Computing value correspondences for repeated games with state

Anuncio

COMPUTING VALUE

CORRESPONDENCES

FOR REPEATED

GAMES WITH STATE

VARIABLES

James Conklin

Banco de España - Servicio de Estudios

Documento de Trabajo nº 9622

COMPUTING VALUE

CORRESPONDENCES

FOR REPEATED

GAMES WITH STATE

VARIABLES

(*)

James Conklin

(*)

This research was conducted while the author visited the Banco de España. Errors and omis·

sions are the author's own.

Banco de España - Servicio de Estudios

Documento de Trabajo n' 9622

In publishing this series the Banco de España seeks to disseminate

studies of interest that will help acquaint readers better

with the Spanish economy.

The analyses, opinions and findings of these papers represent

the views of their authors; they are not necessarily those

of the Banco de España.

ISSN: 0213-2710

ISBN: 84-7793-499-)

Depósito legal: M. 29034-1996

Imprenta del Banco de España

Abstract

The nature oC repeated interaction has been extensively studied in the repeated garne liter­

ature. Abreu

(1988),

berger

develop a recursive approa.ch to characterizing repeated games by focusing on

(1994)

Abreu, Pea.rce an,d Stacchetti

(1986, 1990),

and Cronshaw and Luen­

the present values oí suhgame perfect strategies for each player, V. Judd and Conk1in

Cronshaw and Rutherford

(1994)

and Cronshaw

(1996)

(1995),

have implemented these techniques

computationally. Sorne oí the most interesting examples oí strategic interaction, however,

arise in environments with state variables in wruch the recursive techniques cited aboye can­

not be employed.

In such environments tbe set oí values oí suhgame perfect equilibrium

becomes a function of the state variable-the object of inlerest becomes the value correspon­

den ce. This paper presents a general method for computing value correspondences under

perfect monitoring and discounting.

-3-

1. Introduction

The nature oí repeated interaction has been extensively studied in the repeated game liter­

ature. While the theory oí repeated games has produced important qualitative results, one

weakness oí this theory is the lack oí quantitative applications. A second weakness is that

this theory has yet to be broadly extended to environments with state variables. In an earlier

paper we address the first weakness, presenting a method for computing the set oí subgame

perfect equilibria in infinitely repeated games witb perfect monitoring. Our approach is re­

cursive, lollowing the lead 01 Abreu (1988) and Abreu, Pearch and Staccbetti (1986, 1990),

and Cronshaw and Luenberger (1994). Here, we extend that technique to games with state

variables, restricting the state space to have finite elements.

The recursive tbeory of supergames introduces the concept of self-generating sets of pay­

offs to characterize the set of equilibria. The numerical method discussed below revolves

around efficient ways to approximate and construct these self-generating sets. As in Cron­

shaw and Luenberger (1994) and Judd and Conklin (1995), we allow public randomization.

This is advantageous since the resulting elements oC the equilibrium value correspondence

are convex, and a convex set can be represented by a simple function denoting the distance

Croman interior point to each point on its boundary. We cboose a piecewise linear procedure

to approximate these boundary functions. This method is of interest since it generates a

"lower bound" to the true solution and is computationally cheap to evaluate and recom­

puteo We iIlustrate the method with an example: computing subgame perfect equilibria Cor

government fiscal poliey in a primitive society.

This example needs moderate computer power. We give running times -on Pentium­

based personal computers. Furthermore, we used standard, freely available software. Al!

the prograros were written in FORTRAN, but could be implemented in any programming

language, such as BASIC or Matlab.

Section 2 covers notatiofl. Section 3 discusses the methods for approximating convex sets

and describes the basic algorithm. Section 4 applies the algorithm to the two examples, and

Section 5 concludes.

2. Supergames and Characterization of Equilibrium Payoffs

We examine an N-player infinitely repeated game with state variables. A;, i = 1,···, N,

will denote the action space of player i in the stage game. X = U�=¡{Xk} will denote the

state space of K finite elements. We will call elements of A == Al X A2 X . . . X AN action

profiles.

A X X -t R.

(aJ,·· ·,Gi_1!ai+1,··· ,aN ) and Jet

Player i's payoff in the stage game will be II¡ :

the standard way, we define a_i =

Abusing notation in

(1)

-5-

denote the best response payoff for pIayer i given the actions a_i by his opponents and the

state x. Considering that for each value of x we can define a one+period garne, we rnake the

following assurnptions:

Assumption 1: Ai, i

=

1,···,N, is a compact subset of Rm for sorne m.

Assumption 2:

II¡(·,x),

Assumption 3:

The stage game has a pure strategy Nash equilibrium for x

Assumption 4:

The value correspondence is non-empty for a1l values of x E X.

i=

l, ...,N, is continuous.

xk,k

_

1, ... , K.

Assumptions 1 and 2 are trivially satisfied by finite-play games. Assumptions 3 and 4 are

satisfied by many interesting games, and are essential. Mixed strategy equilibria could be

included if actions consisted of publicly observed randomization over pure strategy actions.

Prom the stage game, we can construct the corresponding supergame. The action space

in the supergame is Aoo == x�lA. We assume that player i aims to maximize his average

discounted payoff, which equals

1

-

ó

ó

00

L 6tIli(at,xt)

(2)

t=1

where aj is the action profile taken in period t. A history,

{a"x,}�=o. By the continuity of ni and compactness of A;,

yt,

is defined as the sequence

lI;(x)

_

min n¡(a,x)

(3)

ni(x)

_

ma.>< lI;(a,x)

(4)

.eA

.eA

are both finite. Therefore, for any given value of the state, the supergame payoffs are

contained in the compact set

W(x)

=

X"II.!!i(X), lI;(x)].

(5)

A strategy for player i is a mapping from the history of the game in time t ioto pIayer i's

.

action space Cor each time t: Ui : A! x XL _ A¡, t 0,1,2, .... A strategy profile is the set

strategies oC all pIayers: u = UieN 17;.

For each subgame perfect strategy profile 17, we define its value to player i to he

:;:

Vi(XI,U)

=

1-6 00 ó

'lIi(a"x,lu).

ó- ¿

t =1

-6-

(6)

It foHows that for each state there is a value

players across aH strategies:

U

V(x)=

set,

representing the values that arise for

v(x,<1),xEX.

all

(7)

SPE

Finally, we define the value corrspondence to be

(8)

Our objective is to compute the value correspondence V(X).

The perspective implicit in the notation aboye does not provide us with a numerically

tractable way of viewing the supergame since it focusses on infinite sequences of actions.

While such descriptions are useful theotetically and descriptively, they are not useful when

it comes to computation since infinite sequences are costly, if at all possible, to represent in

a computer. Furthermore, examining the set of possible strategies and checking for subgame

perfection is also difficult if one takes an infinite sequence approach. Naturally, we take a

dynamic prograrnming approach to the problem, compressing the information in the game's

histories into continuation values and extend the approach to garues with state variables.

This "dynamic progarnming approach" to supergames with state variables can be ex­

pressed through a map, B. Let W(x) be a ca.ndidate for V(x) for each state x. Then the set

of possible payoffs today are those consistent with N.ash play today with continuation values

in W(x'), a.nd are defined by the map

B(W)(x)=

U

(a,w(x'))EA xco(W(x'))

{(i-ó)lI(a,x)+ów(x')}

X'= h(a,x)

subject to:

i

=

h(ii;,a_;,x)

(1 -ó)lI;(a,x) + ów;(x') � m.ax{ (1

;

'

-

ó )lI;(ii;,a_;, x) + óll!;(i), \li E N).

(9)

(!O)

(11)

(12)

h(a, x) is tbe Iaw oC motion of tbe state variable. Intuitively, a value b(x) is in B(W)(x) iC

tbere is sorne action profile, a, and continuation payoff, W(X')EW(x'), such that b(x) is the

value oC playing a today and receiving the continuation value w(x') tomorrow, a.nd, for each

i, player i will cboose to play a¡ because he believes tbat to do otherwise will yield him the

worst possible continuation payoff. The right ha.nd side oC equation 12 represents tbe value

oC deCection from the prescribed equilibriurn. For player i playing a¡ implies that the state

tomorrow will be x'= h(a,x). However if player i defects a.nd takes action a·, the economy

will Dot be in state x' tomorrow but state x· = h(ai,a_i,x). Hence when computing the

value oC defection, the punishment value must be drawn Crom the set W(x·).

