Barclays Ecuador Is it possible to break the default restructuring cycle

Anuncio

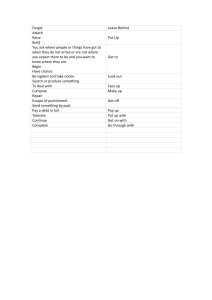

FICC Research EM Strategy 13 November 2023 Ecuador Is it possible to break the default/ restructuring cycle? The mismatch between political and economic cycles narrows the window of opportunity to tackle Ecuador's structural challenges. The main option left for authorities to change market perceptions seems to be sending a strong signal of willingness to pay through some sort of liability management. • The political cycle does not generate incentives for reforms or fiscal adjustment measures in the near future. This should not be a surprise; however, a delay of any type of adjustment measures leaves markets with no clear positive catalyst in the near future; instead, there is a risk of additional deterioration of economic fundamentals. • The core challenge for Ecuador seems to be addressing the political risks and uncertainty about the willingness to service its debt. Although macroeconomic fundamentals have been deteriorating, they remain better than many peers and do not seem sufficient to justify the perception of risks. • Despite the government's limited resources, we think it still has options to muddle through in the near future and incentives to avoid a default. It may still have access to pockets of liquidity that could allow it to conduct a debt buyback that delivers some cash saving, improves the debt profile in a way that could significantly reduce default risk in the short and medium term, and might facilitate access to other sources of financing. If it fails to take rapid action, waiting until 2025 could be too late to change market perceptions and it risks remaining trapped in the default/restructuring cycle. A strong signal of willingness to pay is needed The election of President Daniel Noboa has contributed to contain short-term political risks (see Ecuador: A new leadership emerges); however, the incoming administration still faces big challenges. It is inheriting a complex fiscal situation amid a tough governability backdrop. A series of political shocks in recent months have made the country backtrack on the fiscal consolidation achievements made until last year. In addition, there are social demands for the creation of jobs and solving the security crisis, which could have non-negligible fiscal costs. The country is also exposed to the effects of El Niño and will have to deal with the closing of the ITT field, which puts at risk more than 10% of the country's oil production. These economic conditions impose major hurdles for the new administration; however, probably the biggest challenge is the mistrust and lack of confidence in the country generated by the perceived This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors under U.S. FINRA Rule 2242. Barclays trades the securities covered in this report for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to the recommendations offered in this report. Please see analyst certifications and important disclosures beginning on page 8. Completed: 13-Nov-23, 18:29 GMT Released: 13-Nov-23, 18:34 GMT Restricted - External CORE Alejandro Arreaza +1 212 412 3021 alejandro.arreaza@barclays.com BCI, US Barclays | Ecuador political risks and its willingness to pay, which restricts access to financing. Under these conditions, the country risks repeating the cycle of debt default and restructuring in which has been trapped, but authorities may still have a chance to break this cycle. Currently, there is a mismatch between the political and economic cycles that narrows the window of opportunity to take actions to tackle the country's structural challenges. The political cycle does not generate incentives for reforms or fiscal adjustment measures that could be politically costly in the short term and for which economic benefits will take longer to materialize. The new administration was elected as a transitional government for just 18 months, which makes its re-election in 2025 the top priority. Considering the centrist approach of the Noboa administration, its re-election could be positive news for markets, particularly considering that the alternative could be a less market-friendly government. However, a delay of any type of adjustment measures leaves the market with no clear positive catalyst in the near future; instead, there is a risk of additional deterioration of the economic fundamentals. Waiting until 2025 to tackle the fiscal challenges could be too late, as the government might not have enough time to regain market confidence before debt payments start to come due. The alternative scenario in which the government front-loads the adjustment might not deliver better results either. Even if Ecuador were to present a highly qualified economic team and announce a series of orthodox measures to reduce its fiscal imbalance, such as reducing the fuel subsidy and increasing taxes, it might prove insufficient to radically change market perceptions. Considering the precedents in Ecuador's recent history, if such measures were implemented, against a complex governability backdrop, the stability of the administration might be perceived to be at risk and the credibility of the program would be low. The core challenge for Ecuador seems to be addressing the political risks and the uncertainty about the willingness to service its debt. Although macroeconomic fundamentals have been deteriorating, they remain better than many peers and do not seem sufficient to justify the perception of risks. The new administration is making progress in the political forum and has options to form a coalition in the National Assembly that could allow it to advance some elements of its agenda. A more centrist composition of the assembly could facilitate an alliance with the centrist party Construye and the PSC; alternatively, the interest of correismo in a quid