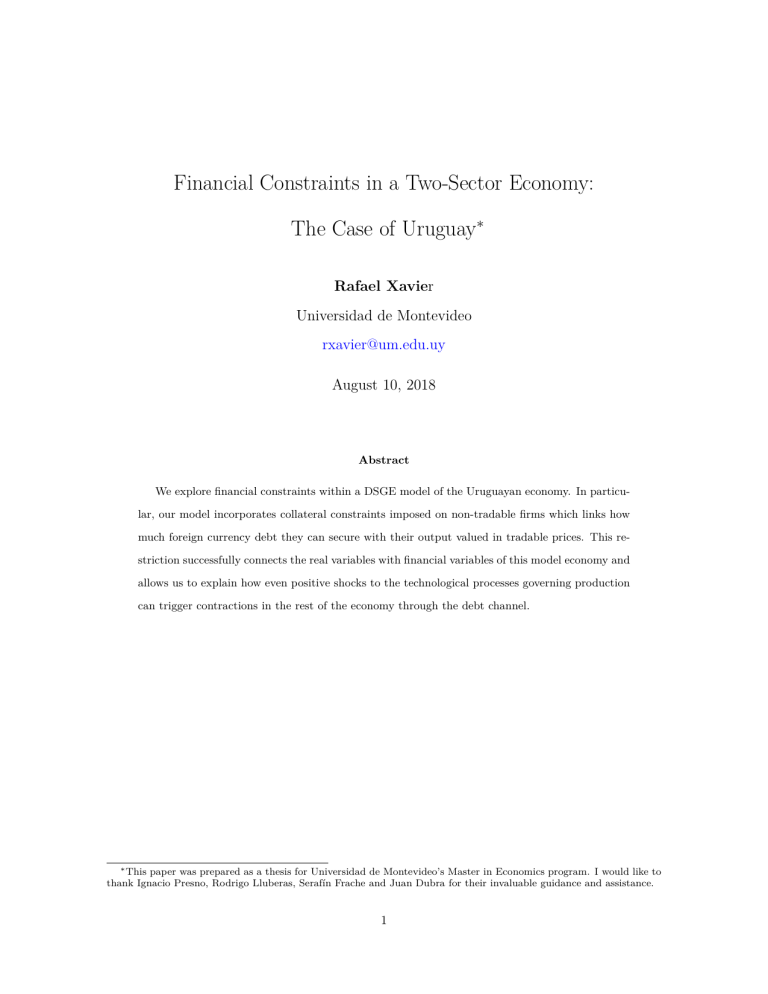

Financial Constraints in a Two-Sector Economy: The Case of Uruguay∗ Rafael Xavier Universidad de Montevideo rxavier@um.edu.uy August 10, 2018 Abstract We explore financial constraints within a DSGE model of the Uruguayan economy. In particular, our model incorporates collateral constraints imposed on non-tradable firms which links how much foreign currency debt they can secure with their output valued in tradable prices. This restriction successfully connects the real variables with financial variables of this model economy and allows us to explain how even positive shocks to the technological processes governing production can trigger contractions in the rest of the economy through the debt channel. ∗ This paper was prepared as a thesis for Universidad de Montevideo’s Master in Economics program. I would like to thank Ignacio Presno, Rodrigo Lluberas, Serafín Frache and Juan Dubra for their invaluable guidance and assistance. 1 1 Introduction Monetary authorities in small open economies are often subject to pressure by exporting sectors to allow the currency to depreciate as simple way of improving competitiveness and boosting foreign demand for local goods. Even without taking into consideration the merits of this type of intervention as a stimulus policy for exporters, the fact remains that large and unexpected shifts in the exchange rate represent a source of instability in economies with a high degree of liability dollarization, as seen in the “Original Sin” literature started by Eichengreen and Hausmann (1999) and further explored in Eichengreen et al. (2002). While foreign currency debt has been trending downwards for the last several years in emerging market economies, it has far from disappeared and still represents a very attractive means of financing public and private expenditures and investments, in particular in economies with underdeveloped domestic financial markets that cannot, or find it too expensive to, issue local currency liabilities1 . In the case of Uruguay, which will be the focus of this work, public debt dollarization fell significantly after the 2002 financial crisis but still remains stubbornly above 40 percent and has been increasing since the end of 20122 . On the other hand, private sector firms have not been exempt from taking on foreign currency debt and on average exhibit dollarization levels that exceed those of the public sector and do not appear to be falling, even when considering non-tradable sector firms that should expect their incomes to be denominated in local currency and are the most exposed to exchange rate movements. As can be gathered from figure 1, debt dollarization in the non-tradable sector remained above 70 percent in the fourth quarter of 2016 even though it had dropped by more than 15 percentage points in the previous 15 years. This balance sheet composition poses a dangerous combination in the face of a weaker peso and is at the crux of the mechanism we intend to explore: non-tradable firms’ economic performance depends not only on their underlying marginal productivities but on also on the dynamics of real exchange rates. In particular, the question that we want to answer is how damaging a scenario in which financial constraints are endogenously tightened is for the economy of as a whole. To further illustrate this situation, consider a scenario in which non-tradable sector firms face a limit on how much they can borrow; a real depreciation will increase the peso value of foreign currency debts 1 Klingebiel (2014) estimates that foreign currency debt represented 17 percent of total outstanding debt in 10 large emerging market economies in 2013, down from a share of 55 percent in 2000. 2 Uruguay’s 2002 financial crisis was, as De Brun and Licandro (2006) put it, a “triplet” crisis: a currency crisis, a public debt crisis and a bank run. GDP fell on average 3.8% per year between 1999 and 2002. 