-

7-

Proposition:

proof:

V(X) = B�WO(X) il WO(X) 2 V(X).

The numerical algorithm"described in section

While this characterization oí

V(X)

ficulties associated with computing ¡t.

3

provides a constructive prooL

is elegant and intuitive, there are important dif­

The maio problem is that

V(X)

can be aD ugly

correspondence, difficult to represent in a computer. To deal with these problems, we alter

the supergarne by including public randomization. Intuitively, we assume that a.t the end oí

each stage game, a lottery is used to determine how the game continues. Formally, strategies

will now map histories of players' a.ctions, the history oí the realizations oí tbe lottery and

the current lottery outcome, ioto current actions. Realized stage-game payoffs will differ

from expected stage-game payoffs in strategies where non-trivial (non-degenerate) lotteries

are employed. Operationally, we imagine the Collowing scenario.

tomorrow's continuation value líes in

co(W(x')).

AH

the players know that

However, they don't know what that con­

tinuatíon value will be until after a publicly observed random valuable is revealed, whích

will signal tomorrow's

w(x') E W(x'). ThereCore,

co(W).

Crom today's perspective, we can

ex ante

construct a continuation value in

While the main motivation Cor adding lotteries is to make the computation easier, it does

generalize the notion oC subgame perCect Nash equilibrium in an appropriate and interesting

Cashion. Since one aim oC this research is to see what is possible in the absence oC contracting,

it is natural to add this public randomizing device. The addition oC lotteries will possibly

be inessential. In particular, iC

not expand

V(X) and

V(X) without

lotteries is convex, then adding lotteries will

our algorithm wiU compute

V(X).

One couId also further generalize

the anaIysis to correlated equilibria. However, that would admit private information and

assume sorne coordinating agent, unappealing assumptions in many contexts.

3. Computing the Equilibrium Value Correspondence

Choosing.n initia! set

B(Wk)(x),

WO(X) 2 V(X), the sequence 01 sets {W'(X)}f:o, where W'+I(x)

V(x) Cor each x E X. Direct application of this technique, however,

=

converges to

poses two computational obstacles. The first is that Cor many supergames, equilibrium value

correspondence

V(X)

is infinite and thereCore impossible to represent on a computer. We

treat this problem by exploiting the convexity of

W(X) and B(W)(X):

any ray originating

from any'interior point of a convex set intersects the boundary of that set only once.

convex set can be represented by its boundary, a fact we will exploit.

A

By virtue oC its

"star-shapeness", a convex sets comprising the value correpondence can be represented in a

particularly simple fashion; we discuss the details of this in section

2.1.

W(X)

B(W)(X) can involve exhaustive pairing of actions with all possible value

(Wi(X'),!Qo(x')) to derive incentive compatible actions and rewards. This technique is

The second computational obstacle we confront is that even if we can represent

finitely, generating

pairs,

-8-

too crude for anything but tbe smallest problems. As an illustration, consider constructing

B(W)(X)

W(X) in direct fasbion: for a given state today, x, and the state tbat will

x' h(a,x), applying tbe definition of B(W)(x) for each player, you pair

an action ai with two continuation values (Wi(X'),y!.{r(a¡, x» ) E Wi(x') x Wi(.i(ai,a_i,x)).

1f.(w,(x'), !Q;(x(a;,x))) s.tis6es incentive compatibility, (1 - ó)Il,(a,x) + ów,(x') ;:: (1 ó)Il;(a_i,x) + ó",,(x(a;,x)), then we koow the oew poiot b,(a,x, w,(x')) (1 - ó)Il,(a,x) +

áw;(x') will lie in B(W)(x). Doing this exhaustively, for every possible combination of action

profile and promisc·threat pair, will generate the correspondence B(W)(X). Exhaustive

from

arise tomorrow,

=

=

pairing is clearly impracticaJ for most games.

boundary of

2.2

B(W), ignoring interior points.

We avoid it by directly approximating the

We describe this method in section 2.1. Section

covers more specific details of the algorithm's implementation.

3.1 Piecewise Linear Approximations of Convex Sets

Since tbe sets the comprise the elements of tbe value correpondeoce are convex, we need

efficient ways to approximate'convex sets in the computer.

Also, for tbeoretical reasans

apparent below, we wil1 want to use approximations which allow us to have useful and

relatively precise inforrnation about the approximation error. For these rcasans we will use

piecewise linear approximations. Sinee we will only develop a twa--player implementation of

our methods, our discussion will focus on approximating twa--dimensional convex sets, such

as those in Figure

1.

3.2 Value Set Iteration for Convex Sets

To do thi s, we exploit

the sl.r-sh.peness

assumption that there exists sorne point

of.e.eh 01 the

vNa(x,\:)

sel B(W)(x,), k

=

1,2, . . . K .nd Ihe

for every state which is the equilibrium

value of at least one subgame perfeet equilibrium whose path passes through tbat state.

W(X,l;) and B(W)(x,l;). Any ray originating from

8B(W)(x,\:) only once. Henee, we can deter·

mine the boundary at a given direction 9 E [0,211"] by extending a ray from the set center

vNa(x,\:). Let a be the length oí the ray and let w(a,9,x,\:) be the poiot at the "tip" of

the rayo We want to increase a until w(a,e,x,l;) is no longer in B(W)(x,\:). To determine if

w(a, 9, x,\:) E B(W)(x,\:), we check two conditions. First, tbere must be both an action profile

and a eontinuation value promise and threat, (a,w(x,\:),Yl(ai, a_j, x¡(a;,a_j" x,\:»), tbat sup·

port w(a, 9). Second, the supporting triple (a, w(x,\:),.w.(ai, a_i, XI(ai, a_j,,x,\:) must satisfy

incentive compatibility. Maximizing a at each 9 E [0,211"], subject to these two constraints,

Refer to Figure 1, where

vNa(x,\:)

vNa(X,l;)

is in

intersects the boundary oí the set

-9-

Figure

1:

Star-shapeness

- 10-

oC B(W)

defines a periodic function representing 8B(W)(xlo):

)

(

")

In Equation (9), the point tii(a, O,XI:) is written as VNc(xk)+av(O), where v(O) = (cos O,sin O).

In order for VNc(Xk) + av(O) to be in B(W)(Xk), this point must be generated by a triple

(a, W(xk),1Q(a¡,a_i,x/(ai,a_i" XIo» where vNc(xlo) + av(8) (1 - ó)IT(a, Xk) + ów(x'), for

sorne w(x') E W(x'). This irnplies that [(vN·(x.) + ,,¡¡(e) - (1 - S)TI(a,x.)JlS

w(x').

Imposing w(x') E W(x'),x' = h(a,xlo) yields condition i. in the equation. If we define

a grid of M angles, e � [0, 211"J, this representation reduces the problem of finding the

boundary 8B(W)(Xk) in every direction 8 for each state k E {1, ... , K} to M x K constrained

maximization problems, a task that can be handled by conventional software and hardware.

We compute the total approximation of the boundary function R(8) by first convexifying

the vertices defined by the R(9m) and computing the appropriate coefficients for the linear

approximation between vertices.

Figure 2 illustrates the method applied with an angular grid. Starting at the "center"

VN"(Xk), we select an angle 9m E 0. At that angle, we extend a ray to the boundary of

B(W)(xlo) by maximizing 0'. At that maximized 0''", tii(a'",Om, Xk) is the interpolant vertex

for the piecewise linear approximation of B(W)(xlo). Note that our constraints appear in the

set W(x'). For this examplc, the binding con st raint on maximizing a is that we hit aW(x/)

- W(x') will afford us no more extravagant promises than w(x').

