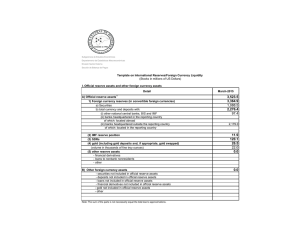

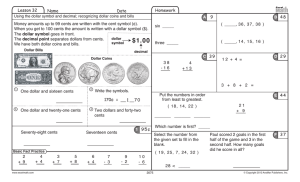

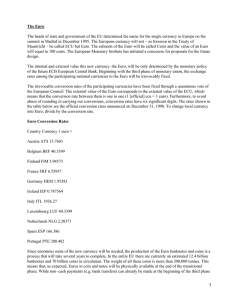

Fed and ECB with Dollar and Euro as International Currency Reserves

Anuncio