pro quo of governability for some sort of legal amnesty could allow the administration to reach a "political truce," which could give it some political room for maneuver. However, reducing the perception of political risks would require a broader national consensus agreement to improve governability, which seems difficult to achieve, could face multiple implementation risks, and would, at the least, take time to be effective. The main option left for the authorities to change market perceptions seem to be sending a strong signal of willingness to pay that generates a confidence shock. President Noboa has reiterated his commitment to honoring the country's obligations; however, given the economic conditions, this has not been enough to change market perceptions, as this message is seen as contradictory to the direction in which economic fundamentals are moving. Therefore, with Ecuadorian debt under increasing pressures, some sort of liability management could increasingly start to make sense and might be the alternative authorities have left to try to reset the market's expectations. Despite its limited resources, the government could still have access to pockets of liquidity that could allow it to conduct a debt buyback that delivers some cash saving, improves the debt profile in a way that could significantly reduce default risk in the short and medium term, and might facilitate access to other sources of financing. President Noboa has suggested the possibility of using international reserves as a source of funding.1 He has softened his position on this point and has placed it as a last resort option, but 1 13 November 2023 Daniel Noboa también quiere 'meterle mano' a las reservas internacionales, Primicias.ec, September 8, 2023 2 Barclays | Ecuador has not taken it off the table, and given the current conditions, there seems to be an increasing probability that he might have to use it. While this is a risky measure that could contribute to financial instability in the longer term, its final implications would depend on how the authorities might implement it use those resources. Despite the decline registered in recent months, reserves are still at USD6.0bn, USD2bn above their historical average (Figure 1), and the country has a current account surplus (Figure 2). A direct borrowing from the central bank reserves to the government would require undoing legal reforms that have been put in place to preserve the stability of the dollarization system. However, there could be an indirect way to access the reserves and yet mitigate the damage, by allowing local banks to use their reserve requirements to buy local debt, which could potentially provide enough liquidity for the government to conduct a debt buyback and cover some of its funding needs. Using the reserves to purely finance current expenditures would be negative news and leave the country in a more vulnerable position. However, if the government uses at least USD1bn to buy back its shortest-maturity bond (ECUA 2030), which is currently priced at less than half its nominal value, it could take out of the market almost the entire issuance and drastically reduce the default risk over the next seven years. FIGURE 1. International reserves remain above the historical average (USD bn) Thousands 10.0 FIGURE 2. The country still has a current account surplus 9.0 8.0 7.0 6.0 1.5 140 120 1.0 100 0.5 5.0 80 4.0 Source: Haver, Barclays Research Jan-23 Jan-22 Jan-21 Jan-20 Jan-19 Jan-18 Jan-17 Jan-16 Jan-15 Jan-14 Jan-13 Jan-12 Jan-11 International Reserves Average Q3-23 Q1-23 Q3-22 Q1-22 Q3-21 Q1-21 Q3-20 Q1-20 Q3-19 Q1-19 -0.5 1.0 Q3-18 2.0 Q1-18 0.0 3.0 60 40 -1.0 20 Current Account (USDbn) Brent (USD/b, RHS) Source: Haver, Barclays Research Authorities seem to have room and incentives to muddle through with debt payments over the 18-month period for which they have been elected. Despite the fiscal challenges, the short-term situation seems manageable. Although the government is proposing infrastructure and security plans and other initiatives that could have some fiscal cost, risks related to fiscal expenditures might be contained. The new president is supposed to take office on December 1; therefore, it does not even seem to have enough time to present and approve the budget for next year, which, in principle, would imply that the Noboa administration will have to work over the next year with the 2023 budget that was approved for the Lasso administration. Even if some changes are possible, there would be limited room to increase expenditures, so the government might end up reallocating resources. Moreover, a new administration, in which many of its members have limited experience in the public sector, would have to overcome a learning curve, which could slow the execution of many of its projects. Risks related to the fiscal accounts seem to be more concentrated on the revenue side but there is a significant level of uncertainty about the magnitude of the resources that the government could lose. The closing of the ITT oil field implies the loss of fiscal revenue of up to USD600mn, but it is still unclear how fast that would occur, which may affect the timing of effects. The government is proposing a tax reform that is intended to provide incentives to the private sector 13 November 2023 3 Barclays | Ecuador to generate jobs, which is also likely to imply a sacrifice for the government in terms of tax collection, at least in the near future. However, details of the reform that would allow an assessment of the size of the effect are still missing. Similar tax cuts implemented by the current administration have had a cost of around USD300mn. If that is taken as a reference, although the loss of revenue under current conditions is not ideal, there could be some space to accommodate it, too. We remain of the view that domestic and multilateral funding could provide enough room to