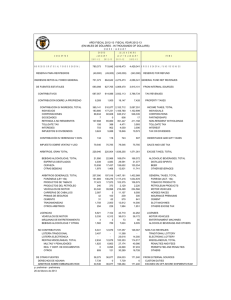

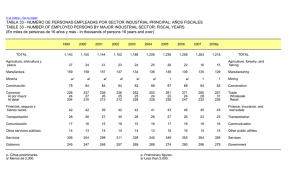

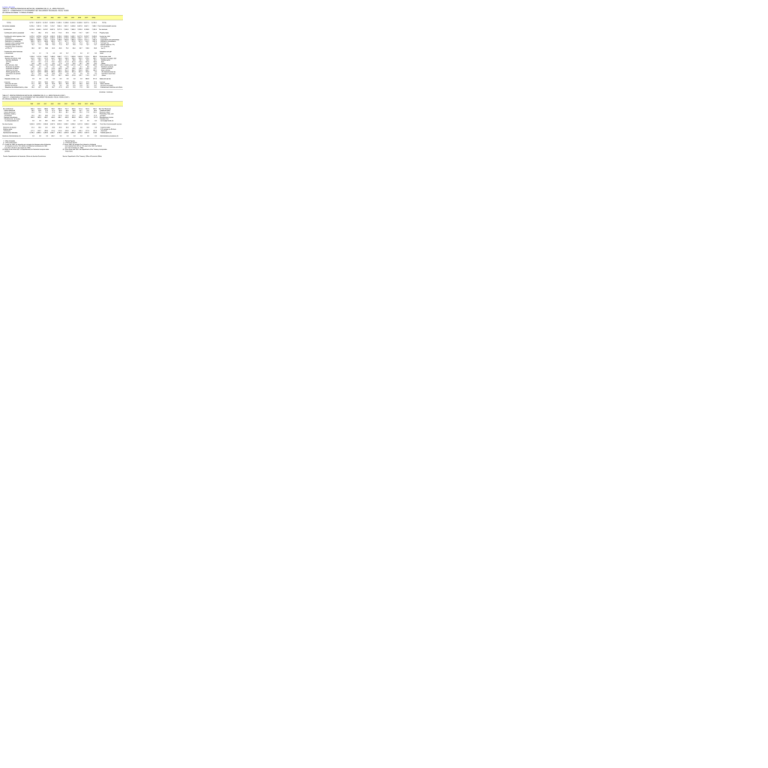

tabla 27 - rentas periodicas netas del gobierno del ela: años fiscales

Anuncio

Ir al índice - Go to index TABLA 27 - RENTAS PERIODICAS NETAS DEL GOBIERNO DEL E.L.A.: AÑOS FISCALES TABLE 27 - COMMONWEALTH GOVERNMENT NET RECURRENT REVENUES: FISCAL YEARS (En millones de dólares - In millions of dollars) 1999 2000 2001 2002 2003 2004 2005 2006r 2007r 2008p TOTAL 9,770.1 10,057.9 10,702.7 10,508.4 11,465.4 11,299.8 12,444.0 12,829.8 12,877.4 12,784.2 De fuentes estatales 6,765.2 7,081.6 7,108.1 7,316.7 7,962.3 7,991.7 8,385.8 8,597.9 8,927.1 7,888.1 From Commonwealth sources 6,215.0 6,548.3 6,418.7 6,607.0 7,077.5 7,240.0 7,560.3 7,876.5 8,169.6 7,352.4 116.1 98.2 87.3 84.5 114.4 97.8 116.8 114.7 128.7 111.6 4,470.2 2,244.4 1,692.2 369.4 114.5 10.7 4,878.6 2,352.1 1,806.8 557.3 111.1 11.7 4,813.9 2,259.1 1,735.1 696.8 49.5 14.8 4,903.5 2,450.0 1,733.9 583.2 59.5 14.3 5,189.2 2,766.9 1,798.8 517.1 45.3 11.3 5,306.5 2,720.9 1,842.6 631.1 31.6 10.1 5,495.1 2,885.9 1,883.3 612.0 23.0 10.5 6,017.2 3,087.7 1,872.5 921.3 27.4 11.5 6,233.7 3,071.7 2,011.1 933.7 25.1 12.1 5,483.6 2,793.1 1,567.4 1,087.8 21.6 13.7 39 39.0 0 39 39.7 7 58 58.6 6 62.5 62 5 49.8 49 8 70.2 70 2 80.4 80 4 66.7 66 7 138.9 138 9 59.8 59 8 1.8 3.1 7.5 2.0 2.8 15.7 7.1 9.4 4.7 6.6 1,535.6 243.5 47.5 181.3 14.6 1,292.2 5.6 119.1 411.6 520.3 70.1 165.6 1,473.8 236.4 49.4 170.1 16.9 1,237.4 4.7 115.1 390.0 525.5 24.8 177.3 1,409.7 237.5 47.0 177.4 13.1 1,172.2 7.0 119.1 406.2 509.0 1.9 129.0 1,488.9 249.7 51.7 179.7 18.2 1,239.2 5.1 116.0 418.0 486.3 38.6 175.1 1,664.7 299.6 58.4 223.3 17.9 1,365.1 5.9 149.5 499.3 505.4 12.9 192.1 1,717.1 296.3 61.3 217.6 17.4 1,420.8 4.9 144.7 551.2 535.4 0.0 184.6 1,829.8 298.2 56.6 221.9 20.0 1,531.6 5.1 146.5 606.7 557.3 0.0 215.9 1,643.9 292.2 54.1 219.4 18.7 1,351.7 5.1 135.3 534.0 551.7 0.0 125.7 1,122.4 279.0 52.3 207.8 18.9 843.4 6.0 132.4 396.7 193.9 0.0 114.3 863.6 268.1 50.1 198.9 19.0 595.5 8.4 119.1 366.3 0.0 0.0 101.7 Excise taxes, total Alcoholic beverages, total Distilled spirits Beer Others Other taxable goods, total Petroleum products Tobacco products Motor vehicles 5% General excise tax Petroleum import fees Others 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 582.6 911.0 Sales and use tax 91.3 47.2 4.6 39.4 94.6 49.3 4.6 40.7 100.4 50.0 4.5 45.9 128.1 56.8 4.6 66.7 106.2 59.3 5.0 41.9 103.0 55.6 4.8 42.5 85.2 55.7 14.5 15.0 91.3 59.5 14.8 17.0 97.5 65.5 15.1 16.9 87.6 51.9 19.7 16.0 Contributivas Contribución sobre la propiedad Contribución sobre ingresos, total Individuos Corporaciones y sociedades Retenida a no residentes Impuesto sobre repatriaciones Intereses sujetos al 17% Impuestos sobre dividendos all 10% (1) Contribución sobre herencias y donaciones Arbitrios, total