Aporte Económico - Ministerio de Energía y Minas

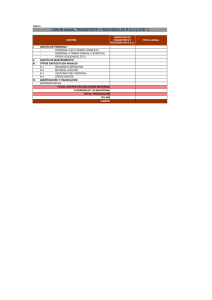

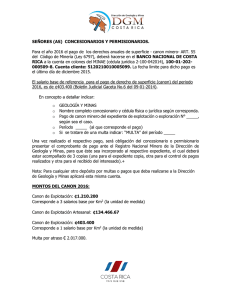

Anuncio

APORTE ECONÓMICO Y SOCIAL ECONOMIC & SOCIAL CONTRIBUTION APORTE ECONÓMICO A LAS REGIONES ECONOMIC CONTRIBUTION Las empresas mineras contribuyen de diversas maneras al desarrollo económico y social del país. Una de esas formas es mediante el pago de sus impuestos y contribuciones económicas que el Estado recauda y distribuye a las regiones. LAS REGIONES donde se ubican las unidades en operación minera son las que se benefician principalmente por el canon minero y las regalías que reciben, sin embargo cabe destacar que el pago del derecho de vigencia y penalidad beneficia a todo el país inclusive regiones donde no existe minería, pero si petitorios o es mejor decir, concesiones mineras tituladas. En el 2009 se transfirieron un total de 4,058 millones de nuevos soles por estos tres aportes siendo la Región Ancash la mayor beneficiada principalmente por el canon minero que recibe por la minas de clase mundial que alberga y que generaron altas utilidades durante el año anterior, le siguen los departamentos de Arequipa, Moquegua, Tacna, Puno y Cajamarca según se puede ver en la gráfica posterior. CANON MINERO, REGALÍAS Y DERECHO DE VIGENCIA El canon minero es el 50% del Impuesto a la Renta que el Estado recibe por la explotación económica de los recursos mineros. Dinero que anualmente es transferido a los gobiernos regionales y locales ubicados en las zonas donde se encuentran dichos recursos. Esta transferencia es realizada por el Ministerio de Economía y Finanzas. De acuerdo a las leyes peruanas, ese dinero debe de ser invertido en proyectos orientados exclusivamente a combatir la pobreza, mejorar la calidad de vida de la población, para investigación y desarrollo tecnológico por parte de las universidades. A su vez, los pobladores pueden participar activamente en la elección de los 90 proyectos que se ejecutaran con el dinero del canon minero a través de los presupuestos participativos, que son reuniones con sus autoridades locales y organizaciones comunales. Durante el 2009, se transfirió a las regiones por concepto de canon minero un total de S/. 3’671, 679,736.48. Siendo Ancash la región que recibió mayor participación seguido por Arequipa, Moquegua, Tacna, Cajamarca y Puno, regiones donde operan la mayor concentración de productoras de minerales. Por otro lado, las regalías constituyen una contraprestación que hacen las empresas mineras por emplear recursos naturales no renovables, independiente y adicional al impuesto a la renta que puedan generar. En el 2009, se recaudo por concepto de regalías S/. 273, 515,681 a nivel nacional. El derecho de vigencia es el pago que hacen anualmente todos los titulares mineros para solicitar una concesión minera y mantenerla vigente; adicional a la penalidad a la que pudieran ser pasibles de no haber acreditado producción o inversión mínima al cabo del periodo determinado por la ley. El 75% de los montos recaudados por derecho de vigencia y penalidad se distribuye a los distritos donde su ubican las concesiones. En el año 2009 la cifra distribuida alcanzó la cifra de S/. 113,686,788. Debido a que el desarrollo de la actividad minera en una región es temporal, es necesario identificar las prioridades en la utilización de estos recursos generados, con el objetivo de: “... Debido a que el desarrollo de la actividad minera en una región es temporal, es necesario identificar las prioridades en la utilización de estos recursos generados...” The mining companies contribute of diverse ways to the economic and social development of the country. One of these forms is by means of the payment of its taxes and economic contributions that the State collects and distributes to the regions. THE REGIONS where the units are located in mining operation are those which are of benefit principally for the mining canon and the royalties that receive, nevertheless it is necessary to emphasize that the payment of the right of force and punishment benefits to the whole country inclusive regions where mining industry does not exist, but if petitioner or is better to say, mining qualified concession. In 2009 transfer a whole of 4,058 million Nuevos Soles for these three contributions being the Region Ancash the major one benefited principally by the mining canon that receives for its mines of world class MINISTERIO DE ENERGÍA Y MINAS DEL PERÚ / MINISTRY OF ENERGY AND MINES OF PERU 1. Atender necesidades básicas: escuelas, hospitales, obras de agua/desagüe, electrificación. 