Online Distribution Channel Delivery: Power Structures & Arrangements

Anuncio

Omega 126 (2024) 103070

Contents lists available at ScienceDirect

Omega

journal homepage: www.elsevier.com/locate/omega

Delivery arrangement in online distribution channels under different

power structures✰

Xiongwei Zhou a, Chaoqun Zhu a, Dan Cai b, *

a

b

School of Business, Central South University, Changsha, 410083, PR China

School of Economics and Management, Chongqing University of Posts and Telecommunications, Chongqing, 400065, PR China

A R T I C L E I N F O

A B S T R A C T

Keywords:

Supply chain management

Delivery arrangement

Online distribution channel

Nonlinear delivery cost

Power structure

Logistics delivery is a critical but costly operation in e-commerce. The e-retailer who sells products online may

ask the supplier to ship products to customers, and the supplier responds by accepting or rejecting such a delivery

proposal. Motivated by these observations, we consider an online distribution channel with two competing

suppliers and one common e-retailer and analytically characterize the equilibrium delivery arrangement based

on the nonlinear delivery cost in the E-retailer-Stackelberg, Supplier-Stackelberg, and Vertical-Nash games. Our

analysis reveals that the market follower might be more willing to deliver products than the market leader in

each Stackelberg game. Counterintuitively, the e-retailer prefers undertaking the delivery when there is a large

delivery diseconomy under each power structure but prefers asking both suppliers to deliver products when there

is a delivery economy (a small delivery diseconomy) in the E-retailer-Stackelberg and Vertical-Nash games

(Supplier-Stackelberg game). The suppliers agree to ship products only when the delivery economy is apparent in

the E-retailer-Stackelberg game but reject to do so in the Vertical-Nash game; in the Supplier-Stackelberg game,

they accept the delivery proposal even though there is a significant delivery diseconomy. Although both suppliers

can benefit from refusing to undertake the delivery when there is fierce competition in each Stackelberg game,

interestingly, they still agree to do so and trap themselves in a prisoner’s dilemma. In each Stackelberg game,

only shifting the delivery responsibility to the suppliers might achieve a triple-win situation for the channel

members, consumers, and society; in the Vertical-Nash game, however, this situation never occurs, and the

consumer surplus and social welfare are invariant to the delivery arrangement.

1. Introduction

Developments in payment and internet technologies have stimulated

the rapid growth of e-commerce worldwide in the past decades. One

salient feature of online retailing is that firms must deliver products to

consumers once the payment is completed. It is well established that

delivering products is a costly operation in online retailing (X. [1–6]). As

per a recent report by the Council of Supply Chain Management Pro­

fessionals, logistics costs for businesses in the United States rose by 22.4

% to $1.85 trillion, accounting for 8 % of the country’s GDP in 2021.1

Similarly, the China Federation of Logistics and Purchasing reported

that China spent approximately 335.2 trillion RMB on logistics in 2021,

an increase of 9.2 % from the previous year.2 Given the significance of

logistics delivery in online transactions, delivery arrangement, i.e., who

is responsible for delivering products to consumers, has always been

among the most critical issues for online distribution channel members.

It is evident from practical observations that e-retailers who sell

products online often take up the responsibility of product delivery.

However, for some product categories, e-retailers may ask the suppliers

to ship products to consumers directly. In response, the suppliers accept

or reject this delivery proposal. For instance, JD.com, one of the largest

e-retail giants in China, delivers substitutable products when selling

✰

Area - Supply Chain Management This manuscript was processed by Associate Editor Shen.

* Corresponding author at: School of Economics and Management, Chongqing University of Posts and Telecommunications, Chongqing, 400065, PR China.

E-mail address: caidancsu@126.com (D. Cai).

1

https://cscmp.org/ (accessed July 10, 2023).

2

http://www.chinawuliu.com.cn/ (accessed July 10, 2023).

https://doi.org/10.1016/j.omega.2024.103070

Received 16 July 2023; Accepted 27 February 2024

Available online 8 March 2024

0305-0483/© 2024 Elsevier Ltd. All rights reserved.

X. Zhou et al.

Omega 126 (2024) 103070

products for competing suppliers such as Haier3 and Midea.4 Conversely,

for suppliers like Li-Ning5 and ANTA,6 JD.com may ask them to deliver

products, and both agree. The same commercial phenomenon also oc­

curs with other e-retailers such as Gome,7 Suning,8 Amazon (Direct

Fulfillment Program) ,9 and Walmart (Dropship Vendor Program) .10

Another typical example is that, on the wholesale website 1688 in China,

some suppliers accept the e-retailer’s delivery proposal while others

reject it.11 The above anecdotal evidence implies that the attitudes of

channel members towards undertaking the delivery are sometimes

inconsistent, which, thus, also stimulates our interest in exploring the

underlying mechanism that drives the delivery arrangement in online

distribution channels.

As mentioned above, product shipping is expensive for firms because

it involves associated operations such as warehouse building or renting,

package handling, and product transporting. Particularly when

encountering scale diseconomies of delivery (G. [7]), channel members

might be reluctant to undertake the delivery due to the increased costs.

Suppliers usually consider these operational costs when deciding

whether to accept the e-retailer’s delivery proposal. However, as is well

documented in the literature, the delivery of products may also exhibit

economies of scale ([8]; B. [9]). In this regard, JD.com12 and Haier13

have also publicly reported that delivering online orders may exhibit

economies of scale. These two types of delivery scale effects are opposite

and thus can profoundly affect the channel members’ preferences over

undertaking the delivery. Despite these delivery scale effects, little is

understood about their implications for the delivery arrangement in

online distribution channels. Therefore, further investigation is neces­

sary to comprehend how and why these different scale effects shape

firms’ delivery arrangement preferences.

In addition to the delivery scale effect, power structure also mate­

rially matters because a dominant market power can ensure sufficient

profits to cover the delivery cost (Y. [10]) and is essential in influencing

channel members’ delivery willingness. When the e-retailer plays a

dominant role in online distribution channels, she could claim retail

markup at first, which narrows the wholesale price the supplier demands

later and thus might reduce his willingness to be responsible for deliv­

ering products to customers. In contrast, a powerful supplier can sub­

stantially extract the wholesale price, leaving the e-retailer with

inadequate retail markup to compensate for the associated costs when

she undertakes the delivery. In recent years, with the expansion of on­

line sales scale and the continuous integration of related businesses,

many e-retailers are becoming more formidable than their suppliers;

e-retail giants such as Amazon, Walmart, and JD.com often exploit

power to push their suppliers towards the situation where they have less

bargaining power ([11]; Yujie [12,13]). In the vertical competition be­

tween channel members, well-known and influential suppliers such as

Huawei, Siemens, Xiaomi, Nike, and Adidas may play a leading role

when distributing products through downstream smaller e-retailers

([14]; G. [15]; T.-Y. [16]). In many cases, however, channel members

may be involved in the vertical Nash competition (S. [17,18]). Although

the existing literature has emphasized the critical role of the power

structure in the supply chain’s operation behaviors ([19–23]; X. [24]),

there is no existing theory that thoroughly explains how the power

structure affects the delivery arrangement in online distribution

channels.

Both forces discussed above make the problem of delivery arrange­

ment more complex, and the equilibrium arrangement cannot be readily

observed. To fill the research gap, we consider the nonlinear delivery

cost reflecting delivery economy or diseconomy and develop a gametheoretic model to fully characterize the equilibrium delivery arrange­

ment under three power structures: E-retailer-Stackelberg, SupplierStackelberg, and Vertical-Nash games. In particular, we attempt in this

paper to pursue the following research questions: (1) How would the

power structure and nonlinear delivery cost shape firms’ delivery

arrangement preferences? (2) Which delivery arrangement can be sus­

tained as an equilibrium outcome under different power structures? If

so, under what conditions? (3) Is there a particular delivery arrangement

that benefits the channel members involved and generates the highest

consumer surplus and social welfare concurrently? To address these is­

sues, we consider an online distribution channel consisting of one

common e-retailer and two competing suppliers. The e-retailer and

suppliers are assumed to have the ability and funds to undertake the

delivery. Initially, the e-retailer decides to ask none, one, or both of the

suppliers to ship products to customers. After that, the supplier, condi­

tional upon receipt of a delivery proposal from the e-retailer, determines

whether to undertake the delivery. Based on the interactions between

the supplies and the e-retailer, we study three delivery arrangements:

EE, SE/ES, and SS. The delivery arrangement EE means that the eretailer undertakes the delivery of two substitutable products, the hybrid

delivery arrangement SE/ES denotes that only one of the suppliers de­

livers products to customers, and the delivery arrangement SS represents

that both suppliers are responsible for shipping products to consumers.