2 Figure 1: Uruguay - Foreign currency debt, % total debt (a) Public sector (b) Private sector firms 100% 100% 80% 80% 60% 60% Tradable Jun-16 Sep-15 Dec-14 Jun-13 Mar-14 Sep-12 Dec-11 Jun-10 Mar-11 Dec-05 Sep-09 0% Dec-08 0% Jun-07 20% Mar-08 20% Dec-99 Sep-00 Jun-01 Mar-02 Dec-02 Sep-03 Jun-04 Mar-05 Dec-05 Sep-06 Jun-07 Mar-08 Dec-08 Sep-09 Jun-10 Mar-11 Dec-11 Sep-12 Jun-13 Mar-14 Dec-14 Sep-15 Jun-16 40% Sep-06 Non-Tradable 40% Notes: Data for the public sector refers to foreign currency public debt as a percentage of total public debt, while data for the private sector refers to foreign currency credit as a percentage of total credit. The tradable aggregate is composed of primary sectors (agriculture, fishing and mining) and the industrial sector, whereas the non-tradable aggregate is defined as the rest of gross value added. Sources: Author’s calculations based on Banco Central del Uruguay. and force non-tradable firms to reduce their debt stocks, which will in turn produce a reduction of firms’ expenditures on inputs and a fall in non-tradable output. The existence of such a constraint is at least suggested by data on debt and output of the Uruguayan non-tradable sector: as non-tradable GDP valued in dollars plateaued by the end of 2013 and fell between mid-2015 and 2016 —explained fundamentally by the gradual but sustained peso depreciation between the second quarter of 2013 and the second quarter of 2016 rather than by a contraction of economic activity—, foreign currency debt growth stalled and prevented the debt-to-GDP ratio from expanding, contrary to standard Real Business Cycle theory which indicates that agents will expand their debt holdings during adverse states of nature in order to smooth out consumption (see figure 2). 3 Figure 2: Non-tradable sector GDP and foreign currency debt (a) Current GDP, million US$ (b) Foreign currency debt, million US$ 45,000 4,000 40,000 3,500 35,000 3,000 30,000 2,500 25,000 2,000 20,000 1,500 15,000 Sep-15 Jun-16 Dec-14 Mar-14 Sep-12 Jun-13 Dec-11 Mar-11 Sep-09 Jun-10 Dec-08 Mar-08 Sep-06 Dec-05 Sep-15 Jun-16 Dec-14 Mar-14 Sep-12 Jun-13 Dec-11 Mar-11 Sep-09 Jun-10 Dec-08 Mar-08 0 Sep-06 0 Jun-07 500 Dec-05 5,000 Jun-07 1,000 10,000 Notes: Non-tradable GDP refers to total gross value added minus primary sectors (agriculture, fishing and mining) and the industrial sector. Ssources: Author’s calculations based on Banco Central del Uruguay. The necessity to leave behind the standard frictionless Real Business Cycle model for small open economies (as explored in the seminal work by Kydland and Prescott (1982)) in order to study currency movements and their impact on the real economy in a general equilibrium scenario has been outlined by Mendoza (2006), due to the fact that under complete financial markets agents would perfectly insure against regular macroeconomic shocks, making some degree of incompleteness necessary in order to simulate this type of adjustment. Several authors have explored the role of credit market frictions in economic performance and adjustments, most notably the works of Kiyotaki and Moore (1997), Bernanke et al. (1999) and Aiyagari and Gertler (1999), which introduce a financial friction by linking investment to some measure of net worth, followed by Mendoza (2002), Arellano and Mendoza (2002), Bianchi (2011) and Schmitt-Grohé and Uribe (2016), where households have access to a one-period asset but they are limited in how much of this asset they can accrue by a credit constraint, which leads to sudden stop-like scenarios when the debt limit is reached3 . While there is an overlap between these two sets of articles, our work finds itself more at home with the second in that the currency mismatch is more explicitly considered and explored. 3 These collateral constraints can take the form of stock (for example, real estate) or flow (output) constraints. Our work deals with the latter. 