2. Consolidar la capacidad de producción para autoconsumo mediante la construcción de reservorios de agua, accesos y caminos, almacenes de productos. 3. Incrementar la capacidad productiva de sus actividades cotidianas (agricultura, ganadería y manufactura), mediante la tecnificación de dichas actividades para generar excedentes que puedan ser comercializados en el mercado local y conseguir así ingresos adicionales n that has shelters and high usefulness generated during the previous year, it continued by the departments of Arequipa, Moquegua, Tacna, Puno and Cajamarca as it is possible to see in the posterior graph. MINING CANON, ROYALTIES AND RIGHT OF FORCE The mining canon is 50 % of the Tax to the Revenue that the State gets for the economic exploitation of the mining resources. Money that annually is transferred to the regional governments and places located in the zones where they find the above mentioned resources. This transfer is realized by the Department of Economy and Finance. In agreement to the Peruvian laws, this money must be invested in projects orientated exclusively to attacking the poverty, improving the quality of life of the population, for investigation and technological development on the part of the universities. In turn, the settlers can take part actively in the election of the projects that were executed by the money of the mining canon across the participative budgets, which are meetings with its local authorities and communal organizations During 2009, it was transferred to the regions for concept of mining canon a whole of S/. 3 ' 671, 679,736.48. Being Ancash the region that got major participation followed for Arequipa, Moquegua, Tacna, Cajamarca and Puno, regions where they produce the producers' major concentration of minerals. On the other hand, the royalties constitute a consideration that the mining companies do for using natural not renewable resources, independently and additional to the tax to the revenue that they could generate. In 2009, It collects for concept of royalties S/. 273, 515,681 national ones. The right of force is the payment that all the mining holders make annually to request a mining concession and keep it in force; additional to the penalty which they could be sensitive of not having credited production or minimal investment after the period determined by the law. 75 % of the amounts collected by right of force and penalty are distributed to the districts where they locate the concessions. In the year 2009 the distributed number reached the number of S/. 113,686,788. Due to the fact that the development of the mining activity in a region is temporary, it is necessary to identify the priorities in the utilization of these generated resources, with the aim of: 1. To attend to basic needs: schools, hospitals, works of water / outlet, electrification. 2. To consolidate the capacity of production for self-consumption by means of the construction of reservoirs of water, accesses and ways, stores of products. 3. To increase the productive capacity of its daily activities (agriculture, cattle and manufacture), by means of the modernization of the above mentioned activities to generate surpluses that could be commercialized on the local market and to obtain additional income like that. MINISTERIO DE ENERGÍA Y MINAS DEL PERÚ / MINISTRY OF ENERGY AND MINES OF PERU 91 MINERÍA EN PERÚ / MINING IN PERU APORTE ECONÓMICO A LAS REGIONES (DERECHO DE VIGENCIA, CANON Y REGALIAS MINERAS / ECONOMIC CONTRIBUTION TO THE REGIONS (RIGHT OF FORCE, CANON AND MINING ROYALTIES (Nuevos Soles / S/.) 