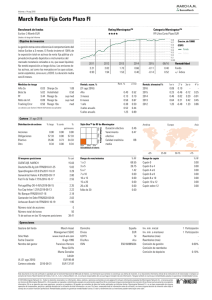

March Europa Bolsa FI

Anuncio

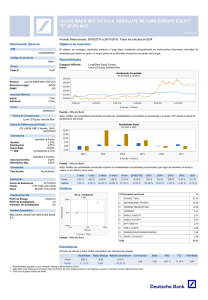

Report as of 10 Jun 2016 March Europa Bolsa FI Fund Benchmark STOXX Europe 50 NR EUR Morningstar Rating™ Morningstar® Category Europe Large-Cap Blend Equity QQ Used throughout report 16.0 15.0 14.0 13.0 12.0 11.0 10.0 9.0K Investment Objective International Equity Fund that invests at least 75% of its securities and equities in European companies trading on approved European markets, but may also invest in countries that are considered emerging. Risk Measures 3-Yr Alpha 3-Yr Beta R-Squared Information Ratio Tracking Error 3-Yr Sharpe Ratio 0.33 3-Yr Std Dev 13.01 3-Yr Risk bel avg 5-Yr Risk bel avg 10-Yr Risk - Calculations use STOXX Europe 50 NR EUR (where applicable) (EUR) Fund Index 2011 2012 2013 2014 2015 05/16 Performance -16.28 -11.17 16.28 3.30 12.88 -4.22 1.20 -4.97 6.69 0.17 -3.01 0.99 Fund +/- Index Return % Trailing Returns -1.28 0.91 89.05 -0.41 4.45 Growth Of 10000 (31 May 2016) YTD 3 Months 6 Months 1 Year 3 Years Annualised 5 Years Annualised +/-Idx -3.01 4.64 -8.15 -15.09 3.55 2.55 0.99 -1.14 1.28 -2.48 -1.81 -3.00 Quarterly Returns 1st qtr 2nd qtr 3rd qtr 4th qtr 2016 2015 2014 2013 2012 -5.63 19.75 0.50 5.20 8.92 -2.81 -10.18 3.13 -3.54 -3.92 7.82 -5.42 7.32 2.06 1.23 3.58 5.17 Portfolio 31 May 2016 Asset Allocation % Short % Net 97.74 0.00 2.50 0.00 0.00 0.00 0.24 0.00 97.74 0.00 2.26 0.00 Morningstar Equity Style Box™ Small % Long Size Large Mid Stocks Bonds Cash Other Value Blend Growth Style Giant Large Medium Small Micro Avg Mkt Cap % Equity Americas Sector % Port. Sector Weightings Greater Asia 10297 EUR <25 Top 10 Holdings Greater Europe 31.76 23.81 28.23 12.64 3.56 % Equity 25-50 World Regions 50-75 >75 % Equity h Cyclical 41.73 r t y u 6.26 22.72 12.75 - Americas 0.00 United States Canada Latin America 0.00 0.00 0.00 Greater Europe 100.00 j Sensitive 41.25 i o p a 8.14 4.11 17.92 11.08 United Kingdom Eurozone Europe - ex Euro Europe - Emerging Middle East / Africa 22.81 55.99 21.21 0.00 0.00 Basic Materials Consumer Cyclical Financial Services Real Estate Communication Services Energy Industrials Technology k Defensive 17.01 s Consumer Defensive d Healthcare f Utilities 8.97 6.31 1.73 Greater Asia 0.00 Japan Australasia Asia - Developed Asia - Emerging 0.00 0.00 0.00 0.00 Operations Fund Company March Asset Management SGIIC Website www.march-am.com Inception Date 6 Mar 2007 Fund Manager Francisco Javier Pérez Fernández Antonio López Silvestre NAV (31 May 2016) 10.41 EUR Total Net Assets 2016-05-31 57.08 EUR (mil) Domicile Currency UCITS Inc/Acc ISIN Spain EUR Yes Acc ES0160746030 Minimum Initial Purchase Minimum Additional Purchase Exit Charge Exit Charge Annual Management Fee Redemption Fee Depository Fee 1 Share 1 Share 1.85% 0.10% Este documento no ha sido verificado ni aprobado por la Comisión Nacional del Mercado de Valores. La información que contiene no constituye una oferta de inversión, ni un documento informativo oficial de la institución en él mencionada ni tampoco un extracto del mismo. March Gestión de Fondos, S.G.I.I.C., S.A.U. y Banca March, S.A. no se hacen responsables del uso que haga el receptor de esta información. Téngase también en cuenta que rentabilidades pasadas no garantizan rentabilidades futuras. © 2016 Morningstar. All Rights Reserved. The information, data, analyses and opinions (“Information”) contained herein: (1) include the proprietary information of Morningstar and Morningstar’s third party licensors; (2) may not be copied or redistributed except as specifically authorised;(3) do not constitute investment advice;(4) are provided solely for informational purposes; (5) are not warranted to be complete, accurate or timely; and (6) may be drawn from fund data published on various dates. Morningstar is not responsible for any trading decisions, damages or other losses related to the Information or its use. Please verify all of the Information before using it and don’t make any investment decision except upon the advice of a professional financial adviser. Past performance is no guarantee of future results. The value and income derived from investments may go down as well as up. ® ß