Our analysis reveals several noteworthy findings. (1) The market

follower is more willing to undertake the delivery than the market

leader when the delivery is economy in each Stackelberg game. (2)

Channel members prefer undertaking the delivery when the delivery

diseconomy is significant but may avoid it when there is a delivery

economy. (3) The delivery arrangement EE might emerge in equilibrium

under each power structure, irrespective of the delivery scale effect;

however, the delivery arrangement SS emerges in equilibrium only

when the delivery economy is large (the delivery diseconomy is not so

small and the competition intensity is not too large) in the E-retailerStackelberg (Supplier-Stackelberg) game; even in a symmetric setting,

the hybrid delivery arrangement SE/ES can emerge in equilibrium in the

Supplier-Stackelberg game. (4) Interestingly, even if both suppliers can

earn higher profits by rejecting the e-retailer’s delivery proposal when

there is fierce competition in each Stackelberg game, they still accept it

and eventually fall into a prisoner’s dilemma. (5) In each Stackelberg

game, only shifting the delivery responsibility to the suppliers might

benefit channel members and generate the highest consumer surplus

and social welfare concurrently (i.e., a triple-win situation). In the

Vertical-Nash game, however, such a situation never occurs, and the

consumers and society are indifferent to who ships products.

Our contribution is threefold. First, to the best of our knowledge, we

are among the first to examine the delivery arrangement in an online

distribution channel under different power structures and show that the

equilibrium delivery arrangements under the three power structures are

dramatically different. Moreover, the market follower who possesses

less negotiation power might be more willing than the market leader to

be responsible for delivering products. Therefore, our research provides

novel insights into how power structure impacts the delivery arrange­

ment. Second, our analysis provides surprising insights that channel

members might benefit from delivering the product with a significant

delivery diseconomy but suffer from shipping the product with the

apparent delivery economy. Third, our research sheds light on the

implication of an e-retailer’s delivery proposal for the competing sup­

pliers and suggests that such a delivery proposal might lead to a

3

https://item.jd.com/100037217877.html (accessed July 10, 2023).

https://item.jd.com/100022748756.html (accessed July 10, 2023).

5

https://item.jd.com/100033049869.html (accessed July 10, 2023).

6

https://item.jd.com/100044484654.html (accessed July 10, 2023).

7

https://item.gome.com.cn/9140420462-1131249887.html (accessed July

10, 2023).

8

https://product.suning.com/0000000000/12183309510.html? (accessed

July 10, 2023).

9

https://vendorcentral.amazon.com/ (accessed July 10, 2023).

10

https://supplierhelp.walmart.com/s/ (accessed July 10, 2023).

11

https://www.1688.com (accessed July 10, 2023).

12

https://finance.sina.com.cn/stock/relnews/hk/2023-08-29/docimziwkqa1409310.shtml (accessed October 10, 2023).

13

https://www.sohu.com/a/16607610_115469 (accessed October 10, 2023).

4

2

X. Zhou et al.

Omega 126 (2024) 103070

prisoner’s dilemma in each Stackelberg game. Overall, our findings

uncover the underlying mechanism behind the delivery arrangement

and provide concrete and valuable guidelines for channel members on

who and when to undertake the delivery.

We also consider three alternative extended scenarios in the Online

Appendix, namely asymmetric suppliers with different market poten­

tials, differentiated delivery scale effects between channel members, and

a lower linear delivery cost for the e-retailer, to verify the robustness of

our main results. The remainder of the article proceeds as follows. We

review the relevant literature in Section 2 and introduce the model in

Section 3. Section 4 conducts the comparative analysis, and Section 5

derives the equilibrium delivery arrangement. Section 6 presents the

welfare implications, and Section 7 concludes this study. All equilibrium

outcomes and proofs are relegated to the Online Appendix.

a proposal and ultimately fall into the prisoner’s dilemma. Therefore, on

this point, our research sheds light on the dark side of the e-retailer’s

delivery proposal.

Our work also contributes to the growing literature investigating the

impact of power structure on supply chain performance. Power structure

usually refers to different timing rules involving demanding profit

margins. For instance, S. C. Choi [36] investigates the implications of

power structure for manufacturers’ decisions when distributing prod­

ucts through a retailer in a two-echelon supply chain. Nagarajan and

Sošić [37] investigate the role of the power structure in supplier alli­

ances in a decentralized assembly system with the consideration of

Supplier-Stackelberg, Vertical-Nash, and Assembler-Stackelberg game

models. Pan, Lai, Leung, &Xiao [38] focus on a supply chain consisting

of two competing manufacturers and a shared retailer or a single

manufacturer and two competing retailers to demonstrate that the

power structure influences the selection of two types of contracts. Using

a game-theory-based framework, Shi, Zhang, &Ru [39] examine the

impacts of the power structure and demand model on supply chain

performance. Luo, Chen, Chen, &Wang [18] explore how the power

structure affects pricing policies for differentiated brands by considering

horizontal and vertical competition. Liao, Yano, &Trivedi [23] discuss

how the power structure influences producer choice and store-brand

quality optimization. With a dual-channel supply chain, Yujie Xiao,

Niu, Zhang, &Xue [13] analyze how quality differentiation and power

structure affect the retailer’s store-brand introduction incentive and

profitability.

Overall, these studies have discussed the impacts of power structure

on the supply chain’s marketing strategy or operational behavior but

neglect the implications of power structure for the delivery arrange­

ment. However, one exception is a study reported by Geng, Krishnan,

&Queyranne [40], which explores the focal retailer’s internalization

decision in logistics under different power structures. Specifically,

considering the three power structures, Geng, Krishnan, &Queyranne

[40] examine the conditions under which the focal retailer would

benefit from internalizing the inbound logistics that raise its costs.

Nevertheless, our work differs from theirs in the following ways. First,

we allow two competing suppliers to respond by accepting or rejecting

the e-retailer’s delivery proposal. In contrast, they allow only one focal

retailer to decide whether or not to undertake the inbound logistics

delivery. Importantly, our findings suggest that the competing suppliers

might fall into the prisoner’s dilemma by accepting the e-retailer’s de­

livery proposal. Second, in their study, the delivery cost structure would

differ due to the internalization decision, whereas, in our study, the

delivery cost structure is consistent regardless of who undertakes the

delivery. Under this assumption, each supplier might be willing to un­

dertake the delivery. Third, their work reveals that one retailer can

benefit from undertaking the inbound logistics delivery because such a

decision can negatively affect its rival profit; however, our analysis

shows that the suppliers can benefit from accepting the e-retailer’s de­

livery proposal because of the higher demands they can obtain.

2. Literature review

Our paper is related to the vast literature on logistics delivery-related

operational problems in online distribution channels. As one of the

critical operations for online sellers, logistics delivery has attracted

much research interest (Y. [25,26]). One stream of the literature ex­

amines the logistics delivery-related operational problems from the

perspective of demand-enhancing service. For example, X. Li, Li, Cai,

&Shan [2] explore the service channel choice for supply chain players by

considering four different service formats. By comparing three coordi­

nation models, W. Liu et al. [27] reveal the implications of demand

disruption for logistics service supply chain (LSSC) coordination. Qin,

Liu, &Tian [4] investigate the strategic and economic impacts of logis­

tics service sharing in a hybrid platform. Considering a retailer-led

supply chain, Lou et al. [28] investigate logistics outsourcing choices

and find that the retailer does not necessarily benefit from offering lo­

gistics services. Some recent works also examine firms’ logistics delivery

strategies with other considerations including selling mode choice [29],

service channel integration (Y. [10]), direct channel opening (L. [30]),

channel structure selection (H. [31]), competition at the e-commerce

platform [1] and platform-based co-opetition supply chain structure (P.

[32]). Another stream of the literature investigates those problems by

focusing on the delivery cost. Among them, Tian, Vakharia, Tan, &Xu

[33] study the optimal selling mode for an e-commerce platform and

reveal that the fulfillment (i.e., delivering physical goods to customers)

costs and upstream competition intensity jointly play a critical role in

the choice of selling mode. Niu et al. [34] consider the delivery cost gap

between the fast-food restaurant and the online food-delivery platform

and derive the optimal delivery arrangement for the fast-food restau­

rant. Likewise, B. He, Gupta, &Mirchandani [9] discuss the optimal

selling and delivery strategy for a local Brick-and-Mortar store in the

context of emerging online-to-offline (O2O) third-party platforms. Based

on the linear logistics delivery cost, P. He et al. [35] explore the impacts

of manufacturer encroachment and the e-commerce platform’s logistics

integration strategy.

