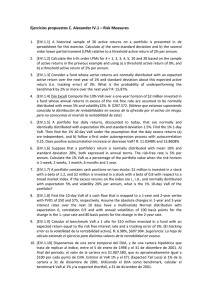

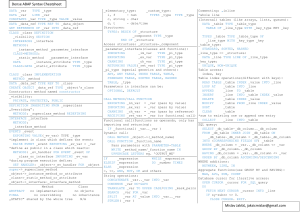

CRANFIELD UNIVERSITY CRANFIELD SCHOOL OF MANAGEMENT FINANCE & ACCOUNTING GROUP MSc IN FINANCE & MANAGEMENT Academic Year 2009 - 2010 MAURICIO HILBCK RIOS Managing and Hedging the Foreign Exchange Risk of a Multinational UK NGO Supervisor: Tarik Driouchi September 2010 This thesis is submitted in partial fulfilment of the requirements for the degree of Master of Science © Cranfield University 2010. All rights reserved. No part of this publication may be reproduced without the written permission of the copyright owner. ABSTRACT The following paper develops a comprehensive risk management guideline in order to identify, measure, monitor and report the foreign exchange (FX) risk exposure of a Multinational UK Corporation which has to manage more than 80 different currencies during its regular operations. The paper implements a number of models going from MeanVariance Analysis (Modern Portfolio Theory) to Value-at-Risk (VaR) models, finishing with a framework for risk management including hedging by using linear (forwards) and nonlinear (options) financial derivatives. Results suggest that the main FX risk factors for the company are Euro and US Dollars and that its current FX portfolio is not efficient. VaR results could serve as a reference to set aside some FX risk reserve (e.g. its current 3 times 10-day 99% VaR is currently £2.8m). Also, Historical and Monte Carlo VaR allow us to identify the presence of “fat tails” which are measured by the calculation of a monthly Conditional VaR (CVaR) as an additional £0.3m. Moreover, a Stress Test suggests that if the last crisis scenario repeats, there is 1% chance that the company loses an additional 1.8% of its monthly net positions. Finally, a Full Valuation model shows that the GBP hedge reached by using a portfolio of EUR and USD options is well higher than the hedge given by forwards only. KEYWORDS: Risk Management, Portfolio Optimization, Value-at-Risk, Currency Forwards, Currency Options. A mis adorados padres, Cecilia y Kike, A mis queridos hermanos, Joche y Kiko, Y a mis bellos abuelos en la eternidad del cielo, All we need is Love ACKNOWLEDGMENTS My first thanks go to all the Cranfield SoM’s people, professors, lecturers, staff, students…it’s been an amazing year and they’ve been always nice and helpful. I’m leaving campus, 100% satisfied with both my master degree and the extraordinary friends I made here. I’m sure most of these new friendships will be last forever as well as my future life as proud Cranfield alumni. In particular, I want to thank Tarik not only as his student but also, if he let me say so, as his friend. He is an admirable teacher and tutor and an excellent and reliable friend. I’ll be grateful always for his academic support during the entire programme and during the development of this project and I will be especially grateful as his friend, for his honest and helpful advices that always will be taken into account for my future decisions. I also would like to thank our Director’s programme Sunil. He’s been always very helpful and interested in our progress as students and also as professionals. In fact, He was the person who allows me to be part of this interesting project which has let me learn more than I expected. Furthermore, it’s been a great experience to work with a great company and great people like Paul. I am very happy that they would use my work as the beginning of their FX risk management’s improvements. Last but not least: Thank you very much to my family! They are not only my lovely parents and brothers but also my loyal best friends. It’s been a great year but I was able to enjoy this experience only because all the love I always receive from my family. Thanks to my father Kike for his strength and his eternal support and lucid advices, to my mother Cecilia for her eternal love and concern about me and my life and thanks to my brothers, Joche y Kiko, for their eternal and truly love and friendship. Together we are the strongest team I’ve ever seen. I love you so much! Mauricio TABLE OF CONTENTS INTRODUCTION ................................................................................................................................... 1 Chapter 1 RESEARCH CONTEXT AND LITERATURE REVIEW ................................................................ 4 1. Foreign Exchange Risk ............................................................................................................. 4 2. The Origins of Risk Measures: Modern Portfolio Theory and Mean-Variance Analysis.......... 6 3. Measuring Downside Risk: from MVA to VaR ....................................................................... 10 4. To Hedge or not to Hedge, that is the question .................................................................... 15 Chapter 2 RESEARCH QUESTION AND OBJECTIVES........................................................................... 19 1. Research Questions ............................................................................................................... 19 2. Objectives .............................................................................................................................. 20 3. A brief description of the Company ...................................................................................... 21 Chapter 3 DATA AND METHODOLOGY.............................................................................................. 22 1. Data Gathering ...................................................................................................................... 22 2. Economic Exposure ............................................................................................................... 