Bolsa Mexicana de Valores Fact Sheet

Anuncio

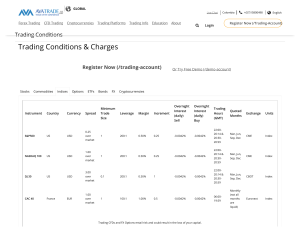

ab Electronic Trading Americas Bolsa Mexicana de Valores Fact Sheet The Exchange Bolsa Mexicana de Valores www.bmv.com.mx Time Zone CDT – Central Daylight Time (UTC/GMT – 6 hours) Currency Mexican Peso MXN Market Hours (Local Time) Pre Open: 8:00 – 8:24:59 AM (9:00 – 9:24:59 AM EST) Continuous Trading: 8:30 AM – 3:00 PM (9:30 AM – 4:00 PM EST) Between 8:25 – 8:30 AM (9:25 – 9:30 AM EST) no new orders may be entered, and no existing orders may be amended. There is no closing auction. The closing price is determined by the VWAP of the last 20 minutes of trading. If no trade occurs in the last 20 minutes, then the last tick is used. Board Lots 1 share. For stocks with a price > 200 MXN, the displayed size is rounded down to the nearest hundred. Tick Size Price ≤ 1.00 MXN > 1.00 MXN Major Equity Indices IPC: The Indice de Precios y Cotizaciones is a capitalization-weighted index of the 35 leading stocks traded on Bolsa Mexicana. Tick size 0.001 MXN 0.01 MXN Additional Indices: IPC RT, INMEX, INMEX RT Settlement Cycle T+3 Order Types Buy/Sell, Market and Limit Orders Due to exchange regulations, UBS will convert all market orders into marketable limit orders with a limit price 6% away from the last sale price. This allows us to target immediate execution while avoiding triggering a trading halt. Useful Information Reuters Suffix: MX Bloomberg Suffix: MM Bolsa Mexicana has the power to halt trading in any stock for a variety of reasons including large intraday price movements. An intraday price movement of 15% or more is the benchmark for a trading halt. Once trading has been stopped, the Exchange will contact the company and require it to submit a statement with information concerning the reasons for the price movement. When the Exchange deems that sufficient information has been provided, they will hold an auction for the stock and resume trading. Usually, trading resumes within 20 minutes of a trading halt, but the Exchange has the right to suspend trading indefinitely. During a trading halt, Bolsa Mexicana will reject all new orders entered. Orders entered during an auction will participate in the auction; however, execution is not guaranteed. For rules and operating procedures, please refer to www.bmv.com.mx For additional information, or if you have questions about your specific order, please call your account manager or the Direct Execution sales trading desk at the numbers below. UBS Direct Execution Americas: +1-800-563 8018 or +1-203-719 1750 Europe: +44-20-7568 8313 Asia: +852-2971 8334 Australia: +612-9324 2017 Japan: +81-3-5208 7249 de-sales@ubs.com Issued by UBS AG, or an affiliate thereof (“UBS”) to professional investors only. Issued in the US by UBS Securities LLC, member FINRA, NYSE and SIPC. Issued in Australia by UBS Securities Australia Limited ABN 62 088 586 481 AFSL 231098. Issued in Europe by UBS Limited, Company Number 2035362, of 1 Finsbury Avenue, London, EC2M 2PP, United Kingdom, VAT Number (GB)447151456. This material is published solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in the material. In the event of any discrepancy between this material and the information contained in any official statement, the information contained in the official statement shall prevail. © UBS 2012. The key symbol and UBS are among the registered and unregistered trademarks of UBS. All rights reserved. ab Electronic Trading Americas Bolsa Mexicana de Valores Electronic Trading FAQs Which algorithms are available on Bolsa Mexicana? UBS offers UBS Tap, TapNow, Volume Inline, Price Inline, Implementation Shortfall, VWAP, TWAP, Hidden, Float and Pairs algorithms on Bolsa Mexicana.1 Which DMA order types can I trade on Bolsa Mexicana? UBS supports both market and limit orders on Bolsa Mexicana. Due to exchange regulations, UBS will convert all market orders into marketable limit orders with a limit price 6% away from the last sale price. This allows us to target immediate execution while avoiding triggering a trading halt.1 Can I trade GTC or GTD orders with UBS on Bolsa Mexicana? No, orders on Bolsa Mexicana are only good for the day on which they are entered. Are there any restrictions for odd lot trading on Bolsa Mexicana? No. As of January 23, 2012, there are no odd lots on Bolsa Mexicana and one lot equals one share. How do I participate in the opening auctions on Bolsa Mexicana? UBS begins accepting DMA orders for the opening auction at 8:00 AM local time (9:00 AM EST). The cut-off for entering orders to the opening auction is 8:24:59 AM (9:24:59 AM EST). No orders may be entered or amended between 8:25 – 8:30 AM (9:25 – 9:30 AM EST). Currently, algorithmic trading orders will not participate in the opening auction. Is there a closing auction on Bolsa Mexicana? No, there is no closing auction on Bolsa Mexicana. The closing price for a stock is calculated as the VWAP of the last 20 minutes of trading. If no trades occur in the last 20 minutes, then the last tick is used. What circuit breakers exist on Bolsa Mexicana? No exchange-wide circuit breakers exist for Bolsa Mexicana. However, the exchange does have the power to halt trading in any individual stock for a variety of reasons, including large price movements. Usually, a 15% price movement triggers a trading halt. Once trading has been stopped, the Exchange will contact the company and require it to submit a statement with information concerning the reasons for the price movement. When the Exchange deems that sufficient information has been provided, they will hold an auction for the stock and resume trading. Usually, trading resumes within 20 minutes of a trading halt, but the Exchange has the right to suspend trading indefinitely. Can I enter orders on Bolsa Mexicana during a trading halt or intraday auction? During a trading halt, Bolsa Mexicana will reject all new orders entered. Orders entered during an auction will be accepted to participate in the auction; however, execution is not guaranteed. Can I settle my electronic Mexican trades in USD? At this time, UBS supports settlement in Mexican Pesos only. UBS Direct Execution Americas: +1-800-563 8018 or +1-203-719 1750 Europe: +44-20-7568 8313 Asia: +852-2971 8334 Australia: +612-9324 2017 Japan: +81-3-5208 7249 de-sales@ubs.com UBS algorithmic trading and DMA are only available to UBS clients trading into Mexico. At this time, they are not available to clients domiciled in Mexico trading in Mexico. 1 Issued by UBS AG, or an affiliate thereof (“UBS”) to professional investors only. Issued in the US by UBS Securities LLC, member FINRA, NYSE and SIPC. Issued in Australia by UBS Securities Australia Limited ABN 62 088 586 481 AFSL 231098. Issued in Europe by UBS Limited, Company Number 2035362, of 1 Finsbury Avenue, London, EC2M 2PP, United Kingdom, VAT Number (GB)447151456. This material is published solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in the material. In the event of any discrepancy between this material and the information contained in any official statement, the information contained in the official statement shall prevail. © UBS 2012. The key symbol and UBS are among the registered and unregistered trademarks of UBS. All rights reserved.