maneuver for the administration to muddle through its term. While the central government has a deficit of around USD4bn (c. 3.5% of GDP), the rest of the public sector, mainly the social security and local governments, runs a surplus of approximately 2.0% of GDP (Figure 3). Although the government might not be able to appropriate all of those resources, they could be a source of funding either directly through the purchase of government debt or forcefully through the accumulation of arrears. Additionally, this year, the government is receiving more than USD2bn in multilateral funding, and next year, it could have options to increase that amount to somewhere around USD3bn. 13 November 2023 4 Barclays | Ecuador FIGURE 3. There is space in public entities (IESS, GADS) to provide financing to the central government either through local debt or accumulation of arrears(USD) 2020 2021 2022 Jan-Aug 22 Jan-Aug 23 2023F* 19.4 4.7 2.7 1.9 25.1 8.8 5.4 3.4 28.6 10.5 7.5 3.0 20.9 8.7 5.6 3.0 14.5 2.0 2.0 0.0 22.5 3.6 3.6 0.0 Non-oil 14.8 16.3 18.1 12.2 12.5 18.8 Tax 12.4 13.6 15.1 10.4 10.0 14.9 Non-tax 1.9 2.1 2.6 1.5 2.0 3.0 Transfers 0.5 0.5 0.5 0.3 0.5 1.0 27.5 29.3 30.0 20.3 17.1 26.7 22.3 21.9 24.8 17.4 13.9 21.1 Interest 3.3 1.9 2.4 1.5 2.1 3.2 Salaries 8.6 8.2 9.2 5.8 6.2 9.7 Goods & Svcs 6.1 7.4 8.1 6.8 2.0 2.8 Others 0.2 0.1 0.1 0.1 0.1 0.1 Revenue Oil Exports Derivatives sales Expenditures Current Expenditures Transfers Capital Expenditure Central Gov Balance (% GDP) Primary Balance 4.2 4.2 5.0 3.2 3.5 5.3 5.2 7.4 5.2 2.9 3.2 5.6 0.6 -2.5 -8.1 -4.3 -1.4 -8.1% -4.0% -1.2% -4.2 -3.5% -4.8 -2.3 1.0 -4.8% -2.2% 0.8% Other Public Entities 2.1 2.5 1.4 1.4 1.8 2.2 Public Sector Balance -5.9 -1.8 0.0 2.0 -0.7 -2.1 -6.0% -1.7% 0.0% -1.7% Oil Price (Brent, USD/b) 43.0 72.0 99.0 84.0 GDP growth (%) -7.8 4.2 2.9 1.7 Inflation -0.9 1.9 3.7 2.7 Oil Production (k b/d) 479 473 481 470 (% GDP) (% GDP) 2.1 -0.4 -1.0 -0.9% Asumptions * There is a change in the reporting in 2023 for oil revenues and the purchases of refined products previously included in good and services; they are now being deducted from the oil revenues. Source: Haver, Barclays Research President Noboa has been in conversations with the IMF and has expressed interest in a bridge loan.2 A regular stand-by agreement or EFF program seems unlikely, given the limited scope for reform; however, given the effects of El Niño, a rapid financing instrument could be a viable alternative to receive unconditioned funding. On a regular basis, this facility could allow access of up to 50% of quota per year and a cumulative amount of 150% of quota. This would mean at least USD600mn that Ecuador could obtain in 2024. If authorities are able to move fast and close a deal before the end of this year, they might be able to negotiate USD600 for this year, too, for a total of USD1.2bn. In the case of large natural disasters, the fund establishes a limit 2 13 November 2023 El presidente electo Daniel Noboa dice en Washington que Ecuador necesita un “préstamo puente” para financiar su plan de gobierno, El Universo, November 6, 2023 5 Barclays | Ecuador that could be up to 80% of quota per year and 183.33% of quota on a cumulative basis; this could mean something in the range of USD1-2bn; however, Ecuador might not qualify for this larger facility, as it would likely require a more destructive phenomenon. Avoiding a credit event at least over the next 18 months seems to be in the best interest of most of the stakeholders, including the government. Market debt service next year is about USD600mn; the government would not gain much from a default. If the experience of the country in 2020 is taken as a reference, stopping servicing the market debt payments could also put multilateral disbursements at a standstill until the government is able to reach an agreement with private creditors, which would leave the government without resources to deliver results to its constituents ahead of the elections. Therefore, the incentive to default in the near future seems low. On the contrary, there seems to be incentive to provide resources to muddle through and reach the election milestone. FIGURE 4. Multilateral and domestic financing may provide enough room for the new administration to muddle through (USD bn) USD bn 2020 Financing needs 2021 2022 2023F 2024F 12.0 6.7 5.0 7.5 9.2 Deficit 5.9 1.8 (0.0) 2.1 2.7 Debt amortization 6.1 4.9 5.0 5.5 6.6 Domestic 2.7 3.1 2.6 3.5 4.2 External 3.4 1.8 2.4 2.0 2.4 Financing sources 12.0 6.7 5.0 7.5 9.2 Debt issuance 13.4 7.3 5.2 6.5 8.3 Domestic 4.3 1.9 0.9 4.2 5.0 External 9.1 5.4 4.4 2.3 3.3 Market 1.5 - Multilaterals 2.3 2.8 7.7 4.0 4.4 IMF 4.6 0.9 1.6 Others 3.0 3.1 2.8 Banks - - - Bilateral - 0.4 Others - 1.0 - (1.4) (0.6) (0.3) Net accum arrears/assets var 0.6 2.3 2.2 0.5 1.1 0.9 Source: Haver, Barclays Research Ecuador has assets (eg, Banco Pacifico, Sacha oil field, CNT, etc.) that could be sold to obtain additional liquidity. However, considering the currently elevated country risk premium, those transactions are not viable, or the country would have to sell at extremely low prices. Nonetheless, if authorities are able to reset market expectations and there is a significant reduction of the country risk premium, this could be an additional source of funding that it could tap. The actions the authorities take over the coming months will determine the room to maneuver to avoid a credit event from 2025 onward. If the country is not able to break the cycle of defaults and debt restructuring, it risks remaining without access to capital markets for a prolonged period, and limited capacity to raise additional financing from multilateral and bilateral sources would limit the economy's ability to grow and the government's ability to respond to social demands. From the market's perspective, risks might be more contained, considering the concessions that creditors already