24 3. Portfolio Optimization (MVA) ............................................................................................... 26 4. Value-At-Risk (VaR) Methodology ......................................................................................... 32 a. Parametric (Variance-Covariance) VaR ......................................................................... 33 b. Historical VaR ................................................................................................................ 35 c. Monte Carlo VaR ........................................................................................................... 36 5. Improving VaR: Conditional Value-at-Risk (CVaR) and Stress Testing ................................... 40 6. Hedging the Portfolio: Options and Forwards ...................................................................... 42 a. Definitions ..................................................................................................................... 42 b. Derivatives Valuation and Optimal Hedge .................................................................... 44 c. Reassessing the risk of the hedged portfolio ................................................................ 46 Chapter 4 ANALYSIS OF RESULTS AND DISCUSSION ......................................................................... 49 1. Regression Analysis Results................................................................................................... 49 2. Portfolio Optimisation Results .............................................................................................. 51 a. 3. Allowing Short Selling .................................................................................................... 55 Value-at-Risk Results ............................................................................................................. 58 a. Parametric VaR results .................................................................................................. 58 b. Historical VaR results..................................................................................................... 60 c. Monte Carlo VaR results................................................................................................ 62 d. A comparison between different approaches and their results ................................... 63 4. CVaR and Stress Testing results............................................................................................. 66 5. Portfolio Hedging Results ...................................................................................................... 68 a. Valuation ....................................................................................................................... 68 b. Risk measures after hedging ......................................................................................... 69 Chapter 5 CONCLUSIONS, RECOMMENDATIONS AND CRITIQUE ..................................................... 73 REFERENCES ...................................................................................................................................... 77 APPENDICES ...................................................................................................................................... 81 a. Appendix A: List of Currencies ...................................................................................... 81 b. Appendix B: Variance-Covariance Matrix ..................................................................... 84 c. Appendix C: Historical VaR, Portfolio’s values distribution .......................................... 85 d. Appendix D: Monte Carlo VaR, Portfolio’s values distribution..................................... 86 e. Appendix E: Correlation Matrix .................................................................................... 87 f. Appendix F: Regressions Results ................................................................................... 88 g. Appendix G: Optimal Weights (Without short selling) .................................................. 92 h. Appendix H: Optimal Weights (With short selling) ....................................................... 93 i. Appendix I: Individual VaRs ........................................................................................... 94 LIST OF FIGURES Figure 1-Portfolio Optimization Example ............................................................................................ 8 Figure 2-Asymmetric Distributions.................................................................................................... 11 Figure 3-Normal Distribution ............................................................................................................ 34 Figure 4-Exchange Rate’s Volatilities................................................................................................. 41 Figure 5-Derivative’s Pay-offs............................................................................................................ 48 Figure 6-Efficient Frontier, Income Weights ..................................................................................... 52 Figure 7-Portfolio’s Comparison, Main Currencies ........................................................................... 55 Figure 8-Efficient Frontier, Short Selling ........................................................................................... 56 Figure 9- Parametric VaR Results, Distribution ................................................................................. 59 Figure 10-Historical VaR Results, Distribution................................................................................... 