Although the above papers have identified the significant role of

logistics delivery in online distribution channels, one missing feature

among all existing research is the delivery economy or diseconomy

prevalent in real-life business settings. Our aim, however, is to under­

stand how and why these different scale effects shape firms’ delivery

preferences. Counterintuitively, our analysis shows that the channel

members prefer undertaking the delivery when there is a large delivery

diseconomy but might prefer to refrain from undertaking the delivery

when there is a delivery economy. Hence, this unexpected result chal­

lenges the conventional presumption that the channel members might

be less willing to undertake the delivery when the delivery of products is

more expensive. Furthermore, departing from the existing literature, we

examine the equilibrium delivery arrangement in an online distribution

channel with supplier competition. Interestingly, when there is fierce

competition, the competing suppliers can achieve higher profits by

rejecting the e-retailer’s delivery proposal but cannot help rejecting such

3. Model setup

Consider an online distribution channel with two identical suppliers

(indexed by 1 and 2) selling substitutable products through a nonex­

clusive e-retailer (indexed by e). The suppliers produce goods with a

symmetric and constant marginal cost, which we normalize to zero

without losing generality. We refer to either supplier as he and the eretailer as she. Table 1 summarizes all notations used in this study.

In line with the extant literature [41,42], the consumer demand for

each product is given by14

14

These demand functions are derived by maximizing the representative

∑

consumer utility U =

(aqi − qi 2 /2 − pi qi ) − kq1 q2 .

i=1,2

3

X. Zhou et al.

Omega 126 (2024) 103070

Table 1

Notation.

Notation

Description

∧

∼

−

pi

qi

wsi

mei

a

k

cqi

bq2i

Δei

Δsi

Πe

Πsi

EE

SE

SS

CS

SW

Superscript used to denote the E-retailer-Stackelberg game

Superscript used to denote the Supplier-Stackelberg game

Superscript used to denote the Vertical-Nash game

Retail price of product i

Demand of product i

Supplier i’s wholesale price

E-retailer’s retail markup for product i

Market Potential

Intensity of competition (degree of product differentiation)

Linear part of delivery cost

Nonlinear part of delivery cost

E-retailer’s unit profit for product i

Supplier i’s unit profit

E-retailer’s payoff

Supplier i’s payoff

The delivery arrangement where the e-retailer undertakes the delivery of two substitutable products

The hybrid delivery arrangement where supplier 1 undertakes the delivery of his product while the e-retailer undertakes the delivery of supplier 2′s product

The delivery arrangement where both suppliers undertake the delivery of their products

Consumer surplus

Social welfare

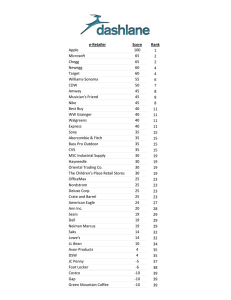

Fig. 1. Delivery arrangements: EE, SE, and SS.

(

)

a

p1

kp2

1−

+

1+k

1− k 1− k

(

)

⎪

a

p2

kp1

⎪

⎪

⎩ q2 =

1−

+

1+k

1− k 1− k

⎧

⎪

⎪

⎪

⎨ q1 =

fulfill online orders for the products (e.g., sofa, bed, air conditioner,

refrigerator, fresh food, and television) with characteristics such as large

volume, heavy weight, perishable, or fragile because the increased sales

quantities of these products need more expensive capacity or profes­

sional operation, and result in a lower delivery efficiency (G. [7]).

However, when channel members fulfill online orders for products (e.g.,

electronic products, digital accessories, clothes, hats, and shoes) that are

easy to handle, the delivery might be economy due to economies of

scope ([8]; B. [9]). Therefore, to capture the essential feature of the

delivery economy or diseconomy, we consider a nonlinear delivery cost

cq + bq2 . Specifically, c represents the unit delivery cost, determined by

delivery distance, product weight, volume, and other factors; b > 0 in­

dicates that the firms face the delivery diseconomy, while b < 0 implies

that the firms encounter the delivery economy.15 This cost structure has

been widely used in operations management literature to characterize

the diseconomy or economy of scale [43–46]. Note that channel mem­

bers are indifferent to who undertakes the delivery in the case of linear

delivery cost; thus, we omit the analysis of this trivial case. The delivery

cost is assumed to be identical when the e-retailer or the supplier

(1)

The parameter k ∈ [0, 1) characterizes the degree of product differ­

entiation; a larger k implies more intense competition between the

substitutable products. Here, p1 (p2 ) represents the retail price of prod­

uct 1 (2), which is the sum of the wholesale price ws1 (ws2 ) that supplier 1

(2) demands and the retail markup me1 (me2 ) that the e-retailer claims for

product 1 (2). q1 (q2 ) is the quantity of product 1 (2). Suppliers are

assumed to possess equal market potential, a, normalized to 1 without

losing generality. We relax this assumption in the Online Appendix D

and show that our main results hold qualitatively.

In practice, product delivery can often be undertaken by different

parties of the online distribution channel (X. [2,29]). In this study, we

assume that both the supplier and the e-retailer have sufficient capital

and capability to undertake the delivery. As highlighted previously, the

delivery of online orders generally exhibits different scale effects. When

the marginal delivery cost increases with the online order volume, we

refer to it as the delivery diseconomy; conversely, when the marginal

delivery cost decreases with the online order volume, we refer to it as the

delivery economy. Delivery diseconomy might occur when merchants

15

When b < 0, we focus on −2bc > q so that the delivery is economy. A similar

assumption was adopted by Shang, Ha, &Tong (35) and Zhao and Li (47).

4

X. Zhou et al.

Omega 126 (2024) 103070

Fig. 2. Sequence of events.

undertakes the delivery to clarify the implications of the power structure

for the delivery arrangement. We relax this assumption in the Online

Appendix E and F to check the robustness of our core model.

Following industry practice, we consider three possible delivery ar­

rangements, depicted in Fig. 1. Under the delivery arrangement EE, the

e-retailer undertakes the delivery of two substitutable products and in­

curs associated costs. Such an arrangement arises if the e-retailer asks

neither of the suppliers to undertake the delivery or if the e-retailer asks

at least one supplier to undertake the delivery and no suppliers agree to

do it. Hence, the channel parties’ payoffs under this arrangement are ΠEE

s1

EE

EE

EE

EE EE

EE EE

EE EE

EE EE

= wEE

s1 q1 , Πs2 = ws2 q2 , and Πe = me1 q1 − (c + bq1 )q1 + me2 q2 −

EE

(c + bqEE

2 )q2 . Under the hybrid delivery arrangement SE, product 1 is

delivered by supplier 1, while product 2 is by the e-retailer; this

arrangement occurs when the e-retailer asks at least one supplier to

deliver products to customers, but only one supplier does. Thus, the

channel parties’ payoffs under the delivery arrangement SE are ΠSE

s1 =

SE

SE

SE

SE SE

SE SE

SE SE

SE SE

wSE

s1 q1 − (c + bq1 )q1 , Πs2 = ws2 q2 , and Πe = me1 q1 + me2 q2 −

SE

(c + bqSE

2 )q2 . Since the two suppliers are symmetric, we omit the

analysis of the hybrid delivery arrangement ES in the remainder of our

study. Under the delivery arrangement SS, both suppliers undertake the

delivery of their products and incur corresponding costs. This arrange­

ment happens when the e-retailer asks two suppliers to deliver products

to consumers, and both agree. Accordingly, the channel parties’ payoffs

SS

SS SS

SS SS

under such an arrangement are ΠSS

s1 = ws1 q1 − (c + bq1 )q1 , Πs2 =

SS

SS SS

SS SS

SS SS

SS SS

ws2 q2 − (c + bq2 )q2 , and Πe = me1 q1 + me2 q2 .

