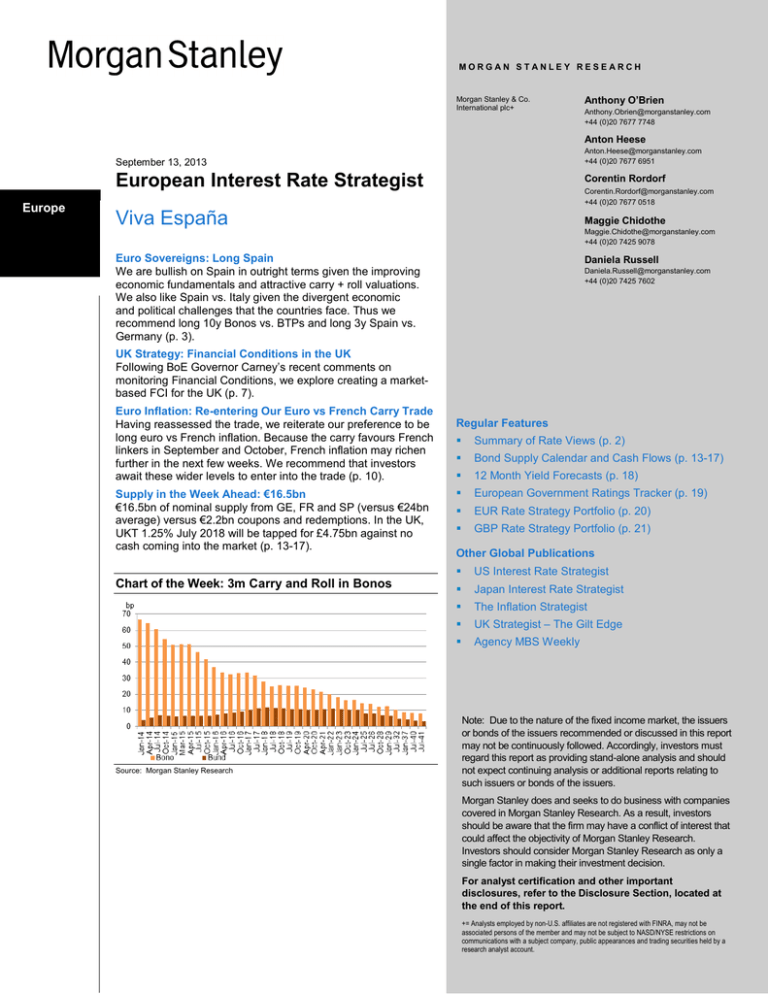

European Interest Rate Strategist Viva España

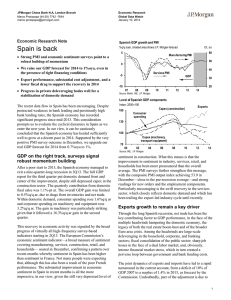

Anuncio