Direct application of this technique, however poses two computational obstacles. The

first is that for many supergames, equilibrium value sets V(x) are infinite and therefore im­

possible to represent on a computer. We treat this problem by invoking lotteries to render

W(x) and B(W)(x) convexo Any ray originating from any interior point of a convex set

intersects the boundary of that set only once. By virtue of this quality, "star-shapeness", a

convex set can be represented by its bounda.ry, hence, in finite fashion. The second compu­

tational obstacle we confront is that even representing W(x) finitely, generating B(W)(x)

can involve exha.ustive pairing of actions with value pairs, (wi(x),.lQ¡(i)). This technique is

too crude for anything but the smallest problems. As an illustration, consider constructing

B(W)(x) from W(x) in direct fashion: applying the definition of B(W), you pair an action

profile with a continuation value: (a,w(x') E A x W(X'). If (a,w(x')) satisfies equations 2023, then we know the new point w(a,W(X/), x) (1-ó)Il(a, x) +ÓW(X') will lie in B(W)(X'),

Xl = h(a,x). Doing this exhaustively, for every possible action profile and promise pair, will

=

=

I

=

generate the correspondence B(W)(x). Exhaustive pairing is c1early impractical for most

-11-

games. We avoid it by using a piecewise linear approximation of the boundary of B(W)(x),

ignoring interior points, and directly approximating the boundary of B(W)(x) from the

boundary of W(x).

0.1

Speciflcs of Value Set Iteration for the 2-player Case.

At this point, we shall discuss the steps in detail for the special case where N = 2, Al> the

action-space of player 1, is finite with J elements, and A2 is finite with L elements, and the

state space has K elements. Starting with an initial W( X) that we are sure contains the

equilibrium value correspondence V(X), we apply the operator B(o) to W until 11 B(W) W II"N.S é, where é is the convergence criterion and 11

II"N. is the root sum of squared

differences oC o� at each (Jm between iterations. We summarize the principal steps for the

operator B(·) witb the following scheme:

o:

Initialize

0.1: Select vNa E

V(x) for x E

0.2: Set angle grid e

=

X.

{thet." .. . ,OM} � [0,2�]

0.3: Seleet initia] R(O)(x) lengths for eaeh o

for

1:

x

E X.

E

e, thereby eonstructing a W(x) 2

V(x)

For each Xk E X do

2: For each (Jm E e do

2.1:

For each action profile (aj,al) E A do

o(aj,a,) = max

a

s.t.

(i) 6-1[(VN(X.) + av(Om)) - (1- 6) n(.j,.¡,x.))]

E W(x'(aj ,a" Xk))

(1- 6)n (.¡,.¡,x.) + 6w( x')

(ii)

� (1- 6)W(._;.x.)+

ów(i(aj,ah Xk))

where o(aj,al,Xk)=

2.2:

O

(iii)· a � O

is understood if the constraint set is empty.

o·((Jm,Xk) = max(o(at.a¡,xk) ,o(alla2,xk), . .. ,o(aJ,aL));

2.3: w(a·( Om.x, ) . Om,X' ) = vN·(x.) + a·(Om.x.)v(Om);

3: Determine those elements oC the set UmEMW(O·((Jm,Xk), Om,Xk) which lie in W·, the

boundary oí the set 's oonvex hu11;

4:

Compute piecewise linear approximation oC the boundary oC

compute the convex hull oC the points from (2).

-12-

B(W)(Xk);

specificalIy,

5,

W(X)

Sel

Step

B(W)(X).

=

W

has changed little; else go lo

1.

in the scheme specifies that the a.Jgorithm "loop" through each angle

1

... M. We maximize

(10).

Slop if

O'

8""

m

=

in at each angle, subject to the constraints that appear in Equation

These constra.ints are functioos oC action profiles, and sorne profiles will be more

constraining than albers. We loop through all action profiles in step

profile tbat yields the maximal

each iteration on

W,

a.

1.1, 8m

In step

a

we maximize

M

x

J

x

L

numerical subproblem oí deciding if a paiot is in

(aj,a¡)

and

1. ti

to find tbe a.ction

are fixed, meaning that for

x K times. Note that in 1.1, there is the

W(Xk). These points show that the heart

oí the algorithm is a constrained maximization problem.

To understand this constrained maximization problem, we study how large

before hitting one of the two constraints.

l.).

With reference to Figure

3, consider

a

can be

constraint

w(x'), used to support today's

vN (x, ) + av(Óm) = (1- 6)II(a"a"x,) + 6w(x'), musl be in W(x').

break w(x') down into two components, one that varies with 0', and one

This constraint didates that tombrrow's value promise,

value,

w(x"a,Om)

Moreover, we can

=

,

that is fixed:

w (x' )

_

-

vN,(x,)

-

(1- 6)II(a"a"x,)

fj

This decomposition appears in Figure

approaches tbe boundary of

this quantity as ir.

Now consider constraint

W(x')

A3.

� "

+ fj V(Vm) =

_

Va( Xk) +

� (ió )

fj V Vm

(14)

We increase a so that

along tbe angle

(Jm'

When

w(a,x') = Va (Xk) + lV(Om)

w(a,x') strikes the boundary,

¡i.), the incentive compatibility (le) condition.

We can rearrange

this constraint as the inequality

w;(x') � 6-'[(1- 6)(II;(a "a" x,) - 1I;(a_;,x,)) - 6m (x')],

Examine Figure

player

A3.

as el a.nd el in Figure

a, they

Since these constraints are not a function of

1, borizontal for player 2,

A3.

i = 1,2.

and shift as a function of the action profiJe

(15)

are vertical for

a.

They appear

The le constraints are binding if a given player's value promise,

V;,a(Xk)+ ¡Vi, is equal to tbe le constraint. In Figure A3, tbis is shown happening

at o' = ó. Therefore, at the angle 8m and the action profiJe (aj,al), Ó is the

constrained maximum for step 1.1; tbe le constraint for player 2 and tbe constraint w E W

w;(o',x')

=

for player

1

are not binding. Tbe maximization problem oí step

1.1

boils down to solving a Cew linear

equations that identify tbe intersedions oC the ray at angle

two le constraints and the boundary oC

We do, tbe maximization in step

8m

originating at Va, witb tbe

1.1 for alI possible action profiles.

impJy different constrained maxima for

show bow botb

W.

a.

This is shown in Figure

Va and the le constraints shiCt as a function oC Q.

I One might exploit game structure to economize on this search

-

13 -

I

Different action profiJes

A4.

In tbat figure, we

eonsider the action profile

as one would

have to if A were continuou$.

�

w( ,,�e..l =- 11"'+ ¡( if

B{W)

=(I-rlTr/a)<

(J...

I

I

,W

----�-�==--�

!.!l,

--+Figure 2: Extending the ray v + ov at the boundary oí B(W)

-14-

v....

B{'N)

'1f.

-

.��-

1r""_(J-f)1r/G)

Ó

;,-....

Figure 3: Extending the ray at angle () with the a.ction profile fixed

-

15

-

B(V.¡)

j

" ...". ... +«,IV"

--- "V.....tI% ,.;r

� 'Y"'" �t<'JV

¿'v.:(J)

ir""

�(r)

..

Figure

4:

. . '1,r"(3))

Ray extension from

varjous action profile

s

-16-

a(l): it shifts Va(t) to the upper Ieft of vNa. As we inerease a at angIe 8m, we find that

we encounter pIayer l's re constraint first, it(a(l». Hence, a.ction profile a(l) produces a

maximaI a of length al' Moving on to a.ction profile a(2) , Va(2) shifts directly below vNa.

The le constraints for this action profile are non.binding, therefore we hit the constraint

Va(2) + ¡'v(8m) = w(a) E W first. This determines that the maximal a for a(2) is 0'2' For

action profile a(3) we hit pIayer 2's le eonstraint first (the le constraint for pIayer 1 is not

depicted) giving us a muimal a which we denote 0'3' Aetion profiles do not always generate

a point Va which lies in W. We show this with action profile a(4). As we extend a, the point

w(a) enters the set W. Hence, it is possible that although a = O is not in the constraint set,

there are larger values of a that do fall in the constraint seto With 8m remaining fixed, after

having looped through each action profile we determine the largest value o(aj, ak) and set

it equal to o· (step 1.2). We determine the extremal elements of B(W) at each angle Om in

cartesian coordinates, w(a"(Om),Om) = v: + o·v(8m) (step 1.3). We then convexify this set

of extremal points and then fit an approximation of R(O) (steps 2 and 3).

4. An Example: Credible Fiscal Policy in a Primitive Society.

In this example a government must finance a varying but periodic series of (exogenous)

expenditures, either through varying the taxes paid by its constituents, or through financing

fluctuations in expenditures with the help of a lendee. Government's objective is to maximize

the welfare of its constituents. Included in the specification of the government's action space

is a budget constraint. If an action violates tbe budget constraint, it is rendered unavailable.