We consider three different power structures: E-retailer-Stackelberg

game (denoted by superscript “∧”), Supplier-Stackelberg game (denoted

by superscript “∼”), and Vertical-Nash game (denoted by superscript “ −

”). In the E-retailer-Stackelberg game, the e-retailer initially claims her

retail markups for two products, and then the suppliers set their

wholesale prices. On the contrary, in the Supplier-Stackelberg game, the

suppliers demand wholesale prices, followed by the e-retailer claiming

her retail markups. In the Vertical-Nash game, the suppliers and the eretailer make decisions simultaneously. The sequence of events under

each power structure is illustrated in Fig. 2. In the first stage, the eretailer decides to ask none, one, or both of the suppliers to deliver

products to consumers.16 Then, the supplier, conditional on receiving

the e-retailer’s delivery proposal, determines whether to accept this

delivery proposal. After the product delivery arrangement, the suppliers

and the e-retailer set their wholesale prices and retail markups in the

second stage under different power structures, respectively. Notably, it

is not the channel member with greater pricing power that can deter­

mine the delivery arrangement, but the e-retailer who acts as the

product owner may ask the supplier to be responsible for delivering

products (Yongbo [29,47]) and the supplier can respond by agreeing or

rejecting to do so. For example, JD.com, Gome, Walmart, and Amazon

have greater pricing power and ask the suppliers to be responsible for

delivering products to customers, but some suppliers refuse to undertake

the delivery. Another example is that numerous e-retailers working as

market followers on the wholesale website 1688 in China ask the sup­

plier to deliver products, and the suppliers decide whether to undertake

it. To ensure that the equilibrium outcomes are positive and unique and

there exists the delivery economy, we assume that b > (k − 1)(k +2)/2

and max{̂c 1 (b, k), 0} < c < 1 (b > k − 1 and max{̃c1 (b, k), ̃c2 (b, k),

0} < c < 1) in the E-retailer-Stackelberg (Supplier-Stackelberg) game.

Similarly, we assume that b > k2 − 1 and max{c1 (b, k), 0} < c < 1 in the

Vertical-Nash game. More details about the expressions of ̂c 1 (b, k), ̃c1 (b,

k), ̃c2 (b, k), and c1 (b, k) are presented in the Online Appendix A.

4. Comparison and analysis

In this section, we compare the equilibrium outcomes to investigate

the performance of the three arrangements and reveal how and why

these comparative results vary with the power structure. All equilibrium

outcomes and proofs appear in the Online Appendix A.

4.1. Retail markups and wholesale prices

This subsection examines e-retailer’s retail markups and suppliers’

wholesale prices across the three delivery arrangements. The compara­

tive results of e-retailer’s retail markups are summarized in the

following lemma.

Lemma 1 (E-retailer’s Retail Markups).

̂ SS

̂ SE

̂ EE

(1) For the E-retailer-Stackelberg game, max{ m

ei , m

e1 } < min{ m

ei ,

̂ SE

m

e2 }.

SS

SE

EE

SE

̃ ei , m

̃ e1 } < min{m

̃ e2 }.

̃ ei , m

(2) For the Supplier-Stackelberg game, max{m

SE

max{mSS

ei , me1 }

SE

min{mEE

ei , me2 }.

(3) For the Vertical-Nash game,

<

Lemma 1 (1) and (3) show that, compared with when the supplier

undertakes the delivery, the e-retailer always claims a higher retail

markup for the product when she undertakes the delivery in the Eretailer-Stackelberg and Vertica-Nash games. The intuition is that the eretailer incurs associated costs when delivering products to customers,

which we call the cost-increasing effect, and she prefers to keep the retail

markup high to compensate for these costs. Lemma 1 (2) replicates the

results of Lemma 1 (1) and (3). However, the key rationale behind this is

twofold: on the one hand, when the e-retailer undertakes the delivery,

she prefers to keep the retail markup high owing to the cost-increasing

effect; on the other hand, when the supplier (i.e., the market leader)

undertakes the delivery, he might claim a higher wholesale price and

thus leaves the e-retailer (i.e., the market follower) a lower retail

markup, which we call the margin-squeezing effect.

16

Logistics delivery requires upfront operations, such as picking arrange­

ments, warehousing layout, and route planning. These operations stay mostly

the same, while the price decision often changes. Therefore, we assume that the

delivery arrangement occurs before the price decision.

5

X. Zhou et al.

Omega 126 (2024) 103070

Lemma 2 presents the comparison results of the suppliers’ wholesale

prices.

Lemma 2 (Suppliers’ Wholesale Prices).

derstand the above results, note that the demand for a product is

negatively affected by its price but positively impacted by the substitute

product price, and the retail prices across the three delivery arrange­

ments are equal when there is no delivery scale effect.17 When the eretailer (i.e., the market leader) undertakes the delivery, compared with

without the delivery scale effect, the delivery economy directly moti­

vates her to reduce retail markup, which, however, indirectly forces the

supplier (i.e., the market follower) to raise his wholesale price because

the supplier’s wholesale price is negatively affected by the retail markup

̂ EE

̂ SS

̂ SE

(1) For the E-retailer-Stackelberg game, max{ w

si , w

s2 } < min{ w

si ,

̂ SE

w

s1 }.

SS

SE

EE

SE

̃ s2 } < min{w

̃ s1 }

̃ si , w

̃ si , w

(2) For the Supplier-Stackelberg game, max{w

√̅̅̅

if ( 5 − 1)/2 < k < 1, 0 < b < k2 + k − 1 and 0 < c < ̃c3 (b, k); and

̃ EE

̃ SE

̃ SE

̃ SS

max{w

si , w

s2 } < min{w

si , w

s1 } otherwise.

SE

SS

SE

(3) For the Vertical-Nash game, max{wEE

si , ws2 } < min{wsi , ws1 }.

The expression of ̃c3 (b, k) is provided in the Online Appendix A.

Lemma 2 (1) indicates that, compared with when the e-retailer un­

dertakes the delivery, the supplier always claims a higher wholesale

price when delivering products in the E-retailer-Stackelberg game. The

supplier prefers to keep the wholesale price high due to the costincreasing effect when undertaking the delivery while earning a lower

wholesale price because of the margin-squeezing effect when shifting

the delivery to the market leader (i.e., the e-retailer). Because of the

cost-increasing effect, the supplier in the Vertical-Nash game claims a

higher wholesale price when he undertakes the delivery, as shown by

Lemma 2 (3).

Similar to Lemma 2 (1) and (3), Lemma 2 (2) suggests that, in the

Supplier-Stackelberg game, compared with when the e-retailer un­

dertakes the delivery, the supplier always claims a higher wholesale

price when undertaking the delivery in the case of delivery economy.

However, somewhat surprisingly, Lemma 2 (2) reveals that when there

is a delivery diseconomy, compared with under the delivery arrange­

ment EE, the supplier might even demand a lower wholesale price under

the delivery arrangement SS. When the delivery is economy, compared

with the delivery arrangement EE, the delivery arrangement SS not only

motivates the supplier to demand a higher wholesale price due to the

cost-increasing effect but also prevents the supplier from drastically

̃ EE

reducing his wholesale price as competition becomes fierce (i.e., ∂w

si

̂ EE

̂ EE

̂ SE

̂ SE

the e-retailer demands (i.e., ∂ w

si /∂ m

ei < 0 and ∂ w

s2 /∂ m

e2 < 0) in such

a case. However, when the product is delivered by the supplier,

compared with without the delivery scale effect, such a delivery econ­

omy only directly motivates the supplier to reduce his wholesale price.

Therefore, with the delivery economy, the double marginalization effect

is alleviated when the supplier undertakes the delivery while aggravated

when the e-retailer does it. Consequently, because of the dominant role

the price of a product itself plays, shifting the delivery to the supplier

generates a lower retail price (see Lemma A1 (1) in the Online Appendix

A) and a higher demand for the product. On the contrary, when the

delivery is diseconomy, shifting the delivery to the e-retailer can alle­

viate the double marginalization effect and thus generate a lower retail

price (see Lemma A1 (1) in the Online Appendix A) and a higher

demand.

The results of Lemma 3 (2) are in stark contrast to those of Lemma 3

(1). That is because shifting the delivery responsibility to the market

leader (follower) can alleviate the double marginalization effect in on­

line distribution channels when there is a delivery diseconomy (econ­

omy), and the price leadership in the Supplier-Stackelberg game is

opposite to that in the E-retailer-Stackelberg game. However, different

from parts (1) and (2), part (3) reveals that, in the Vertical-Nash game,

the product demands are invariant to the delivery arrangement. When

all channel members make decisions simultaneously, although the de­

livery arrangement makes the e-retailer (the supplier) claim different

retail markups (wholesale prices), it does not change the sum of retail

markup and wholesale price for a product. Consequently, the retail

prices and product demands do not vary with the delivery arrangement

(see Lemma A1 (3) in the Online Appendix A and Lemma 3 (3)).

SS

̃ si /∂k < 0). As a consequence, compared with when not un­

/∂k < ∂w

dertaking the delivery, the supplier always claims a higher wholesale

price when undertaking the delivery in the case of a delivery economy.