4 2 Model The model economy is characterized by households that consume an aggregate of tradable and nontradable goods and do not have access to any financial assets, which means their decisions have consequences only on the current time period and that all income must be consumed. The aggregate consumption good is composed of non-tradable goods supplied by firms and a tradable-goods endowment. Furthermore, households provide labor services in a competitive market to non-tradable sector firms which utilize them in a Cobb-Douglas-type production function subject to standard technological shocks. Non-tradable firms can finance their expenses by taking out one-period foreign currency loans from commercial banks. Time is assumed to be discrete and agents have rational expectations about the future path of the model’s variables. It bears mentioning that we have chosen not to explicitly model the financial sector and instead assume that there are no frictions in the supply of credit. The only friction in this economy stems from a credit constraint imposed on non-tradable sector firms that limits how much financing they can secure. In this particular setup, creditors demand that non-tradable firms’ debt do not surpass a certain fraction of their production. We do not explicitly describe microfoundations for this constraint and as in Mendoza (2002) rely on the fact that this type of restriction is an empiric regularity as observed, for example, in the real estate market where buyers can generally secure loans up to some percentage of their income (Jappelli (1990) and literature found therein support this claim using US data). Another way of thinking about this restriction is assuming lenders have the ability to seize a share of non-tradable firms’ production in the event of default. 2.1 Firms Real tradable production is characterized by an endowment, which can be thought of as commodity production. Formally yT,t = aT,t (1) Where aT,t is an AR(1) process with i.i.d. shocks. Non-tradable firms on the other hand produce goods by employing labor from households in a standard Cobb-Douglas production function. They also have access to non-state contingent single period debt contracts that pay an interest rate of R and are denominated in units of tradable goods. Although defaulting on debts is not possible in this model specification, we instead assume lenders finance firms 5 by demanding collateral that is linked to aggregate non-tradable production valued in tradable goods units, which imposes an upper bound on how much debt firms can take. Firms in the non-tradable sector maximize profits subject to their production function and the liability constraint. max E0 ( ∞ X β t (pN,t yN,t − wt ht + dt − dt−1 Rt−1 ) ) t=0 s.t yN,t = aN,t hα t (2) dt ≤ φpN,t yN,t Where β denotes the subjective discount factor, pN,t refers to non-tradable goods prices in terms of tradable goods prices, yN,t equals non-tradable production in real terms, wt represents real wages in terms of tradable goods, ht represents hours worked, dt equals debt outstanding (a positive value indicates that firms have taken on debt), Rt stands for the interest rate, aN,t is an AR(1) process with i.i.d. shocks which stands for productivity in the non-tradable sector, and φ stands for the share of the firm’s production, measured in tradable prices, that the firm can offer as collateral. Put this way, the term φpN,t yN,t imposes a limit on how much debt the firm can secure. pN,t captures the real exchange rate dynamics described on first section, i.e., a weakening of real domestic currency would be reflected by a decrease in this variable (which would tighten the collateral constraint), while the opposite is true for a real appreciation. Solving with respect to the firms’ choice of work-hours pN,t αaN,t hα−1 − wt + ηt φpN,t αaN,t hα−1 =0 t t Where ηt is the Lagrange multiplier of the collateral constraint. Arranging the terms we get pN,t αaN,t hα−1 (1 + φηt ) = wt t (3) This equation shows that marginal productivity in the non-tradable sector equals real wages after adjusting for the financial wedge, which means that the financial frictions will feed into the real variables in the model. Additionally, from the debt constraint ηt (φpN,t yN,t − dt ) = 0 6 (4) Meaning that either the constraint is binding, in which case dt = φpN,t yN,t and ηt > 0, or the constraint is slack, which implies ηt = 0 and dt ≤ φpN,t yN,t . In this