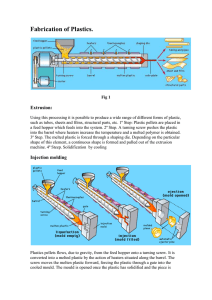

LECTURE NOTES – WORKSHOP 5 Understanding the Value System Today, we are going to talk about value – value is the basis of any strategic effort, if you correctly define the value, i.e. something someone is willing to pay for, then you can be profitable. Either by charging a higher price associated with the value, or being efficient and controlling costs. Let’s start by building off Porter’s model. This is why stated in the last session that you need to draw it correctly, there is a method to the madness of Porter's model – it is the basis for other strategic frameworks. On the left side, we have suppliers and then you have rivals and then on the right, you have buyers. The reason that's important to Porter's model, the center of it, in effect makes the value system. As we detailed in the book, downstream is towards the buyer, upstream is towards the supplier. As the product moves down the river, i.e. downstream, value is incrementally added on. The reason the value system is so important is there's something called profit pools. Profit pools are areas of the value system, where the organizations within that part of the value system tend to earn a higher margin. Another way of thinking of this is that profits are not equally distributed across the value system. One example in the book is the PC industry – it is one that's very near and dear to my heart - and I can speak to directly and that's why it's in the book. My first job out of school was working for Daewoo, the large Korean conglomerate and I worked in their PC division called Leading Edge. I worked there in the early '90s. Daewoo and dozens of other PC companies went out of business, bankrupt in the early '90s into the mid '90s. The reason that all these companies went bankrupt, very simply was they were in the wrong place in the value system. There were no profits to be made here - the profit pool was very small. Think about the PC value system. Upstream you have raw materials, very simply things like silicon. Depending on the availability here, this will either be very, very profitable or not all. Silicon, believe it or not, is very abundant as are a lot of the materials that go into PCs. The raw materials are then made into subcomponents. Here, believe it or not, is where some of the profit pools are. The chips and who makes the chips? What's one of the most successful companies the last 25 years? Intel. After that, you start to assemble systems related to personal computers – hard disk drive units, cards, boards, and displays. Sounds like some value here – right? Wrong. Where are most of these things assembled? China. The assembly is done by uneducated labor, people making literally pennies on the hour. This is to a large degree a commodity and there are no profits here either. The PC companies take all the sub components and make a computer. Minimal value here and minimal profits. If you aren’t efficient – good luck to you, because if you are not, then you will go under business. Then you have the PC companies and there was no profit here as well. Remember, these folks all went bankrupt. What do you have to put on a PC to make it create value? Software. And who is the most successful PC software company of the last 25 years? Microsoft. Microsoft did some really good things strategically, but they were profitably largely because they were in the right place in the value system. The last stop on our river cruise downstream in the PC industry before we get to buyers? Retailers, the Best Buys and Circuit Citys of the world. How have they faired over the past ten years? Not good – why, they don’t add value! A real smart entrepreneur and strategist was super prescient in this regard – he based his whole company on the fact that most PC retailers just stock shelves – he cut them out all together 25 years ago? Who? Dell – founded by no other than Michael Dell out of his college room. The takeaway from the value system, it's important that you note this, is that the value is not created equally. It's created at certain spots and along with that, the profits are not distributed equally. They pool in certain spots. That's the value system. All right, let me give you another example. One of the neat things about my job is that I get to work with really interesting companies and I think I mentioned it before, one of the companies I'm working for now is a company called IVG. They are a large veterinarian care company. Here’s the value system in the vet industry – you find a location, put in some equipment and get some meds, hire a vet, and take care of the pet. Pretty simple. In the past, the vet aspect of the value system was where the profit pools were – but now there are too many vets, so in effect reducing the value. So this brings us to a second point – finding existing value is critical, but inserting new value into the equation is important too. Many vets are doing just that – selling toys, foods, doggie daycare. There’s profit there – so in effect, they are adding a stop on the river journey in the value system of veterinary care. This is a great example too of forward integration. They are finding ways of adding value closer to the end customer. Forward integration gets you closer to the customer, i.e. downstream. More often than not, more value is closer to the customer – so typically