El texto del Acuerdo negociado con la Unión Europea se hace

Anuncio

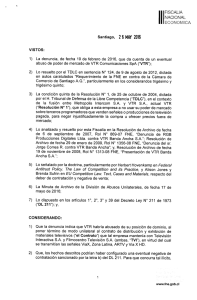

RESTREINT UE ACLARACION: El texto del Acuerdo negociado con la Unión Europea se hace público únicamente para efectos de información y transparencia. El documento que se presenta es el resultado obtenido al final de las negociaciones conducidas por el Ecuador con la Unión Europea. Este texto será sujeto a revisión legal para verificar su consistencia interna y para asegurar que las formulaciones resultantes de la negociación sean redactadas en un lenguaje jurídico. Superada la revisión jurídica este texto y sus anexos formarán parte del instrumento que será suscrito por Ecuador y la UE. Este documento no tiene efecto vinculante hasta que no se complete el proceso para su aprobación y ratificación por ambas Partes. EU Agricultural offer to Ecuador The European Union (EU) hereby submits its final tariff offer to Ecuador. Bananas 1) For fresh bananas originating in Ecuador under heading 0803 00 19 (CN 2007) listed in Annex X (EU schedule) under category "SP1", the following preferential customs duty will apply: Year Customs duty (€/t.) 2014 2015 2016 2017 2018 2019 As from 1 January 2020 118 111 104 97 90 83 75 Trigger import volume (Metric Tonnes) 1 566 772 1 645 111 1 723 449 1 801 788 1 880 127 1 957 500 Not applicable The preferential customs duties indicated in the table shall apply from the date of the entry into force of this Agreement; the duties shall not be retroactively reduced; 2) A stabilisation clause will be based on the following elements: (i) a trigger import volume is set for imports of originating goods provided for in the tariff lines in staging category ‘SP1’ for each of the years during the transition period, as indicated in the third column of the table above; RESTREINT UE (ii) once the trigger volume is met during the corresponding calendar year, the EU Party may temporarily suspend the preferential customs duty applicable during that same year for a period of time not exceeding three months, and not going beyond the end of the corresponding calendar year; (iii) in the event that the EU Party suspends the said preferential customs duty, the EU Party shall apply the least of the base rate or the Most Favoured Nation (hereinafter referred to as ‘MFN’) duty that will apply at the time this action will be taken; (iv) in the event that the EU Party applies the actions mentioned under subparagraphs (ii) and (iii), the EU Party shall immediately enter into consultations with Ecuador in order to analyse and evaluate the situation on the basis of available factual data; (v) the measures mentioned under paragraphs (ii) and (iii) may be applicable only during the transition period ending on 31 December 2019; Annex II: Explanatory notes to the EU offer In column "category" 0 Liberalisation at entry into force of the Agreement 3 Liberalisation in 3 years after the entry into force of the Agreement 5 Liberalisation in 5 years after the entry into force of the Agreement 7 Liberalisation in 7 years after the entry into force of the Agreement 10 Liberalisation in 10 years after the entry into force of the Agreement No offer 0+EP The ad valorem element of the custom duty is eliminated on entry into force of the Agreement, The specific duty(s) is(are) maintained. Entry Price system maintained 0/5+EP The ad valorem element of the custom duty is eliminated: a) Between 1 May until 31 October: at entry into force of the Agreement; b) Between 1 November until 30 April: in 5 years. The specific duty(s) is(are) maintained. Entry Price system maintained SP1 Preferential applied duty, covering fresh Bananas (excluding plantains) of CN07 0803 00 19 TQ(GC) Duty free quota of 500 tonnes of garlic. TQ(MM) Duty free quota of 100 tonnes, covering mushrooms under headings 0711 51 00, 2003 10 20 and 2003 10 30. TQ(MZ) Duty free quota of 37 000 tonnes of maize under headings 100590, 1102 20 10 and 1102 20 90 with a yearly increase of 1 110 tonnes. TQ(RI) Duty free quota of 5 000 tonnes of rice1. TQ(MC) Duty free quota of 3 000 tonnes of manioc starch. TQ(RM) Duty free quota of 250 hl of pure alcohol equivalent, with a yearly increase of 10 hl. TQ(SC1) Duty free quota of 400 tonnes, covering sweet corn excluding frozen. TQ(SC2) Duty free quota of 300 tonnes, covering frozen sweet corn. 1 5 years after entry into force of the Agreement the EU and Ecuador will examine the possibility to improve the market access of this product. 2 RESTREINT UE RESTREINT UE TQ(SR) Duty free quota of 15 000 tonnes, covering raw sugar, expressed in raw sugar equivalent (raw sugar of the standard quality shall be sugar with a yield in white sugar of 92%), with a yearly increase of 450 tonnes2. TQ(SP) Duty free quota of 10 000 tonnes, covering refined sugar of subheadings 170191 and 170199 expressed in raw sugar equivalent (raw sugar of the standard quality shall be sugar with a yield in white sugar of 92%) and covering products with a high sugar content, with a yearly increase of 150 tonnes. In column "Comments" Ad valorem @ 0 The ad valorem element of the custom duty is eliminated on entry into force of the Agreement. Where appropriate, the specific duty is liberalised as indicated in the column "category", i.e. in the number of years after the entry into force of the Agreement or within a duty free quota. Only ad valorem Elimination of the ad valorem element of the custom duty only. The specific duty is maintained. EP Entry Price system maintained. Sugar In the meaning of content of total sugar. Added sugar In the meaning of content of total added sugar. 2 This TRQ includes the product "panela". 3 RESTREINT UE

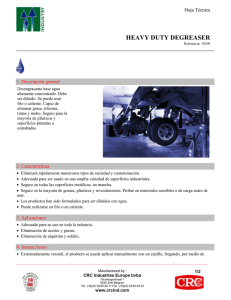

![INFORMACI_N ]TÉCNICALUBRIKOOLANT950HEAVY DUTY.doc](http://s2.studylib.es/store/data/003364227_1-adc9ad0a2db4a9c24c4b8ca775626ded-300x300.png)