2007 DER. VIGENCIA CANON MINERO 2008 REGALIA MINERA AMAZONAS 1,334,328.89 7,683.13 72,610.58 ANCASH 6,919,692.04 1,628,350,356.48 APURIMAC 4,369,043.91 AREQUIPA 11,322,521.30 AYACUCHO 5,826,158.82 20,963,254.59 CAJAMARCA 9,335,281.23 DER. VIGENCIA 2009 REGALIA MINERA DER. VIGENCIA CANON MINERO REGALIA MINERA 17,933.04 134,259.78 2,592,743.29 75,524.16 7,922.96 4,425,189.48 7,609,673.35 1,319,496,305.51 5,169,377.48 7,052,826.51 934,087,176.35 1,841,946.70 3,107,404.80 7,311,686.23 22,544,897.59 2,377,545.08 4,862,696.71 11,586,581.93 509,228.98 157,529,684.76 15,152,959.70 11,722,985.67 457,527,413.31 32,353,501.70 12,933,807.49 554,577,075.38 33,006,655.89 2,142,750.44 6,847,880.65 41,206,251.90 2,987,536.33 4,857,966.29 11,535,798.77 4,179,854.21 585,612,960.00 229,752.64 13,332,317.70 183,348,632.80 603,619.46 13,214,397.39 236,068,594.44 11,990,389.58 10,589.51 168.20 0.00 11,283.81 1,886.72 0.00 10,756.58 141.39 0.00 CUSCO 6,483,400.43 272,885,025.51 0.00 8,324,960.13 242,406,460.46 0.00 8,241,437.45 147,652,495.61 0.00 HUANCAVELICA 5,187,684.90 37,918,782.57 8,007,180.41 5,565,537.93 48,079,583.93 13,695,532.00 5,053,023.01 19,048,069.01 6,999,444.28 HUANUCO 1,440,888.06 10,470,335.27 3,478,684.22 2,456,672.89 7,728,576.99 1,932,103.74 1,270,523.14 2,971,464.00 831,700.64 ICA 2,607,409.89 66,374,063.98 7,924,233.67 3,411,007.02 68,652,141.74 11,287,173.31 2,954,972.17 108,876,979.18 7,955,405.41 JUNIN 4,025,802.97 110,707,734.76 41,214,041.58 4,400,136.08 123,229,875.47 28,059,807.41 4,010,637.24 44,785,877.99 17,477,380.06 LA LIBERTAD 7,381,306.77 283,398,346.41 17,551,853.63 9,694,864.19 264,799,247.04 23,501,266.94 10,208,128.29 383,496,680.24 23,596,830.54 0.00 1,057,995.17 0.00 0.00 1,394,592.81 275,554.85 0.00 199,229,306.71 45,075,171.07 7,639,057.65 183,366,498.43 42,749,831.79 7,639,638.20 76,017,466.82 17,552,009.47 CALLAO LAMBAYEQUE LIMA LORETO 595,910.36 7,605,118.47 23,069,613.57 3,172.90 1,885,669.07 CANON MINERO 214,350.90 0.00 0.00 415,397.82 0.00 0.00 459,516.16 0.00 0.00 MADRE DE DIOS 1,411,028.05 42,911.72 0.00 1,422,198.21 47,797.50 0.00 1,508,006.21 46,961.72 0.00 MOQUEGUA 3,597,750.48 487,216,297.61 95,313,610.19 3,868,937.55 211,435,193.41 104,590,057.73 5,212,981.27 398,388,019.52 50,029,460.49 PASCO 3,493,547.67 355,486,278.67 92,382,901.91 3,959,093.91 377,199,408.10 57,814,651.22 3,886,502.76 132,040,467.14 25,417,058.06 PIURA 3,680,023.14 758.84 5,400,749.37 9,607.29 913.31 5,303,955.18 34,563.80 27.56 PUNO 6,760,651.30 144,315,028.28 36,685,326.00 7,009,876.57 172,502,222.28 62,394,204.47 7,136,200.49 263,020,980.91 35,605,299.83 11,504.42 1,034,538.46 478,211.55 14,991.84 659,711.43 536,729.86 15,286.93 773,249,540.38 106,142,170.26 3,145,713.72 711,596,409.20 84,725,432.09 3,189,534.87 346,556,533.41 36,499,780.19 SAN MARTIN TACNA 957,333.37 2,423,457.96 6,876.60 164,007.07 TUMBES 10,809.35 10,964.56 0.00 0.00 11,044.01 0.00 0.00 UCAYALI 92,841.38 28,238.61 0.00 0.00 21,189.20 0.00 0.00 117,567,436.30 4,435,674,554.26 474,391,805.68 113,686,788.13 3,671,679,736.48 273,515,681.78 TOTAL 92 97,086,931.15 5,157,001,429.17 478,918,103.84 MINISTERIO DE ENERGÍA Y MINAS DEL PERÚ / MINISTRY OF ENERGY AND MINES OF PERU ANUARIO MINERO 2009 MINING ANNUAL REPORT2009 TUMBES S/. 11,044 LORETO S/. 459,516 AMAZONAS S/. 2,676,190 PIURA S/. 5,338,546 LAMBAYEQUE S/. 1,670,147 CAJAMARCA S/. 261,273,381 Aporte Económico a las Regiones SAN MARTIN S/. 1,211,728 LA LIBERTAD S/. 417,301,639 ANCASH S/. 942,981,949 HUANUCO S/. 5,073,687 UCAYALI S/. 21,189 PASCO S/. 161,344,027 LIMA Monto total distribuido S/. 101,209,114 por Canon Minero + CALLAO Regalias + S/. 10,897 Derecho de Vigencia y Penalidad JUNIN S/. 66,273,895 MADRE DE DIOS S/. 1,554,967 HUANCAVELICA S/. 31,100,536 Total amount distributed by Mining Canon + Royalties + Law of Force and Penalty En Millones de Soles S/. Million ICA S/. 119,787,356 CUSCO S/. 155,893,933 APURIMAC AYACUCHO S/. 16,958,507 S/. 20,573,619 PUNO S/ 305,762,481 > S/. 700 S/. 300 - 700 S/. 200 - 300 S/. 100 - 200 S/. 50 - 100 S/. 0 - 50 MINISTERIO DE ENERGÍA Y MINAS DEL PERÚ / MINISTRY OF ENERGY AND MINES OF PERU AREQUIPA S/. 600,517,538 MOQUEGUA S/. 453,630,461 TACNA S/. 386,245,848 93