Impuesto Único de Primera Categoría Impuesto General de Primera

Anuncio

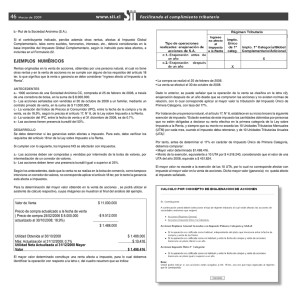

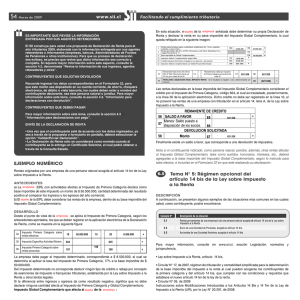

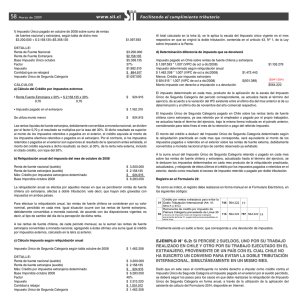

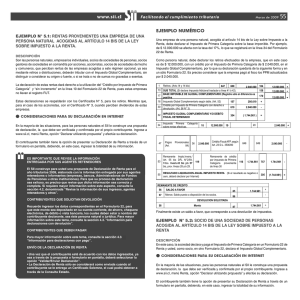

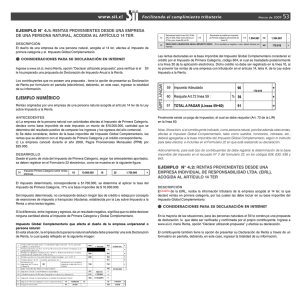

Marzo de 2009 3FOUBZRVFOPMMFWBODPOUBCJMJEBERVFBMUÊSNJOPEFMFKFSDJDJPEFUFS NJOFOVOBCBTFJNQPOJCMFEFM*NQVFTUP(FOFSBMEF1SJNFSB$BUFHPSÎB EFMBSUÎDVMPEFMB-FZTPCSF*NQVFTUPBMB3FOUBRVFOPFYDFEBEF 65" &TUBMJCFSBDJÓOOPSJHFQBSBBRVFMMBTFNQSFTBTJOEJWJEVBMFTRVFFTUÃO PCMJHBEBTBMMFWBSDPOUBCJMJEBEZBQSBDUJDBSVOCBMBODFHFOFSBMBOVBMBM UÊSNJOPEFMQFSÎPEPMBTDVBMFTEFCFOQSPQPSDJPOBSMBJOGPSNBDJÓODPO UBCMFZUSJCVUBSJBRVFDPSSFTQPOEBBOUFMBBVUPSJEBEàTDBMJ[BEPSB 2.4 Impuesto adicional a la renta 5BNQPDPFTUÃOPCMJHBEPTBEFDMBSBSFO*NQVFTUP"OVBMBMB3FOUBMBT QFSTPOBTOBUVSBMFTPKVSÎEJDBTTJOEPNJDJMJPOJSFTJEFODJBFO$IJMFRVF TFBOBDDJPOJTUBTEF4PDJFEBEFT"OÓOJNBT4" ZFODPNBOEJUBQPS BDDJPOFTFTUBCMFDJEBTFOFMQBÎTFOFMDBTPEFRVFTVTSFOUBTDPSSFT QPOEBO TÓMP B EJWJEFOEPT QFSDJCJEPT EVSBOUF FM BÒP ZB RVF FM *NQVFTUP"EJDJPOBMRVFMFTBGFDUBEFCJÓTFSSFUFOJEPQPSMBSFTQFDUJWB FNQSFTBFOFMNPNFOUPEFMBEJTUSJCVDJÓOEFMPTEJWJEFOEPTPSFUFOJEP BM NPNFOUP EF QBHBS P SFNFTBS QPS MPT TFSWJDJPT DPOUFNQMBEPT EF BDVFSEPBMBSUÎDVMP/EFMB-FZTPCSF*NQVFTUPBMB3FOUB &TJNQPSUBOUFTFÒBMBSRVFTJFTUFUJQPEFDPOUSJCVZFOUFTUSBCBKBEPSFT EFQFOEJFOUFTZQFRVFÒPTDPOUSJCVZFOUFT BEFNÃTEFMBTSFOUBT QSPWFOJFOUFTEFTVQSPQJBBDUJWJEBEPCUJFOFOSFOUBTEFCJFOFTSBÎDFT EJTUJOUBTEFMBTBOUFSJPSNFOUFJOEJDBEBTPJOHSFTPTDVZPNPOUP FYDFEBBMHVOPTEFMPTMÎNJUFTFYFOUPTFTUBCMFDJEPTPTFBOEJTUJOUPT BMPTTFÒBMBEPTFOFTUFÙMUJNPDBTPDVBMRVJFSBRVFTFBTVNPOUPTF FODVFOUSBOPCMJHBEPTBFGFDUVBSMB%FDMBSBDJÓOEF3FOUB 2.2 Impuesto Único de Primera Categoría -PTDPOUSJCVZFOUFTOPPCMJHBEPTBEFDMBSBSMBSFOUBFGFDUJWBFOMBQSJ NFSBDBUFHPSÎBRVFEVSBOUFFMBÒPIBZBOFGFDUVBEPPQFSBDJPOFT BGFDUBT BM *NQVFTUP ¼OJDP EF 1SJNFSB $BUFHPSÎB QPS DVNQMJS DPO MPT SFRVJTJUPTFTUBCMFDJEPTQBSBFMMPDPNPQPSFKFNQMPFOBKFOBDJPOFTEF BDDJPOFTEF4PDJFEBEFT"OÓOJNBT4" QFSUFOFODJBTNJOFSBTEFSF DIPTEFBHVBTEFSFDIPEFQSPQJFEBEJOUFMFDUVBMPJOEVTUSJBMBDDJPOFT Z EFSFDIPT FO TPDJFEBE MFHBM NJOFSB P FO VOB TPDJFEBE DPOUSBDUVBM NJOFSBRVFOPTFBBOÓOJNBZCPOPTZEFCFOUVSFTZFMNPOUPOFUPEF MBT SFOUBT EF GVFOUF DIJMFOB