Tbougb the government's source of revenue is a tu 00 the productioo of bouseholds, it

ca.nnot directly choose allocations of consumption and leisure on behalf of the households.

Naturally, these allocations are ehosen by the households themselves, in light of the tax

rateo Taxes are distorting and therefore decrease households' welfare beyond losses that

would arise tbrougb lump sum taxation. Due to its restriction to a distorting instrument of

taxation, the government prefers to smootb taxes, since tbis maximizes household welfare

subject to the government financing its expenditures.

Tbe lender is risk neutral. He lends· to the govemment out of an endowment he receives

each period, w. His payoff, de, is the sum of the endowment he receives each period less

tbe net transfer made to the government. One can interpret the lender as a banking house

or cartel of banks, assuming also that the coalition is rohust to defection by tbe individual

players tbat comprise it.

The fiscal problem faced by tbe government reduces to a two..player ga.me between tbe

government and its lender. The government is tempted to default on tbe lender once it

has debt outstanding¡ the lender protects birnself from such opportunism with the threat

of witbdrawing lending services indefinitely in the future sbould tbe government defa.uIt.

-

17 -

Literature 00 sovereign leoding2 has shown that, perhaps surprisingly, this threat is not

sufficient to support lending in all environments. That is, the Folk Theorem does not hold

for a11 games of sovereign lending. The key to such "no lending results" is whether the

government has access to an alternative channel for smoothing taxes: if the government

does not have access to a storage technology, bankers effectively have a sanction technology.

·

They can deny the government the means by which to smooth taxes in the face of fluctuating

expenditures. If the government does have access to a storage technology (e.g., or a state­

contingent form of savings deposity in an environment of uDcertainty), it can self-smooth,

and will always be better off not paying lenders, and using the proceeds of default to build

a tax-smootbing fundo

As an illustration of the algorithm, we replicate these well-known results in the economy

described aboye.

4.1 Program 1: the government cannot save

The bargaining session works as. íollows: a11 lending matures in one periodo Lending oí

tonger maturity must be arranged by successively "rolling over" principal. The government

begins by stating how much interest and principal from last period's loaos it will pay back,

RIB,_I, where Rt is the gross factor oí return (one plus the interest rate). Simultaneously,

the government states how much fresh credit it wants, Bt. Next, the ooalition oí lenders

state how much they are willing to lend, E,. New credit extended is Bt min(Bt. Bt), and

the net transíer of funds in the period is (B, - RtBt_d.l This specification reduces to an

arrangement where the government and its lender bargain over net flows: let T, = (B, R,B,_,) and f, = (B, - R,B,_,). Then T, sign(f,)·min(lf,¡, If,1) il f, and f, are the same

sign, T, = O ií T, and T, are of opposite signo

The repeated game has a state variable, the leve! of government expenditure. For a given

profile oí actions, players' current and expected future payoffs differ according to the value

oí the state variable. The discounted present value of a strategy will aloo depend upon the

current value of the state. Hence, the discounted value of an equilibrium is actually a set of

values, indexed by the states tbat occur aJoog the path arising in that equilibrium. The set

of equilibrium values is comprised oí many sets, one associated with each state of the world.

Because the game is recursive, given the state of the world, the set of equilibrium values that

can be achieved does not depend on time.

Formally, the lender's problem is

=

=

'Bulow and Rogoff (198980, 1989b); Chari and Kehoe (199380, 1993b).

sTec:hnically, the timing scheme amounts to a device of exp08ition: the solution algorithm used to compute

eq,uilibruim utilizes tbe stage game in its normal form, which is equivalent to a version of tbe game wbere

neitber player observes tbe otber's action at tbe time be cbooses. We do not adopt a Rubenstein bargaining

set-up for negotiations, common in other of tbe debt literature.

-18-

V(9o) = m.!'x

(16)

subject tO:

(17)

{Te}

if

if

(1

�

-8)¿:: 8'd,

1=6

�

1'1 and TI are

oC the sa.me sign

(18)

T¡ and Tt are

oí the opposite signo

V(9.)

(19)

In the problem fJ is the discount factor1 (I-b") is a normalization factor that scales the dis­

counted present value of utility.to the range oí single period utility values. Equation 3 is the

bargaining rule .on nel transfers between government and hanker explained aboye. Equation

4 imposes subgame perfect behavior on the lender.

The economy is inhabiled by a number oí identical households that produce the single

consumption good by supplying labor. They have access lo a production technology, f(nd,

that allows thero to convert labor. nI, ioto the consumption good. This fundian is increasing

in its first derivative and concave. Households optimize over an infinite horizon, {) is the

discount factor, and preferences are definoo over consumption and leisure, U(er. lt). The

households' basic choice is how much to work versus how much to eat. The formal problem

is

max

{CI'/'}

subject to:

(J

�

-8)¿::8'U(c"I,)

t:O

c,

$

It

(20)

(1 - r,)! (n,)

(21 )

1 - nt.

(22)

The family is a "tax·taker", that is, it accepts the tax levy Tt as giveo each periodo The

family does oot save because it is denied means to do so. Assume that production technology

and preferences are 5uch that the revenue maximizing tax rate, T-, always yields' revenues

sufficient to cover government expenditure: gt � T·f(nt(T")). Households do oot behave

strategically. They go through life equating marginals in their repeated, static problem.

The government solves the problem

�

(! -8) ¿:: 8' U(c"I,)

t=O

-19-

(23)

(24)

subject to:

U,(c" 1,)fU, (e" 1,)

=

(1 - T, )f'(n,)

C , = (1 - T,)f(n,)

ir

ir

(25)

(26)

Tt and Tt are

oC the same sign

(27)

Tt and Tt are

oC tbe opposite signo

(1 -ó) L ó' U(c" 1,) ? W(y.)

t =.

(28)

Equation 8 is tbe government's objective Cunction, equal to the discouted present value oC

the weighted utility oC its subjects. Ut(Ch lt) > O, U2(Ch lt) > O and U(Ct, lt) is concave.

Equation 9 is the government budget constraint. Domestic spending, 9t, must equal the net

current flow oC Cunds Crom the lenders plus total revenue taxes. Equations 10 and 11 are

the households' incentive compatibility constraints. Tbey determine how government taxes

11 yi eld the aggregate resource

equilibrium condition Ct +dt +9t :;;; f(nt)+w. Equation 12 is the outcome rule for bargaining

over tbe net flow of funds between the lender and the borrower. Equation 13 imposes subgame

perCection on the government.

Solutions to Program 1 show that in punishment phases oC pa' ths arising in subgame per·

Cect equilibria, tbe government must move taxes up and down with fluctuating expenditure.

In high welfare equilibria, the government borrows and repays to allow smoothing of taxes.

Tbese results are graphed and discussed in greater detail in Section 4.

affect consumption and labor supply. Equations 2, 9 and

4.2 Program 2: the government can save

In

this program, the government has a.ccess to a storage technology. This makes the lender's

penalty oC cutting off future credit much less severe. The government can smooth without

creditors, but it must save in advance. The government now solves the problem

W(Yo, Ao) =

00

",ax

{....T.,A.+I}

(l-ó)¿;ó'U(c" I,)

t=O

(8)

(14)

subject to:

-20-

U,(c"I,)/U,(c" 1,)

e, =

=

(1- T,)f' (n,)

(1 - T,)f(n,)

if

if

(10)

(11 )

TI and T, are

of the same sigo

(12)

TI and Tt are

oí the opposite signo

00

(l-ó)Ló'U(c" I,)::> W(g"A,)

f=.

(13)

Households' and the lender's problems are unchanged from Program lo

Granting the government a storage technology causes lending to break clown. This is

because in the first period the government owes the lender a. repayment it can instead save

the resources that were to be used to repay. In the next period the government has need of

resources in arder to smooth taxes, it draws clown ¡ts savings. The lender, in anticipation

of this, never ¡ends. These results are sensitive to tbe assumptions: T" f(C(T")¡) ;::: 91 is

criticaL It is also important that the sequence {gtl� is known with certainty. If {gr} �o

was stochastic, a. no-lending result would depend the on distribution and support of gl'

With a storage technology and no lending the government is worse off at the best equilibria

oí Program 2 than it would be at the best equilibria oí Program 1: in those states oí the

world where the government has low savings and high expenditures, it must raise taxes

and deíer a plan oí smooth taxes until the next period oC low government expenditure. If

it could borrow, it could begin smoothing right away. These findings are sensitive to the

efficiency oC the government's storage technology. [f it can save and earn interest equal to

or greater than the lender's discount rate, there will be no lending whatsoever. As interest

earned by the government approaches zero, or becomes negative, small amounts oC debt

can be supported. As the storage technology becomes less efficient, lending nears levels for

Program 1. This confirms results of ehari .nd Kehoe (1993b) .nd Bulow and Rogoff (1989.)

in tbis environment.

4.3 Computational results

For the computation oC all programs, we assume the Collowing íunctional forms:

( 15)

-

21

-

f(n,) = n,'.

( 16)

The period ayer which the experiments will be run will be about three or four years. We

choose this period length because we are modeling expenditure fluctuations and this seerns

a reasonable duration to posit for a typical cause oí expenditure fluctuation, war. Therefore

6 0.9 ror most experiments.

=

4.3.1 Computations for Program 1

To run the first computation we set 0") = 0.6, 0"2 = 0.2. While these elasticities are oot

particularly "realistic", Cor the additive separable specification oí utility and the households'

environment it yields negative labor supply response to the tax rateo (For lag preferentes, ¡.e.

0'"1 = (72 = 1, labor supply is inelastic; Cor 0"1 > 1 and 0'2 > 1, labor supply rises in response

to higher taxes.) The production parameter "1 is set at 0.65. The process for exogenous

government expenditure is of period two: one period of high expenditure, one oc. low (four

years of wa.r, four years of pea.ce). {gl}�o {O, 0.24, O, 0.24, ...}. The endowment for

the lender, w = 0.24. The lender is always capable of funding the government's full need for

finance. Utility functions were scaled up or down by affine transformation so that payofrs

lie in the interval [O, IOJ. Calling the government player 1, the lender player 2, and ·their

respective payoffs IT1(a) and Ih(a), we have

=

11,(a) =�, + 6U(c" 1,)

and

11,(a)

=

(, + (,d,.

The values � = (-26,15.5) and (

(0,20.8) map government and lender payoffs into

¡O, 10J x ¡O, IOJ.

Finally, we, discretize both action and state spaces oí tbe government and bankers. Dis­

cretization is not necessary for varia.bles ct, and lt, for they are determined as a result of

the government's choice of T and can be solved exactly without increasing computational

complexity. For the government's actions,

=

TI

r,

=

lJ,-R,B,_,

e

{-0.24,

E

{O.O,

0.2,

0.46, 0.715};

-0.18,

-0.12,

-0.06,

0.0,

0.06,

0.12,

0.18,

0.24}.

-0.18,

-0.12,

-0.06,

0.0,

0.06,

0.12,

0.18,

0.24}.

For the lender's a.ction:.

r, = lJ,-R,B,_,

e

{-0.24,

Negative transfers go from government to lender; positive transfers go írom lender to govern­

mento We have chosen the grids on gt, Tt and TI so that the accounting oí the government's

-22-

6.2 r------�--__,

6.4

6.2

6

o

6

5.8

�5.8

i

.2 5.6

'"

�5.6

�

=

o

�

..

Q.

o::

.E

�5.4

5.4

�

5.2

5.2

5

5

4.85

•

5.5

6

6.5

4.84L- --o- -o5--: 6 --: - --7-:

7

-

-

Payoff tar Player 1

Payoff tar Player 1

Figure 1: Value sets, Program

1

budget ¡eaves only small amounts oí taxed resources unaUocated. However, the government

still has the choice to give these inter·grid rounding errcrs back lo consumers lump sum, or

lo give thero to the lender, as a small adjustment to the bargained transfer in the lender's

favor.

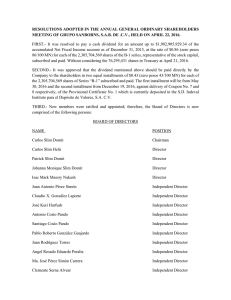

The value sets for Program

1

are shown in Figure

1 for tbe two values oC the state variable

9c. The axes oC tbe graphs represent the average oC the present discounted values each pIayer

receives ftom playing a subgame perfect equilibrium. The value sel corresponding to peace

(9t = O) appears on the left, war (ge =

.24 )

on the right. There are many possible equilibria,

and by extension, many equilibrium values in each state of the world.

The punishment

values on the southwest border of the value sets arise in two types of equilibria: the first

are autarkic-the government.never borrows, and the lenders never lend. The second are

"carrot and stick" punishments-in these equilibria, it is not best to play non.cooperatively,

but rather to go along with your own punisbment.

In

such equilibria, the player that is

known as the deviator deliberately chooses an action that results in a low one-shot payoff.

-

23

-

Of course the inducement is that the continuation promise associated with going along with

one's punishment is high.

As a con.sequence,

carrot

and stick paths

can

generate severe

punishment5, yet they still allow pIayers to emerge from punishment, or non-cooperative

play.

It is possible to generate outcome allocations along �he paths that alise in equilibrlum

from

V(x) using

optimal penal codes, in the language oC Abreu (1988). The evolution oC the

value of playing a particular equilibrium is shown in Figure

5.

The value of the outcome

• ) in the state g,

.24.

'

can move all over the value sets.

O, at the point (5.2, 5.4). Since gt = .24 in tbe subsequent perlod,

hand value set: the star al (4.4, 5.44) i. the value oC Ihe equilibrium

path i. marked by circl..

(o)

in the otate g,

=

O and by staro (

=

Firstly note that the value of playing a given equilibri�

Play originates in g,

=

.kip over to the right

in the second period. The value of play evolves rising to nearly the top of the value sets,

altemating from one set to the other. Then, play moves the position of continuation values

down, in southeast directioo, along the Pareto frootier.

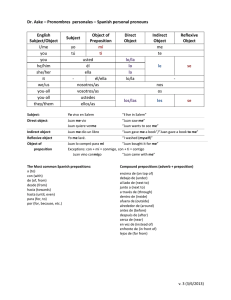

The Cour ploto in Figure

top row (the govermnent

bottom row.

In periods

00

• graph

the on...shot payoffs Cor each player through time on the

the left, the lender on the right), the evolution of value on the

1-11, perlod payoft'a for tbe govemmeot are volatile, reftecting the

fact that it is in punishment phase4 and that it ia not being allowed to smooth by tbe tender.

Tbe government also mues small tranafers to tbe tender out of revenues not allocated to

9,. Trua is part of "going along with its own punishment." In perlod 10 the government

begins lo mue larger IransCers lo the lender during periods oC peace (declining peaks in Ihe

Iop left plot). With that show oC "good faith", the lender slarts lending lo Ihe governmenl.

Govemment ta.xes, and perlod-payoft's are tben smooth for tbe remainder of play. The lender

now aborbs the volatility of the sequence g, through financial flows. The four plots in Figure

3 graph the underlying economic allocations through time.

Note thal tbis path i. only one arnong literally infinile palhs lhal arise in equilbrium.

We were able to see allocations during a punishment because we chose to start the path at a

punishment value. Paths moving along the northeast frontiers of the equilibrlum value sets

always uve the govemment smootbing taxes.

4.3.2 Computations for Program 2

In

Program 2, the government has the capacity to save. As with Program 1, parameters are

al = 0.6, 002 = 0.2, and -¡ = 0.65. The process for exogenous government expenditure

remains {gt}:'o = {O, 0.24, O, 0.24, . . . }, and tbe endowment for tbe lender w = 0.24.

The values e

(-26,15.5) and ( (0, 20.8).

set as

�

�

·Once on a cooperative path, punishments do not arise in equilibrium as can happen in a game with

imperCect inCormation. However by initiating tbe. game at a punisbment value, we are able to trace out

punisbment patbs tbat would otherwise líe "off path.

n

- 24 -

-

i

rt.

10

10

8

8

6

.;¡ 6

�

Q. 4

ii:

w

4

2

2

O

O

-

10

20

Periodo

30

O

O

40

10

10

8

8

6

.;¡ 6

2

2

�

Q. 4

:>

O

O

10

20

30

40

20

Periodo

30

40

Periodo

f4

:>

10

20

Periodo

Figure

6:

30

O

O

40

10

Evolution of Value, Payoff's ayer time, Program 1

- 25 -

0.8

0.8

� 0.6

10.6

..