Differently, when the delivery is diseconomy, compared with the de­

livery arrangement EE, although the delivery arrangement SS motivates

the supplier to demand a higher wholesale price due to the costincreasing effect, it forces the supplier to reduce his wholesale price

̃ SS

̃ EE

more drastically as competition becomes intense (i.e., ∂w

si /∂k < ∂w

si

/∂k < 0). Ultimately, compared to under the delivery arrangement EE,

the supplier even demands a lower wholesale price under the delivery

√̅̅̅

arrangement SS as competition becomes fierce (i.e., ( 5 − 1)/2 < k

< 1), and the cost-increasing effect gets small (i.e., 0 < b < k2 +k − 1 and

0 < c < ̃c3 (b, k)).

4.3. Unit profits

We compare firms’ unit profits across the three delivery arrange­

ments. The primary distinction between the unit profit and the retail

markup (wholesale price) is that when the firm incurs the delivery cost,

the former incorporates that cost while the latter does not. Let

Δxei = mxei − Zxei (c +bqxi ) be the e-retailer’s unit profit for the product i and

Δxsi = wxsi − Zxsi (c +bqxi ) be the supplier i’s unit profit under the delivery

arrangement x ∈ {EE, SE, SS}, where Zeix , Zxsi ∈ {0,1}, and Zxsi = 1 − Zxei .

The parameters Zxei and Zxsi assign the delivery cost to the e-retailer and

the supplier, respectively. Zxei = 1 (i.e., Zxsi = 1 − Zxei = 0) implies that the

e-retailer undertakes the delivery for the product i and Zsix = 1 (i.e., Zxei =

1 − Zxsi = 0) indicates that the supplier i undertakes the delivery under

the delivery arrangement x. We first consider the e-retailer’s unit profits.

Lemma 4 (E-retailer’s Unit Profits).

4.2. Product demands

We now proceed to examine the product demands across the three

delivery arrangements.

Lemma 3 (Product Demands).

EE

SE

SS

SE

(1) For the E-retailer-Stackelberg game, max{̂

qi , ̂

q 2 } < min{ ̂

qi , ̂

q1 }

SS

SE

max{̂

qi , ̂

q1 }

EE

SE

if (k − 1)(k +2)/2 < b < 0 and

q 2 } if b > 0.

qi , ̂

< min{ ̂

SS SE

EE SE

(2) For the Supplier-Stackelberg game, max{̃

qi , ̃

q1 } < min{̃

q2 }

qi , ̃

EE SE

SS SE

q2 } < min{̃

qi , ̃

q1 } if b > 0.

k − 1 < b < 0 and max{̃

qi , ̃

SE

SS

(3) For the Vertical-Nash game, qEE

= qSE

i

2 = q1 = qi .

̂ EE = Δ

̂ SE = Δ

̂ SE = Δ

̂ SS if

(1) For the E-retailer-Stackelberg game, Δ

ei

e1

e2

ei

(k − 1)(k +2)/2 < b < 0 or b > 0.

̃ SE < Δ

̃ EE < Δ

̃ SS < Δ

̃ SE if

(2) For the Supplier-Stackelberg game, Δ

e2

ei

ei

e1

√̅̅̅

̃ SE < Δ

̃ SS < Δ

̃ EE < Δ

̃ SE if

0 < k < ( 5 − 1)/2 and k2 + k − 1 < b < 0; Δ

e2

ei

ei

e1

if

Part (1) of Lemma 3 indicates that, in the E-retailer-Stackelberg

game, the demands of products delivered by the suppliers (both products

under the delivery arrangement SS and product 1 under the delivery

arrangement SE) are higher than those of products shipped by the eretailer (both products under the delivery arrangement EE and product 2

under the delivery arrangement SE) when the delivery is economy;

however, the reverse is true when the delivery is diseconomy. To un­

̃ SE < Δ

̃ SS < Δ

̃ EE < Δ

̃ SE if b > max{k2 +

k − 1 < b < min{k2 +k − 1, 0}; Δ

e1

ei

ei

e2

√

̅̅̅

̃ SE < Δ

̃ EE < Δ

̃ SS < Δ

̃ SE if ( 5 − 1)/2 < k < 1 and 0 < b <

k − 1, 0}; and Δ

e1

ei

ei

e2

k2 + k − 1.

17

6

This result can be verified with a simple algebraic operation.

X. Zhou et al.

Omega 126 (2024) 103070

SE

EE

SS

compared with not undertaking delivery, the supplier will obtain a

lower unit profit by undertaking the delivery for products with delivery

diseconomy. Counterintuitively, Lemma 5 (1) illustrates that, in the Eretailer-Stackelberg game, both suppliers can achieve the highest unit

profits via shifting the delivery to the e-retailer (i.e., the delivery

arrangement EE) when the delivery is economy but can earn the highest

unit profits through undertaking the delivery (i.e., the delivery

arrangement SS) when the delivery is diseconomy. Before explaining

this result, it is necessary to understand what factors and how they affect

the suppliers’ unit profits under different delivery arrangements. On the

downside, undertaking the delivery generates a cost-increasing effect

that negatively affects the suppliers’ unit profits; on the upside, it also

enables both suppliers to raise their wholesale prices, which alleviates

the competition between them and thus generates the competitionmitigating effect, positively affecting the suppliers’ unit profits. Be­

sides, we learn from Lemma 2 (1) that when shifting the delivery re­

sponsibility to the e-retailer, the suppliers will suffer from the marginsqueezing effect that negatively affects their unit profits. When there

is a delivery economy, undertaking the delivery generates a costincreasing effect, which dominates the competition-mitigating and

margin-squeezing effects; thus, the suppliers earn the highest unit profits

under the delivery arrangement EE in such a situation. Whereas in the

case of the delivery diseconomy, both the competition-mitigating and

margin-squeezing effects become more prominent. Therefore, the sup­

pliers earn the highest unit profits under the delivery arrangement SS

even though the delivery is diseconomy.

Different from Lemma 5 (1), Lemma 5 (2) demonstrates that, in the

Supplier-Stackelberg game, both suppliers can achieve the highest unit

profits through undertaking the delivery (i.e., the delivery arrangement

SS) when the delivery is economy but can earn the highest unit profits

via shifting the delivery to the e-retailer (i.e., the delivery arrangement

EE) if the delivery is diseconomy. When the suppliers possess dominant

market power, their unit profits will no longer be negatively affected by

the margin-squeezing effect if they shift the delivery to the e-retailer.

Therefore, which delivery arrangement can bring about the maximum

unit profits hinges on the tradeoff between the cost-increasing effect and

the competition-mitigating effect. Specifically, when there is a delivery

economy, the delivery arrangement SS generates the most apparent

EE

̃ SE

̃ SE

̃ SS

wsi , w

competition-mitigating effect (i.e., w

si > max{̃

s1 , w

s2 }) that

overweighs the cost-increasing effect, thereby resulting the highest unit

profits for them. Conversely, when the delivery is diseconomy, under­

taking the delivery might generate the competition-mitigating effect

(shown by Lemma 2 (2)), but this effect is immaterial compared with the

cost-increasing effect the suppliers can avoid by shifting the delivery to

the e-retailer. Hence, the delivery arrangement EE eventually generates

the highest unit profits for the suppliers in such a case.

Lemma 5 (3) indicates that, in the Vertical-Nash game, the suppliers

obtain the same and highest unit profits for products delivered by the eretailer (both products under the delivery arrangement EE and product 2

under the delivery arrangement SE) when there is a delivery economy;

the reverse is true when there is a delivery diseconomy. The reason is

that the cost-increasing effect avoided by shifting the delivery to the eretailer dominates (is dominated by) the competition-mitigating effect

resulting from undertaking the delivery when the delivery is economy

(diseconomy), and the suppliers obtain the same wholesale prices and

the same demands for products delivered by the e-retailer (or

themselves).

To sum up, the differences in the comparison results of firms’ unit

profits under the three power structures are driven by the fact that the

power structure changes the number of driving forces affecting the unit

profit and the relative magnitude of these driving forces. When the eretailer (supplier) does not undertake the delivery, the marginsqueezing effect does not influence her (his) unit profit in the Eretailer-Stackelberg and Vertical-Nash games (Supplier-Stackelberg and

Vertical-Nash games) but by that effect when she (he) works as the

SE

(3) For the Vertical-Nash game,Δe2 = Δei < Δei = Δe1 if k2 − 1 < b <

SS

Δei

SE

Δe1

SE

Δe2

EE

Δei

0 and

=

<

=

if b > 0.