PCUFOJEBT EF UBMFT PQFSBDJPOFT EFCJEB NFOUFBDUVBMJ[BEPBMUÊSNJOPEFMFKFSDJDJPOPFYDFEBEFMFRVJWBMFOUFB 65" OPFTUÃOPCMJHBEPTBQSFTFOUBSVOBEFDMBSBDJÓO BOVBMEFM*NQVFTUP¼OJDPEF1SJNFSB$BUFHPSÎBRVFMFTBGFDUBBMDVN QMJSDPOUPEPTMPTSFRVJTJUPTZDPOEJDJPOFTRVFFYJHFOMBTMFUSBTB D E F I ZK EFM/EFMBSUÎDVMPEFMB-FZTPCSF*NQVFTUPBMB3FOUB QBSB RVF MPT CFOFàDJPT PCUFOJEPT OP RVFEFO HSBWBEPT DPO FM DJUBEP *NQVFTUP¼OJDPEF1SJNFSB$BUFHPSÎB 2.3 Impuesto General de Primera Categoría 5BNQPDPFTUÃOPCMJHBEPTBEFDMBSBSFMJNQVFTUPBOVBMMBTFNQSFTBT o JOEJWJEVBMFTOPBDPHJEBTBMPTBSUÎDVMPTCJTZUFSEFMB-FZEFMB III y BENEFICIOS TRIBUTARIOS QUIéNES PUEdEN ACOGERSE A BENEFICIOS TRIBUTARIOS Al mOmENTO dE dEClARAR El ImPUESTO ANUAl A lA RENTA? 5BM DPNP IFNPT WJTUP MB -FZ TPCSF *NQVFTUP B MB 3FOUB FTUBCMFDF RVJÊOFTFTUÃOMJCFSBEPTEFDVNQMJSDPOMBPCMJHBDJÓOEFEFDMBSBSQFSP UBNCJÊOFYJTUFOTJUVBDJPOFTEPOEFMPTDPOUSJCVZFOUFTQVFEFOIBDFSVTP EFCFOFàDJPTUSJCVUBSJPTBàOEFSFCBKBSTVSFOUBCSVUBJNQPOJCMF1BSB EFUFSNJOBS TJ MF DPSSFTQPOEFO FTUPT CFOFàDJPT TF FOUSFHBO BMHVOPT FKFNQMPTEPOEFVTUFEQPESÃJOGPSNBSTFTJDVNQMFDPOMPTSFRVJTJUPTQBSB BDPHFSTFBFMMPT &OMPTDBTPTFORVFFMCFOFàDJPUSJCVUBSJPTFFODVFOUSFWJODVMBEPBDSÊ EJUPTIJQPUFDBSJPTÊTUPTEFCFOTFSTPMJDJUBEPTBMBFOUJEBECBODBSJBSFT QFDUJWBBàOEFRVFEJDIBJOTUJUVDJÓOJOGPSNFBMBFOUJEBEàTDBMJ[BEPSB TJDVNQMFDPOMPTSFRVJTJUPTQBSBIBDFSVTPEFMCFOFàDJP-VFHPTFSÃMB NJTNBFOUJEBECBODBSJBRVJFOMFFOUSFHBSÃVODFSUJàDBEPRVFDVBOUJàRVF FMNPOUPRVFTFSFCBKBSÃEFTVSFOUBCSVUBBMNPNFOUPEFSFBMJ[BSTV %FDMBSBDJÓOEF3FOUB B #FOFàDJPUSJCVUBSJPEFMPTJOUFSFTFTQPSEJWJEFOEPTIJQPUFDBSJPT QBSBQFSTPOBTDPODSÊEJUPTDPOHBSBOUÎBIJQPUFDBSJB $POTJTUFFORVFFMDPOUSJCVZFOUFQPESÃSFCBKBSEFMBSFOUBCSVUBJNQP OJCMFBOVBMMPTJOUFSFTFTFGFDUJWBNFOUFQBHBEPTEVSBOUFFMBÒPBMRVF DPSSFTQPOEFMBSFOUBFOMBTTJHVJFOUFTTJUVBDJPOFTDPOUSJCVZFOUFTQFS TPOBTOBUVSBMFTBGFDUPTBM*NQVFTUP¼OJDPEF4FHVOEB$BUFHPSÎBFTUB CMFDJEPFOFMBSUÎDVMP/EFMB-FZTPCSF*NQVFTUPBMB3FOUBZMPT DPOUSJCVZFOUFTQFSTPOBTOBUVSBMFTBGFDUPTBM*NQVFTUP(MPCBM$PNQMF NFOUBSJPFTUBCMFDJEPFOFMBSUÎDVMPEFMB-FZTPCSF*NQVFTUPBMB3FO UBDVBMRVJFSBTFBFMUJQPEFSFOUBTFGFDUJWBTPQSFTVOUBTRVFEFDMBSFO FOMBCBTFJNQPOJCMFEFEJDIPUSJCVUP -PTJOUFSFTFTEFCFOQSPWFOJSEFDSÊEJUPTDPOHBSBOUÎBIJQPUFDBSJBRVFTF EFTUJOBSPOBBERVJSJSPDPOTUSVJSVOBPNÃTWJWJFOEBTQBSBMBIBCJUBDJÓO