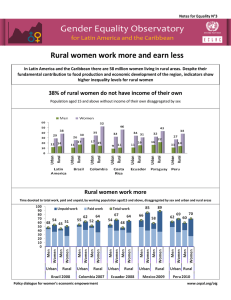

Figure 1 Photograph by Sarah Elliot for TIME ABSTRACT AGENT BANKING & INTERCORPORATE LOANS IN RURAL AFRICA Process & Services Innovation Innovating the banking experience to address the high cost of financial services and low trust & financial literacy. Combing Agent banking and Microcredit to provide loans and banking services in rural Africa, specifically Uganda. Group C Anne-Sophie Droeshout, Daniel Altgelt, Luca Lattuada, Shivam Bansal, Oleg Jecov, Joaquin Alonso Table of Contents 1.0 Introduction ................................................................................................................. 2 2.0 Our Innovation ............................................................................................................. 2 3.0 Market Conditions ....................................................................................................... 3 3.1 Challenges in the Market and Pain Points ............................................................................. 4 3.2 Market Statistics .................................................................................................................. 4 4.0 African Consumers ....................................................................................................... 5 4.1 Rural Consumers .................................................................................................................. 5 4.2 Zonal Champions.................................................................................................................. 6 5.0 Entrepreneurship in Uganda ........................................................................................ 6 5.1 Statistics .............................................................................................................................. 6 5.2 Real life example .................................................................................................................. 6 5.3 Solution Attempts (Government) ......................................................................................... 7 6.0 Consumer Behavior Research ....................................................................................... 7 6.1 Consumer Profile.................................................................................................................. 7 6.2 Interview with Manos Unidas............................................................................................... 8 SILC ............................................................................................................................................................... 8 Common Banks ............................................................................................................................................. 8 How Does Manos Unidas Do It ..................................................................................................................... 8 Feedback On Agent Banking ......................................................................................................................... 9 7.0 Implementation Plan.................................................................................................... 9 7.1 Testing ................................................................................................................................. 9 7.2 Credit Score Management System ...................................................................................... 10 7.3 Stakeholders ...................................................................................................................... 10 The Company .............................................................................................................................................. 10 Agent Bankers ............................................................................................................................................. 10 The Consumers ........................................................................................................................................... 10 8.0 Prototype ................................................................................................................... 11 8.1 Customer Journey- Before .................................................................................................. 11 8.2 Customer Journey- After .................................................................................................... 12 8.2 Addressing Pain Points ....................................................................................................... 12 Exhibits ............................................................................................................................ 13 Bibliography .................................................................................................................... 16 1 1.0 Introduction “2.6 billion people in the world live on less than $2 a day. 90% of whom will never see any form of financial services.” (Christen, 130) Everybody has heard about Muhammad Yunus and his work with the Grameen Bank. He was awarded the Nobel peace prize in 2006 for founding the bank and creating the concept of microcredit and microfinance. Microcredit refers to lending small loans for small and poor entrepreneurs that do not qualify for traditional bank loans. These loans initially were intended for women in developing countries, to help them get out of poverty when they invest these loans in their small business and make them grow. Microcredit is part of the microfinance industry, which besides providing credit, also offers insurance, savings, and other basic financial services to the poor. Although there has always been informal lending and borrowing, the more formal microfinance started around the mid 1970s in Bangladesh with