Lemma 4 (1) shows that the e-retailer earns the same unit profits

across the three delivery arrangements in the E-retailer-Stackelberg

game. When the e-retailer acts as the market leader, she never suffers

from the margin-squeezing effect when shifting the delivery to the

market follower (i.e., the supplier), which implies that the dominant

position enables her to obtain a reasonable retail markup when not

undertaking the delivery. Such a dominant position, however, also en­

dows the e-retailer with the power to demand a sufficiently high retail

markup to cover associated costs when undertaking the delivery. As a

result, she achieves the same unit profits under the three delivery

arrangements.

However, in the Supplier-Stackelberg game, Lemma 4 (2) suggests

that when there is a delivery economy, the e-retailer earns the highest

unit profit for the product the supplier delivers under the hybrid

arrangement SE. When shifting the delivery of products to both sup­

pliers, the e-retailer can avoid the cost-increasing effect but suffers from

̃ SS

̃ SE

the margin-squeezing effect severely (i.e., m

ei < m

e1 ), and when un­

̃ SE

dertaking the delivery, the e-retailer can avoid that effect (i.e., m

e1 <

̃ SE

̃ EE

min{m

ei , m

e2 }) but it is overshadowed by the cost-increasing effect. As a

result, when the delivery is economy, the e-retailer earns the highest

unit profit for the product delivered by the supplier under the hybrid

arrangement SE. Unlike when the delivery is economy, the e-retailer

earns the highest unit profit for the product she delivers under the

hybrid arrangement SE when the delivery is diseconomy, which arises

because the e-retailer can avoid the margin-squeezing effect and de­

̃ SE

̃ EE

̃ SE

̃ SS

mands the highest retail markup (i.e.,m

e2 > max{m

ei , m

e1 , m

ei }) to

compensate for the increased operational costs. Lemma 4 (2) further

shows that, compared with the delivery arrangement SS, whether the

delivery arrangement EE can bring about a higher unit profit for the eretailer depends on the competition intensity (k) and delivery scale ef­

fect (b). These results still hinge on the trade-off between the marginsqueezing effect caused by the delivery arrangement SS and the costincreasing effect arising under the delivery arrangement EE.

Lemma 4 (3) indicates that, in the Vertical-Nash game, the e-retailer

obtains the same and highest unit profits for products delivered by the

suppliers (both products under the delivery arrangement SS and product

1 under the delivery arrangement SE) when there is a delivery economy;

the opposite holds when there is a delivery diseconomy. Recall from

Lemma 1 (3) that the cost-increasing effect stemming from undertaking

the delivery stimulates the e-retailer to demand higher retail markups.

Compared with such a positive impact, its negative impact on the unit

profits is more (less) apparent when the delivery is economy

(diseconomy). In addition, Lemma 1 (3) and Lemma 3 (3) show that the

e-retailer obtains the same retail markups and the same demands for

products delivered by suppliers (or herself). As such, the e-retailer ob­

tains the same and highest unit profits for products shipped by suppliers

(herself) in the case of a delivery economy (diseconomy).

The following lemma presents the comparison results of the sup­

plier’s unit profits.

Lemma 5 (Supplier’s Unit Profits).

̂ SE < Δ

̂ SS < Δ

̂ SE < Δ

̂ EE if

(1) For the E-retailer-Stackelberg game, Δ

s2

si

s1

si

√

̅̅̅̅̅̅̅̅̅̅̅̅̅

̅

SS

SE

SE

̂ <Δ

̂ <Δ

̂ <Δ

̂ EE if

(k − 1)(k +2)/2 < b < (k2 − 4 +k 8 + k2 )/4; Δ

si

s2

s1

si

√̅̅̅̅̅̅̅̅̅̅̅̅̅̅

̂ SS < Δ

̂ SE < Δ

̂ SE < Δ

̂ EE if k − 1 < b

(k2 − 4 +k 8 + k2 )/4 < b < k − 1; Δ

si

s1

s2

si

̂ EE < Δ

̂ SE < Δ

̂ SE < Δ

̂ SS if b > 0.

< 0; and Δ

si

s2

s1

si

̃ EE < Δ

̃ SE < Δ

̃ SE < Δ

̃ SS if k − 1

(2) For the Supplier-Stackelberg game, Δ

si

s1

s2

si

̃ SS < Δ

̃ SE < Δ

̃ SE < Δ

̃ EE if b > 0.

< b < 0 and Δ

si

s2

s1

si

SS

SE

SE

EE

(3) For the Vertical-Nash game, Δsi = Δs1 < Δs2 = Δsi if k2 − 1 < b <

SE

EE

SS

SE

0 and Δs2 = Δsi < Δsi = Δs1 if b > 0.

Because of weak pricing power, one might intuitively believe that,

7

X. Zhou et al.

Omega 126 (2024) 103070

market follower in the Supplier-Stackelberg (E-retailer-Stackelberg)

game.

(2) indicates that the e-retailer can obtain higher demands by asking the

suppliers to deliver products; however, Lemma 4 (2) shows that she

achieves much lower unit profits. Ultimately, when the delivery be­

comes more diseconomy, the decreased unit profits are higher than the

increased demands as the e-retailer shifts the delivery to the suppliers.

Hence, the e-retailer prefers to undertake the delivery in such a situa­

tion. However, it is worth mentioning that when there is a large delivery

diseconomy, the force that drives the e-retailer to prefer undertaking the

delivery in the E-retailer-Stackelberg game is the higher demand, but the

one in the Supplier-Stackelberg or Vertical-Nash game is the higher unit

profit.

The suppliers’ delivery arrangement preferences are shown in the

following proposition.

Proposition 2 (Suppliers’ Delivery Arrangement Preferences).

(1)

For

the

E-retailer-Stackelberg

game,

when

̂

(k − 1)(k +2)/2 < b < b 1 (k), the suppliers prefer being the only supplier to

5. Equilibrium delivery arrangement

In this section, we first investigate channel members’ delivery

arrangement preferences and then derive the equilibrium delivery

arrangement. All proofs are provided in the Online Appendix B.

5.1. Firms’ preferences of delivery arrangement

The following proposition summarizes the e-retailer’s preference for

delivery arrangement.

Proposition 1 (E-retailer’s Delivery Arrangement Preference).

(1) For the E-retailer-Stackelberg game, when (k − 1)(k +2)/2 < b < 0,

̂ SS

the e-retailer prefers both suppliers to deliver products, i.e., Π

e

EE

̂ SE > max{ Π

̂ EE , Π

̂ SE , Π

̂ SS }; when

undertake the delivery, i.e., Π

s1

si

s2

si

̂

b 1 (k) < b < 0, the suppliers prefer the e-retailer to deliver products, i.e.,

SE

̂ ,Π

̂ }; when b > 0, the e-retailer prefers undertaking the de­

> max{ Π

e

e

̂ EE > max{ Π

̂ SE , Π

̂ SS }.

livery by herself, i.e., Π

e

e

e

̂ EE > max{ Π

̂ SE , Π

̂ SE , Π

̂ SS }; when b > 0, the suppliers prefer both of them to

Π

si

s1

s2

si

(2) For the Supplier-Stackelberg game, when b > ̃

b1 (k) or k − 1 < b < 0,

̃ EE

the e-retailer prefers undertaking the delivery by herself, i.e., Π

̂ SS > max{ Π

̂ EE , Π

̂ SE , Π

̂ SE }.

undertake the delivery, i.e., Π

si

si

s1

s2

̃ SS > max{Π

̃ EE , Π

̃ SE }.

to deliver products, i.e., Π

e

e

e

(3) For the Vertical-Nash game, when k2 − 1 < b < 0, the e-retailer

̃ SE > max{Π

̃ EE , Π

̃ SE , Π

̃ SS }; when ̃

undertake the delivery, i.e., Π

k2 < k < 1

s2

si

s1

si

and k − 1 < b < min{0, ̃

b2 (k)}, the suppliers prefer both of them to under­

̃ SS > max{Π

̃ EE , Π

̃ SE , Π

̃ SE }; when b > max{0, ̃

take the delivery, i.e., Π

b3 (k)},

(2) For the Supplier-Stackelberg game, when 0 < k < ̃

k1 and

max{k − 1, ̃

b2 (k)} < b < 0, the suppliers prefer being the only supplier not to

e

̃ SE , Π

̃ SS }; when 0 < b < ̃

> max{Π

b1 (k), the e-retailer prefers both suppliers

e

e

SS

EE

SE

prefers both suppliers to deliver products, i.e., Πe > max{Πe , Πe }; when b

EE

si

> 0, the e-retailer prefers undertaking the delivery by herself, i.e., Πe >

SE

si

s1

s2

the suppliers prefer being the only supplier to undertake the delivery, i.e.,

̃ SE > max{Π

̃ EE , Π

̃ SE , Π

̃ SS }; when ̃

Π

k1 < k < 1 and 0 < b < ̃

b3 (k), the sup­

s1

si

s2

si

SS

max{Πe , Πe }.

