The office market in the Greater Paris Region

Anuncio

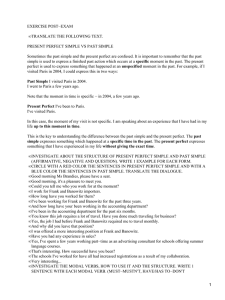

The office market in the Greater Paris Region On Point I1 st © Francesco Rizzato quarter 2015 I 1 I 2 Key messages Paris, unrivalled attractiveness to companies In a lifeless leasing context at the start of this year, we can cite the performance of Paris overall which has captured more than one square metre out of two leased since the start of 2015. With 56% of take-up, inner Paris has reached an unequalled weighting in the market, whereas over the long term the ratio is habitually below 40%. Of course, in a market of small volumes the number of square metres taken up in Paris is not exceptional and only exceeds by 10% the average of the last 15 years with a total of 207,000 sq m. However, whereas the Paris market has little supply, we note that 7 of the 11 transactions exceeding 5,000 sq m at the start of the year have taken place in Paris with one transaction exceeding 10,000 sq m in the CBD and, exceptionally, two transactions exceeding 9,000 sq m in the 7th district. All of these large transactions in Paris alone represent close to 60,000 sq m of take-up. Among the companies that are positioned in Paris this quarter we note two that are from the insurance sector, two from luxury retail and one legal firm. So is this due to a financial opportunity seized by traditional Paris users or a desire to modernise their real estate? We note that the majority of transactions have taken place in buildings that have had or will have work done. I 3 Latest from the market An investment market buoyed by continuous demand In the leasing market the hoped for upturn in the economy is not shown in the Q1 figures The leasing market has had a particularly difficult start to 2015 with scarcely 373,000 sq m of office space let over the first three months of the year. Thus, in one year, a 27% fall has been registered on the Paris office market. Cumulative take-up Source: JLL/ImmoStat Thousands of sq m However, we note that last year the segment of transactions exceeding 5,000 sq m was active with notably, two large transactions representing more than 90,000 sq m in Q1 (SAFRAN in Châteaufort and VEOLIA ENVIRONNEMENT in Aubervilliers). It is mainly large transactions (> 5000 sq m) that have been lacking in the market at the start of the year (11 compared to 15 last year), and they are of a smaller unit size. In fact, the largest transaction in the quarter was PSA taking up a lease in the second part of “Art & Fact” (~15,000 sq m) in Rueil-Malmaison. Despite positive macroeconomic signals in the eurozone such as the fall in the price of oil, as well as the depreciation of the euro, companies have been less active in terms of productive investment and real estate projects. “In its last economic climate memo, the INSEE reported a certain wait-and-see approach of companies”, emphasises Marie-Laure Leclercq De Sousa, Head of the French leasing team of JLL. “The business climate remains below its long-term average and this even though it has improved since the start of 2014,” she added. The segment of small and medium surface areas (below 1,000 sq m) rose slightly over one year (+7% en volume), whereas that of intermediary surface areas (1,000-5,000 sq m) is down (-21%), the latter is still directly impacted by the local economic situation with an intermediary business sector that continues to suffer on account of the weak growth in France in Q4. If we analyse the geographical distribution of the take-up, Paris takes up the lion's share, with over half of the square metres leased in the Greater Paris Region over the first three months of the year, which is clearly above its usual ratio (35-40%). While in the CBD the square metres consumed have remained stable over one year, we note that Paris 5-6-7 has registered a sharp rise in its take-up since two transactions, each around 9 000 sq m, were finalised in the 7th district (YVES SAINT LAURENT for “Penthemont”, vacated by the MINISTÈRE DE LA DÉFENSE, and the legal firm, BREDIN PRAT for “Orsay”). In the inner suburbs, all the markets have suffered, La Défense and the Inner Southern Suburbs being the only ones that Q1 Q2 Q3 Q4 Number of large deals > 5,000 sq m Source: JLL/ImmoStat 15 1st quarter 2014 -4 11 1st quarter 2015 I 4 have held up compared to last year. The same goes for the outer outskirts where only the Outer Southern Suburbs have succeeded since one transaction exceeding 10,000 sq m was finalised (GE ENERGY POWER CONVERSION on Villebon-sur-Yvette). The abundance of supply on the Greater Paris Region market persists, however, vacant stock has fallen just below the symbolic threshold of 4 million square metres of office space, which still represents a 7.6% vacancy rate for the Greater Paris Region. The immediate availability of office space in the capital and the Central Business District (5.5%) remains stable, with a vacancy rate of around 5% on average. Supply is scarce in Paris 5-6-7 where BREDIN PRAT's lease alone has absorbed a good proportion of the vacant stock in this market. The gap between Paris and the inner outskirts has increasingly widened. In the latter, supply remains abundant, particularly in the Western Crescent where 1 million square metres of office space is empty (excluding La Défense). In La Défense, the vacancy rate continued its slight fall to total 11.5% at the end of Q1 2015. “Prime” headline rents have experienced mixed fortunes from one sector to the next, but remain within a low range of values. In the large tertiary markets there have been no notable changes. “Prime” rent in the Central Business District has fallen to €725, with the largest transactions being finalised at around €700. On the other hand, in La Défense, after having reached its low point in mid-2014, the rent curve rose slightly to €530. Leasing conditions are still particularly attractive and real rents are at their lowest. Incentives currently total on average 18% in the Greater Paris Region, going from 15% in inner Paris (indeed, below this for certain Paris districts) to 20%, and higher, in the inner suburbs, while of course varying according to the size of the leased surface areas and the firm-period but also according to the strategy of the owners who remain very flexible concerning the leasing conditions offered to their tenants, whether it concerns retaining or attracting them. Vacancy rate as at 1st quarter Source: JLL/ORIE Vacancy rate of the quarter In % > 15% 10 à 15% 8 à 10% 6 à 8% 4 à 6% < 4% Rent - Central Business District (€/sq m/yr) Prime 740 Source: JLL 725 Average Grade A 660 1st quarter 2014 1st quarter 2015 I 5 Source: JLL I 6 The investment market continues on the same path as in 2014 The investment market has again been buoyed by demand that has not weakened in Q1. With a total of €3.565 billion invested in the Greater Paris Region, the market ended Q1 very active up 13% compared to 2014. “The market has continued on the same path as last year and the elements stimulating investment demand are numerous. Between the fall in bond rates and the record inflow into REITs and life insurance, the pressure to invest remains high,” explains Stephan von Barczy, Head of French Capital Markets Group at JLL. In contrast to last year, market performance has not been due to a large leading transaction; no “Cœur Défense” to boost volumes, but many transactions exceeding €100 million. Since the start of the year there have been 13 transactions in this segment, which is 6 more than last year at the same time for a volume of €2.5 billion, up 20%. Among the key transactions exceeding €200 million, we note the acquisition by ADIA of the “Ecowest” transaction in Levallois-Perret, that of “91-93 boulevard Pasteur” in Paris by PRIMONIAL or the SEB portfolio by NORTHSTAR. The market again confirmed its international dimension with an equal division of volumes between French and international investors. French investors have also been very active on large volumes (> €100 M), which are traditionally the domain of international investors. In Q1 the French represented half of the transactions and investments made in this market segment with, for example, the stake acquired by ALTAREA COGEDIM in the “Qwartz” shopping centre in Villeneuve-la-Garenne or the acquisition by SOGECAP of the “M7” building in the 13th district. We again note the arrival of a new investor on the market, NORTHSTAR which purchased the SEB “Europe Prime Office” portfolio, whereas OXFORD PROPERTIES GROUP, which made its first acquisition last year confirmed its interest in the Paris market by purchasing “92 avenue de France” in the 13th district. Under the pressure of demand and a fall in the remuneration of competing real estate assets, yields have fallen overall. Currently, it is no longer exceptional to talk about yields below 4% for good Paris products. At the end of Q1, prime Paris yields in office space fell 25 points in the CBD and were situated in a range comprised between 3.50% and 4.00%. In real estate as in other asset classes, investors are seeking yield and moving their strategy on the risk curve through wider geographical choices or riskier investment profiles. As a result, with demand being displaced, the downward trend in rates has been more rapid on markets where products traditionally offer higher yield levels. Therefore, the yields in certain sectors of the Western Crescent have fallen by 50 points, as for example in La Défense, which fell from 5.50-6.00% to 5.00-5.50% for prime. Nevertheless, investors remain cautious in their analyses and, as a consequence of this widening of their acquisition strategy, the average length of transactions still remains fairly long. Volumes invested Total investment volume Source: JLL/ImmoStat € billion Q1 Q2 Q3 Investment deals Source: JLL/ImmoStat 13 Deals > €100 M Q4 I 7 The breakdown by type of product shows a particularly high weighting of office space, which represents practically 90% of the volume invested whereas retail represents a little less than 10% of the investments. The bulk of the amount invested in retail concerns the stake of ALTAREA COGEDIM in “Qwartz”, with the balance coming from exclusively Parisian city centre unit-shops. On the forward funding sales side, the trend started in 2014 continued at the start of the year with a renewed appetite of the market for development. Among the headline transactions in Q1 we note the sale of “Ecowest” in Levallois-Perret, which was bought by ADIA or the second portion of “CityLights” in Boulogne-Billancourt bought by GECINA, both being part of the large transactions segment. « M7 - OP3 » - Paris 13th © Jean-Marc Lavigne I 8 Outlook The INSEE forecasts a 1.1% growth in GDP in 2015, which is the best performance since 2011. Beyond this, the consensus of a large number of economists is for growth of 1 to 1.1% for 2015. However, positive signals such as a fall in the euro or the price of oil have not yet been concretely transferred to companies. The latter are still taking a wait-and-see approach with a business climate that is struggling to recover in France. It is this wait-and-see approach that is clearly reflected in the leasing market figures at the start of the year. Still according to the INSEE, the gap between the expected effects of the macro good news (euro and oil) and the real perception that companies have, remains a real factor of uncertainty on the consolidation of growth: either companies are heading towards a more positive perspective with an upwards business climate, and growth could be better than forecasted; or they continue to take a wait-and-see approach and growth for 2015 will be lower than expected due to a lack of investment by them. However, at this stage of the year the forecasts continue to grow stronger for 2015 and 2016 and the economic activity indices such as the PMI Markit are in the growth zone. Lastly, as a general rule, growth forecasts for the Greater Paris Region are higher than the national average (1.6% in 2015 and 1.9% in 2016 according to Oxford Economics). Leasing market Despite a very slow first quarter, the office market should follow the trends of the economy and accelerate during HY2 2015. Moreover, certain large movements in the process of being finalised should be registered, and the business climate should continue on an upward path. Under these conditions, we maintain our forecast at around 2.2 million square metres leased in 2015 on the Paris market. The markets that know how to offer quality supply and attractive rent will be a part of this growth. Headline rents should be maintained at the current level, with the adjustment variable being more on the level of incentive measures granted. Landlords must continue to be flexible to capture new occupants, or keep those that they already have. Regarding supply, as the INSEE observes, with companies taking a wait-and-see approach, for the moment they continue to look for cost control, rather than growth. Therefore, supply should not change significantly in the short term, even if certain markets will begin to absorb their new surplus supply due to a high pre-let level on office projects. GDP growth in Greater Paris Region Source: Consensus Forecast / Oxford Economics GDP France Forecast GDP Greater Paris Region Greater Paris Region Forecast I 9 Investment market Given the overall market context, the demand for real estate investment should not fall in the coming months. French investors will remain active and competitive players, as long as their inflow level is very high (for the first time, the net inflow of French REITs equalled that of German funds in 2014). According to Stephan von Barczy, Head of French Capital Markets Group at JLL, “The year should be marked by large pan-European portfolios being put on the market, which will contribute to improving performance in 2015”. Moreover, a first portfolio of this type was sold in Q1 with the sale of the SEB portfolio, whereas others are currently being leased with, for example, the “Aqua” portfolio put on the market by UNION INVESTMENT comprising amongst others three office buildings in the Greater Paris Region. These large portfolios will increase supply in 2015 and could contribute to capturing new foreign purchasers including Chinese investors who are starting to take an interest in office products. Given the dynamic start to the year and transactions underway, we revise upwards our outlook for 2015 to an investment volume comprised between €15 and €17 billion. Concerning yields, the latter will remain under the duel influence of high demand and an economic and financial environment (ECB's Quantitative