the help of Yunus. Later on, another major microfinance innovation came along which was the agent banking. The idea is that financial institutions contract a retail outlet to process client’s transactions in behalf of the institution. Economically speaking, it doesn’t make sense for banks to open branches or placing ATMs in these small rural towns. According to Marcelo Rescala, a major pain point in the system is cash management and transportation, and the cost of cash replenishment can add up to more than 30% of the cost to manage an ATM network (Rescala). So, instead of the bank opening branch, or installing an ATM, the owner of the retail outlet is in charge of conducting the transaction such as clients deposit, withdraw, transfers, pay their bills, inquire about an account balance, or receive government benefits or a direct deposit from their employer. These banking agents can be anything from a pharmacy, supermarket, convenience stores, among others. After agent baking, the next innovation in the financial services world was mobile banking, which also became very strong in many parts of Africa. This concept refers to the act of performing financial transactions with a mobile device. Although in developed countries most people used their bank application through a smartphone, in developing countries these transactions were mostly done with a very basic cell phone through SMS. These transactions made on these devices are mostly transfers and payments, but for many other transactions or processes people had to go to the agent bank. 2.0 Our Innovation Our idea is to do a combination of agent banking and microcredit. These two ideas are somewhat already implemented in some developing countries in Africa and South America but there is still a lot of room for improvement and innovation. After doing some research we found out that the main problem for these developing countries is that there is none or almost no credit. Most people cannot get out of poverty because they are not able to obtain credit and therefore improve their quality of life. As mentioned before, most of the people 2 don’t have access to the banking system and microcredit is not present in all areas of the country and usually the loans are too small. We realized that agent banking, which was an extension of the traditional banks and the microfinance institutions (MFIs) were working totally separated and there could be a huge advantage by combining efforts and at the same time involving the local agent in the process. This a win-win-win situation for three parties involved: the bank or MFI, the agent, and the customer. One problem with microfinance institutions (MFIs) is that the repayment rates are not very high. One possible reason for this is that microcredit institutions are unable to analyze properly and select productive borrowers that we will able to repay their loans. The unproductive borrowers are more likely to default on their loans, and they end up paying higher interest rates in the informal credit market. Therefore, when microloans are available, these unproductive borrowers are incentivized to apply for them. The problem is that MFI loan officers cannot identify these less-productive borrowers because they lack detailed information about the characteristics of individual borrowers. Our idea is that local informal lenders are better informed about the characteristics of individual borrowers. This would be called agent-intermediate lending. The MFI delegates borrower selection to an informal lender in the community. The agent receives commissions that depend on how well the households he recommends repay their loans. This incentivizes the agent to select borrowers with low default risk. The other innovation to the system that we are proposing is a mobile solution for agent banking.To provide banking services we propose creating a network of agents that serve the customers at their doorstep. These agents would travel throughout rural areas to meet customers and collect deposits, open new accounts, among other services. All these transactions are registered live with a smartphone or tablet provided to the agent by the financial institution. We want to develop this idea in Africa, specifically in Uganda at first. This will be our initial market and if everything works out, we can later expand it to more countries in Africa and eventually in other parts of the world. Basically, we chose Uganda for two main reasons: one reason is because a member of our team lived in Uganda for a couple of months and has a contact there, and the second reason is that Uganda is one of the most entrepreneurial countries in Africa so there is a big need for credit and financial services innovation. 3.0 Market Conditions More than half of Uganda’s adult population now has access to an account at a formal financial institution. This is almost twice as many as in 2009. This positive development is only one piece of the puzzle, given that a very small proportion of individuals, households, and firms are able to utilize the formal financial system. Only 16% of the adult population keep their savings at formal deposit-taking institutions, including banks, microfinance institutions and savings and credit institutions. Up to 60% of adult Ugandans still keep their savings at 3 home and in the form of assets such as animals. Moreover, a much larger share of the population, reaching more than 65%, are unable to access formal financial institutions for credit. The Ugandan economy has slowed down to an average rate of growth of 4.5% in recent years, which is almost half of the rate of growth Uganda recorded during the high growth periods of the 1990s and early 2000s. (Sebudde, 2017). 