specification of the model we will assume that firms are always credit constrained so that dt = φpN,t yN,t . While ideally we would consider an occasionally binding constraint which would become active depending on the model’s dynamics, we leave that excercise for the next iteration of this work. The firm’s decision regarding borrowing implies β t (1 − ηt ) − β t+1 Rt = 0 And arranging the terms we get (1 − ηt ) = βRt Which is the common interest rate equilibrium condition β = (5) 1 R adjusted by the financial constraint. Additionally, we assume that commercial banks acts as frictionless intermediaries of international capital and simply charge firms a premium over the international interest rate. However, the premium is increasing in the firms’ debt levels relative to equilibrium debt4 , as outlined in Schmitt-Grohé and Uribe (2003). International interest rates R∗ , in turn, are represented by an AR(1) process with i.i.d. shocks, which will be used to emulate international monetary policy shocks. Rt = ∗ κ dt −d Rt e (6) Where d¯ represents equilibrium outstanding debt and κ is a parameter that controls the rate premium. 2.2 Households Households consume an aggregate basket of goods that includes tradable and non-tradable goods, provide labor services to non-tradable sector firms in a competitive labor market and receive profits from both tradable and non-tradable sector firms. They have no way of saving or otherwise shifting consumption into the future. Households maximize a utility function of the Greenwood, Hercowitz and 4 Formally, this specification allows for interest rates charged to local firms to be lower than international interest rates, but we do not focus on these cases 7 Huffman form5 , which depends positively on consumption and leisure, subject to the budget constraint max s.t h 1 1−γ (ct − ψhvt )1−γ i σ 1 σ−1 σ−1 σ−1 1 σ σ ct = ω σ cT,t + (1 − ω) σ cN,t (7) cT,t + pN,t cN,t = wt ht + πT,t + πN,t Where ct represents aggregate consumption in terms of tradable goods prices, ψ represents the labor weight, v represents labor curvature and γ represents the utility curvature in GHH preferences. The budget constraint underlines the fact that in equilibrium total consumption must equal wages from labor services provided wt ht , tradable firm profits πT,t and non-tradable firm profits πN,t . Solving households’ lagrangian H in terms of labor supply and aggregate consumption ∂H = −vψhv−1 (ct − ψhvt )−γ + λt wt = 0 t ∂ht ∂H = (ct − ψhvt )−γ − λt pt = 0 ∂ct Where we have defined aggregate consumption as pt ct = cT,t + pN,t cN,t (8) In which pt stands for aggregate prices in terms of tradable prices. Combining these FOC we obtain the labor supply equilibrium condition, which indicates that households will provide labor services up to point in which wages in terms of aggregate goods equate the marginal disutility of labor6 wt = vψhv−1 t pt 5 See (9) Greenwood et al. (1988). This specification allows us to exclude income effects from households’ leisure decisions. reason why real wages (in terms of tradable goods) are divided by aggregate prices relative to tradable prices is that households care about a basket of tradable and nontradable goods, so it stands to reason that wages should be deflated by the price of the aggregate good. 6 The 8 Solving for tradable and non-tradable consumption we obtain 1 −1 ∂H = ω σ cT,tσ ct (ct − ψhvt )−γ − λt = 0 ∂cT,t 1 ∂H −1 = (1 − ω) σ cN,tσ ct (ct − ψhvt )−γ − λt pN,t = 0 ∂cN,t Combining these FOC we get the relative prices equilibrium condition, which shows that non-tradable prices (relative to tradable prices) increase as tradable consumption increases with respect to nontradable consumption. pN,t = 1−ω ω cT,t cN,t σ1 (10) Using the last equation and equation 4 we obtain dt = φ 1−ω ω cT,t cN,t σ1 yN,t (11) Which shows that households’ decisions on consumption affect how much debt non-tradable firms hold. This effect is not internalized by households, meaning that the social planner’s desired equilibrium may not be achieved. 