Latin America: Steel imports from China decreases 33% while the

Anuncio

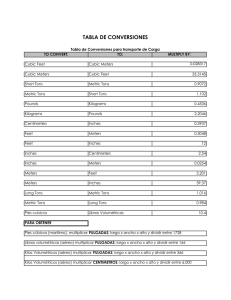

Press release @redAlacero Alacero ASOCIACIÓN LATINOAMERIC ANA DEL ACER O N°2016_12 | Chinese exports (price) Latin America: Steel imports from China decreases 33% while the average price fell 32% during Jan/Mar 2016 Latin American steel imports from China (January/March 2016): • 1.8 million tons received • Volume drops 33% vs Jan/Mar 2015 • Average price per ton falls 32% Alacero, Santiago, May 02nd, 2016. During the first quarter of the year, Latin America imported 1.8 million tons of steel from China, -which 1.6 million tons were finished steel and 193 thousand tons of steel-derivatives products-, decreasing 33% versus 1°Q 2015. In the same months, China shipped to the rest of the world (ex-Latin America) 25.4 million tons (24.1 million tons of finished steel and 1.3 million tons of steel-derivatives products). Price: Chinese exports to the world and to the region The volume send to the region reached US$ 778 million, equivalent to an average price of US$ 436 per ton, 6% higher than the rest of the world. On the other hand, Chinese steel shipped to the rest of the world (ex-Latin America) reach US$ 10,448, resulting in an average price of US$ 411 per ton. Finished Steel: Average price of Chinese exports to Latin America, Jan/mar 2016 1,200 $ 991 1,000 $ 757 800 Benjamín 2944, 5º Piso Las Condes 755 0032 Santiago Chile www.alacero.org $ 380 Dominican Republic Source: Alacero based on GTA/Chinese Customs data 200 $ 400 $ 374 Ecuador In this period, the average price of Chinese exports to Latina America decreased 37%, while the volume send to the rest of the world fell 46%. $ 341 Figure 02 shows the movement in the volume of Chinese steel (finished + derivatives) received by Latin America and the rest of the world, since the beginning of 2014 to 1 Q 2016. World whithout Latam = $411 Peru $ 373 Colombia $ 415 $ 507 400 $ 558 600 US$ / Tons Venezuela Chile Central AMerica Brazil Argentina Latin America 0 Mexico The Figure 01 shows that the most affected countries are: Central America (average price of US$ 341, 17% below r-o-w average), Colombia (average price of US$ 373, 9% below r-o-w average), Ecuador (US$ 374, 9% below r-o-w average), Dominican Republic (US$ 380, 7% below r-o-w average) and Peru (US$ 400, 2% below r-o-w average). Graph 01 $ 436 Several destinations in the region are facing imports prices significantly lower than the ones seeing in the rest of the world. L AT I N A M E R I C A N STEEL ASSOCIATION @redAlacero Alacero ASOCIACIÓN LATINOAMERIC ANA DEL ACER O Volume (tons) and price per ton (US$/ton) – Variations vs 1Q 2014 Latin America - Tons Latin America - US$/Tons World without Latam - Tons World without Latam - US$/Tons 100% 80% Tons to rest of the world: +62% 60% 40% Tons to Latin America: -13% 20% 0% Decrease to Latin America: - 37% 1T ‘14 = The volume of flat products send from China to the region were observed at a price 5% higher than the rest of the world, yet its value has decreased 27% over Jan/Mar 2015, while for the rest of world the fall plunge to 34%. -20% base 0 Chile, Central America and Colombia, the three largest importers of flat steel from China received 175 thousand, 143 thousand and 90 thousand tons respectively. In Chile, the average prices was 6% lower than r-o-w average. In the case of Central America, average price was 3% lower. While, Colombia registered an average price 12% lower than the r-o-w. Source: Alacero based on GTA/Chinese Customs data 1º 2014 2º 2014 3º 2014 4º 2014 1º 2015 2º 2015 3º 2015 4º 2015 1º 2016 Graph 03 FLAT STEEL: Average Price of Chinese Exports to Latin America, JAnuary/march 2016 1,400 $ 1,219 1,200 $ 974 1,000 $ 405 $ 380 $ 377 Chile Colombia Ecuador $ 418 Argentina 200 $ 481 $ 455 400 World without Latam = $ 433 $ 443 600 $ 396 800 Latin America Venezuela Dominican Republic Central America 0 Brazil During Jan/Mar 2016, hot galvanized steel (217 thousand tons) and steel sheets and other alloy steel coils (208 thousand tons) were the most significant exports from China to the region, showing a drop in its export volume of 32% and an increase of 63% over the 1°Q 