gave the government in the 2020 restructuring, and at current debt levels, Ecuador does not seem to need a significant reduction in the nominal value of the debt or a reduction of coupons. The most that it could likely obtain 13 November 2023 6 Barclays | Ecuador from a negotiation with creditors is an extension of maturities, which could still result in a relatively high recovery value for the debt in a potential restructuring scenario. FIGURE 5. Debt profile suggests the government would gain little from a default in the near future and it could put multilateral funding at risk (USD bn) FIGURE 6. Debt stock suggests that Ecuador may not need a significant reduction in the nominal value of the debt or a reduction of coupons (% GDP) 5.0 1 70 4.5 0 68 4.0 66 -1 3.5 64 3.0 -2 2.5 -3 60 -4 58 2.0 1.5 1.0 -5 0.5 -6 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040 0.0 Old debt service Restructured debt service Source: Ministry of Finance, Barclays Research 13 November 2023 62 56 54 52 -7 50 2018 2019 2020 2021 Public sector balance 2022 2023F 2024F Public debt Source: Haver, Barclays Research 7 Barclays | Ecuador Analyst(s) Certification(s): I, Alejandro Arreaza, hereby certify (1) that the views expressed in this research report accurately reflect my personal views about any or all of the subject securities or issuers referred to in this research report and (2) no part of my compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this research report. Important Disclosures: This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors under U.S. FINRA Rule 2242. Barclays trades the securities covered in this report for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to the recommendations offered in this report. Barclays Research is produced by the Investment Bank of Barclays Bank PLC and its affiliates (collectively and each individually, "Barclays"). All authors contributing to this research report are Research Analysts unless otherwise indicated. The publication date at the top of the report reflects the local time where the report was produced and may differ from the release date provided in GMT. Availability of Disclosures: For current important disclosures regarding any issuers which are the subject of this research report please refer to https:// publicresearch.barclays.com or alternatively send a written request to: Barclays Research Compliance, 745 Seventh Avenue, 13th Floor, New York, NY 10019 or call +1-212-526-1072. Barclays Capital Inc. and/or one of its affiliates does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that Barclays may have a conflict of interest that could affect the objectivity of this report. Barclays Capital Inc. and/or one of its affiliates regularly trades, generally deals as principal and generally provides liquidity (as market maker or otherwise) in the debt securities that are the subject of this research report (and related derivatives thereof). Barclays trading desks may have either a long and / or short position in such securities, other financial instruments and / or derivatives, which may pose a conflict with the interests of investing customers. Where permitted and subject to appropriate information barrier restrictions, Barclays fixed income research analysts regularly interact with its trading desk personnel regarding current market conditions and prices. Barclays fixed income research analysts receive compensation based on various factors including, but not limited to, the quality of their work, the overall performance of the firm (including the profitability of the Investment Banking Department), the profitability and revenues of the Markets business and the potential interest of the firm's investing clients in research with respect to the asset class covered by the analyst. To the extent that any historical pricing information was obtained from Barclays trading desks, the firm makes no representation that it is accurate or complete. All levels, prices and spreads are historical and do not necessarily represent current market levels, prices or spreads, some or all of which may have changed since the publication of this document. Barclays Research Department produces various types of research including, but not limited to, fundamental analysis, equity-linked analysis, quantitative analysis, and trade ideas. Recommendations and trade ideas contained in one type of Barclays Research may differ from those contained in other types of Barclays Research, whether as a result of differing time horizons, methodologies, or otherwise. In order to access Barclays Statement regarding Research Dissemination Policies and Procedures, please refer to https://publicresearch.barcap.com/S/ RD.htm. In order to access Barclays Research Conflict Management Policy Statement, please refer to: https://publicresearch.barcap.com/S/CM.htm. Disclosure(s) regarding Information Sources Copyright © (2023) Sustainalytics. Sustainalytics retains ownership and all intellectual property rights in its proprietary information and data that may be included in this report. Any Sustainalytics’ information and data included herein may not be copied or redistributed, is intended for informational purposes only, does not constitute investment advice and is not warranted to be complete, timely and accurate. Sustainalytics’ information and data is subject to conditions available at https://www.sustainalytics.com/legal-disclaimers/ Bloomberg® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”) and the Bloomberg Indices are trademarks of Bloomberg. Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material, or guarantee the accuracy or completeness of any information herein, or make any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, Bloomberg shall have no liability or responsibility for injury or damages arising in connection therewith. All pricing information is indicative only. Unless otherwise indicated, prices are sourced from Refinitiv and reflect the closing price in the relevant trading market, which may not be the last available price at the time of publication. Types of investment recommendations produced by Barclays FICC Research: In addition to any ratings assigned under Barclays’ formal rating systems, this publication may contain investment recommendations in the form of trade ideas, thematic screens, scorecards or portfolio recommendations that have been produced by analysts in FICC Research. Any such investment recommendations produced by non-Credit Research teams shall remain open until they are subsequently amended, rebalanced or closed in a future research report. Any such investment recommendations produced by the Credit Research teams are valid at current market conditions and may not be otherwise relied upon. Disclosure of other investment recommendations produced by Barclays FICC Research: Barclays FICC Research may have published other investment recommendations in respect of the same securities/instruments recommended in this research report during the preceding 12 months. To view all investment recommendations published by Barclays FICC Research in the preceding 12 months please refer to https://live.barcap.com/go/research/Recommendations. Barclays does not assign ratings to asset backed securities. Barclays Capital Inc. and/or one of its affiliates may have acted as an underwriter for public offerings of any asset backed securities that are otherwise recommended in trade ideas contained within its securitised research reports. Legal entities involved in producing Barclays Research: Barclays Bank PLC (Barclays, UK) Barclays Capital Inc. (BCI, US) 13 November 2023 8 Barclays | Ecuador Barclays Bank Ireland PLC, Frankfurt Branch (BBI, Frankfurt) Barclays Bank Ireland PLC, Paris Branch (BBI, Paris) Barclays Bank Ireland PLC, Milan Branch (BBI, Milan) Barclays Securities Japan Limited (BSJL, Japan) Barclays Bank PLC, Hong Kong Branch (Barclays Bank, Hong Kong) Barclays Capital Canada Inc. (BCCI, Canada) Barclays Bank Mexico, S.A. (BBMX, Mexico) Barclays Capital Casa de Bolsa, S.A. de C.V. (BCCB, Mexico) Barclays Securities (India) Private Limited (BSIPL, India) Barclays Bank PLC, India Branch (Barclays Bank, India) Barclays Bank PLC, Singapore Branch (Barclays Bank, Singapore) Barclays Bank PLC, DIFC Branch (Barclays Bank, DIFC) Disclaimer: This publication has been produced by Barclays Research Department in the Investment Bank of Barclays Bank PLC and/or one or more of its affiliates (collectively and each individually, "Barclays"). It has been prepared for institutional investors and not for retail investors. It has been distributed by one or more Barclays affiliated legal entities listed below or by an independent and non-affiliated third-party entity (as may be communicated to you by such third-party entity in its communications with you). It is provided for information purposes only, and Barclays makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to any data included in this publication. To the extent that this publication states on the front page that it is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors under U.S. FINRA Rule 2242, it is an “institutional debt research report” and distribution to retail investors is strictly prohibited. Barclays also distributes such institutional debt research reports to various issuers, media, regulatory and academic organisations for their own internal informational news gathering, regulatory or academic purposes and not for the purpose of making investment decisions regarding any debt securities. Media organisations are prohibited from re-publishing any opinion or recommendation concerning a debt issuer or debt security contained in any Barclays institutional debt research report. Any such recipients that do not want to continue receiving Barclays institutional debt research reports should contact debtresearch@barclays.com. Unless clients have agreed to receive “institutional debt research reports” as required by US FINRA Rule 2242, they will not receive any such reports that may be co-authored by non-debt research analysts. Eligible clients may get access to such cross asset reports by contacting debtresearch@barclays.com. Barclays will not treat unauthorized recipients of this report as its clients and accepts no liability for use by them of the contents which may not be suitable for their personal use. Prices shown are indicative and Barclays is not offering to buy or sell or soliciting offers to buy or sell any financial instrument. Without limiting any of the foregoing and to the extent permitted by law, in no event shall Barclays, nor any affiliate, nor any of their respective officers, directors, partners, or employees have any liability for (a) any special, punitive, indirect, or consequential damages; or (b) any lost profits, lost revenue, loss of anticipated savings or loss of opportunity or other financial loss, even if notified of the possibility of such damages, arising from any use of this publication or its contents. Other than disclosures relating to Barclays, the information contained in this publication has been obtained from sources that Barclays Research believes to be reliable, but Barclays does not represent or warrant that it is accurate or complete. Appearances by Third-Party Speakers: Any views or opinions expressed by third-party speakers during this event are solely those of the speaker and do not represent the views or opinions of Barclays. Barclays is not responsible for, and makes no warranties whatsoever as to, the information or opinions contained in any written, electronic, audio or video presentations by any third-party speakers at the event (“Third-Party Content”). Any such Third-Party Content has not been adopted or endorsed by Barclays and does not represent the views or opinions of Barclays. Third-Party