2.3 Aggregation and Market Clearing Since non-tradable goods can only be sold locally, production has to equate consumption yN,t = cN,t (12) Finally, consider households’ resource constraint and substitute firm profits cT,t + pN,t cN,t = yT,t + pN,t yN,t + dt − dt−1 Rt−1 Which gives us the economy’s overall resource constraint. Using the clearing condition in the goods markets we get cT,t = yT,t + dt − dt−1 Rt−1 9 (13) Showing that tradable consumption has to equal tradable production plus net debt issuance7 . The trade balance is simply tbt = yT,t − cT,t 3 (14) Model Solution The equilibrium of this economy can be characterized by the numbered equations and the AR(1) processes depicting productivity in both sectors and international interest rates8 . Additionally we calculate real wages in therm of the overall price level. wp,t = wt pt (15) For the purpose of calibrating this model around the sationary equilibrium we consider data for Uruguay between 2005 and 2016 and rely on literature for the remaining parameters. We first normalize the values of tradable and non-tradable productivity, while we calibrate steady state non-tradable relative prices so that the observed 2005-2016 average ratio of tradable production to non-tradable production of 107% is matched. The share of collateral accepted for loans φ is set to match the average foreign currency loan to non-tradable production ratio during the relevant period. We assume households work a third of their time which puts hours worked at 1/3 and set the elasticity of labor in production to 0.6. Consumption elasticity σ is set to 0.61, which is the average of the long-run values estimated in Lorenzo et al. (2005) for Uruguay between 1983-86 and 2002. Steady state international interest rates are set to 0.7% per quarter which matches the average quarterly interest rate for Uruguayan 1-year sovereign international bonds. The labor curvature v is set to 1.6 as in Neumeyer and Perri (2005). Finally, the risk premium parameter κ is set to 0.01, which is the value estimated for Uruguay by Basal et al. (2016). With these values the share of tradable consumption in total consumption ω comes out at 0.57, slightly above the 0.42 calculated using consumption shares in the 2010 CPI basket, and the labor weight comes out at 1.55. 7 For all intents and purposes equation 13 is the current account identitity because banks acts as frictionless intermediaries of international financial flows, i.e., external debt. 8 Equilibrium conditions can be found in Appendix I. 10 We solve the model through a first order approximation using perturbation methods. To this end, our model is built using Dynare within MATLAB, which allows us to compute policy functions and impulse response functions to various shocks9 . 4 Results We focus on three types of exogenous shocks10 . First we consider a negative shock to tradable production technology, which can be thought of as, for example, adverse weather conditions that lower the amount of primary products that can be extracted from the land in a given period. Second we consider a positive shock to non-tradable production thechnology, i.e., a one time increase in the quantity of goods a single worker can produce within a set time frame. Finally we consider a negative shock to international financial conditions that affects international interest rates. Every shock has the size of a 1% standard deviation. In the abscence of the collateral constraint, firms’ hiring and debt decisions would be completely separable, severing any interaction between relative prices, output and financial assets. This mechanism is at the crux of this paper. Negative shock to tradable firms’ technology A negative shock to tradable firms’ technology enters the model by lowering tradable output one-forone. This shift produces a fall in relative non-tradable prices, which causes the collateral constraint to tighten and lowers the optimal amount of work hours. As a consequence, non-tradable production falls and, because the non-tradable goods market has to clear locally, so does non-tradable consumption, although less so than tradable goods consumption. As the collateral constraint is tightened non-tradable firms have to shed their debt positions, which lowers interest rates as the risk premium component is reduced. Finally, since tradable consumption falls more abruptly than tradable production, the trade balance sharply improves on impact and quickly settles back to the steady state. Apart from the behavior of debt and interest rates, the model’s responses to this shock are qualitatively similar to the friction-less model, although they differ quantitavely. 