forward integration is more commonplace. But you need to be careful! Looking back at the book, we talked about Apple – they were vertically integrated in opening stores – now some market watchers are wondering if that was a good idea. People love to visit the Apple store, but often aren’t buying. Sorry, businesses don’t stay in business by having folks hang out! Unless you are Starbuck and putting a coffee and scone in their hand! Vertical integration can be risky, because the nature of value changes. Understanding the Value Chain As we shift from the value system, to the value chain, I need to reinforce a critical distinction. The value system deals with the external dynamics related to value, the value chain deals with internal dynamics. The value system is about understanding where the profit pools lie – the value system helps us understand where are unique activities are essential – remember those from the DNA. Below is the value system graphic – and with this graphic, you are probably saying, “Well no duh, every company has HR! Every company has operations!” Yes – that is true. But I would like to make a couple points in defense of the value system. First, it helps slow down our thinking about a company. It provides the means to break down what a company does. Second, and more importantly, the value chain gives a sense of where we need to be at the industry standard, and where we have to be different. Strategy is being different through unique activities, while operational effectiveness is meeting industry standards associated with customer expectations. Imagine the same value chain where we label each activity as either “operationally effectiveness” or “unique activity” – then respectively, operationally effective activities must meet an industry standard. For example, it might be that new cars only have a .01 recall rate or that if we manufacture syringes only .001 are rejected. If we shift to a service industry, perhaps the operational effectiveness measure is that customer service calls aren’t put on hold for more than 60 seconds. More concretely, think about the neighborhood pizza shop – what would the operational effective activities be? Maybe service and support – having clean tables and bathrooms. What would the unique activities be? Well perhaps smoke fired baking pits, where you have found a unique wood smoking baking methods that provides the most unique pizza in a ten mile radius. Folks, I cannot stress enough how these little things matter. FURTHER EXPLORING THE VALUE SYSTEM AND VALUE CHAIN: LEGO Let’s talk about a company that we will cover in detail in a few weeks, Lego. Lego is a great case study in the value system and the value chain. Okay, so in the value chain, profits pool in certain areas. The key is putting your company in the area of the value chain that is associated with the highest level of profits. First, let’s take the value system. Below is a hypothetical value system in the toy industry. Raw materials include the oil and resins that make up the plastics. At this point, the raw materials are still pretty much defined by a commodity product, i.e. oil. It does change a little bit, but not a great deal. If, and when, crude oil gets rarer, then the scarcity drives value. The next step up is the design of plastic toys. This could be as simple as making a shovel and pail for the beach. Again, a pretty basic process, not a tremendous amount of value. Same thing if the it is a plastic doll (hold on – we will get to Barbie in a few seconds!). After the raw materials are acquired, and the toy designed, then you squish the plastic base material into a mold, and churn out a million units. There is zero value here – zero! Then it is packaged up and sent to retailers. Retail is one step in the value system; I would like to comment on. Guess how many toys in America are sold in through Wal-Mart? One in three! Well, Wal-Mart kills the value in any market it plays in. You go to Wal-Mart – you see a toy, and you pull it off the shelf. If you are Lego, the above value system is downright scary – and to their credit they recognized it. Lego strategists saw that one aspect of the value chain that they could capitalize on was design and creation. As the patent on their plastic blocks expired, they moved into licensing and character development. For example, they do sets for Disney and Nickelodeon (This is the Barbie model – take a plastic doll and make it a story – take a plastic block and make it part of a story). They also saw the negative effect of retailing on the value system and sought to capture more of the profit associated with that value, and launched their own stores. Let’s bring an aspect of horizontal diversification. Again, I would like to stress that value shifts – here today, gone tomorrow. We tried to illustrate this with the book publishing industry. Now design and creation is being capitalized on by all toy block makers – Hasbro is doing Transformers (Kreo), MegaBlock is doing Halo. This will squeeze margins in this area of the value system. Will it remain an area of value? I don’t know. Below is depiction of Lego’s value chain, specifically the activities associated with each area from Lego’s perspective. Certain areas, such as inbound logistics, are characterized by operational effectiveness. Other areas, such as the design of toys need to be unique.