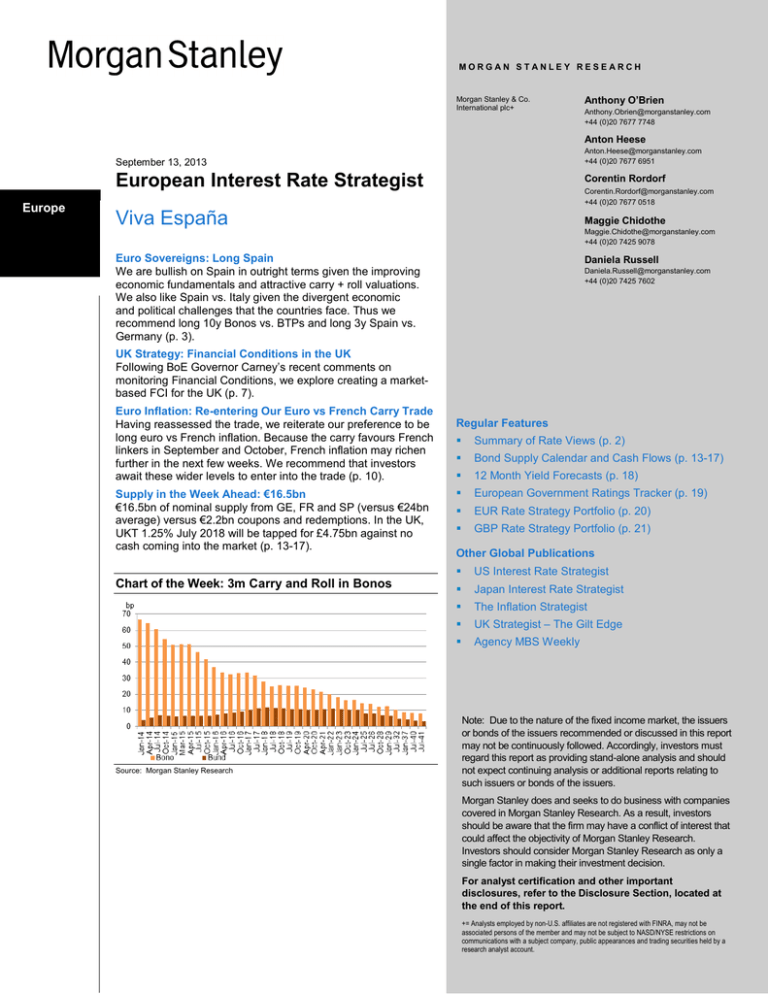

European Interest Rate Strategist Viva España

Anuncio