3.1 Challenges in the Market and Pain Points High cost of financial services Low level of trust and financial literacy A major challenge for Uganda’s firms and households is the high cost of financial services. Interest rates typically range between 22 and 25%, and depending on the duration of the loan, consumers can end up paying more than twice the value of the original amount. Another challenge is the low levels of public confidence in formal financial institutions, largely due to historical experiences related to a series of crises and upheavals in the financial system. The low level of access is explained by both supply and demand side challenges. While financial institutions have not been successful in developing credit products meeting the needs of enterprises, the lack of financial literacy among enterprises, failure to keep financial records and to design viable projects have also greatly contributed to the low volume of credit to the private sector. These issues were the focus of the World Bank’s eighth Uganda Economic Update (2017). 3.2 Market Statistics Ugandans display a high degree of caution when it comes to borrowing. According to Finscope 2013, 35 per cent of adults had active loans at the time of the survey, a decrease from the level of 44 per cent recorded in 2009. The most commonly cited reasons for accessing credit included to pay for education (20 per cent) and to manage emergencies (15 per cent). Most individuals stated that the main reason they did not participate in loans was their fear of being in debt. Finscope 2013 also shows that there is a significant difference between household preferences in urban and rural areas in terms of their preferences for credit providers. While the overall rate of usage of formal credit from both bank and non-bank providers is very low (13 per cent in 2013), households in rural areas use non-bank formal providers to a relatively greater extent, while the opposite is true for those in urban areas. Within rural areas, the Uganda Poverty Assessment14 showed that financial institutions are almost completely absent in northern Uganda. 4 Up to 25 per cent of households in urban areas obtain financing from formal financial institutions such as banks, credit institutions, and micro-deposit taking institutions, with this proportion falling to only 10 per cent for households in rural areas. Across time, the largest evolution in sources of funding for households has involved the rate of usage of SACCOs, which now provide 52 per cent of financing to households in rural areas and 47 per cent to households in urban areas. Family and friends are still a significant source of financing for enterprises. According to the Enterprise Survey in Uganda (2013), limited access to credit is reported as being the most significant constraint to doing business in Uganda. Only 9.8 per cent of firms in Uganda have a bank loan and/or line of credit from a bank, compared to the average figure of 23.8 per cent recorded in sub-Saharan Africa and 36.5 per cent worldwide. Borrowers in Uganda are required to provide a lower value of collateral for a loan than the world average, but the proportion of loans requiring collateral is higher. Financial sector inclusion is also associated with rural-urban migration, a critical part of the structural transformation of the economy. At the household level, rural households that include at least one member who has migrated to an urban area are 13 percentage points more likely to have a formal loan than households that do not (28 per cent compared to 17 per cent), and 15 percentage points more likely to have a savings account with a formal institution (29 percent compared to 15 per cent). Having a formal loan and a formal savings account increases the likelihood of becoming a migrant-sending household by 3 and 6 percentage points respectively. The results suggest that facilitating households’ access to these savings and credit products could help them overcome liquidity constraints to migration, making households less dependent on agriculture and fragile rural livelihoods. 4.0 African Consumers By 2025, the population of the African continent will make up 1/5th of the world population (Agyenim-Boateng, 2015). With more and more people joining the middle class (90 million/year), the African continent is becoming an increasingly important target consumer segment . The consumers are young and willing to spend, and the two most prominent trends in the economy are the rise of urbanization (exhibit 4) and the rise of mobile communication. The main consumer-related challenges that companies now face are the political instability, poor infrastructure, linguistic diversity, price sensitivity and low data availability (Agyenim-Boateng, 2015). 4.1 Rural Consumers Rural consumers are very similar to urban ones in that they value quality highly and are willing to spend for it, especially for products such as household appliances and mobile phones (Overlooked Rural Consumers, 2016). This segment is neglected by many competitors, though there is a lot of opportunity to innovate services. They neglected because of high cost of reaching them, everyone is dispersed across wide spaces and infrastructure is even worse in rural areas (Maritz Africa Intelligence, 2017). Traditional marketing methods are also wasted on these consumers, as they rely on word of mouth and 5 trust when considering new products and services. Companies who have targeted rural areas have begun to use the marketing tool of Zonal Champions. 4.2 Zonal Champions Zonal champions are “members of local communities who are hired to represent a brand and promote products during their daily interactions”. These individuals are responsible for persuading friends, family members and neighbors to try something new (Overlooked Rural Consumers, 2016). 