Consumer confidence - Casa de Bolsa Banorte Ixe

Anuncio

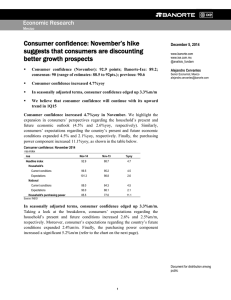

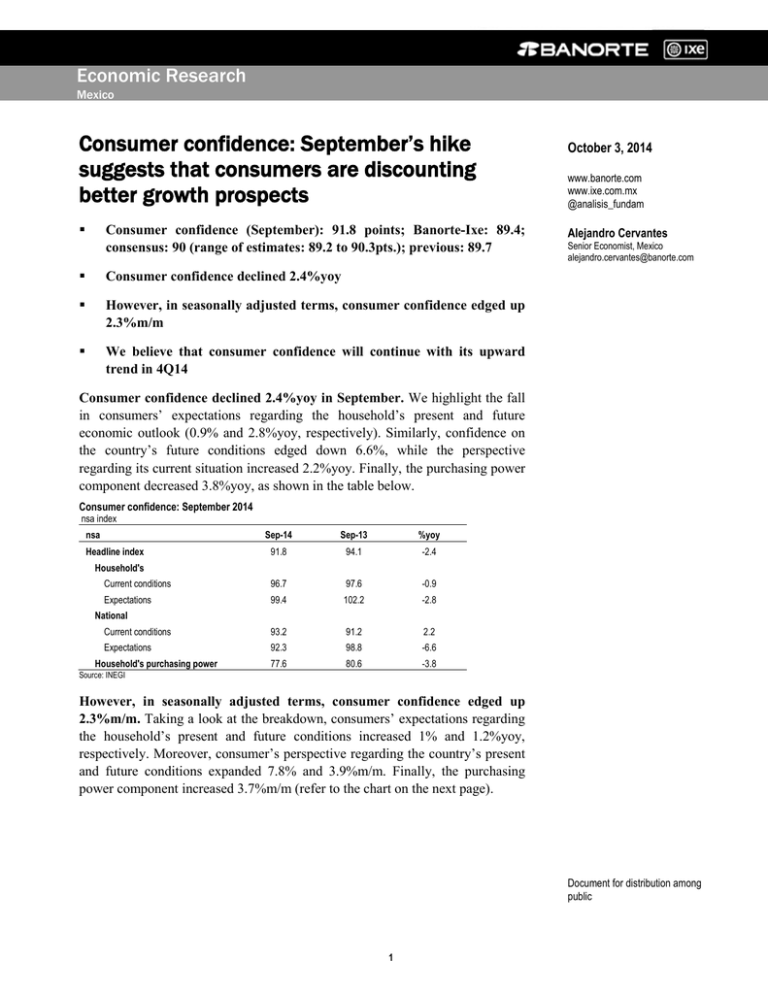

Economic Research Mexico Consumer confidence: September’s hike suggests that consumers are discounting better growth prospects Consumer confidence (September): 91.8 points; Banorte-Ixe: 89.4; consensus: 90 (range of estimates: 89.2 to 90.3pts.); previous: 89.7 Consumer confidence declined 2.4%yoy However, in seasonally adjusted terms, consumer confidence edged up 2.3%m/m We believe that consumer confidence will continue with its upward trend in 4Q14 October 3, 2014 www.banorte.com www.ixe.com.mx @analisis_fundam Alejandro Cervantes Senior Economist, Mexico alejandro.cervantes@banorte.com Consumer confidence declined 2.4%yoy in September. We highlight the fall in consumers’ expectations regarding the household’s present and future economic outlook (0.9% and 2.8%yoy, respectively). Similarly, confidence on the country’s future conditions edged down 6.6%, while the perspective regarding its current situation increased 2.2%yoy. Finally, the purchasing power component decreased 3.8%yoy, as shown in the table below. Consumer confidence: September 2014 nsa index nsa Headline index Sep-14 Sep-13 %yoy 91.8 94.1 -2.4 Household's Current conditions 96.7 97.6 -0.9 Expectations 99.4 102.2 -2.8 Current conditions 93.2 91.2 2.2 Expectations 92.3 98.8 -6.6 77.6 80.6 -3.8 National Household's purchasing power Source: INEGI However, in seasonally adjusted terms, consumer confidence edged up 2.3%m/m. Taking a look at the breakdown, consumers’ expectations regarding the household’s present and future conditions increased 1% and 1.2%yoy, respectively. Moreover, consumer’s perspective regarding the country’s present and future conditions expanded 7.8% and 3.9%m/m. Finally, the purchasing power component increased 3.7%m/m (refer to the chart on the next page). Document for distribution among public 1 Consumer confidence: September 2014 sa index sa Sep-14 Aug-14 %m/m 90.4 88.4 2.3 Current conditions 96.3 95.3 1.0 Expectations 98.4 97.2 1.2 Current conditions 95.5 88.6 7.8 Expectations 90.4 87.0 3.9 76.6 73.9 3.7 Headline index Household's National Household's purchasing power Source: INEGI We believe that consumer confidence will continue with its upward trend in 4Q14. While the non-seasonal adjusted figures continue to show a downward trend, we believe that the progress observed in the seasonally adjusted figures during the last eight months could be showing that consumers have begun to project a more positive outlook for the economic performance of Mexico. In this regard, we believe that consumer confidence will continue with its upward trend, which will eventually translate into better growth dynamics in private spending. Disclaimer The information contained in this document is illustrative and informative so it should not be considered as an advice and/or recommendation of any kind. BANORTE is not part of any party or political trend.