Easing) generally pushing the remuneration of investments downwards. However, changes should be nuanced according to markets and product types, with certain sectors having probably exhausted most of their downwards potential, such as the CBD. I 10 Notebook Better economic results in the Greater Paris Region If we are accustomed to talking about not being able to see the bigger picture with regard to economic indicators, this would be the opposite or how national figures mask Parisian performances. In fact, we forget that the Paris region often does better than the average in particular with regard to jobs and company start-ups, two elements of tertiary demand. For jobs, the latest regional figures (Q3 2014) show that over the past twelve months, the number of salaried jobs rose 0.3% in the Greater Paris Region whereas it fell by 0.4% on the national level. It is the commercial services sector, and principally in the scientific, administrative and support areas, which has been the most dynamic and has created 15,000 jobs in one year. Furthermore, the Greater Paris Region has shown a strong dynamism with regard to company start-ups since 141,000 new companies were created in 2014, which is a 6.1% growth rate, practically triple the national level. It is the services sector (specialised, scientific, technical and administrative and support services) that has been the largest provider of new companies. However, in the Greater Paris Region, one company in two created is a micro-company. Regarding GDP growth, for a long time in the Greater Paris Region it has been above the national average (+0.3 to +0.5% per year). Currently, we note that the high permeability of the region to the international economic climate impacts the change in figures with higher than average growth or slowdown episodes. While the growth surplus in the Greater Paris Region has been less obvious since 2011, we note that economists are unanimously in the process of revising upwards their economic growth forecasts in Europe and in France (+1% in 2015 and +1.5% in 2016 at Consensus Forecast or +1.1% in 2015 and +1.7% in 2016 by the OECD for France). Therefore, in a cautious approach we anticipate that the region will follow the average national results, which are improving. Indeed, in a more optimistic approach it will draw on internationalisation and capture more quickly and more strongly the fruits of the recovery in Europe and worldwide. Furthermore, the launch of works in Greater Paris and their rise should generate an increase in activity in the coming years. According to the CCIP (Paris’s Chamber for Commerce and Industry) the growth rate in regional GDP should reach +2% per year by 2010 and +2.5 to +3% by 2030. I 11 A number of factors will boost demand in real estate investment Although yields are headed downwards and approaching their historic low point, everything leads us to believe that demand will not fall in France. In fact, a number of parameters continue to push investors to position themselves on real estate that appears as attractive compared to other asset classes and contributes to improving the overall performance of their portfolio. 10 year bond rate (Source: Agence France Trésor) Real estate is profitable compared to bonds to which it is always compared. The launch of Quantitative Easing by the ECB, purchases of government bonds of 60 billion a month until September 2016, has had the effect of reducing the remuneration from these products. The yield from 10-year French bonds is currently situated around 0.5 to 0.6% per year, that of Germany around 0.2%, whereas Italy and Spain are indebted for 1.3% for the same duration. Over the shorter durations the remuneration from bonds approaches 0 (for example, it is less than 0.1% per year for the French TEC 5), indeed in certain cases falls to a negative yield! For bond investors, the solutions can be to take longer maturities (e.g. the TEC 30 currently yields around 1.1% to 1.4%), exit their usual investment zone (leave the eurozone to buy better remunerated UK or US bonds – between 1.5 and 2% for 10 years) but with a foreign exchange risk or position themselves on riskier products (company bonds, emerging markets). However, these developments come at the cost of security and/or liquidity. Savings inflow remains very high, whether it concerns life insurance or financial investments based on real estate. The announcements made at the start of the year by the “general public” savings funds show that the appetite of individuals for real estate is steadfast. Therefore, through insurance via inflows, general public OPCIs real estate funds reached a record level in 2014 with over €800 million according to the IEIF. For 2014, the SCPIs announced a record net inflow of around €3 billion, which is an increase of over 16%. The strong interest of the public for these products certainly comes from the