5.0 Entrepreneurship in Uganda African countries are among the fastest growing economies in the world and Small and Medium Enterprises are one of the main drivers of this growth. But while entrepreneurship is growing rapidly in Africa, entrepreneurs continue to face significant domestic challenges that impede their efforts, including a lack of access to funding, support services, skills training and infrastructure, as well as administrative barriers. Responding to these challenges, Africa’s entrepreneurs are contributing a host of cutting-edge products and services, enabling them to leap forward in such fields as mobile and information technology, and to develop innovations in agriculture, transportation, healthcare and other vital fields (Boer, 2018). 5.1 Statistics According to the Global Entrepreneurship Monitor (GEM) Uganda is one of the most entrepreneurial countries and in 2016 it topped the list. Also, according to the same source 28% of adults in Uganda own or co-own a new business (Patton, 2018). The main reason of this figure is a very high unemployment among youth population. Uganda has a second highest youth population in the world after Niger. About 400,000 young people enter the job market annually, for a mere 9000 jobs each year (Business Fights Poverty, 2018). The Micro, Small, Medium, Enterprises (MSMEs) are the engine of growth for the economic development, innovation, wealth creation of Uganda. They are spread across all sectors with 49% in the service sector, 33% in the commerce and trade, 10% in manufacturing and 8% in other fields. Over 2.5 million people are employed in this sector, where they account for approximately 90% of the entire private sector, generating over 80% of manufactured output that contributes 20% of the gross domestic product (GDP) (Ugandainvest, 2018). 5.2 Real life example Orator Twesiime runs a horticulture business called Natural Basket Uganda. She started her business in 2012. She saw a demand for qualitative organic products such as honey, hibiscus wine, tea, apples, grapes and hibiscus dry flowers in rural markets in Uganda and she decided to found a company which will supply this demand. Back then her company was able to supply 8 markets. The biggest issue she faced was difficulty to get a loan. The only collateral was her father’s or husband’s property (Agmis, 2018). Struggling with similar problems many 6 young people decide to quit their businesses. While almost 10% of Ugandans started a business last year, a fifth of individuals aged 18-64 have also discontinued a business in the past year, GEM found. Young entrepreneurs in particular have “generally low” growth expectations; few innovate or vary product lines. Creating an additional business is more common than expanding an existing one (Montgomery, 2018). 5.3 Solution Attempts (Government) As one of the governments solutions to tackle the unemployment problem and eradicate poverty among the youth was to make an easy access to affordable credit service. Government called this program Youth Venture Capital Fund and allocated 32 billion Ugandan shillings (approx. 7,5 million euros) to this fund. To access the funds, one must provide two personal guarantors with active accounts in Centenary Bank. Individuals can access up to 5 million shillings, while youth partners or cooperatives and company can borrow up to 25 million shillings. The interest rate for the Fund is 11 percent per annum and it's computed on declining balance basis (Kampala, 2018). 6.0 Consumer Behavior Research Given the nature and location of our intended project, ee are unable to access rural African consumers and therefore conducting consumer behavior research is difficult. Our group member (Anne-Sophie) worked in rural Uganda for 2 months in 2016, which is the extent of our consumer behavior insights. We have contacted a teacher from the Bududa Learning Center, a school in the Bududa region, a rural area of Uganda on the foothills of Mount Elgon. Through communication with the teacher (Namisi Isaac), we have derived key consumer insights. From this, we have created a “Consumer Profile”. 6.1 Consumer Profile Name: Namisi Isaac Occupation: Teacher at Bududa Learning Center Location: Bududa/Mbale, Uganda Insights: • Acquiring loans in rural Africa is extremely difficult. Isaac is one of the few rural Ugandans employed by a foreign company, so he has many official documents (salary, electricity bills because he lives in a larger city) that can show his credit score. 7 • • • Believes providing rural communities with incentives and possibilities to start their own businesses is key to developing rural parts of Uganda Slightly confused about our concept o Indicates that we need to have a clear explanation about “inter-party” lending Local vendor already accepts mobile-top up payments, so could be done via him 6.2 Interview with Manos Unidas Interviewee: Goril Meisingset-East Africa Head Officer Interviewers: Oleg Jecov and Joaquin Alonso SILC SILC method is a concept we learnt in our meeting which uses social pressure in order to have people repay back their loans. If you don’t pay you can’t just disappear from your neighbors and friends. In some villages people create emergency funds to pay hospital bills so that they all help each other in times of need. It is like their Social Security version. They tend to have simple systems in rural areas that they can manage themselves. Under the SILC System people need to have some kind of insurance to get the finance from the group. Within the group there are people responsible for the accounting, payments, etc. Figure 4,5 and 6 provide a brief overview of Manos Unidas’ SILC system. Common Banks There is no bank available for the common people. In fact, there is barely enough money to pay for transport and the bank wouldn’t give a credit anyways. In fact, banks are businesses that won’t let you go so easily. They can be pretty ruthless at times. Some people borrow from the informal market where there are high interest rates and if you don’t pay back it will go for you and your family. On