61 Figure 11-Monte Carlo VaR Results, Distribution.............................................................................. 63 Figure 12-VaR % Results Comparison................................................................................................ 65 Figure 13-Stress Testing Results ........................................................................................................ 67 Figure 14-Hedged and Non-hedged Portfolio Comparison ............................................................... 70 LIST OF TABLES Table 1-Income/Expenditure Data Summary - £m............................................................................ 22 Table 2-Portfolio Return.................................................................................................................... 29 Table 3-Regression Results................................................................................................................ 50 Table 4-MVA, Income Weights .......................................................................................................... 51 Table 5-MVA, Efficient Income Weights............................................................................................ 53 Table 6- MVA, Main Currencies......................................................................................................... 54 Table 7-MVA, short selling ................................................................................................................ 56 Table 8-Efficient Income Weights, Short Selling ............................................................................... 57 Table 9-Parametric VaR Results ........................................................................................................ 58 Table 10-Parametric VaR, Benefits of Diversification........................................................................ 60 Table 11-Historical VaR Results ......................................................................................................... 60 Table 12-Monte Carlo VaR Results .................................................................................................... 62 Table 13-Comparison of VaR Results ................................................................................................ 64 Table 14-CVaR Results ....................................................................................................................... 66 Table 15-Stress Testing Results ......................................................................................................... 67 Table 16-Derivative’s Valuation ........................................................................................................ 68 Table 17-Hedged VaR Comparison.................................................................................................... 69 Table 18-Derivative’s Hedging .......................................................................................................... 71 LIST OF FORMULAS and OPTIMIZATION PROBLEM Formula 1-Economic Exposure Regression ....................................................................................... 24 Formula 2-Adjusted CF ...................................................................................................................... 24 Formula 3-Exchange Rate’s Return ................................................................................................... 28 Formula 4-Portfolio Return ............................................................................................................... 28 Formula 5-Portfolio Variance ............................................................................................................ 29 Formula 6-General Quadratic Utility Function .................................................................................. 30 Formula 7-Particular Quadratic Utility Function ............................................................................... 30 Formula 8-VaR, General Form ........................................................................................................... 32 Formula 9-VaR, Parametric Form ...................................................................................................... 34 Formula 10-Geometric Brownian motion Model .............................................................................. 37 Formula 11-Simulated Return’s Generator ....................................................................................... 37 Formula 12-Univariate Standardized Normal Distribution ............................................................... 38 Formula 13-Conditional VaR ............................................................................................................. 40 Formula 14-Forward Exchange Rate ................................................................................................. 44 Formula 15-Optimal Hedge ............................................................................................................... 44 Formula 16-Call and Put Valuation Model (BSM) ............................................................................. 45 Formula 17-Portfolio Value, Linear Model ........................................................................................ 46 Optimization Problem 1- MVA .......................................................................................................... 