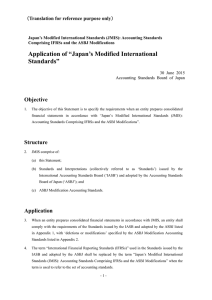

Stage 1

Anuncio