fact that, although it fell in 2014, the average yield from SCPIs, despite everything, exceeds 5%. Over the long term it is also due to the transfer of funds by former individual shareholders who have left the stock markets since the crisis (from 7.1 million in 2008 to 4.2 million) and transferred their assets into collective management funds such as life insurance. The different stock market crashes have dissuaded many individuals from investing in the stock market, which is considered as too risky, reinforcing the “safe haven” side of real estate. Lastly, we also note that the eurozone has become more attractive to international investors. The euro has fallen and is currently situated around 1.10 per dollar compared to 1.40 per dollar a year ago. Therefore, by exchange rate alone, the price of real estate has fallen by more than 20% compared to the start of 2014 for an investor in dollars. For investors who are positioned on the London market, France has become more attractive. With prime rent twice as low as prime rent in the West End and the euro down by around 15% compared to the pound sterling, Paris is much less expensive than London at an equivalent yield, for example. Parity Euro / Dollar (Source: INSEE) I 12 News from the Grand Paris development project • The International Trade Center, the first part of the Roissy cluster In a few years time the “International Trade Center” (ITC) will be the biggest and most innovative business complex in Europe. This giant project will house 317,000 sq m of facilities, including a conference centre, 3 large exhibition halls, 7 hotels, a catering wing and all this right next to the Roissy-Charles de Gaulle Airport. The work has already begun for delivery by 2018; the total cost of the project is €650 million. Therefore, the ITC will be the first completed complex, after the Aéroville shopping centre, of the “Events and International Exchanges” cluster. • Airports at the gateway of Paris In a few years time, the busiest airports in France, namely Roissy-Charles de Gaulle and Orly, will have new direct connections in the capital. By 2023, the “Charles de Gaulle Express” line will directly link the Gare de l'Est (Paris 10th district) to the Roissy-Charles de Gaulle Airport. This new line will add to the RER B, the only rail line currently linking the capital to the airport. Furthermore, in order to keep to the deadlines, the government adopted an accelerated procedure on 12 January. The work will begin in 2017, to create 8 km of track linking Villeparisis to the airport (with the existing Gare de l'Est-Villeparisis link). With a €24 ticket price identical to that of London, close to 6 million passengers a year are expected when the line opens. By 2024, the south extension of line 14 will link the Olympiades station (Paris 13th district), to the Orly Airport. Currently, the latter has no direct link to the capital, with the journey being made via RER B then the “Orlyval” shuttle. On 16 February, the SGP1 council gave the go ahead to extend the line; the next steps, the inquiry and the public utility declaration are expected by the end of 2016, followed by the launch of work during 2017. These two projects will ensure that the airports are easily accessible. Passengers will now have their journey time cut in half. • Tramways are expanding In addition to the expansion and creation of new underground lines, the tramways are following the same trend. The extension to the west of tramway T1 should link, over 6.4 km, the current “Les Courtilles” terminus, situated in Asnières-sur-Seine, to the “Gabriel Péri” stop in Colombes. Currently, the application for a public utility declaration is underway. The extension is due to be completed by 2023, with a first section, up to the “QuatreRoutes” crossroads in Asnières-sur-Seine, by the end of 2018. The Maréchaux tramway (line T3) continues its progress and will link the Porte de la Chapelle, in the 18th district, to the Porte Maillot, on the border of the 16th and 17th districts. This extension will serve the new Clichy-Batignolles quarter as well as the Palais des Congrès. The go ahead has been granted by the Paris Council and the STIF should undertake, during 2016, the consultations and the public inquiry. This new section should open in 2020. Find all the latest news on the Grand Paris development project at: www.grand-paris.jll.fr/ 1. Grand Paris company © Mikhail Starodubov - Shutterstock I 13 Montparnasse is changing appearance Paris City Hall is rethinking the Montparnasse quarter. Three restoration programmes (two of which have been launched by private operators) should change the face of the area by 2020 and therefore improve its image and attractiveness. By launching the “atelier Montparnasse”, Jean-Louis Missika, deputy to the Mayor of Paris in charge of town-planning, intends to gather together the operators heading these programmes, and