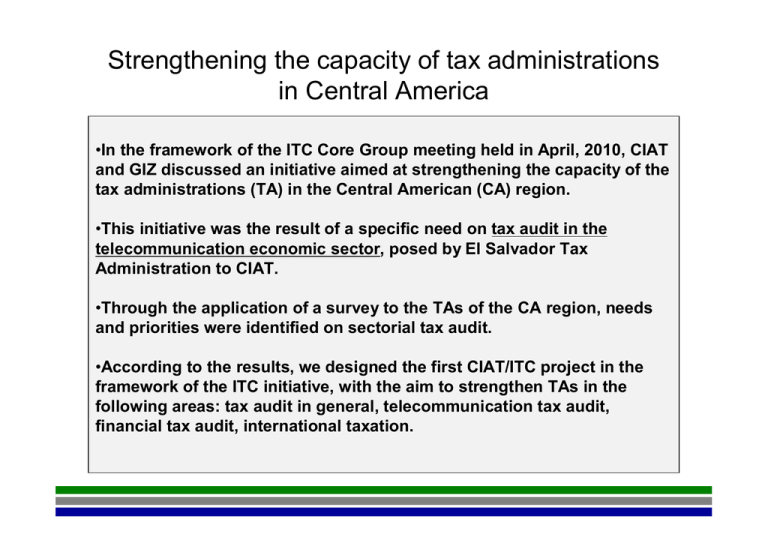

Strengthening the capacity of tax administrations in Central America

Anuncio

Strengthening the capacity of tax administrations in Central America •In the framework of the ITC Core Group meeting held in April, 2010, CIAT and GIZ discussed an initiative aimed at strengthening the capacity of the tax administrations (TA) in the Central American (CA) region. •This initiative was the result of a specific need on tax audit in the telecommunication economic sector, posed by El Salvador Tax Administration to CIAT. •Through the application of a survey to the TAs of the CA region, needs and priorities were identified on sectorial tax audit. •According to the results, we designed the first CIAT/ITC project in the framework of the ITC initiative, with the aim to strengthen TAs in the following areas: tax audit in general, telecommunication tax audit, financial tax audit, international taxation. Strengthening the capacity of tax administrations in Central America • CAPTAC-DR & US Treasury-OTA, organizations with strong presence in CA and wide experience in providing technical assistance, joined the initiative. • The activity was carried out under the “workshop” format and discussions were focused on the general and sectorial examination capacity of Central American the tax administrations, particularly, the financial and telecommunications sectors. • The workshop was not planned as an isolated activity. Instead, the purpose was to familiarize Central American tax administrations with more advanced experiences of other countries so that they may determine needs that could be covered through technical assistance projects to be carried out within the framework of the ITC initiative. • Experts from the Tax Administrations of Chile, Ecuador, France, Mexico and Peru presented their experiences. Strengthening the capacity of tax administrations in Central America • • In El Salvador, the CA tax officials specifically indicated the type of assistance and the modalities in which they would like to receive it (preferably technical assistance and training to improve capacity building- coaching, mentoring). Likewise, they harshly criticized the way in which cooperation was currently being provided, due to, among other reasons, the following: – Lack of coordination among those providing assistance in the region. – Financing of assistance which does not respond to their specific needs. – Activities that do not result in tangible benefits. – Responding to numerous diagnoses that ultimately do not result in effective actions. Strengthening the capacity of tax administrations in Central America • Nevertheless, several tax administrations in this region are partially unaware of their own needs and how to best address them. International organizations are aware of this fact. Taking all of this into account, how can one best deliver assistance? • Because of this situation, it was decided that a coordination meeting be held with the organizations present in El Salvador as well as others, in order to undertake actions that may generate synergies responding in a coordinated and coherent manner to the demands of the tax administrations. • Consequently, a meeting was organized at the headquarters of the World Bank Group in Washington, D.C. on January 24-25, 2011. INITIATIVE FOR COORDINATING TECHNICAL ASSISTANCE IN THE SPHERE OF TAX ADMINISTRATION AND POLICY IN THE LATIN AMERICAN AND CARIBBEAN REGION World Bank Headquarters, Washington, D.C., January 24 and 25, 2011 Office of Techn ical Assistance MAIN OBJECTIVE: To pave the way towards development of a common strategy aiming at providing coordinated technical assistance to Latin American countries in tax policy and administration, by ensuring efficient utilization of resources assigned for coordination, and subsequently through joint actions promoting synergies Strengthening the capacity of tax administrations in Central America Other outcomes from the 1st ITC project: • According to the issues discussed in El Salvador, CIAT proposed