petroleos de venezuela, sa venezuelan national petroleum company

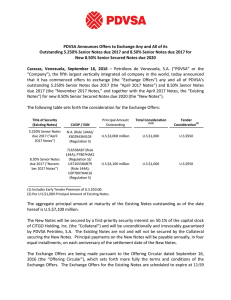

Anuncio