9 See 10 Full Adjemian et al. (2011). The mod-file that builds and solves the model can be found here. impulse response functions can be found in Appendix II. 11 Positive shock to non-tradable firms’ technology A positive shock to non-tradable firms’ technological process increases marginal labor productivity, which in turn increases the optimal amount of work hired and non-tradable goods output. Market clearing implies that non-tradable goods consumption must increase, which in turn reduces relative non-tradable prices and tightens the collateral constraint through equation 11, forcing a reduction of outstanding debt and interest rates as the risk premium is lowered. In this case, the fall in relative non-tradable prices is large enough to offset the increase in non-tradable goods output so that the right hand side of equation dt = φpN,t yN,t decreases, which explains the negative response of debt. As debt falls (and in the absence of an increase of tradable output), households have to reduce their tradable goods consumption as shown in equation 13, which increases the trade balance at the time of the shock. This response accurately captures the true effects of the financial restriction in the model and the mechanism outlined on the introduction, since in the absence of the collateral constraint, debt (and tradable goods consumption) would remain unaffected. Figure 3: Impulse response functions to a 1% positive shock to non-tradable firms’ technology abbreviated results (a) Non-tradable output (b) Labor market 1.2% 0.12% 1.0% 0.10% 0.8% 0.08% 0.6% 0.06% 0.4% 0.04% 0.2% 0.02% 0.0% Hours worked Wages (wrt general prices) 0.00% 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 1 3 5 7 9 (c) Relative non-tradable prices 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 (d) Debt 0.0% 0.00% -0.01% -0.4% -0.02% -0.8% -0.03% -1.2% -0.04% -1.6% -0.05% -2.0% -0.06% 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 1 12 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 Positive shock to international interest rates A positive shock to international interest rates propagates to domestic interest rates (though not fully, since debt holdings also fall and cushion the effect), making debt more expensive. As a consequence tradable goods consumption has to fall to accomodate lower outstanding debt (again through equation 13), which in turn pushes down relative non-tradable prices, resulting in a fall of labor marginal productivity as per equation 3. The latter translates into lower labor demand, lower wages and lower non-tradable output, which triggers a contraction in non-tradable goods consumption. Figure 4: Impulse response functions to a 1% positive shock to international interest rates - abbreviated results (a) Domestic interest rates (b) Debt 1.20% 0.00% 0.00% 1.00% 0.00% 0.00% 0.80% 0.00% 0.60% 0.00% 0.00% 0.40% -0.01% -0.01% 0.20% -0.01% 0.00% -0.01% 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 1 3 5 7 (c) Tradable consumption and prices 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 (d) Non-tradable firms 0.06% 0.00% 0.04% Tradable consumption -0.02% Relative non-tradable prices 0.02% 0.00% -0.04% -0.02% Hours worked -0.06% -0.04% -0.06% Non-tradable output -0.08% -0.08% -0.10% -0.10% 1 5 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 Conclusions and avenues for further research The fundamental issue addressed in this paper is how financial constraints, particularly those relating to foreign currency debt, affect the overall workings of this economy. In the first half of this work we have documented Uruguay’s exposition