Mexico Flash. Lower than expected industrial production contracted

Anuncio

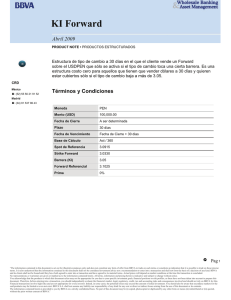

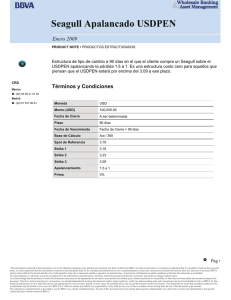

Economic Analysis October 12, 2012 Mexico Flash Lower than expected industrial production contracted (-) 0.8% mom in July (3.8% yoy). Highlights falls in construction and manufacturing components. The dynamics of the industry was worse than expected (expected BBVA Research: 0.0% 0.8% observed m / m), linked to the worsen external demand. Particularly strong were the falls in the construction industry (-) 1.9% mom and manufacturing (-) 0.9% mom., 3.1% and 4.3% respectively in terms of seasonally adjusted annual growth. The dynamics of the industry in August is consistent with growth in activity somewhat lower than the second quarter, and close to 0.6% per quarter. Lower than expected industrial production contracted (-) 0.8% in August. With this result, in terms of annual growth rates in the industry growth was 3.8% and the moderation profile of the trend series is confirmed. In 2Q12, average monthly expansion in the industry trend was 0.4%, while in the two months July-August average growth was 0.1%. For components of the industry, in accordance of moderation in U.S. production, Mexican manufacturing had a contraction of (-) 0.9%, the third lowest of the year. In August, in contrast to what was observed in the second quarter, key manufacturing industries such as transportation equipment had a fall of (-)3.5% mom, and the branch is responsible for 0.5 pts of the 0.9 drop in manufactures. Recall that the automotive industry is particularly relevant as its value added accounts for about 20% of manufactures, meanwhile about 80% of automobile production is destined for export mainly to United States, so that their relationship to the outer loop is very narrow. The other branches of production with strong ties to foreign demand (correlation greater than 0.6%) also resented the fall in the outer loop, so that in August this set of branches are responsible for the decline in manufacturing. Meanwhile, the construction industry had a monthly contraction of (-)1.9% mom (3.1% yoy) mainly due to the building component (-)2.9% mom (3.3% yoy). Remember that based on data from the National Survey of Construction Companies, until the second quarter, the contribution of the public component in the growth of the construction value in real terms was particularly important. The short-term information available to Q3 suggests that growth will be more moderate than in the second quarter of the year, both indicators form producer side (U.S. ISM, industrial employment, producer confidence) and internal demand side (consumer confidence, real wages) point to moderation. Thus, we maintain the GDP growth forecast of 3.7% for the year. Graph 1 Graph 2 Industrial production, trend (y/y%) Manufactures & components, quarterly average m/m% and July m/m% 0.0 0.0 -2.0 -0.2 -0.2 -4.0 -0.4 -0.4 -6.0 abr-12 oct-11 jun-10 Industry, Mexico Ago-12 0.2 jun-12 0.2 ago-12 2.0 feb-12 0.4 dic-11 0.4 jun-11 4.0 ago-11 0.6 feb-11 0.6 abr-11 6.0 dic-10 0.8 oct-10 0.8 ago-10 8.0 feb-10 1.0 abr-10 1.0 Prendas Computat. Equip. Chemical Ind. Basic Metal Non metal Minerals Mach. & Transport. Equipement Beverages Equip. 0.0 Food Metalic Prod.. -8.0 -6.0 Industry, USA -4.0 -2.0 0.0 2.0 4.0 6.0 2Q12 Source: BBVA Research Source: BBVA Research Graph 3 Graph 4 Industrial Production & Contributions (m/m%) Industrial production & employment (m/m%) 2.0 2.0 1.5 1.5 1.0 1.0 1.2 0.4 1.0 0.3 0.8 0.5 0.5 0.0 0.0 -0.5 -0.5 -1.0 -1.0 0.6 0.2 0.4 0.1 Minning Electricity, gas & water Construction Manufactures Industry Employment (lhs.) jun-12 ago-12 feb-12 abr-12 dic-11 oct-11 jun-11 ago-11 abr-11 feb-11 dic-10 oct-10 ago-10 0.0 jun-10 -1.5 abr-10 jul-12 ago-12 jun-12 may-12 abr-12 feb-12 mar-12 ene-12 dic-11 nov-11 oct-11 sep-11 ago-11 jul-11 abr-11 may-11 mar-11 feb-11 ene-11 -1.5 jun-11 0.2 0.0 Industrial Production Industrial Production Source: BBVA Research Source: BBVA Research Cecilia Posadas c.posadas@bbva.com Av. Universidad 1200, Col. Xoco, México 03339 D.F. │ researchmexico@bbva.bancomer.com │ www.bbvaresearch.com │ Síguenos en Twitter Aviso Legal Este documento ha sido preparado por el Servicio de Estudios Económicos del Banco Bilbao Vizcaya Argentaria (BBVA) y del BBVA Bancomer S. A., Institución de Banca Múltiple, Grupo Financiero BBVA Bancomer en su propio nombre y se facilita exclusivamente a efectos informativos. La información, opiniones, estimaciones y previsiones contenidas en este documento hacen referencia a su fecha específica y están sujetos a cambios que pueden producirse sin previo aviso en función de las fluctuaciones del mercado. La información, opiniones, estimaciones y previsiones contenidas en este documento están basadas en la información disponible al público obtenida a partir de fuentes consideradas fiables. No obstante, dichas informaciones no han sido objeto de verificación independiente por BBVA Bancomer, por lo que no se ofrece ninguna garantía, expresa ni implícita, en cu anto a su precisión, integridad o corrección. Este documento no constituye una oferta de venta ni una incitación a adquirir o disponer de interés alguno en valores.