mBanking 365 Solutions

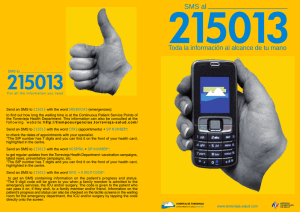

Anuncio

PRODUCT SHEET mBanking Sybase Sybase mBanking 365 allows financial institutions to address a wide range of business objectives, including service extension, cost savings and direct marketing by exploiting the mobile channels. SOLUTIONS The unique combination of Sybase mBanking 365 product suite and our industry-leading global mobile messaging infrastructure enables Financial Institutions to achieve an ever increasing range of businesses objectives, by adding mobile banking and payments to their product portfolio. With Sybase mBanking 365, Financial Institutions can offer their customers a wide range of mobile banking services. From marketing campaigns and push alerts to full service mobile banking, Financial Institutions are extending existing services and creating new revenue streams via the mobile channel. With multi-channel support, Sybase mBanking 365 enables banks to offer their services over SMS, WAP and smart client. mBanking creates the potential for a wide range of new services and products for both consumer/retail banking, corporate/SME and investment banking. These opportunities can be summarised as: Cost Savings Service Extension mBanking Sybase Enhanced Security Mobile Marketing Service Extension SMS mBanking, and in particular alerts, have been identified as the ‘hook’ to bring customers to mobile banking services. Today SMS is a truly ubiquitous service, with the ability to reach all mobile phone users, a reach that exceeds that of fixed-line or the internet. For retail customers, weekly account balance and overdraft alerts are highly sought-after services; the natural introduction to mobile banking. With Sybase mBanking 365 support for out-of-band authentication, services such as bill pay and money transfers can be offered over the SMS channel. For corporate customers, information services such as Target Balance updates and Controlled Disbursement totals via the mobile channel provide instant updates, even when recipients are away from their desks. Sybase mBanking 365 can extend the range of activities to transaction services such as Account Register confirmations and Wire Transfer authorizations. For Financial Institutions wishing to offer a richer user interface experience, Sybase mBanking 365 support for WAP and smart client mean banks can provide a full range of services via the channel best suited to the service and its customers. mBanking Sybase SOLUTIONS Cost Savings mBanking services present a wide range of cost savings opportunities for banks, whilst improving the customer experience. Banks and credit card issuers are using mobile notifications as a direct replacement for outbound and inbound call centre interactions. With Mortgage applications generating an average of 5 inbound calls, and 60% of telephone banking calls involving a bank balance request, there are clear opportunities for cost savings. Mature mBanking services now extend to using SMS as a replacement for communications that were previously issued via post or email, such as dispute resolution. Sybase mBanking 365 flexible alerts engine, along with support for pull information, enables Financial Institutions to maximise the potential for cost savings. Mobile Marketing The mobile channel is well established as a marketing channel. With SMS shortcode call to actions and the richer experience offered by WAP and MMS, Financial Institutions can use the mobile channel as a personal and immediate way to communicate with their customers. Marketing messages can include customer acquisition campaigns, promotion of new services and offers, and the creation of highly targeted campaigns for existing customers. Enhanced Security There are a number of services that utilise mBanking for enhanced security and increase in consumer confidence for mobile banking services. SMS based alerts enable retail banks and credit card issuers to enhance security and offer peace of mind over simple decision-based services. From corporate customer alerts, such as negative event messaging and payment approvals, to password lockout. Many banks today are implementing multi-factor authentication to enhance security for their internet banking service. Traditionally this has involved issuing hardware tokens to account holders. With all the costs and inventory management issues associated with this, using SMS to deliver a one-time-PIN to the customer removes the need to issue hardware, and for the customer to carry additional devices to access their internet banking account. Sybase 365 securePay enables credit and debit card issuers to extend the chip & PIN experience to the mobile phone, reducing fraud and increasing consumer confidence when making internet and MOTO transactions. Contact: info365@sybase.com www.sybase.com/365 Copyright © 2008 Sybase, Inc. All rights reserved.