0.4

�

° 0.2

"l;: 0.4

Ir

o

° 0.2

O

10

30

20

O

40

jj

20

30

40

0.8

;:.

"R:O.6

<il

.8 0.4

0.5

�

�

10

Periad:

Periad:

!I 0.2

-0.5

O

�--�4O

0�--�17

0--�

2O

�--7

30

-1 � � -=--���

40

0 --10 -- 20

30

Periad:

Period:

Figure

7;

Evolution oí allocations over time, Program 1

-

26 -

For the government's action space,

T.

E

T

{O.O,

is discretized as

0.2,

0.46,

The gross rate of interest for the government,

R,

0.715}.

is constant at

1/6 or 1.111.

The govern­

ment's assets lie in the grid

A.

E

{O.O,

0.06,

0.12}.

The government's bargaining position for transfers Hes in

T.

=

B.-R.BI-l

E

{-0.24,

E

{-0.24,

-0.18,

-0.12,

-0.06,

0.0,

0.06,

0.12,

0.18,

0.24}.

-0.12,

-0.06.

0.0,

0.06,

0.12,

0.18,

0.24}.

The lender's transfer offers lie in

t.

=

B.-R.BI-l

-0.18,

There are six possible states in the garne, one for eac� combination of gt and

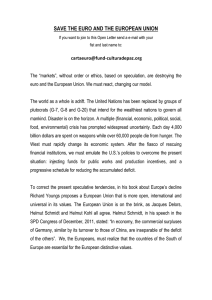

The value sets for Program

(g" A.)

=

{(O,O),

(0,0.12),

At.

2 are shown in Figure 8.. The only four states are shown,

(.24,0), (.24,.12)}. The value set in e&eh st.te has col­

lapsed to a single point. TOOs is because lending breaks down, and there is a unique equilib­

rium action (and hence a unique subsequent path oí play and a unique value) in each state.

The lenders never lend, and the government smooths using its own assets. The path shown

is marked by a + and a

6 (gt

=

.24,

At

=

x:

.12),

in state

1 (gt

=

O.

it raises revenues oí

At

=

.12,

O), the government saves

0.12.

In state

draws down savings, and gives interest

back to the households as a lump-sum payrnent. The penod payoffs and evolution oí values

through time are shown in Figure �, and Figures 1 0 and l 1 show the economy's allocations

through time.

5. Conc1usion

In this paper we have described and implemented a computer algorthm to solve discounted

sugergarnes with perfect monitoring and state variables. Key assumptions are restriction to

pure strategies, the inclusion of public randomization and a finite state space. We represent

the key object in the "dynamic prograrnrrung approach to supergames", the value set, by

its boundary. This parsimonious representa.tion of the value set allows us to compute a.n

inner approxima.tion oí the set rapidly, far more ra.pidly tnan would be possible using "brute

force" methods such as exhaustive search.

We demonstrate the algonthm for a. fiscal policy game played by a government and its

lender. The level of government expenditures to be financed is the state variable. Com­

puta.tions venfy theoretical results of Cronshaw and Luenberger and Abreu, Pearce and

Stacchetti, Bulow and 'Rogoff and Chari and Kehoe. Tbis computa.tiooal approach is gener­

alizable to games of imperfect information, stochastic garues, a.nd games oí asymmetnc in­

íormation. Areas oí research we are exploriog are wa.ys to produce an "outer-approxima.tion"

oí the value set, and other a.pplications.

- 27 -

6

6

'"

'"

I!i 5.5

� 5.5

...

..

l

.e 5

¡;:

.e 5

+

"'

o

...

�

.f 4.5

4

6

¡f 4.5

6.5

7

7.5

Payoff for Player

4

6

8

6.5

7

7.5

Payoff for Player 1

1

8

6 ,------,

6 ,------,

'"

� 5.5

'"

:s 5.5

�

l

¡;:

.2 5

x

.2 5

"'

�

¡f 4.5

�

.f 4.5

4 �--�------------�

8

6

7.5

6.5

7

--��--�--���

4�

7

7.5

6

8

6.5

Payoff for Player 1

Payoff for Player 1

Figure 8 : Value sets, Program 2

- 28 -

10

10

8

8

.;.; 6

N 6

2IL

4

a:

2

�

iL

4

2

O

O

O

O

10

5

Penad:

�

10

10

8

8

6

N 6

4

¡¡:

4

>-

:>

2

2

O

O

10

!;.

2-

IL

5

Penad:

O

O

10

5

Figure

9:

5

10

Periad:

Perlad:

Evolution oí Value. Payoffs over time, Program

-

29 -

2

0.8

0.8

0.6

1

><

';'! 0.4

¡,;

!' 0.6

..

a:

:r-

�

CI 0.2

O

O

0.4

iS

CI 0.2

5

O

lO

O

Period:

�

lO

0.8

0.5

�

!

5

Period:

O

-0

5

.

O

�

---5

-0L----10

-oL-------�

5

lO

Period:

Period:

Figure l O: Evolution oC allocations over time, Program

-

30

-

2

0.8

,;:

z

el

0.8

0.6

.!i 0.6

0.4

a:

� O.4

0.2

0.2

O

O

..

5

O

O

10

B

O

en

.8 0.4

-0.5

� 0.2

-1

O

10

0.8

>.

8:0.6

0.5

¡,;

5

Periodo

Periodo

"

5

O

O

10

5

Periodo

Periodo

Figure 11: Evolution oí allocations over time, Program 2

-

31

-

10

References

[1] Abreu, Dilip. (1988): "On the Theory oC Infinitely Repeated Games with Discounting,"

Economelrica 56, 383-396.

[2J Abreu, Dilip, David Pearce, and Eneio Stacchetti (1986): "Optimal Cartel Equilibria

with Imperfect Monitoriog,"

Joumal oi Economic Theory 39,

251-269.

[3] Abreu, Dilip, David Pearce, and Enoio Stacchetti ( 1990): "Toward a Theory oC Dis­

counted Repeated Games with Imperfect Monitoring," Econometrica 58, 1041-1063.

[4] Bulow, Jererny and Kennetb Rogoff. 1989a. "Is to Forgive lo Forget?"

nomic Review 12: 497-513.

American Eco­

[5) Bulow, Jeremy and Kenneth Rogoff. 1989b. '"A Constant Recontracting Model oC

Sovereign Debt," Journal 01 Political Economy 97(1): 155-178.

[6J Chari, V.V. and Patrick J. Kehoe. 1990. "Sustainable Plans,"

omy 98, 783-802.

[7J Chari,

V.V.

Joumal 01 Political Econ­

and Patrick J. Kehoe. 1993a. "Sustainable Plans and Debt,"

230-261.

Journal ol

Economic Theory 61:

[8J Chari,

V.V.

and Patrick J. Kehoe. 1993b. "Sustainable Debt and Mutual DefauIt,"

60: 175-195.

Review 01 Economic Studies

[9J Judd, Kenneth and Conklin, James. (199.5 ). "Cornputing Supergarne Equilibria,"

.

rnirneo, Hoover Institution.

[lOJ Cronshaw, Mark and David C . Luenberger ( 1994): "Strongly Syrnmetric Subgarne Per­

fect Equilibrium in Infinitely Repeated Carnes with Perfect Monitoring and Discount­

ing," Cames and Economic Behavior 6: 220 - 237.

[11] Judd, Kenneth L. (1996):

Numerical Methods in Economics,

[12] Stokey, Nancy L. (1991): "Credible Public Poliey,"

and Control 15, 627-656.

-

33

-

manuscript.

The Joumal 01 Economic Dynamics

WORKING PAPERS

(1)

9210

Ángel Serrat Tubert: Riesgo, especulación y cobertura e n un mercado d e futuros dinámico.

921 J

Soledad Núñez Ramos: Fras, futuros y opciones sobre el MIBOR.

9213

Javier Santillán: La idoneidad y asignación del ahorro mundial.

9214

Maria de los Llanos Matea: Contrastes de raíces unitarias para series mensuales. Una apli­

cación al lPe.

92/5

Isabel Argimón, José Manuel González-Páramo y José María Roldán: Ahorro, riqueza y

tipos de interés en España.

92/6

Javier Azcárate AguiJar-Amat: La supervisión de los conglomerados financieros.

92/7

Olympia Bover: An empirical modeJ of house prices in Spain (1976-1991). (The Spanish

original of this publication has the same number.)