those of the town halls concerned (6th, 14th and 15th districts), to coordinate these restorations in the best way. In fact, the tunnel from the Avenue du Maine could be filled in or reduced, Rue du Commandant-Mouchotte could be equipped with a green central reservation and paths facilitating access to the Jardin Atlantique. This little-known park is suspended 18 metres above the level of the SNCF tracks and spread over three and a half hectares between the Montparnasse and Pasteur stations. On the other side of the Montparnasse tower, Place du 18 juin 1940, and Rue du Départ and Rue de l'Arrivée could, in the long term, become the “Paris Times Square”. These developments will probably not happen straightaway and in the meantime the space reserved for pedestrians will increase and pavements will be widened. One of the three projects concerns the restoration of the Ilot Gaité, which will be part of the reconstruction of the “Galerie Gaité”. Its surface area will be tripled to exceed 40,000 sq m and will be next to new housing and offices in a building that will bring together a collection of multi-coloured units. This project is headed by UNIBAILRODAMCO, which plans a gradual delivery from 2017 to 2020. The real estate company should also finance a part of the restructuring of neighbouring public spaces: Avenue du Maine and Rue du Commandant-Mouchotte. It will also take charge of the restructuring of the municipal library on the site of the former bowling alley, the construction of a building comprising 62 council flats; the creation of a private crèche, and the reconfiguration of 2000 parking spaces (one of the largest in Paris). The second project concerns the Montparnasse tower; all of the co-owners (300 in total, which is, incidentally, one of the largest co-owned buildings in Europe) have finally agreed to launch a restoration project. Besides the asbestos removal, the front of the building could be modernised. The shopping centre situated at the foot of the tower could also be extended and the work is to be launched in 2017. Lastly, the Gare SNCF – second largest TGV station after the Gare de Lyon – of which the number of passengers will increase from 55 to 80 million by 2017 with the opening of two new high-speed lines (to Bordeaux and Rennes), will be modernised by Gares & Connexions. To accompany this major change, the multiple-Michelinstarred chef Alain Ducasse will open a restaurant in three years time in the heart of the Montparnasse station. Therefore, this quarter will undergo a major transformation which should make it much more attractive in the medium term. © rrrainbow - Fotolia I 14 The ICC (cost of construction), ILAT (rent and tertiary activities) and ILC (retail rent) indices are still moderate After having recorded a rise of close to 1% in Q3, the ICC's progress slowed in Q4. In fact, it increased 0.62% year-on-year (compared to 0.93% in the previous quarter) to reach 1625 points. At the same time, the ILAT has also been published, and its annual growth rate is still moderately rising with growth of 0.50% over one year. Therefore, the index totalled 107.80 in Q4 2014. To end, concerning retail leases, the ILC again remained stable at 108.47 in Q4 2014. For nearly two years, the ILC has stagnated in a range between 108.47 and 108.52 points. Comparison of ICC, ILAT and ILC changes Source: INSEE I 15 Virginie Houzé MRICS Head of Research France Research Department – Paris T : +33 1 40 55 15 94 virginie.houze@eu.jll.com Manuela Moura Consultant Research Department – Paris T : +33 1 40 55 85 73 manuela.moura@eu.jll.com I 16 Paris 40-42, rue La Boétie 75008 Paris T : +33 1 40 55 15 15 F : +33 1 46 22 28 28 Le Plessis-Robinson Centre d’affaires la Boursidière RN 186 BP 171 92357 Le Plessis-Robinson T : +33 1 40 55 15 15 F : +33 1 46 22 28 28 Lyon 55, avenue Foch 69006 Lyon T : +33 4 78 89 26 26 F : +33 4 78 89 04 76 La Défense Cœur Défense 100-110 esplanade Charles de Gaulle 92932 Paris La Défense cedex T : +33 1 40 55 15 15 F : +33 1 49 00 32 59 Saint-Denis 3, rue Jesse Owens 93210 Saint-Denis T : +33 1 40 55 15 15 F : +33 1 48 22 52 83 Marseille 2, place Sadi-Carnot 13002 Marseille T : +33 4 95 09 13 13 F : +33 4 95 09 13 00 www.jll.fr COPYRIGHT © JONES LANG LASALLE IP, inc. 2015 - This publication is the sole property of Jones Lang LaSalle IP, Inc. and must not be copied, reproduced or transmitted in any form or by any means, either in whole or in part, without the prior written consent of Jones Lang LaSalle IP, Inc. The information contained in this publication has been obtained from sources generally regarded to be reliable. However, no representation is made, or warranty given, in respect of the accuracy of this information. We would like to be informed of any inaccuracies so that we may correct them. Jones Lang LaSalle IP, Inc does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication.