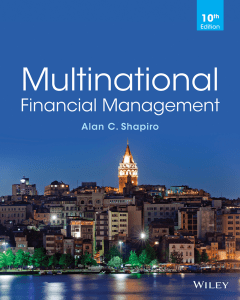

Maestro: Jorge Everardo Martínez Morales jeverardotec.mx cel: 2226154722 Grading: 60% partial exam 15% mock 15% assignments and activities 10% participation and engagement Final Note: 25% first-term grade 25% second-term grade 5% assignments for final term 30% cumulative final exam 15% final project Libro: international Financial Management 10th. Edition CURRENCY EXCHANGE RATES Foreign currency markets serve companies and individuals that purchase or sell foreign goods and services denominated foreign currencies. Foreign Exchange Markets Derivatives markets o Community markets Metals Energy and oil Raw materials Equity market (stock) Bonds/ Fixed income markets Forex market > Continuous market, it operates 24/7 Crypto market Alternative investments o Venture capital o Private market HEDGING (cobertura) vs. SPECULATIVE PURPOSES Risk arise from their cross-border transactions When a firm takes a position in the foreign exchange market to reduce an existing risk, we say the firm is hedging its risk. Investors, companies and financial institutions, such as banks and investment funds, all regularly enter into speculative foreign currency transactions. BUY SIDE vs SELL SIDE The primary dealers in currencies and originators of foreign exchange contracts are multinational banks. The buy since consists of the many buyers of foreign currencies. These buyers include: Scotiabank > Canada Citibank > USA BNP > France Commerce Bank > Germany ICBC > China JP Morgan > USA HSBC > UK Barclays > UK Capital One > USA Santander > Spain BBVA > Spain Buy side: Incorporations o Multinational enterprises (part of the buy side): Engage in cross-border transactions, purchase and sell foreign currencies as a result. Blackrock Cemex Bimbo Samsung P&G Investment Accounts: Hold foreign currencies and may both speculate and hedge with currency derivates. o Private funds o Retirement and pension funds Governments and government entities: Acquire foreign exchange for transactional needs, investment or speculations. Retail Market: It refers to the FX transactions by households and relatively small institutions and may be for tourism, cross-border investment or speculative trading. Hard currency Soft currency Largely tradeable Rarely known Well recognized as a medium of payment Not accepted as widely as the hard globally. currencies. Liquid Illiquid CAD BRL SEK HKD EUR MXN USD GBP CHF JPY AUD NZD CNY RBC etc. ISO code the way currencies are known. WHAT IS AN EXHANGE RATE? Is simply the price of units of one currency in terms of another. 18.6270 MXN USD > domestic currency foreign curency (peso x dólar) In financial databases and webpages, such as Bloomberg to get the currency of the previous example you need to write it in the other way. Example: USDMXN. PRICE CURRENCY vs. BASE CURRENCY In a foreign currency quotation, we have the price of one currency in units of another currency. These are often referred to as the base currency and the price currency. domestic currency price currency > foreign currency base currency DIRECT QUOTE vs. INDIRECT QUOTE DQ: Currency quote for a foreign currency per unit terms of a domestic currency. Because it is the most traded currency in the world. IQ: the opposite or reciprocal of a direct quote, also known as a “price quotation”, which expresses the price of a fixed number of units of a foreign currency as compared SPOT EXCHANGE RATE The currency exchange rate is for immediately delivery, which for most currencies means the exchange of currencies takes 2-days after the trade. PERCENTAGE CHANGE IN A CURRENCY RELATIVE TO ANOTHER CURRENCY US DOLLAR INDEX Indicator measured of the value of the USD relative to the value of a basket of six currencies of the majority of the US´s most significant trading partners. The six currencies are EUR, CHF, JPY, CAD, GBP and SEK. EJERCICIOS EN LIBRETA MID QUOTES Bloomberg Webpage BID – ASK (Compra y Venta) In the middle of this is MID (value of the currency) - BID: we buy (bank), client sells - ASK: we sell (bank), client buys Ask quote will always be higher than the bid quote CROSS CURRENCY RATE The cross rate is the exchange rate between two currencies implied by their exchange rates with a common third currency. Cross rates are necessary when there is no active FX market in the currency pair. FOREIGN EXCHANGE RATE MATRIX This matrix displays MID quotes for cross rates for the currencies under analysis, that is, it shows both direct and indirect quotes. BLOOMBERG WEBPAGE PRICE BASE CCY = CURRENCY Spot exchange rate: Is the currency exchange rate for immediately delivery. FORWARD EXCHANGE RATE Currency exchange rate for an exchange to be done in the future. A forward is actually an agreement to exchange a specific amount of one currency for a specific amount of another on a future date specified in the forward agreement. FORWARD QUOTES Exchange rate regime Is the way a country manages its currency in relation to other currencies and the foreign exchange market. An ideal currency regime would have three properties: 1. The exchange rate between any two currencies would be credibly fixed. 2. All currencies would be fully convertible. This condition ensures unrestricted flow of capital. 3. Each country would be able to undertake fully independent monetary policy in pursuit of domestic objectives, such as growth and inflation targets. FLEXIBLE EXCHANGE RATE The exchange rate is determined by the market forces of supply and demand, and therefore fluctuates freely in the market. FIXED EXCHANGE RATE Is an exchange rate that is set at a determined amount by government policy. Unified currency regime is the presence of only one central bank with the power to expand and contract the supply of money. 1. No separate legal tender In this regime a country does not have its own legal tender. Dollarization. The country uses another country's currency as its domestic currency. Monetary union. In this case a group of countries share a common currency, for example the European Union uses the euro as sole currency. 2. Currency board system The monetary authority is required to maintain a fixed exchange rate with a foreign currency. Its foreign currency reserves must be sufficient to ensure that all holders of its own currency can convert them into the reserve currency. 3. Fixed Parity/ Pegged The country tries to keep the value of its currency constant against another country, but it has no legal obligation to do so. This is also known as the pegged exchange rate system. 4. Target zone This is a fixed parity with fixed horizontal intervention bands that are somewhat wider – up to +/-2 percent around the parity – than in the simple fixed parity regime. The wider bands provide the monetary authority with greater scope for discretionary policy. 5. Managed float A country's exchange rate is adjusted based on the country's internal or external policy targets –intervening or not to achieve trade balance, price stability, or employment objectives. 6. Independent float In this case, the exchange rate is left to market determination and the monetary authority is able to exercise independent monetary policy aimed at achieving such objectives as price stability and full employment.