92/8

Jerocn J. M. Kremers, Neil R. Ericsson and Juan J. Dolado: The power of cointegration

tests.

9219

Luis Julián Álvarez, Juan Carlos Delrieu and Javier Jareño: Treatment oC conflictive Core­

casts: Efficient use of non-sample informarion. (The Spanish original oC this publication

has the same number.)

9221

Fernando Restoy: Interest rates and fiscal discipline in monetary unions. (The Spanish

original of this publication has the same number.)

9222

Manuel Arellano: Introducción al análisis econométrico con datos de panel.

9223

Ángel Sertat: Diferenciales de tipos de interés ONSHORE/OFFSHORE y operaciones

SWAP.

9224

Ángel Serrat: Credibilidad y arbitraje de la peseta en el SME.

9225

Juan Ayuso and Fernando Restoy: Efficiency and risk premia in foreign exchange markets.

(The Spanish original of this publication has the same number.)

9226

Luis J. Álvarez, Juan C. Delrieu y Antoni Espasa: Aproximación lineal por tramos a com­

portamientos no lineales: estimación de señales de nivel y crecimiento.

9227

Ignacio Heroando y Javier Vallés: Productividad, estructura de mercado y situación finan­

ciera.

9228

Ángel Estrada Garda: Una función de consumo de bienes duraderos.

9229

Juan J. Dolado and Samuel Bentolila: Who are the insiders? Wage setting in spanish

manufacturing firms.

9301

Emiliano González Mota: Políticas de estabilización y límites a la autonomía fiscal en un

área monetaria y económica común.

9302

Anindya Banerjee, Juan J. Dolado and Ricardo Mestre: On sorne simple tests Cor cointe­

gration: the cost of simplicity.

9303

Juan Ayuso and Juan Luis Vega: Weighted monetary aggregates: The Spanish case. (The

Spanish original of this publication has the same number.)

9304

Ángel Luis Gómez Jiménez: Indicadores de la política fiscal: una aplicación al caso español.

9305

Ángel Estrada y Miguel Sebastián: Una serie de gasto en bienes de consumo duradero.

9306

Jesús Briones, Ángel Estrada e Ignacio Heroando: Evaluación de los efectos de reformas

en la imposición indirecta.

9307

Juan Ayuso, María Pérez Jurado and Fernando Resloy: Credibility indicators of an ex­

change rate regime: The case of the peseta in the EMS. (The Spanish original of this publi­

cation has the same number.)

9308

Cristina Mazón: Regularidades empíricas de las empresas industriales españolas: ¿existe

correlación entre beneficios y participación?

9309

Juan Dolado, Alessandra Goria and Andrea Ichino: lmmigration and growlh in the host

country.

93/0

Amparo Ricardo Ricardo: Series históricas de contabilidad nacional y mercado de trabajo

9311

Fernando Restoy and G. Michael Rockinger: On stock market returns and returns on in­

9312

Jesús Saurina Salas: Indicadores de solvencia bancaria y contabilidad a valor de mercado.

9313

Isabel Argimón, José Manuel González-Páramo, Maria Jesús Martín and José María Roldán:

para la CE y EEUU: 1960-1991.

vestment.

Productivity and infrastructure in the Spanish economy. (The Spanish original of this publi­

cation has the same number.)

9314

Fernando Ballabriga, Miguel Sebastián and Javier Vallés: Interdependence of EC econo­

9315

Isabel Argimón y M.a Jesús Martín: Se?ie de «stoch de infraestructuras del Estado y de las

9316

P. Martínez Méndez: Fiscalidad, tipos de interés y tipo de cambio.

93J7

P. Martínez Méndez: Efectos sobre la política económica española de una fiscalidad distor­

sionada por la inflación.

9318

Pablo Antolín and Olympia Bover: Regional Migration in Spain: The effect of Personal

Characteristics and of Unemployment, Wage and House Price Differentials Using Pooled

Cross-Sections.

mies: A VAR approach.

Administraciones Públicas en España.

9319

Samuel Bentolila y Juan J. Dolado: La contratación temporal y sus efectos sobre la compe­

titividad.

9320

Luis Julián Álvarez, Javier Jareño y Miguel Sebastián: Salarios públicos, salarios privados

e

inflación duaL

9321

Ana Revenga: Credibility and inflation persistence in the European Monetary System. (The

9322

María Pérez Jurado and Juan Luis Vega: Purchasing power parity: An empirical analysis.

9323

Ignacio Hemando y Javier Vallés: Productividad sectorial: comportamiento cíclico en la

9324

Juan J. Dolado, Miguel Sebastián and Javier Vallés: Cyclical patterns oC the Spanish eco­

9325

Juan Ayuso y José Luis Escrivá: La evolución del control monetario en España.

Spanish original of this publication has the same number.)

(The Spanish original of this publication has the same number.)

economía española.

nomy.

9326

Alberto Cabrero Bravo e Isabel Sánchez Garda: Métodos de predicción de los agregados

monetarios.

9327

9328

Cristina Mazón: Is profitability related to market share? An intra-industry study in Spanish

manufacturing.

Esther Gordo y Pilar L'Hotellerie: La competitividad de la industria española en una pers­

pectiva macroeconÓmica.

9329

Ana Buisán y Esther Gordo: El saldo comercial no energético español: determinantes y

análisis de simulación (1964-1992).

9330

Miguel Pellicer: Functions of the Banco de España: An historical perspective.

940J

Carlos Ocaña, Vicente Salas y Javier Vallés: Un análisis empírico de la financiación de la

9402

P. G. Fisher and J. L. Vega: An empirical analysis of M4 in the United Kingdom.

9403

J. Ayuso, A. G. Haldane aud F. Restoy: Volatility transmission along the money market

pequei'ia y mediana empresa manufacturera espai'iola: 1983-1989.

yield curve.

9404

Gabriel Quirós: El mercado británico de deuda pública.

9405

Luis J. Álvarez and Fernando C. Ballabriga: BVAR models in the context of cointegration:

A Monte Cario experimento

9406

Juan José Dolado, José Manuel González-Páramo y José M: Roldán: Convergencia eco­

9407

Ángel Estrada e Ignacio Hernando: La inversión en España: un análisis desde el lado de la

nómica entre las provincias españolas: evidencia empírica (1955-1989).

oferta.

9408

Ángel Estrada Garda, M: Teresa Sastre de Miguel y Juan Luis Vega Croissier. El meca­

nismo de transmisión de los tipos de interes: el caso español.

9409

Pilar García Perca y Ramón G6mez: Elaboración de series históricas de empleo a partir

de la Encuesta de Población Activa (1964-1992).

94/0

F. J. Sáez Pérez de la Torre, J. M: Sánchez Sáez y M: T. Sastre de Miguel: Los mercados

de operaciones bancarias en España: especialización productiva y competencia.

94/1

Olympia Bover and Ángel Estrada: Durable consumption and house purchases: Evidence

from Spanish panel data.

94/2

José Viñals: Building a Monetary Union in Europe: Is it worthwhile, where do we stand,

and where are we going? (The Spanish original oí this publication has the same number.)

94/3

Carlos Chuliá: Los sistemas financieros nacionales y el espacio financiero europeo.

94/4

José Luis Escrivá and Andrew G. Haldane: The interest rate transmission mechanism: Sec­

94/5

M.a de los Llanos Matea y Ana Valentina Regil: Métodos para la extracción de señales y

toral estimates for Spain. (The Spanish original of this publication has the same number.)

para la trimestralización. Una aplicación: Trimestralización del deflactor del consumo pri­

vado nacional.

94/6

José Antonio Cuenca: Variables para el estudio del sector monetario. Agregados moneta­

rios y crediticios, y tipos de interés sintéticos.

9417

Ángel Estrada y David López-Salido: La relación entre el consumo y la renta en España:

un modelo empírico con datos agregados.

9418

9419

José M. González Mínguez: Una aplicación de los indicadores de discrecionalidad de la

política fiscal a los países de la UE.

Juan Ayuso, María Pérez Jurado and Fernando Restoy: Is exchange rate iisk hjgher in the

E.R.M. after the widening oí fluctuation bands? (The Spanish original of this publication

has the same number.)

9420

Simon Mitner and David Metcalf: Spanish pay setting institutions and perfonnance outcomes.