26 INTRODUCTION Within a more globalised world, Multinational Corporations (MNC) are continuously expanding their operations internationally. Therefore, private, public and nongovernmental Institutions across the world are increasing their concerns about the efficient managing of their foreign exchange (FX) risk. In particular, a company is exposed to FX risk when its operations involve more than one currency and hence its performance could be affected by exchange rate movements. For instance, a firm could have a mismatch between the currency at which its assets are denominated and the currency at which its liabilities are. Therefore, depreciation in the asset’s currency could lead to a loss in value of the company’s assets in relation to their liabilities. The aim of this paper is to develop a comprehensive risk management system in order to identify, measure, monitor and report the FX risk exposure of a UK MNC by using a number of frameworks and models to finally recommend the best alternative in order to reduce its exposure by using linear and non-linear financial derivative’s hedging. In particular, the paper focuses on the Economic and Transaction FX risk exposure of the company. This particular company operates in 99 countries and as a result, it manages 80 different currencies during its regular operations. Consequently, assessing and controlling its FX exposure in the most efficient and accurate way becomes a vital task for them. As described by Buehler, K. (2008), there has been a “risk revolution” not only within Financial Services Institutions but also within Corporation’s Finance Departments during last decades. Following his description of the “Evolution of Risk Management”, this paper implements a number of models going from Mean-Variance Analysis/Portfolio Optimization (or Modern Portfolio Theory) to Value-at-Risk (VaR) and Option Pricing models, finishing with a framework for risk management including hedging by using linear 1 (forwards) and non-linear (options) financial derivatives. All of these models were implemented by using Computational and Programming tools. Hence, it will be noted that the Methodology Chapter is extensive given that another particular objective of this project is to serve as a wide-ranging guideline for the company to be able to successfully apply theoretical/mathematical models into a computational system in order to efficiently manage its FX risk. In general, results suggest that the main FX risk factors for the company are Euro and US Dollars and that its current FX portfolio is not efficient according to the portfolio optimization solution. Also, VaR results are meaningful in terms of applicability for the company since they could serve as a reference to set aside some FX risk reserve (e.g. its current 3 times 10-day 99% VaR is currently £2.8m). Furthermore, Historical and Monte Carlo VaR allow us to identify the presence of “fat tails” which are measured by the calculation of a monthly Conditional VaR (CVaR) as an additional £0.3m. In addition, a stress test suggests that if the last crisis scenario repeats in the near future, there is 1% chance that the company loses an additional 1.8% of its monthly net positions. Finally, a Full Valuation model shows that the GBP hedge reached by using a portfolio of EUR and USD options is well higher that the hedge given by forwards only. The latter point is in line with some Literature’s findings about the fact that hedging does add value to the firm and that Options are more effective than Forwards while hedging against FX risk. The paper is organized as follows. The first Chapter put the readers in the context of the research issue by reviewing the relevant literature about it. Chapter 2 states the research question, objectives and the scope of the following paper. Then, Chapter 3 describes data collection process and main data sources along with a detailed description of the methodologies, models applied and justification of choice. The fourth Chapter provides the reader with a very illustrative analysis of empirical results, interpretations and discussions. Lastly, Chapter 5 summarizes the main findings with a particular reference to 2 questions and objectives and some recommendations for the company along with a critique of the work, limitations and some personal reflections. 3 Chapter 1 RESEARCH CONTEXT AND LITERATURE REVIEW 1. Foreign Exchange Risk In general, companies use to face two different kinds of risk. On one hand, Business Risk derived from business decisions (e.g. strategic risks and product, marketing and organizational risks) and business environment (e.g. macroeconomic risks and technological changes risks) and on the other hand, Non-business Risk derived from financial risks (e.g. market risk, liquidity risk, credit risk and operational risk) and from other risks like reputational, regulatory and political risk (Jorion, P., 2007). The focus of the following paper will be on the Financial Risk faced by companies and in particular the management of foreign exchange risks. A company’s assets could be assumed as a large portfolio of investments whereas their liabilities could be assumed as short positions within the same portfolio (Freixas, X. et al 1997), and hence a company itself is exposed to market risk. Precisely, Hull, J. (2007) defines Market Risk as the risk related to movements in market variables including foreign exchange rates (i.e. FX Risk), interest rates (Interest Rate Risk), commodity or stock prices (Price Risk), etc. Specifically, a company is exposed to FX risk when its operations involve more than one currency. For instance, a firm could have a mismatch between the currency at which its assets are denominated and the currency at which its liabilities are. Therefore, depreciation in the asset’s currency could lead to a loss in value of the company’s assets in relation to their liabilities. Broadly speaking, “exchange rate risk can be defined as the risk that a company’s performance will be affected by exchange rate movements” (Madura, J. et al, 2007). 