to foreign currency debt and outlined the mechanism through which firms could be constrained in how much credit they can get access too. In the second half of this paper we built a DSGE model taking into account these restrictions and tried to match observed 13 data for the Uruguayan economy. We assess the response of the model’s variables to a series of shocks and find that collateral constraints accurately portray the link between real variables and financial variables. In this model we have assumed that the collateral constraint is always binding. In reality, however, firms’ optimal resource allocation can be lower than the maximum that creditors are willing offer in the form of debt. In future research this occasionally binding constraint can be worked into the model through methods like the one explored in Guerrieri and Iacoviello (2015), which would allow us to assess how the economy reacts when it transitions from one state of nature to the other. References Adjemian, S., Bastani, H., Juillard, M., Karamé, F., Mihoubi, F., Perendia, G., Pfeifer, J., Ratto, M., and Villemot, S. (2011). Dynare: Reference Manual, Version 4. Dynare working papers, 1, CEPREMAP. Aiyagari, S. and Gertler, M. (1999). “Overreaction” of asset prices in general equilibrium. Review of Economic Dynamics, 2(1):3–35. Arellano, C. and Mendoza, E. G. (2002). Credit frictions and ’sudden stops’ in small open economies: An equilibrium business cycle framework for emerging markets crises. Technical report, National Bureau of Economic Research. Basal, J., Carballo, P., Cuitiño, F., Frache, S., Mourelle, J., Rodríguez, H., Rodríguez, V., and Vicente, L. (2016). Un modelo estocástico de equilibrio general para la economía uruguaya. Documentos de trabajo 2016002, Banco Central del Uruguay. Bernanke, B. S., Gertler, M., and Gilchrist, S. (1999). The financial accelerator in a quantitative business cycle framework. Handbook of Macroeconomics, 1:1341–1393. Bianchi, J. (2011). Overborrowing and systemic externalities in the business cycle. American Economic Review, 101(7):3400–3426. De Brun, J. and Licandro, G. (2006). To hell and back: Crisis management in a dollarized economy, the case of uruguay 2002. Financial Dollarization: The Policy Agenda, Palgrave. 14 Eichengreen, B. and Hausmann, R. (1999). Exchange rates and financial fragility. Technical report, National Bureau of Economic Research. Eichengreen, B., Hausmann, R., and Panizza, U. (2002). Original sin: The pain, the mystery, and the road to redemption. Inter-American Development Bank, Washington DC. Greenwood, J., Hercowitz, Z., and Huffman, G. W. (1988). Investment, capacity utilization, and the real business cycle. The American Economic Review, pages 402–417. Guerrieri, L. and Iacoviello, M. (2015). Occbin: A toolkit for solving dynamic models with occasionally binding constraints easily. Journal of Monetary Economics, 70:22–38. Jappelli, T. (1990). Who is credit constrained in the u. s. economy? The Quarterly Journal of Economics, 105(1):219–234. Kiyotaki, N. and Moore, J. (1997). Credit cycles. Journal of Political Economy, 105(2):211–248. Klingebiel, D. (2014). Emerging markets local currency debt and foreign investors-recent developments. World Bank Treasury Presentation. Kydland, F. E. and Prescott, E. C. (1982). Time to build and aggregate fluctuations. Econometrica: Journal of the Econometric Society, pages 1345–1370. Lorenzo, F., Aboal, D., and Osimani, R. (2005). The elasticity of substitution in demand for nontradable goods in Uruguay. Inter-American Development Bank, Latin American Research Network. Mendoza, E. G. (2002). Credit, prices, and crashes: Business cycles with a sudden stop. In Preventing Currency Crises in Emerging Markets, pages 335–392. University of Chicago Press. Mendoza, E. G. (2006). Endogenous sudden stops in a business cycle model with collateral constraints: a Fisherian deflation of Tobin’s Q. Technical report, National Bureau of Economic Research. Neumeyer, P. A. and Perri, F. (2005). Business cycles in emerging economies: the role of interest rates. Journal of monetary Economics, 52(2):345–380. Schmitt-Grohé, S. and Uribe, M. (2003). Closing small open economy models. Journal of International Economics, 61(1):163–185. Schmitt-Grohé, S. and Uribe, M. (2016). Is optimal capital-control policy countercyclical in openeconomy models with collateral constraints? Technical report. 