many occasions, the profits of businesses are very low and are very vulnerable to things like rains which can destroy crops. Or if you have a breeding business a disease could also destroy your business. Although many businesses are agriculture and animal related this is changing now with new generations and Internet use. How Does Manos Unidas Do It In the rural world people have little education for running a business. This is why NGOs make people go through basic courses such as accounting and marketing for a period of four months with classes every Saturday. It is mandatory to do the courses first if they want to access finance. If they pass the course they do an exam at the end of the 8 course. If they pass this exam they access another one-month course on computers for basic computing skills. If they pass this exam they go through some interviews and present their business plan and then the local partner studies the viability of the project and they access the credit if they passed this filter. Then, the partner follows up on the business until they pay back the loan. The projects that Manos Unidas is involved in have a payback of 70 to 80% and charge very low interest rates because it is an NGO. The average amount that they have been giving in Uganda is around €800 but it can also be much less or much more. This depends on the type of business. The type of project also has an influence on the payback period for example breeding projects take time to receive income until the animals have bred. The education system is something that could be implemented in our project to improve who we give credit to and so that we can make sure that they have the necessary tools for success. Feedback On Agent Banking We asked what she thought about having a local person deciding on who to give the credit to and this is the reply we received from Goril: In small villages having a local person decide who to give credit to would be too subjective and this could lead to corruption. 7.0 Implementation Plan In order to effectively implement our new banking system, a lot of research needs to be done before hand. This research will provide us with the observations necessary properly adjust certain features of the system (such as who will become the agent banker in a given district). Being able to have a mutual trust with someone from a rural community is important, because then they will help the community trust our service and begin to use it as a legitimate source of financial credit. 7.1 Testing We will begin the pilot of our system in the Bududa district in Uganda. Given that one of our team members (Anne-Sophie) already has several contacts from working there, we already have a foothold into trust in the community. Additionally, the Bududa district is the perfect setting for a service such as ours. The rural district is about an hour away from the closest city (Mbale) by car, and community members rely heavily on each other for support. By researching and speaking to members of the community, such as Namisi Isaac, we will be able to target those zonal champions who could potentially become our agent bankers. Given the low financial literacy and trust in the banking system, beginning in a small community will allow us to see what things are necessary to successfully convince people that this service will aid them in the long run. By holding focus groups, both in order to provide insights into who are the zonal champions and receive feedback in terms of the 9 likeliness adopt the use of such a new service, testing in the Bududa district can give us an idea the key success factor. We also assume that we will need to have basic classes provided to the users of our service, to briefly explain the concepts being inter-party lending as well as microcredit. This will help community members better understand our service, and hopefully adapt it more quickly. 7.2 Credit Score Management System As shown by the above mentioned research, rural Africans rarely have legitimate documentation that can be used to create credit scores. Therefore, we have decided to create our own credit score management system. This system will rely heavily on observation. Not only will these observations be provided by members of the community, this is where our zonal champions become key success factors. These zonal champions (“informal lenders) will be integrated members of the community, who have a deeper knowledge about the characteristics about the individual borrowers. They will be able to provide deeper insights into who the borrowers are, and if they have a history of being trustworthy and therefore worthy of a small loan. 7.3 Stakeholders The Company As a company, we will need to be aware of the risk that is taken when giving local informal lenders the responsibility of acting as credit score providers. Testing this in Bududa will indicate if this credit score management system is effective and a viable solution to the lack of legal and legitimate data in rural Africa. Agent Bankers The biggest issue with informal lenders will be the trust. Both in the sense that if we as an agency can trust them to handle the loans according to our principles, as well as if the community will trust the lender to properly implement the inter-party lending. The Consumers Our borrowers will be locals who are motivated entrepreneurs and need loans in order to begin their businesses. Providing additional value and gaining their trust will allow us to begin combatting the negative image of banks. The financial literacy will also be an issue, but we hope to address this with the classes that will be provided and tested in the Bududa district. This will ensure that they understand the process and concept of interparty lending, a new service which we will introduce into rural Africa. 10 8.0 Prototype Given the nature of our innovated service, a prototype of agent-banking & intercorporate lending does not require a physical object. We will be providing a service that relies on human observation and communication, two key factors that are necessary for the success of our service. This is why our prototype focuses on the customer’s journey, both before the service and after the implementation of our new system. When mapping the customer journey, it is best to start by knowing who the customer is and what is their goal. The customer in this case is low income people leaving in rural areas of developing countries in Africa without access to banking or any financial services. Their specific goal is to have access to banking services in order to store money and get approval for credit. 8.1 Customer Journey- Before The following customer journey map is the current situation that the customer has to face when trying to access financial services: The main pain points with the actual system: • • • • • • • • • Losing time by traveling to bank branch in city Losing money by paying transportation Transportation of big amounts of cash Cash deterioration and not being accepted because of its condition High cost of cash management for bank No credit history and no knowledge of customer ability to repay Only access to very small loans Low percentage of repayment High interest rates for customer 11 8.2 Customer Journey- After The following customer journey map is what it would look like after implementing our idea: 8.2 Addressing Pain Points With this new customer journey most of the pain points for both the customer and the bank are solved. First of all, the customer doesn’t have to travel to the city and can have that extra time and money. The bank saves of managing cash and getting better quality bills since they are deposited more often. At last, since the bank cannot provide loans to most of these people since they don’t have a credit history, the responsibility now relies on the agent banker, which knows the customer in the town and the borrower will probably repay the loan since the agent banker will get a commission. This way also the borrower could ask for a bigger loan at better conditions. Additionally, the customer can save further time by having the agent banker or assistant travel to the homes and collecting cash and doing other type of transactions. 12 Exhibits Figure 1 Figure 2 13 Figure 3 Figure 4 14 Figure 5 Figure 6 15 Bibliography “Overlooked Rural Consumers a Potentially Important Market.” How We Made It In Africa, 26 July 2016, www.howwemadeitinafrica.com/african-consumer-sentiment-2016-promise-newmarkets/55224/. “Standard Chartered Uganda Partners with Mobile Operator on Digital Wallet.” Www.mobilepaymentstoday.com, 19 June 2018, www.mobilepaymentstoday.com/news/standard-chartered-uganda-partners-with-mobileoperator-on-digital-wallet/. “Uganda Economic Update: Let's Solve the Finance Puzzle to Accelerate Growth and Shared Prosperity.” The World Bank, The World Bank, 7 Feb. 2017, www.worldbank.org/en/news/feature/2017/02/07/uganda-economic-update-lets-solve-thefinance-puzzle-to-accelerate-growth-and-shared-prosperity. Agmis. (2018). Natural Basket Uganda Ltd | AGMIS. [online] Available at: http://agmis.infotradeuganda.com/ [Accessed 19 Oct. 2018]. Agyenim-Boateng, Yaw, et al. “Winning in Africa's Consumer Market.” McKinsey & Company, July 2015, www.mckinsey.com/industries/consumer-packaged-goods/our-insights/winningin-africas-consumer-market. Boer, W. (2018). Why entrepreneurship is key to Africa’s development. [online] World Economic Forum. Available at: https://www.weforum.org/agenda/ [Accessed 19 Oct. 2018]. Business Fights Poverty. (2018). Creating Businesses from Nothing - Business Fights Poverty. [online] Available at: https://businessfightspoverty.org/ [Accessed 19 Oct. 2018]. Christen, Robert Peck. “Beyond Microcredit: Delivering Financial Services to the Poor through Agent Banking.” The Annual Proceedings of the Wealth and Well-Being of Nations, II, 2010, pp. 129–134. Foster, Jacqueline, et al. “African Consumer Sentiment 2016: The Promise of New Markets.” Https://Www.bcg.com, 21 June 2016, www.bcg.com/enes/publications/2016/globalization-center-customer-insight-african-consumer-sentiment2016.aspx#chapter1. Kampala Post. (2018). Government Announces Shs32billion Youth Venture Capital Fund. [online] Available at: https://kampalapost.com/content/news/government-announcesshs32billion-youth-venture-capital-fund [Accessed 19 Oct. 2018]. Maritz Africa Intelligence. “Doing Business in Rural Africa: Strategies for Success.” How We Made It In Africa, Maritz Africa Intelligence, 8 Aug. 2017, www.howwemadeitinafrica.com/business-rural-africa-strategies-success/ 16 Montgomery, J. (2018). Meet the Enterprises Kampala, Spring 2017 - Challenges Worldwide. [online] Challenges Worldwide. Available at: https://challengesworldwide.com/meetenterprises-kampala-spring-2017/ [Accessed 19 Oct. 2018]. Patton, A. (2018). Uganda is a land of entrepreneurs, but how many startups survive?. [online] the Guardian. Available at: https://www.theguardian.com/ [Accessed 19 Oct. 2018]. Rescala, Marcelo. “The Curious Case of Correspondent Banking 2.0.” Diebold Nixdorf Blog, 16 Aug. 2016, blog.dieboldnixdorf.com/the-curious-case-of-correspondent-banking-20/#.W8oHxRP7SfR. Sebudde, Rachel K. “In Uganda, Greater Financial Inclusion Is the Key to Unlocking Rapid Growth.” AfricaCan End Poverty, The World Bank, 9 Feb. 2017, blogs.worldbank.org/africacan/in-uganda-greater-financial-inclusion-is-the-key-to-unlockingrapid-growth. Ssettimba, Ivan James. “Mobile Money in Uganda.” Bank of Uganda, 2016. https://www.theigc.org/wp-content/uploads/2016/03/3.-Ivan-Ssettimba-Bank-ofUganda.pdf Ugandainvest.go.ug. (2018). SMEs Driving the Economy – Uganda Investment Authority. [online] Available at: http://www.ugandainvest.go.ug/smes-driving-economy/ [Accessed 19 Oct. 2018]. 17