a strategy to increase capacity building in CA countries. How? CIAT and GIZ planned a second stage of the project aimed at providing CIATdeveloped virtual courses on financial institutions and operations to CA tax administration officials to improve knowledge on this matter. • Guatemala and Honduras showed interest in learning more about the experience of the Mexican and Chilean tax administrations, respectively, and GIZ helped them organized a formal visit to these tax administrations. Other areas CIAT can partner Micro simulation studies Electronic invoicing Digital communication strategy Benchmarking tools Data Bases on Taxation Virtual courses Essay contest Working groups and commitees on different matters Joint resear on tax matters Maturity models Study visits to progressive tax administration Publications Research scholarship Other areas CIAT can partner What can CIAT offer? 40+ years with LAC TAs Network of TA experts on different subjects Efficient HR with experience and knowledge in technical assistance, tax research and international cooperation to support projects knowledge of cultural, social and economic aspects of LAC countries Products and services: virtual courses, manual, models, researches, documents, magazines, seminars Resources to What do we expect from partners? Develop IT projects in poor LAC countries Provide, update and develop CIAT virtual courses, according to LAC countries demands Collaborate on studies and research Implement good practices in LAC TAs Organize workshops and seminars Develop tools for TAs Would you like to learn more about CIAT? Would you like to be a CIAT partner? www.ciat.org Please, contact to: Socorro Velazquez: svelazquez@ciat.org Gonzalo Arias: garias@ciat.org Mónica Alonso: malonso@ciat.org RESULTADO DE ENCUESTA SITUACIÓN ACTUAL Asistencia recibida en materia de fiscalización Panamá El Salvador -Fiscalización de grandes contribuyentes -Fiscalización en general En ambos casos, estructura y funciones. -Implementación de un sistema de selección de casos -capacitación Costa Rica: NO El Salvador: SI Guatemala: SI (OTA/FMI) Nicaragua: NO Panamá: SI (FMI y CIAT/PNUD) Guatemala -Fiscalización de EMN -Procesos de apelación -Estrategia de fiscalización Proceso de cobranza -Evaluación del sistema de control vigente para cada impuesto. -Control de Precios de Transferencia Principales barreras – Gráfico Principales barreras - Detalle Costa Rica El Salvador Guatemala Nicaragua Panamá Falta de información confiable X X X X X Intercambio de información interinstitucional X X X X X Intercambio de información internacional Fiscalización de operaciones internacionales X X Estudios económicos sectoriales X Metodología para identificar risgos en base a la conducta de los contribuyentes X Capacidad operativa para procesar información X Gran informalidad X Capacitación X X ¿QUÉ TIPO DE ASISTENCIA FUE SOLICITADA? Gráfico Detalle Cursos e‐learning Costa Rica El Salvador X X Guatemala Nicaragua Panamá X Cursos presenciales X Cursos blended X X X X Grupos de trabajo Proyectos de AT X X X X X Visitas a AT X X X X X ¿QUÉ ASPECTOS FUERON SOLICITADOS? Gráfico Detalle Costa Rica El Salvador Aspectos organizacionales X RRHH (Capacitación/ética/reclutamiento, etc.) X Guatemala Procesos Panamá X TI para fiscalización X X Gestión de información estratégica X X Ejecución de la fiscalización X Criterios de selección de contribuyentes Control de operaciones internacionales Técnicas de control del movimiento de efectivo Nicaragua X X X X X X X X X X X X X X X X X X X ¿QUÉ SECTORES FUERON SOLICITADOS? Gráfico Detalle Costa Rica Telecomunicaciones Farmacéutico Agropecuario Pesquero Alimenticio Financiero X El Salvador X X X Guatemala X X X X X X Logística en comercio exterior X Construcción Hotelero Gastronómico Seguridad X X Nicaragua X X X X Panamá X X X X X X X Profesiones liberales en general X X Textil X X Refinerías y distribuidoras de combustible X X Bebidas alchoolicas Azucarera Turismo Inmobiliario X X X X X Generación y distribución de energía eléctrica X Supermercados X