Bebidas alcohólicas, total Espíritus destilados Cerveza Otras Otros artículos, total Productos de petróleo Productos de tabaco Vehículos de motor Arbitrio general de 5% Importación de petróleo Otros Impuesto s/venta y uso Licencias Vehículos de motor Bebidas alcohólicas Maquinas de entretenimiento y otras TOTAL Tax revenues Property taxes Income tax, total Individuals Corporations and partnerships Withheld to nonresidents Toll Gate Tax Interest subject to 17% 10% dividends tax (1) Inheritance and gift taxes Licenses Motor vehicles Alcoholic beverages Entertainment machines and others (Continúa - Continue) TABLA 27 - RENTAS PERIODICAS NETAS DEL GOBIERNO DEL E E.L.A.: L A AÑOS FISCALES (CONT (CONT.) TABLE 27 - COMMONWEALTH GOVERNMENT NET RECURRENT REVENUES: FISCAL YEARS (CONT.) (En millones de dólares - In millions of dollars) 1999 No contributivas Lotería tradicional Lotería electrónica Derechos, multas y penalidades Ingresos misceláneos Transferencias de fondos no presupuestados (2) De otras fuentes Derechos de aduana Arbitrios sobre embarques Aportaciones federales Gestiones Administrativas (2) 2000 2001 2002 2003 2004 2005 2006r 2007r 2008p 550.2 59.2 59.2 53.0 533.3 63.8 63.8 70.2 689.4 57.5 57.5 70.2 709.7 61.3 61.3 57.9 884.8 65.8 65.8 89.4 751.7 65.4 65.4 86.1 825.5 64.6 64.6 68.0 721.4 62.7 62.7 55.2 757.5 73.0 73.0 71.8 43.2 394.8 39.3 360.0 66.5 406.1 74.5 436.0 107.8 498.1 110.2 490.0 107.3 585.8 35.7 550.9 65.4 330.1 0.0 0.0 89.1 80.0 123.6 0.0 0.0 0.0 0.0 0.0 3,004.9 2,976.3 3,594.6 2,947.5 3,503.0 3,308.1 4,058.2 4,231.9 3,950.3 4,896.1 61.4 50.2 43.1 30.6 25.9 34.3 26.7 9.6 14.5 4.8 217.3 2,726.2 245.7 2,680.3 286.9 3,264.5 314.2 2,602.7 310.9 3,166.2 328.9 2,944.9 341.2 3,690.3 346.3 3,876.0 377.9 3,557.9 361.8 4,530 0.0 0.0 0.0 244.1 0.0 0.0 0.0 0.0 0.0 0.0 r- Cifras revisadas. p p- Cifras Cifras preliminares preliminares. (1) A partir de 1996, los recaudos por concepto de intereses sobre dividendos se redujeron de 20 a 10% debido a la Reforma Contributiva de 1994 (Ley Núm.120 del 31 de octubre de 1994). (2) Desde el año fiscal 2001, el Departamento de Hacienda incorpora estas partidas. Fuente: Departamento de Hacienda, Oficina de Asuntos Económicos. 535.7 46.6 46.6 105.3 61.9 321.9 Non-Tax Revenues Traditional lottery Electronic lottery Permit fees, fines, and penalties Miscellaneous income Transfers from non-budget funds (2) From Non-Commonwealth sources Customs duties U.S. excises on off-shore shipments Federal grants (3) Administrative procedures (2) r- Revised figures. p p- Preliminary figures figures. (1) Since 1996, the receipts from interest on dividends were lowered from 20% to 10% due to the 1994 Tax Reform (Act 120 of October 31, 1994). (2) Since fiscal year 2001, the Department of the Treasury incorporates these items. Source: Department of the Treasury, Office of Economic Affairs.