4 For Madura, J. et al (2007), Multinational Corporations1 (MNCs) are exposed to exchange rate fluctuations in three forms: ▪ Transaction Exposure: The degree of exposure of the cash inflows and outflows to their respective exchange rates when converting to the domestic currency. This exposure is closely related to the market risk exposure. ▪ Economic Exposure: The degree of exposure of company’s present value of cash flows to exchange rate fluctuations. ▪ Translation Exposure: The degree of exposure of a company owners’ equity to exchange rates fluctuations after consolidating financial statements. 1 MNCs are defined as companies that are operating globally. 5 2. The Origins of Risk Measures: Modern Portfolio Theory and Mean-Variance Analysis. The modern analysis of risk in every investment decision was considered for the first time in the former formulation of the Modern Portfolio Theory developed by Markowitz, H. (1952). Markowitz simplified the optimal selection of a portfolio assuming that the preferences of investors depend only of the first and the second moment (i.e. mean and variance) of the random value of a portfolio’s returns distribution (Freixas, X. et al, 1997). The Mean-Variance Analysis (MVA) or the Markowitz’s “expected return-variance of return rule” set the idea of the trade-off between risk and return i.e. the more risk an investor takes, the most return this investor would expect. It was also the first analytical review of variance (or standard deviation2) as a measure of risk in modern finance. Markowitz also showed that the idea of taking advantage of diversification with a portfolio which gives both the maximum expected return and a minimum variance is not feasible because the portfolio with maximum return is not the one with minimum variance. The reason is that the correlations between the securities included in the portfolio are not equal to zero and therefore to reduce the risk and take advantage of diversification, it is better to invest in securities with low covariance among themselves. As a result, the MVA gives to the investors the decision of maximize the expected return given a level of risk or minimize the risk given a level of return (i.e. a dual optimization problem). Later, Sharpe (1964), by working around Markowitz’s framework, developed what is known as the Capital Asset Pricing Model (CAPM). The model basically relates the expected return of a particular asset and the systematic risk (i.e. the “residual risk” after 2 In fact, both measures of risk can be considered as only one since the standard deviation is just the square root of the variance. However, Lintner, (1965) showed, that under the portfolio optimization framework, the indifference functions of investors are linear only between their expected returns and their variance and not their standard deviation, especially when all covariances are invariant (or zero). 6 diversification which results from movements in the economic activity and remains even after efficient combination of securities within a portfolio) or “β”- Market Risk. As we have seen, the portfolio optimization framework could be used as a tool for minimizing the risk of the portfolio. In particular, since the securities within a portfolio are exposed to the fluctuations of market variables, the major risk is the one called Market Risk. Therefore, the first model to be used for assessing the transaction exposure of the company, will be the MVA framework by minimizing the risk exposure or standard deviation of their FX portfolio (σp) subject to a given level of expected return or E(rp). However, that’s only one side of the problem. Apart from the set of portfolios we can construct based on the minimum variance (i.e. the efficient frontier) for any given expected results, we also have to take into account the preferences of investors. Since no portfolio on the efficient frontier is superior or inferior to another one, the choice of the optimal portfolio depends on the investor’s risk preference. As Elton, E. et al (1995) have explained, utility functions3 have four main economic properties: ▪ The nonsatiation property states that the utility increases as wealth increases (and therefore the first derivative of utility with respect to wealth is positive). ▪ The investor’s taste for risk could take the form of an investor who is either risk averse (i.e. the investor will reject a fair gamble and hence the second derivative of utility with respect to wealth is negative), risk neutral or risk seeking. ▪ Investors can exhibit either an increasing absolute risk aversion (as wealth increases, the investor holds fewer dollars in risky assets), constant absolute risk aversion (as wealth increases, the investor hold the same amount of dollars in risky assets) or a decreasing absolute risk aversion (as wealth increases, the investor holds more dollars in risky assets). According to the author, most evidence suggests that investors should show a decreasing absolute risk aversion. 3 An alternative framework is the one relating to behavioural finance and prospect theory (Khaneman and Tversky, 1979). We don’t consider these aspects here because we examine our research problem from the perspective of a rational risk manager. 