10/28/2015 Business performance Q3 2015PDF 308Kb

Anuncio

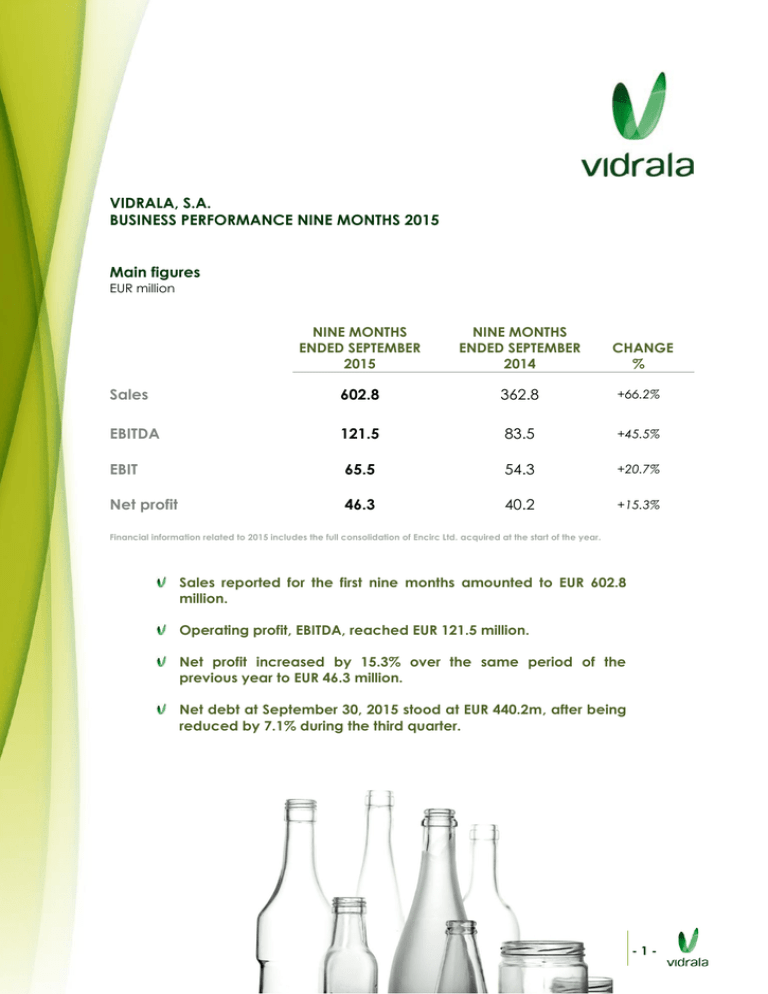

VIDRALA, S.A. BUSINESS PERFORMANCE NINE MONTHS 2015 Main figures EUR million NINE MONTHS ENDED SEPTEMBER 2015 NINE MONTHS ENDED SEPTEMBER 2014 Sales 602.8 362.8 +66.2% EBITDA 121.5 83.5 +45.5% EBIT 65.5 54.3 +20.7% Net profit 46.3 40.2 +15.3% CHANGE % Financial information related to 2015 includes the full consolidation of Encirc Ltd. acquired at the start of the year. Sales reported for the first nine months amounted to EUR 602.8 million. Operating profit, EBITDA, reached EUR 121.5 million. Net profit increased by 15.3% over the same period of the previous year to EUR 46.3 million. Net debt at September 30, 2015 stood at EUR 440.2m, after being reduced by 7.1% during the third quarter. VIDRALA SA. Business performance. Nine months 2015. -1- Sales Net sales registered by Vidrala during the first nine months of 2015 amounted to EUR 602.8 million, representing an increase of 66.2% over the previous year. On a comparable structure basis, including Encirc figures within the previous year, sales grew 4.3% as a result of increased sales volumes and a favorable currency translation. SALES YEAR OVER YEAR CHANGE EUR million 700,0 602.8 600,0 215.0 500,0 Encirc 400,0 300,0 200,0 362.8 Pre-Encirc 100,0 0,0 9 MONTHS 2014 9 MONTHS 2015 FX GBP/EUR 9 MONTHS 2014: 0.8118 FX GBP/EUR 9 MONTHS 2015: 0.7271 VIDRALA SA. Business performance. Nine months 2015. -2- Operations Operating profit, EBITDA, generated over the first nine months reached EUR 121.5 million, 4.2% below the previous year on a comparable structure basis. Operating profit, EBIT, amounted to EUR 65.5 million representing a margin over sales of 10.9%. EBITDA FIRST NINE MONTHS SINCE 2011 EUR million 140,0 121.5 120,0 100,0 80,0 75.9 78.8 88.1 83.5 60,0 40,0 20,0 0,0 9 MONTHS 9 MONTHS 9 MONTHS 9 MONTHS 9 MONTHS 2011 2012 2013 2014 2015 OPERATING MARGINS (EBIT) QUARTER ON QUARTER CHANGE As a percentage of sales 15,0% 10.2% 11.0% 11.3% SECOND QUARTER 2015 THIRD QUARTER 2015 10,0% 5,0% 0,0% FIRST QUARTER 2015 VIDRALA SA. Business performance. Nine months 2015. -3- Results and financial position Net profit obtained during the period stood at EUR 46.3 million. This represents an increase of 15.3% over the previous year, demonstrating that the acquisition of Encirc is earnings accretive since the beginning. Net debt at September 30, 2015 was reduced down to EUR 440.2 million. Leverage ratio stood at 2.7 times twelve months proforma EBITDA, including Encirc. DEBT QUARTERLY EVOLUTION EUR million 500 490.7 473.9 480 460 440.2 440 420 400 AS AT MARCH 31,2015 AS AT JUNE 30,2015 AS AT SEPTEMBER 30,2015 Debt evolution, which reflects the fully disbursed acquisition of Encirc announced January 14 2015, is the result of a free cash flow generation over the last twelve months, excluding the payment for Encirc, of EUR 74.7 million, equivalent to 10.5% of sales. VIDRALA SA. Business performance. Nine months 2015. -4- Outlook Demand of glass containers for food and beverage products along the main European markets is showing signs of recovery. Nevertheless, margins throughout the packaging industry remain affected under a context in which increasing competition is pressurising sales prices downwards. Under this context, management priorities will remain firmly focused on customer service, cost competitiveness and cash generation. This way, Vidrala´s financial results throughout the current year should improve benefited by the integration of Encirc and the previously proven solid business profile. For the full year 2015, these targets will be reflected in earnings per share growth and increased free cash flow. VIDRALA SA. Business performance. Nine months 2015. -5-