To becoming a cut above the rest Source: A Cut Above the Rest research, 2010 So there exists a growing savvy premium audience. But how do you find them and connect with them online? This is where we can help.