2015, respectively. Decrease to rest of the world: -46% -60% US$ / Tons Low prices particularly affected Ecuador (average price of US$ 377, 13% below r-o-w), Colombia (US$ 380, 12% below) and Peru (US$ 396, 8% below). Only Argentina and Venezuela received flat products from China at a higher price than the rest of the world (see Figure 03). -40% Peru During the first three months of 2016, flat products concentrated 45% of the steel (finished + derivate) exports from China to Latin America, with 801 thousand tons (33% less than in Jan/Mar 2015). FINISHED STEEL: EVOLUTION OF CHINESE EXPORTS TO LATIN AMERICA AND R-O-W $ 599 Flat products to Latin America Graph 02 Mexico In Jan/Mar 2016, the average price of Chinese steel (finished + derivate) exports to Latin America was US$ 436 per ton, a decrease of 32% vs 1Q-2015. The sharpest falls were recorded in Ecuador (-40%), Colombia (-37%), Central America (-33%) and Chile (-32%), at values of US$ 374, US$ 373, US$ 341 and US$ 415 per ton, respectively. Source: Alacero based on GTA/Chinese Customs data Long products and seamless tubes to Latin America During the first quarter of 2016, exports of long products from China to Latin America reached 695 thousand tons, 39% of total steel (finished + derivate) received from that country. Average price was US$ 321 per ton, 9% higher than the one observed for the rest of the world and 42% lower than r-o-w registered in the 1Q 2015 (US$ 555 per ton). Benjamín 2944, 5º Piso Las Condes 755 0032 Santiago Chile www.alacero.org L AT I N A M E R I C A N STEEL ASSOCIATION @redAlacero Alacero ASOCIACIÓN LATINOAMERIC ANA DEL ACER O Central America, the largest importer of Chinese long steel in the region (212 thousand tons), registered an average price of US$ 266 per ton, 9% lower than r-o-w and 37% lower than in the 1Q 2015 (US$ 420 per ton). The largest volume of imports in the period was register for bars (407 thousand tons) and wire rod (232 thousand tons) that showed 25% and 35% growths versus Jan/Mar 2015, respectively. In Jan/Mar 2016, seamless pipes accounted for 5.3% of total steel (finished + derivate) shipments from China to the region, a volume of 95 thousand tons (26% drop y-o-y). The average price face by Latin America was US$ 751 per ton, 29% lower than for the rest of the world (see Table 01). Glossary chart 01 Main regional destinations: Average import price per ton (US$) january/march 2016 Flats Longs Seamless pipes without Latam 432 293 1,056 Latin America 455 321 751 Central America 418 266 564 Argentina 974 736 1,634 Brazil 481 402 1,819 Chile 405 368 626 Colombia 380 306 489 Ecuador 377 291 700 Mexico 599 365 1,131 396 301 597 1,219 640 718 World Peru Finished steel: Refers to steel included in one of these 3 groups: Long products (e.g.: reinforcing bars, bars, wire rod, light sections, heavy sections, rails), flat steel (e.g.: sheets and coils, coated sheets, pre-painted, stainless steel, chrome-plate sheets, hot dip galvanized sheet etc.) and seamless tubes. (US$/ton) Desteny Venezuela Source: Alacero based on GTA/Chinese Customs data Steel- derivatives products: Refers to the products that come from finished steel (welded tubes being the most significant item). Central America: Considers Guatemala, Belize, Honduras, El Salvador, Nicaragua, Costa Rica and Panama. Ton: A unit of weight or volume of sea cargo, equal to a metric ton (1,000 kg). About Alacero Alacero –the Latin American Steel Association– is the organization that brings together the Steel Value Chain of Latin America to promote the values of regional integration, technological innovation, corporate responsibility, excellence in human resources, safe working environments, and social and environmental sustainability. Founded in 1959, Alacero is formed by 49 companies in 24 countries, whose production –of about 70 million annual tons– represents 95% of the steel manufactured in the region. Alacero is a Special Consulting Organization to the United Nations and is recognized as International Non-Government Organization by the Republic of Chile, host country of Alacero´s headquarters. _ Benjamín 2944, 5º Piso Las Condes 755 0032 Santiago Chile www.alacero.org _ L AT I N A M E R I C A N STEEL ASSOCIATION