} 2 GRUPO FINANCIERO BANORTE S.A.B. de C.V. Research and Strategy Gabriel Casillas Olvera Raquel Vázquez Godinez Chief Economist and Head of Research Assistant gabriel.casillas@banorte.com raquel.vazquez@banorte.com (55) 4433 - 4695 (55) 1670 - 2967 Economic Analysis Delia María Paredes Mier Julieta Alvarez Espinosa Alejandro Cervantes Llamas Katia Celina Goya Ostos Julia Elena Baca Negrete Livia Honsel Miguel Alejandro Calvo Dominguez Rey Saúl Torres Olivares Lourdes Calvo Fernández Executive Director of Economic Analysis Assistant Senior Economist, Mexico Senior Global Economist Economist, U.S. Economist, Europe delia.paredes@banorte.com julieta.alvarez@banorte.com alejandro.cervantes@banorte.com katia.goya@banorte.com julia.baca.negrete@banorte.com livia.honsel@banorte.com (55) 5268 - 1694 (55) 5268 - 1613 (55) 1670 - 2972 (55) 1670 - 1821 (55) 1670 - 2221 (55) 1670 - 1883 Economist, Regional & Sectorial miguel.calvo@banorte.com (55) 1670 - 2220 Analyst, Mexico Analyst (Edition) saul.torres@banorte.com lourdes.calvo@banorte.com (55) 1670 - 2957 (55) 1103 - 4000 x 2611 Fixed income and FX Strategy Alejandro Padilla Santana Juan Carlos Alderete Macal Santiago Leal Singer Head Strategist – Fixed income and FX FX Strategist Analyst Fixed income and FX alejandro.padilla@banorte.com juan.alderete.macal@banorte.com santiago.leal@banorte.com (55) 1103 - 4043 (55) 1103 - 4046 (55) 1670 - 2144 Equity Strategy Manuel Jiménez Zaldivar Victor Hugo Cortes Castro Marissa Garza Ostos Marisol Huerta Mondragón José Itzamna Espitia Hernández María de la Paz Orozco García Director Equity Research Analyst Telecommunications / Media Equity Research Analyst Senior Equity Research Analyst – Conglomerates/Financials/ Mining/ Chemistry Senior Research Analyst – Food/Beverages Equity Research Analyst – Airports / Cement / Infrastructure / Fibras Analyst manuel.jimenezza@banorte.com (55) 5004 - 1275 victorh.cortes@banorte.com (55) 5004 - 1231 marissa.garza@banorte.com (55) 5004 - 1179 marisol.huerta.mondragon@banorte.com (55) 5004 - 1227 jose.espitia@banorte.com. (55) 5004 - 1266 maripaz.orozco@banorte.com (55) 5004 - 5262 Corporate Debt Tania Abdul Massih Jacobo Hugo Armando Gómez Solís Idalia Yanira Céspedes Jaén Director Corporate Debt Analyst, Corporate Debt Analyst, Corporate Debt tania.abdul@banorte.com hugoa.gomez@banorte.com idalia.cespedes@banorte.com (55) 5004 - 1405 (55) 5004 - 1340 (55) 5268 - 9937 Head of Wholesale Banking Managing Director – Private Banking Managing Director – Corporate Banking Managing Director – Transactional Banking Managing Director – Asset Management marcos.ramirez@banorte.com lpietrini@ixe.com.mx armando.rodal@banorte.com vroldan@ixe.com.mx pimentelr@ixe.com.mx (55) 5268 - 1659 (55) 5004 - 1453 (81) 8319 - 6895 (55) 5004 - 1454 (55) 5268 - 9004 Wholesale Banking Marcos Ramírez Miguel Luis Pietrini Sheridan Armando Rodal Espinosa Victor Antonio Roldan Ferrer René Gerardo Pimentel Ibarrola