Content is provided for information purposes only and has not been independently verified by Barclays for its accuracy or completeness. The views in this publication are solely and exclusively those of the authoring analyst(s) and are subject to change, and Barclays Research has no obligation to update its opinions or the information in this publication. Unless otherwise disclosed herein, the analysts who authored this report have not received any compensation from the subject companies in the past 12 months. If this publication contains recommendations, they are general recommendations that were prepared independently of any other interests, including those of Barclays and/or its affiliates, and/or the subject companies. This publication does not contain personal investment recommendations or investment advice or take into account the individual financial circumstances or investment objectives of the clients who receive it. Barclays is not a fiduciary to any recipient of this publication. The securities and other investments discussed herein may not be suitable for all investors and may not be available for purchase in all jurisdictions. The United States imposed sanctions on certain Chinese companies (https://home.treasury.gov/policy-issues/financial-sanctions/sanctions-programs-and-countryinformation/chinese-military-companies-sanctions), which may restrict U.S. persons from purchasing securities issued by those companies. Investors must independently evaluate the merits and risks of the investments discussed herein, including any sanctions restrictions that may apply, consult any independent advisors they believe necessary, and exercise independent judgment with regard to any investment decision. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results. The information provided does not constitute a financial benchmark and should not be used as a submission or contribution of input data for the purposes of determining a financial benchmark. This publication is not investment company sales literature as defined by Section 270.24(b) of the US Investment Company Act of 1940, nor is it intended to constitute an offer, promotion or recommendation of, and should not be viewed as marketing (including, without limitation, for the purposes of the UK Alternative Investment Fund Managers Regulations 2013 (SI 2013/1773) or AIFMD (Directive 2011/61)) or pre-marketing (including, without limitation, for the purposes of Directive (EU) 2019/1160) of the securities, products or issuers that are the subject of this report. 13 November 2023 9 Barclays | Ecuador Third Party Distribution: Any views expressed in this communication are solely those of Barclays and have not been adopted or endorsed by any third party distributor. United Kingdom: This document is being distributed (1) only by or with the approval of an authorised person (Barclays Bank PLC) or (2) to, and is directed at (a) persons in the United Kingdom having professional experience in matters relating to investments and who fall within the definition of "investment professionals" in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Order"); or (b) high net worth companies, unincorporated associations and partnerships and trustees of high value trusts as described in Article 49(2) of the Order; or (c) other persons to whom it may otherwise lawfully be communicated (all such persons being "Relevant Persons"). Any investment or investment activity to which this communication relates is only available to and will only be engaged in with Relevant Persons. Any other persons who receive this communication should not rely on or act upon it. Barclays Bank PLC is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority and is a member of the London Stock Exchange. European Economic Area (“EEA”): This material is being distributed to any “Authorised User” located in a Restricted EEA Country by Barclays Bank Ireland PLC. The Restricted EEA Countries are Austria, Bulgaria, Estonia, Finland, Hungary, Iceland, Liechtenstein, Lithuania, Luxembourg, Malta, Portugal, Romania, Slovakia and Slovenia. For any other “Authorised User” located in a country of the European Economic Area, this material is being distributed by Barclays Bank PLC. Barclays Bank Ireland PLC is a bank authorised by the Central Bank of Ireland whose registered office is at 1 Molesworth Street, Dublin 2, Ireland. Barclays Bank PLC is not registered in France with the Autorité des marchés financiers or the Autorité de contrôle prudentiel. Authorised User means each individual associated with the Client who is notified by the Client to Barclays and authorised to use the Research Services. The Restricted EEA Countries will be amended if required. Finland: Notwithstanding Finland’s status as a Restricted EEA Country, Research Services may also be provided by Barclays Bank PLC where permitted by the terms of its cross-border license. Americas: The Investment Bank of Barclays Bank PLC undertakes U.S. securities business in the name of its wholly owned subsidiary Barclays Capital Inc., a FINRA and SIPC member. Barclays Capital Inc., a U.S. registered broker/dealer, is distributing this material in the United States and, in connection therewith accepts responsibility for its contents. Any U.S. person wishing to effect a transaction in any security discussed herein should do so only by contacting a representative of Barclays Capital Inc. in the U.S. at 745 Seventh Avenue, New York, New York 10019. Non-U.S. persons should contact and execute transactions through a Barclays Bank PLC branch or affiliate in their home jurisdiction unless local regulations permit otherwise. This material is distributed in Canada by Barclays Capital Canada Inc., a registered investment dealer, a Dealer Member of IIROC (www.iiroc.ca), and a Member of the Canadian Investor Protection Fund (CIPF). This material is distributed in Mexico by Barclays