942/

Javier Santillán: El SME, los mercados de djvisas y la transición hacia la Unión Monetaria.

9422

Juan Luis Vega: ls lhe ALP long-run demand funclion stable? (The Spanish original of this

publication has the same number.)

9423

9424

Gabriel Quirós: El mercado italiano de deuda pública.

Isabel Argimón, José Manuel González-Páramo y José María Roldán: Inversión privada,

gasto público y efecto expulsión: evidencia para el caso español.

9425

Charles Goodhart and José Viñals: Strategy and tactics of monetary policy: Examples from

Europe and the Antipodes.

9426

Carmen Melcón: Estrategias de política monetaria basadas en el seguimiento directo de

objetivos de inflación. Las experiencias de Nueva Zelanda, Canadá, Reino Unido y Suecia.

9427

Olympia Bover and Manuel ArellaRo: Female ¡abour force participation in the 1980s: the

case of Spain.

9428

Juan María Peñalosa: The Spanish catching-up process: General deterrninants and contribution oi the manufacturing industry.

9429

Susana Núñez: Perspectivas de los sistemas de pagos: una reflexión crítica.

9430

José Viñals: ¿Es posible la convergencia en España?: En busca del tiempo perdido.

9501

Jorge Blázquez y Miguel Sebastián: Capital público y restricción presupuestaria guberna­

mental.

9502

9503

Ana Buisán: Principales determinantes de los ingresos por turismo.

Ana Buisán y Esther Gordo: La protección nominal como factor determinante de las im­

portaciones de bienes.

9504

Ricardo Mestre: A macroeconomic evaluation oi the Spanish monetary policy transmis­

sion mechanism.

9505

Fernando Restoy and Ana Revenga: Optimal exchange rate flexibility in an economy with

intersectoral rigidities and nontraded goods.

9506

Ángel Estrada and Javier Vallés: Investment and financial costs: Spanish evidence with pa­

9507

Francisco Alonso: La modelización de la volatilidad del mercado bursátil español.

nel data. (The Spanish original oi this publication has the same number.)

9508

Francisco Alonso y Fernando Restoy: La remuneración de la volatilidad en el mercado es­

pañol de renta variable.

9509

Fernando C. BaUabriga, Miguel Sebastián y Javier Vallés: España en Europa: asimetrías

reales y nominales.

9510

Juan Carlos Casado, Juan Alberto Campoy y Carlos Chuliá: La regulación financiera espa­

9511

Juan LuiS Díaz del Hoyo y A. Javier Prado Domínguez: Los FRAs como guías de las expec­

ñola desde la adhesión a la Unión Europea.

tativas del mercado sobre tipos de interés.

9512

José M: Sánchez Sáez y Teresa Sastre de Miguel: ¿Es el tamaño un factor explicativo de

9513

Juan Ayuso y Soledad Núñez: ¿Desestabilizan los activos derivados el mercado al conta­

las diferencias entre entidades bancarias?

do?: La experiencia española en el mercado de deuda pública.

9514

M: Cruz Manzano Frías y M" Teresa Sastre de Miguel: Factores relevantes en la determinación del margen de explotación de bancos y cajas de ahorros.

9515

Fernando Restoy and Philippe Weil: Approximate equilibrium asset prices.

9516

Gabriel Quirós: El mercado francés de deuda pública.

9517

Ana L. Revenga and Samuel Bentolila: What affects the employrnent rate intensity of

growth?

9518

Ignacio Iglesias Araúzo y Jaime Esteban Velasco: Repos y operaciones simultáneas: estu-

9519

Ignacio Fuentes: Las instituciones bancarias españolas y el Mercado Único.

9520

Ignacio Hernando: Política monetaria y estructura financiera de las empresas.

dio de la normativa.

9521

Luis Julián Álvarez y Miguel Sebastián: La inflación latente en España: una perspectiva

macroeconómica.

9522

Soledad Núñez Ramos: Estimación de la estructura temporal de los tipos de interés en

España: elección entre métodos alternativos.

9523

Isabel Argimón, José M. González·Páramo y José M: Roldán Alegre: Does public spen­

ding crowd out private investment? Evidence from a panel of 14 OECD countries.

9524

Luis Julián Álvarez, Fernando C. Ballabriga y Javier Jareño: Un modelo macroeconomé­

trico trimestral para la economía española.

9525

Aurora Alejano y Juan M.a Peñalosa: La integración financiera de la economía española:

efectos sobre los mercados financieros y la política monetaria.

9526

Ramón Gómez Salvador y Juan J. Doladó: Creación y destrucción de empleo en España:

un análisis descriptivo con datos de la CBBE.

9527

Santiago Femández de Lis y Javier Santillán: Regímenes cambiaríos e integración moneta­

ria en Europa.

9528

Gabriel Quirós: Mercados financieros alemanes.

9529

Juan Aruso Huertas: Is there a trade-off between exchange rate risk and interest rate risk?

(The Spanish original of this publication has the same number.)

9530

Fernando Restoy: Determinantes de la curva de rendimientos: hipótesis expectacional y

primas de riesgo.

9531

Juan Ayuso and María Pérez Jurado: Devaluations and depreciation expectations in the EMS.

9532

Panl Schulstad and Ángel Senat: An Empirical Examination of a Multilateral Target Zone

Model.

9601

Juan Ayuso, Soledad Núüez and María Pércz-Jurado: Volatility in Spanish financial markets:

The recent experience.

9602

Javier Andrés e Ignacio Hernando: ¿Cómo afecta la inflación al crecimiento económico?

Evidencia para los países de la OCDE.

9603

Barbara Dluhosch: On the fate of newcomers in the European Union: Lessons from the

Spanish experience.

9604

Santiago Femández de Lis: Classifications of Central Banks by Autonomy: A comparative

analysis.

9605

M: Cruz Manzano Frías y Sofía Galmés Belmonte: Credit Institutions' Price Policies and

Type of Customer: lmpact on the Monetary Transmission Mechanism. (The Spanish

original of this publication has the same number.)

9606

Malte Krüger: Speculation, Hedging and Intermediation in the Foreign Exchange Market.

9607

Agustín Maravall: Short-Term Analysis of Macroeconomic Time Series.

9608

Agustín MaravaU and Christophe Planas: Estimation Error and the Specification of Un­

observed Component Models.

9609

9610

Agustín Maravall: Unobserved Components in Economic Time Series.

Matthew B. Canzoneri, Behzad Diba and Gwen Eudey: Trends in European Productivity

and Real Exchange Rates.

9611

Francisco Alonso, Jorge Martínez Pagés y María Pérez Jurado: Weighted Monetary

Aggregates: an Empirical Approach. (The Spanish original of this publication has the same

number.)

9612

Agustín Maravall and Daniel Peña: Missing Observations and Additive Outliers in Time

Series Models.

9613

Juan Ayuso and Juan L. Vega: An empirical analysis of the peseta's exchange rate dynamics.

9614

Juan Ayuso Huertas: Un análisis empírico de los tipos de n

i terés reales ex-ante en España.

9615

Enrique Alberola lIa: Optimal exchange rate targets and macroeconomic stabilization.

9616

A. Jorge Padilla. Samuel Bentolila and Juan J. Dolado: Wage bargaining in industries with

market power.

96/7

Juan J. Dolado and Francesc Marmol: Efficient estimation of cointegrating relationships

9618

Juan J. Dolado y Ramón Gómez: La relación entre vacantes y desempleo en España: per­

among higher order and fractionally integrated processes.

turbaciones agregadas y de reasignación.

9619

Alberto Cabrero y Juan Carlos Delrieu: Elaboración de un índice sintético para predecir la

inflación en España.

9620

Una�Louise BeU: Adjustment costs, uncertainty and employment inertia.

9621

M.a de los Llanos Matea y Ana Valentina RegiI: Indicadores de inflación a corto plazo.

9622

James Conklin: Computing value correspondences fOT repeated games with state variables.

(1)

Previously published Working Papers are Usted in the Banco de España publications catalogue.

Queries should be addressed to: Banco de España

Sección de Publicaciones. Negociado de Distribución y Gestión

Telephone: 338 51 80

Alcalá, 50. 28014 Madrid

![29 † List of citizens newly attached [agregados] to the missions: To](http://s2.studylib.es/store/data/005935291_1-cce608f944c11df1f7b0591ad32e0ecf-300x300.png)