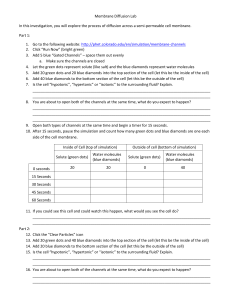

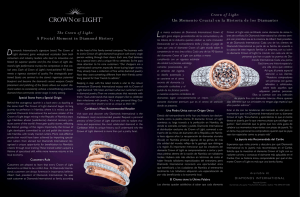

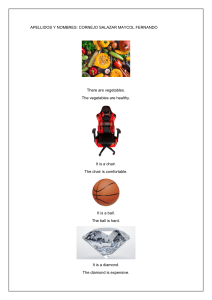

EXPLORING THE DIAMOND RESELLING OPPORTUNITY TOMÁS RESTREPO BENALCAZAR 1) SELLING PRICE The sales price model is related to the retail activities, in this way the finished diamonds are obtained, going through the upstream and midstream processes, where the diamond is perfected as such and the place where it comes from is certified, increasing its value in multiple times with respect to the stages mentioned above. 2) PRE OWNED DIAMONDS It is difficult to be certain of the origin of the material and its use, besides the risks are high and the variability of prices leaves the consumer with doubts at the time of purchase. 3) RESELLING MARKET The exploration starts from the reduction of market share and an opportunity to see that it is possible to recycle, with some risks, but it can be a new profitable market. 4) IIDV/POLISHED DIAMONDS The downstream market may be adversely affected due to the rise in second hand prices, but within that the main company shares part of the market, as well as dignifying some of the diamonds without real certificates. 5) IIDV/ROUGH DIAMONDS This market benefits, although it also reacts due to the creation of an entity that supervises and certifies the origin and value of the diamonds, in addition to changing the market scheme. 6) STANDALONE BUSINESS UNIT? I would look for a way to convince them, it is an opportunity for an unexplored market and to increase market share in the diamond market. 7) ANGLO AMERICAN AND THE GOVERNMENT OF BOTSWANA From this perspective I would be willing to continue with the pilot test year, trying to show progress and thus convince other decisive parties.