15 Appendix I The model’s equilibrium is characterized by the following equations yT,t = aT,t yN,t = aN,t hα t pN,t αaN,t hα−1 (1 + φηt ) = wt t dt = φpN,t yN,t (1 − ηt ) = βRt Rt = Rt∗ e κ dt −d σ 1 σ−1 σ−1 σ−1 1 σ σ ct = ω σ cT,t + (1 − ω) σ cN,t pt ct = cT,t + pN,t cN,t wt pt pN,t = h = vψhv−1 t i σ1 cT ,t 1−ω ω cN,t yN,t = cN,t cT,t = yT,t + dt − dt−1 Rt−1 tbt = yT,t − cT,t wp,t = wt pt ln aT,t = ρaT ln aT,t−1 + εaT ,t ln aN,t = ρaN ln aN,t−1 + εaN ,t ∗ ln Rt∗ = ρR∗ ln Rt−1 + εR∗ ,t 16 Appendix II Figure 5: Impulse response functions to a 1% negative shock to tradable firms’ technology (a) Output (b) Consumption 0.0% 0.0% -0.2% -0.2% -0.4% -0.4% -0.6% -0.6% -0.8% Tradable output Tradable consumption -0.8% Non-tradable consumption Total consumption Non-tradable output -1.0% -1.0% -1.2% -1.2% 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 1 3 5 7 9 (c) Prices 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 (d) Labor market 0.0% 0.0% -0.2% -0.2% -0.4% -0.4% -0.6% Hours worked -0.6% -0.8% Wages (wrt tradable prices) Relative non-tradable prices Relative general prices -1.0% Wages (wrt general prices) -0.8% -1.0% -1.2% -1.4% -1.2% 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 1 3 5 7 9 (e) Interest rates 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 (f) Current account 0.0% 0.2% 0.1% -0.1% Debt 0.1% -0.1% Trade balance 0.0% Domestic interest rates -0.2% -0.1% -0.2% -0.1% -0.3% -0.2% 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 1 17 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 Figure 6: Impulse response functions to a 1% positive shock to non-tradable firms’ technology (a) Output (b) Consumption 1.2% 1.2% 1.0% 1.0% Tradable consumption 0.8% Non-tradable consumption 0.8% Tradable output 0.6% Total consumption 0.6% Non-tradable output 0.4% 0.4% 0.2% 0.2% 0.0% 0.0% -0.2% 1 3 5 7 9 1 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 3 5 7 9 (c) Prices 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 (d) Labor market 0.2% 0.0% -0.2% 0.0% -0.4% -0.6% -0.2% -0.8% -1.0% -0.4% Relative non-tradable prices -1.2% Hours worked Relative general prices -0.6% -1.4% Wages (wrt tradable prices) Wages (wrt general prices) -1.6% -0.8% -1.8% -1.0% -2.0% 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 1 3 5 7 9 (e) Interest rates 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 (f) Current account 0.0% 0.1% 0.0% 0.0% 0.0% 0.0% Debt Trade balance -0.1% 0.0% Domestic interest rates -0.1% 0.0% 0.0% -0.1% -0.1% -0.1% 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 1 18 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 Figure 7: Impulse response functions to a 1% positive shock to international interest rates (a) Output (b) Consumption 0.00% 0.01% 0.00% -0.01% -0.01% -0.02% -0.02% -0.03% -0.03% -0.04% Tradable output -0.04% Tradable consumption -0.05% Non-tradable output Non-tradable consumption Total consumption -0.06% -0.07% -0.05% -0.08% -0.06% -0.09% 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 1 3 5 7 9 (c) Prices 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 (d) Labor market 0.06% 0.00% -0.01% 0.04% -0.02% Relative non-tradable prices -0.03% 0.02% Relative general prices -0.04% 0.00% Hours worked -0.05% Wages (wrt tradable prices) -0.06% -0.02% Wages (wrt general prices) -0.07% -0.08% -0.04% -0.09% -0.06% -0.10% 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 1 3 5 7 9 (e) Interest rates 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 (f) Current account 1.20% 0.09% 0.08% 1.00% 0.07% 0.06% 0.80% 0.05% Domestic interest rates 0.60% International interest rates 0.04% Debt 0.03% Trade balance 0.02% 0.40% 0.01% 0.00% 0.20% -0.01% 0.00% -0.02% 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 1 19 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39