Bank Mexico, S.A. and/or Barclays Capital Casa de Bolsa, S.A. de C.V. This material is distributed in the Cayman Islands and in the Bahamas by Barclays Capital Inc., which it is not licensed or registered to conduct and does not conduct business in, from or within those jurisdictions and has not filed this material with any regulatory body in those jurisdictions. Japan: This material is being distributed to institutional investors in Japan by Barclays Securities Japan Limited. Barclays Securities Japan Limited is a joint-stock company incorporated in Japan with registered office of 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131, Japan. It is a subsidiary of Barclays Bank PLC and a registered financial instruments firm regulated by the Financial Services Agency of Japan. Registered Number: Kanto Zaimukyokucho (kinsho) No. 143. Asia Pacific (excluding Japan): Barclays Bank PLC, Hong Kong Branch is distributing this material in Hong Kong as an authorised institution regulated by the Hong Kong Monetary Authority. Registered Office: 41/F, Cheung Kong Center, 2 Queen's Road Central, Hong Kong. All Indian securities-related research and other equity research produced by Barclays’ Investment Bank are distributed in India by Barclays Securities (India) Private Limited (BSIPL). BSIPL is a company incorporated under the Companies Act, 1956 having CIN U67120MH2006PTC161063. BSIPL is registered and regulated by the Securities and Exchange Board of India (SEBI) as a Research Analyst: INH000001519; Portfolio Manager INP000002585; Stock Broker INZ000269539 (member of NSE and BSE); Depository Participant with the National Securities & Depositories Limited (NSDL): DP ID: IN-DPNSDL-299-2008; Investment Adviser: INA000000391. BSIPL is also registered as a Mutual Fund Advisor having AMFI ARN No. 53308.The registered office of BSIPL is at 208, Ceejay House, Shivsagar Estate, Dr. A. Besant Road, Worli, Mumbai – 400 018, India. Telephone No: +91 22 67196363. Fax number: +91 22 67196399. Any other reports produced by Barclays’ Investment Bank are distributed in India by Barclays Bank PLC, India Branch, an associate of BSIPL in India that is registered with Reserve Bank of India (RBI) as a Banking Company under the provisions of The Banking Regulation Act, 1949 (Regn No BOM43) and registered with SEBI as Merchant Banker (Regn No INM000002129) and also as Banker to the Issue (Regn No INBI00000950). Barclays Investments and Loans (India) Limited, registered with RBI as Non Banking Financial Company (Regn No RBI CoR-07-00258), and Barclays Wealth Trustees (India) Private Limited, registered with Registrar of Companies (CIN U93000MH2008PTC188438), are associates of BSIPL in India that are not authorised to distribute any reports produced by Barclays’ Investment Bank. This material is distributed in Singapore by the Singapore Branch of Barclays Bank PLC, a bank licensed in Singapore by the Monetary Authority of Singapore. For matters in connection with this material, recipients in Singapore may contact the Singapore branch of Barclays Bank PLC, whose registered address is 10 Marina Boulevard, #23-01 Marina Bay Financial Centre Tower 2, Singapore 018983. This material, where distributed to persons in Australia, is produced or provided by Barclays Bank PLC. This communication is directed at persons who are a “Wholesale Client” as defined by the Australian Corporations Act 2001. Please note that the Australian Securities and Investments Commission (ASIC) has provided certain exemptions to Barclays Bank PLC (BBPLC) under paragraph 911A(2)(l) of the Corporations Act 2001 from the requirement to hold an Australian financial services licence (AFSL) in respect of financial services provided to Australian Wholesale Clients, on the basis that BBPLC is authorised by the Prudential Regulation Authority of the United Kingdom (PRA) and regulated by the Financial Conduct Authority (FCA) of the United Kingdom and the PRA under United Kingdom laws. The United Kingdom has laws which differ from Australian laws. To the extent that this communication involves the provision of financial services by BBPLC to Australian Wholesale Clients, BBPLC relies on the relevant exemption from the requirement to hold an AFSL. Accordingly, BBPLC does not hold an AFSL. This communication may be distributed to you by either: (i) Barclays Bank PLC directly or (ii) Barrenjoey Markets Pty Limited (ACN 636 976 059, “Barrenjoey”), the holder of Australian Financial Services Licence (AFSL) 521800, a non-affiliated third party distributor, where clearly identified to you by Barrenjoey. Barrenjoey is not an agent of Barclays Bank PLC. 13 November 2023 10 Barclays | Ecuador This material, where distributed in New Zealand, is produced or provided by Barclays Bank PLC. Barclays Bank PLC is not registered, filed with or approved by any New Zealand regulatory authority. This material is not provided under or in accordance with the Financial Markets Conduct Act of 2013 (“FMCA”), and is not a disclosure document or “financial advice” under the FMCA. This material is distributed to you by either: (i) Barclays Bank PLC directly or (ii) Barrenjoey Markets Pty Limited (“Barrenjoey”), a non-affiliated third party distributor, where clearly identified to you by Barrenjoey. Barrenjoey is not an agent of Barclays Bank PLC. This material may only be distributed to “wholesale investors” that meet the “investment business”, “investment activity”, “large”, or “government agency” criteria specified in Schedule 1 of the FMCA. Middle East: Nothing herein should be considered investment advice as defined in the Israeli Regulation of Investment Advisory, Investment Marketing and Portfolio Management Law, 1995 (“Advisory Law”). This document is being made to eligible clients (as defined under the Advisory Law) only. Barclays Israeli branch previously held an investment marketing license with the Israel Securities