The expression of ̃

b1 (k) is provided in the Online Appendix B.

Proposition 1 (1) presents the e-retailer’s delivery arrangement

preference in the E-retailer-Stackelberg game. Compared with when the

delivery is economy, the delivery of products is more expensive when

there is a delivery diseconomy. Hence, one may expect that the e-retailer

will prefer the suppliers to deliver products when there is a delivery

diseconomy but prefer to undertake the delivery when there is a delivery

economy. Counterintuitively, as illustrated in Fig. 3(a), when the de­

livery is economy, the e-retailer prefers both suppliers to be responsible

for delivery; however, when the delivery is diseconomy, she prefers

undertaking the delivery for two substitutable products. These results

happen because, as shown by Lemma 3 (1) and Lemma 4 (1), the eretailer achieves the highest demands by asking both suppliers to deliver

products (undertaking the delivery for two substitutable products) when

there is a delivery economy (diseconomy) and earns the same unit

profits across the three delivery arrangements. Proposition 1 (3) repli­

cates the result of Proposition 1 (1). However, it is notable that the eretailer prefers both suppliers (herself) to deliver products only because

of the highest unit profits in the Vertical-Nash game when there is a

delivery economy (diseconomy).

Nevertheless, Proposition 1 (2) reveals that, in the SupplierStackelberg game, the e-retailer prefers undertaking the delivery

either when the delivery is economy or when the delivery diseconomy is

apparent; however, she wants both suppliers to undertake the delivery if

the delivery diseconomy is small (see Fig. 3(b)). The key driver is the

tradeoff between the demands and the unit profits the e-retailer can

obtain under different delivery arrangements. When there is a delivery

economy, although Lemma 4 (2) tells us that the e-retailer might earn

higher unit profits by asking the suppliers to deliver products, Lemma 3

(2) demonstrates that she achieves higher demands under the delivery

arrangement EE. Consequently, the increases in product demands are

overwhelmingly beneficial, and the e-retailer prefers to deliver products

in such a case. By contrast, when there is a small delivery diseconomy,

the e-retailer prefers asking both suppliers to undertake the delivery

because the higher demands gained in this arrangement are appealing.

Furthermore, as the delivery diseconomy becomes significant, Lemma 3

̃ EE > max{Π

̃ SE , Π

̃ SE , Π

̃ SS }.

pliers prefer the e-retailer to deliver products, i.e., Π

si

s1

s2

si

(3) For the Vertical-Nash game, when k2 − 1 < b < 0, the suppliers

EE

SE

SE

SS

prefer not to undertake the delivery, i.e., Πsi = Πs2 > max{Πs1 , Πsi }; when

SE

SE

b > 0, the suppliers prefer to undertake the delivery, i.e., Πs1 = Πs2 >

EE

SS

max{Πsi , Πsi }.

The expressions of ̃

k1 , ̃

k2 , ̂

b 1 (k), ̃

b2 (k), and ̃

b3 (k) are provided in the

Online Appendix B.

Proposition 2 (1) describes the suppliers’ delivery arrangement

preferences in the E-retailer-Stackelberg game. As illustrated in Fig. 4

(a), when the delivery economy is large, the suppliers prefer being the

only supplier to undertake the delivery. However, with a small delivery

economy, they are better off when the e-retailer delivers products. The

intuition behind these results still hinges on the impact of delivery

arrangement on the product demands and the unit profits the suppliers

can obtain. Specifically, when the delivery economy is apparent, Lemma

3 (1) and Lemma 5 (1) jointly demonstrate that the suppliers can achieve

a higher demand and a relatively higher unit profit by becoming the only

supplier to deliver the product. Therefore, the suppliers prefer being the

unique supplier to undertake the delivery. As the delivery economy

becomes small, although Lemma 3 (1) indicates that the suppliers can

achieve a higher demand by undertaking the delivery, Lemma 5 (1)

suggests that the suppliers obtain a much lower unit profit. Conse­

quently, the higher demand gained from undertaking the delivery

cannot offset the loss of the unit profit in such a case; thus, the suppliers

prefer the e-retailer to undertake the delivery. Surprisingly, Proposition

2 (1) further shows that when there is a delivery diseconomy, the sup­

pliers always prefer to undertake the delivery. In such a situation, un­

dertaking the delivery can make the suppliers avoid the salient marginsqueezing effect arising from the e-retailer’s delivering products and

earn a higher unit profit because of the competition-mitigating effect. As

a result, the increase in unit profit makes up for the decrease in demand

when both suppliers switch from not undertaking the delivery to doing

it.

Proposition 2 (2) characterizes the suppliers’ delivery arrangement

8

X. Zhou et al.

Omega 126 (2024) 103070

Fig. 3. E-retailer’s delivery arrangement preference.

preferences in the Supplier-Stackelberg game. As shown in Fig. 4(b),

when competition is weak, the suppliers prefer being the only supplier

not to undertake the delivery if there is a delivery economy but prefer

being the only supplier to undertake the delivery in the case of delivery

diseconomy. These results can also be attributed to the trade-off be­

tween the demands and the unit profits under different delivery ar­

rangements. More specifically, compared with other delivery

arrangements, Lemma 5 (2) and Lemma 3 (2) suggest that when

competition is weak, the supplier who undertakes (does not undertake)

the delivery under the hybrid delivery arrangement SE can obtain not

only a relatively large unit profit but also a relatively high product de­

mand if the delivery is diseconomy (economy). Thus, the suppliers

prefer being the only supplier to (not to) undertake the delivery when

there is a diseconomy (economy). However, as competition becomes

fierce, the suppliers prefer to undertake the delivery when there is a

delivery economy but prefer the e-retailer to undertake the delivery

when there is a delivery diseconomy (see Fig. 4(b)). The rationale lies in

the fact that when there is a delivery economy (diseconomy), the

increased unit profits are so high as to offset the loss of demands as the

suppliers switch from other delivery arrangements to the delivery

arrangement SS (EE). Lastly, Proposition 2 (3) reveals that, in the

Vertical-Nash game, the suppliers prefer not to undertake the delivery

when there is a delivery economy but prefer to undertake the delivery

when there is a diseconomy. It is intuitive because, as indicated by

Lemma 5 (3) and Lemma 3 (3), the suppliers obtain the highest unit

profits through undertaking the delivery (shifting the delivery to the eretailer) when the delivery is diseconomy (economy) and achieve the

same demands across the three arrangements.

Therefore, we can learn from Proposition 2 that the suppliers’ de­

livery arrangement preferences vary with the power structure. Specif­

ically, when there is a small delivery economy (a small delivery

diseconomy), the suppliers might prefer the e-retailer (both of them) to

deliver products in the E-retailer-Stackelberg and Vertical-Nash games;

however, the results reverse in the Supplier-Stackelberg game. The

reason for these different outcomes is that the delivery arrangement

yielding the highest unit profit varies with the power structure.

Furthermore, when there is a large delivery economy, the suppliers

might prefer being the only supplier to deliver the product in the Eretailer-Stackelberg game; conversely, in the Supplier-Stackelberg and

Vertical-Nash games, they might like being the unique supplier not to

ship products. The suppliers prefer to do so in the E-retailer-Stackelberg

or Supplier-Stackelberg game because of the relatively higher unit

profits and product demands. However, the suppliers prefer to do so in

the Vertical-Nash game because of only the highest unit profits. It is also

worth mentioning that when there is a large delivery diseconomy, the

suppliers prefer undertaking the delivery due to the higher unit profits in

the E-retailer-Stackelberg and Vertical-Nash games but do so owing to

the higher demands in the Supplier-Stackelberg game.

9

Omega 126 (2024) 103070

X. Zhou et al.

Fig. 4. Suppliers’ delivery arrangement preferences.

We obtain three remarkable observations based on the firms’ de­

livery arrangement preferences. First, compared with the market leader,

the market follower endowed with weaker pricing power might be more

willing to deliver the product when the delivery is economy in each

Stackelberg game. The main reason is that it can bring a higher product

demand to the market follower. Second, channel members might benefit

from undertaking the delivery when the delivery is diseconomy while

suffering from undertaking the delivery when the delivery is economy.

