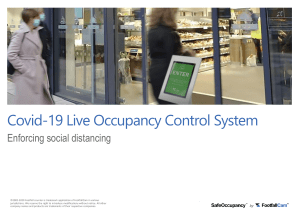

Thriving or surviving

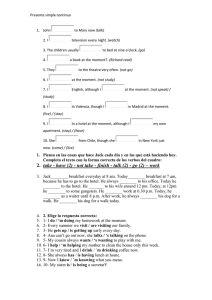

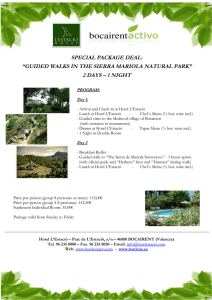

Anuncio