Authority but it cancelled such license on 30/11/2014 as it solely provides its services to eligible clients pursuant to available exemptions under the Advisory Law, therefore a license with the Israel Securities Authority is not required. Accordingly, Barclays does not maintain an insurance coverage pursuant to the Advisory Law. This material is distributed in the United Arab Emirates (including the Dubai International Financial Centre) and Qatar by Barclays Bank PLC. Barclays Bank PLC in the Dubai International Financial Centre (Registered No. 0060) is regulated by the Dubai Financial Services Authority (DFSA). Principal place of business in the Dubai International Financial Centre: The Gate Village, Building 4, Level 4, PO Box 506504, Dubai, United Arab Emirates. Barclays Bank PLC-DIFC Branch, may only undertake the financial services activities that fall within the scope of its existing DFSA licence. Related financial products or services are only available to Professional Clients, as defined by the Dubai Financial Services Authority. Barclays Bank PLC in the UAE is regulated by the Central Bank of the UAE and is licensed to conduct business activities as a branch of a commercial bank incorporated outside the UAE in Dubai (Licence No.: 13/1844/2008, Registered Office: Building No. 6, Burj Dubai Business Hub, Sheikh Zayed Road, Dubai City) and Abu Dhabi (Licence No.: 13/952/2008, Registered Office: Al Jazira Towers, Hamdan Street, PO Box 2734, Abu Dhabi). This material does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe for or purchase, any securities or investment products in the UAE (including the Dubai International Financial Centre) and accordingly should not be construed as such. Furthermore, this information is being made available on the basis that the recipient acknowledges and understands that the entities and securities to which it may relate have not been approved, licensed by or registered with the UAE Central Bank, the Dubai Financial Services Authority or any other relevant licensing authority or governmental agency in the UAE. The content of this report has not been approved by or filed with the UAE Central Bank or Dubai Financial Services Authority. Barclays Bank PLC in the Qatar Financial Centre (Registered No. 00018) is authorised by the Qatar Financial Centre Regulatory Authority (QFCRA). Barclays Bank PLC-QFC Branch may only undertake the regulated activities that fall within the scope of its existing QFCRA licence. Principal place of business in Qatar: Qatar Financial Centre, Office 1002, 10th Floor, QFC Tower, Diplomatic Area, West Bay, PO Box 15891, Doha, Qatar. Related financial products or services are only available to Business Customers as defined by the Qatar Financial Centre Regulatory Authority. Russia: This material is not intended for investors who are not Qualified Investors according to the laws of the Russian Federation as it might contain information about or description of the features of financial instruments not admitted for public offering and/or circulation in the Russian Federation and thus not eligible for non-Qualified Investors. If you are not a Qualified Investor according to the laws of the Russian Federation, please dispose of any copy of this material in your possession. Environmental, Social, and Governance (‘ESG’) Related Research: There is currently no globally accepted framework or definition (legal, regulatory or otherwise) of, nor market consensus as to what constitutes, an ‘ESG’, ‘green’, ‘sustainable’, ‘climate-friendly’ or an equivalent company, investment, strategy or consideration or what precise attributes are required to be eligible to be categorised by such terms. This means there are different ways to evaluate a company or an investment and so different values may be placed on certain ESG credentials as well as adverse ESG-related impacts of companies and ESG controversies. The evolving nature of ESG considerations, models and methodologies means it can be challenging to definitively and universally classify a company or investment under an ESG label and there may be areas where such companies and investments could improve or where adverse ESG-related impacts or ESG controversies exist. The evolving nature of sustainable finance related regulations and the development of jurisdiction-specific regulatory criteria also means that there is likely to be a degree of divergence as to the interpretation of such terms in the market. We expect industry guidance, market practice, and regulations in this field to continue to evolve. Any references to ‘sustainable’, ‘sustainability’, ‘green’, ‘social’, ‘ESG’, ‘ESG considerations’, ‘ESG factors’, ‘ESG issues’ or other similar or related terms in this document are as used in our public disclosures and not to any jurisdiction-specific regulatory definition or other interpretation of these terms unless specified otherwise. IRS Circular 230 Prepared Materials Disclaimer: Barclays does not provide tax advice and nothing contained herein should be construed to be tax advice. Please be advised that any discussion of U.S. tax matters contained herein (including any attachments) (i) is not intended or written to be used, and cannot be used, by you for the purpose of avoiding U.S. tax-related penalties; and (ii) was written to support the promotion or marketing of the transactions or other matters addressed herein. Accordingly, you should seek advice based on your particular circumstances from an independent tax advisor. © Copyright Barclays Bank PLC (2023). All rights reserved. No part of this publication may be reproduced or redistributed in any manner without the prior written permission of Barclays. Barclays Bank PLC is registered in England No. 1026167. Registered office 1 Churchill Place, London, E14 5HP. Additional information regarding this publication will be furnished upon request. BRCF2242 13 November 2023 11