Specifically, in the E-retailer-Stackelberg and Vertical-Nash games, the

e-retailer benefits from undertaking the delivery when the delivery is

diseconomy but benefits from not undertaking the delivery when the

delivery is economy. In the Supplier-Stackelberg and Vertical-Nash

games, the suppliers might benefit from being the only supplier to

(not to) undertake the delivery when the delivery is diseconomy

(economy). Third, our work shows the non-negligible impact of power

structure on channel members’ preferences regarding the delivery

arrangement and also reveals that the drivers may change with the

power structure.

We next characterize the equilibrium delivery arrangement under

each power structure.

b 2 (k), and EE is

(2) EE and SS are two possible equilibria if ̂

b 1 (k) < b < ̂

Pareto optimal;

(3) EE is the unique equilibrium if ̂

b 2 (k) < b < 0, or b > 0.

The expression of ̂

b 2 (k) is provided in the Online Appendix B.

Part (1) of Proposition 3 indicates that when the delivery economy is

large, the delivery arrangement SS emerges in equilibrium, as shown in

the region I in Fig. 5(a). When there is a large delivery economy, given

that the competitor rejects to undertake the delivery, the supplier ben­

efits from undertaking the delivery because he can obtain a higher de­

mand. However, when the competitor agrees to undertake the delivery,

the supplier has no incentive to deviate from agreeing to undertake the

delivery because of the higher demand loss. Therefore, the delivery

arrangement SS emerges in equilibrium in such a case. However, in the

region I in Fig. 5(a), a surprising result manifests: when competition

becomes intense and the delivery economy gets small,18 the delivery

arrangement SS remains a pure-strategy equilibrium even though it

̂ SS < Π

̂ EE ). Put differently, two sup­

hurts the suppliers’ profits (i.e., Π

si

si

pliers are better off rejecting to undertake the delivery when there is

fierce competition, yet they cannot help refusing to do so and eventually

get involved in the prisoner’s dilemma. When the delivery economy is

moderate, Proposition 3 (2) suggests that the delivery arrangements SS

and EE are two possible equilibria (see the region II in Fig. 5(a)). It is

natural to pick EE as the equilibrium outcome because both suppliers

benefit more from this arrangement. As the delivery economy becomes

5.2. Equilibrium delivery arrangement

The following proposition characterizes the equilibrium delivery

arrangement in the E-retailer-Stackelberg game.

Proposition 3 (Equilibrium Delivery Arrangement in the Eretailer-Stackelberg Game).

(1) SS is the unique equilibrium if (k − 1)(k + 2)/2 < b < ̂

b 1 (k);

18

10

The expressions of ̂

b 3 (k) and ̂

b 4 (k) are provided in the Online Appendix B.

X. Zhou et al.

Omega 126 (2024) 103070

Fig. 5. Equilibrium delivery arrangement.

small, Proposition 3 (3) reveals that the delivery arrangement EE

emerges in equilibrium, shown by the region III in Fig. 5(a). The intui­

tion behind this result is that the increase in unit profit justifies the

demand reduction when both suppliers switch from agreeing with the

delivery proposal to rejecting it. Finally, because the e-retailer prefers

delivering products when the delivery is diseconomy, Proposition 3 (3)

indicates that the delivery arrangement EE emerges in equilibrium

naturally (see the region IV in Fig. 5(a)).

The following proposition shows the equilibrium delivery arrange­

ment in the Supplier-Stackelberg game.

Proposition 4 (Equilibrium Delivery Arrangement in the

Supplier-Stackelberg Game).

(1) EE is the unique equilibrium if b > ̃

b1 (k), k − 1 < b < 0, or ̃

k1 < k <

loss of unit profits because the small delivery diseconomy limits the

competition-mitigating effect when there is fierce competition (shown

by Lemma 5 (2)). Ultimately, the higher demands gained through un­

dertaking the delivery cannot make up for the higher loss of unit profits.

Hence, both suppliers refuse to undertake the delivery, and delivery

arrangement EE emerges in equilibrium. Furthermore, when the de­

livery diseconomy is not too small, whereas the competition is intense

(see the region III in Fig. 5(b)), Proposition 4 (2) reveals that the hybrid

delivery arrangement SE or ES emerges in equilibrium even if two

competing suppliers are identical. It is worth noting that, compared with

the delivery arrangement EE, the hybrid delivery arrangement benefits

the supplier who agrees to undertake the delivery while harming the

supplier who refuses to do it. Lastly, as the competitive intensity and

delivery diseconomy fall into the region IV in Fig. 5(b), SS emerges in

equilibrium because the increased demand gained by undertaking the

delivery in such a case is so appealing that it enables the supplier to

agree to deliver products regardless of which strategy the competitor

adopts. Interestingly, there also exists a prisoner’s dilemma: when

competition intensifies, and the delivery diseconomy gets small (i.e.,

̃

k3 < k < 1 and max{0, ̃

b2 (k)} < b < ̃

b4 (k), see the region IV in Fig. 5(b))

1 and 0 < b < ̃

b3 (k);

(2) SE or ES is the unique equilibrium if ̃

k1 < k < 1 and ̃

b3 (k) < b

̃

< b2 (k);

(3) SS is the unique equilibrium if max{0, ̃

b2 (k)} < b < ̃

b1 (k).

From Proposition 1 (2), we know that the e-retailer prefers to un­

dertake the delivery either when there is a large delivery diseconomy or

when the delivery is economy in the Supplier-Stackelberg game.

Therefore, Proposition 4 (1) shows that the delivery arrangement EE

emerges in equilibrium naturally in these two cases (see the regions I

and V in Fig. 5(b)). Alternatively, Proposition 4 (1) demonstrates that

the delivery arrangement EE can also be sustained as an equilibrium

outcome when there is fierce competition and a relatively small delivery

diseconomy (see the region II in Fig. 5(b)). Note that both suppliers can

obtain higher product demands by undertaking the delivery in such a

case (shown by Lemma 3 (2)); however, they suffer from a significant

,19 both suppliers agree to undertake the delivery but obtain lower

profits compared with the case of rejecting to do it.

The equilibrium delivery arrangement in the Vertical-Nash game is

presented in the following proposition.

Proposition 5 (Equilibrium Delivery Arrangement in the

Vertical-Nash Game). EE is the unique equilibrium.

19

11

The expressions of ̃

k3 and ̃

b4 (k) are provided in the Online Appendix B.

X. Zhou et al.

Omega 126 (2024) 103070

Fig. 6. Consumer surplus-maximizing arrangements.

may make the two suppliers unable to escape from this undesirable

result in the E-retailer-Stackelberg game; nevertheless, in the SupplierStackelberg game, the decrease of delivery diseconomy (i.e., the de­

livery is less expensive) might make them unable to avoid this unfor­

tunate outcome.

Our results might also provide a plausible explanation for the busi­

ness practices: some products are shipped by the e-retailer and others by

the suppliers. In the E-retailer-Stackelberg game, online retail giants

might prefer asking the competing suppliers to deliver products to

consumers when the delivery is economy. A canonical example is that

when selling home appliances for competing suppliers Haier and Midea,

JD.com chooses to undertake the delivery because of the delivery

diseconomy of these products. However, when selling products with a

significant delivery economy (e.g., clothing and hats) online, JD.com

may propose to let the competing suppliers Li-Ning and ANTA deliver

products, and both agree to do it. By contrast, in the SupplierStackelberg game, numerous e-retailers might prefer asking the up­

stream suppliers to deliver products to customers when there is a de­

livery diseconomy and undertaking the delivery when the delivery is

economy. For example, when selling home appliances for competing

suppliers such as GREE and Hisense, the downstream e-retailers prefer

asking them to ship products to customers because of the delivery

diseconomy of these products, whereas, in the case of selling digital

products for suppliers such as Xiaomi and OPPO, the downstream eretailers undertake the delivery due to the delivery economy of those

items.

Proposition 5 shows that the delivery arrangement EE constitutes the

only equilibrium outcome in the Vertical-Nash game, which is entirely

different from the equilibrium delivery arrangements in the other two

games. Recall from Proposition 1 (3) that the e-retailer prefers deliv­

ering products when the delivery is diseconomy while prefers asking

both suppliers to undertake the delivery when the delivery is economy.

Thus, the delivery arrangement EE emerges in equilibrium naturally in

the context of delivery diseconomy. When the delivery is economy,

because of the lower unit profits the suppliers obtain by undertaking the

delivery and the same demands the suppliers get among the three

different delivery arrangements, both suppliers reject the e-retailer’s

delivery proposal; thus, the delivery arrangement EE emerges in equi­