7 ▪ Investors can exhibit an increasing relative risk aversion (as wealth increases, percentage invested in risky assets declines), constant relative risk aversion (as wealth increases, the percentage invested in risky assets is unchanged) or decreasing absolute risk aversion (as wealth increases, the percentage invested in risky assets increases). According to the author despite less general agreement about this assumption, often a constant relative risk aversion is assumed. As a result, after making the relevant assumptions behind the utility of investors, the optimal portfolio will be the point where the investor’s utility function is tangential to the efficient set. As showed graphically in the following figure, the red points show optimal portfolios given a particular level of risk aversion (A) i.e. the more risk aversion, the lower the risk taken by the investor. Figure 1-Portfolio Optimization Example 14.0% A=1 12.0% A=2 Expected return 10.0% 8.0% A=5 6.0% A=10 4.0% 2.0% 0.0% 0.0% 5.0% 10.0% 15.0% Standard deviation 8 20.0% 25.0% It has to be noted that since the original objective of using the portfolio optimization framework is to build a guideline in order to choose between different asset classes within a portfolio, most of the literature is mainly focused on the selection between bonds and stocks or between domestic and foreign assets in order to increase portfolio’s diversification. Therefore, most of the literature about portfolio optimization including currencies has been done by implementing a portfolio optimization of “real” assets plus the use of currencies as hedging tools. For instance, Cantaluppi, L. (1994), showed that currency hedge could lower the risk of an internationally diversified portfolio. He developed a methodology where currency hedges are treated as a separate “pseudo- assets” with their own weights, returns and risk. Later, Adcock, C. (2003), reported a performance of currencyhedged portfolios constructed by using MVA. The results showed the superiority of optimally determined hedges over a fixed (1 to 1 ratio) hedge. However, as remarked by Ratner, M. et al (2007) among others4, professional investors are now treating currencies as a new asset class in order to take advantage of diversification. In particular, He applied a portfolio optimization technique to a portfolio of U.S and non-U.S. equity and foreign currencies taking past information between 1975 and 2006. He found that foreign currencies actually improve the Sharpe Ratio5 of the portfolio since they show low correlation with U.S. equities. 4 5 See, for instance, Laise, E. (2006) and Vames, S. (2006). It is a risk-adjusted return measure, defined as (E(Rp)-Rf)/σp, where Rf is the risk-free rate. 9 3. Measuring Downside Risk: from MVA to VaR One of the main assumptions of the MVA framework is that returns are normally distributed and therefore the first two moments of the distribution (i.e. mean and variance) contain all the relevant information about it (Elton, E. et al, 1995). As pointed out by Harvey, C. et al (2010), Markowitz’s first paper didn’t analyze the effect of higher moments in the distribution like skewness and kurtosis over the portfolio’s optimal selection and, in fact, Markowitz himself highlighted that when an investor’s utility is a function of mean, variance and skewness, mean-variance efficient portfolios would not be optimal6. Moreover, variance (and standard deviation) is just a measure of dispersion so it only examines the difference between the actual outcomes and the average return of the assets and hence risk is measured by using both upside and downside movements. However, “ceteris paribus, investors prefer a high probability of an extreme event in the positive direction over a high probability of an extreme event in the negative direction” (Harvey, C. et al, 2010) or, in other words, investors show a preference for a positively skewed return’s distribution (See: Roy, A., 1952 and Sortino, F. et al, 1994). For instance, the following Figure shows two different distributions. Both of them are asymmetric but one of them is skewed towards gains whereas the second one is skewed towards losses. Therefore, while using symmetric measures like variance, we obtain the same level of risk for both of the distributions but while using asymmetric measures, the outcomes show the second distribution as the riskiest one. 6 However, in subsequent years, Markowitz used optimization methods that also included the use of negative semi-variance in place of variance. See: Markowitz, H. (1959) and Markowitz, H. et al, (1993). 10 Figure 2-Asymmetric Distributions Asymmetric distribution towards gains Expected Results Asymmetric distribution towards losses Furthermore, as pointed out by Blair, N. (2008) the focus on the minimization of variance as a main risk management’s objective is not consistent with the financial management of corporations (or MNCs) since their goals “are designed to reduce the expected costs of financial trouble while preserving the company’s ability to exploit any comparative advantage in risk bearing it may have” (Blair, N., 2008). Therefore, “downside risk” measures can result to be better proxies for investor’s and company’s exposures. The use of downside risk measures has been widely studied and implemented and it seems to be even a better measure to implement, for the purpose of portfolio optimizations strategies. For instance, Harlow, V. (1991) showed that downside 11 risk frameworks resulted in a better asset allocation and ultimately higher returns for investors. Since banks manage a large portfolio of tradable securities with daily price’s changes, the need for a tool which can easily measure their daily market downside risk was the main motivation for the creation of Value-at-Risk (VaR) model. JP Morgan introduced the model in 1994 (J. P. Morgan Co., 1994) and now it’s very popular among practitioners and financial regulators like the Basel Committee on Banking Supervision. As explained by Jorion, P. (2007), “VaR summarizes the worst loss over a target horizon that will not be exceeded with a given level of confidence”. For instance, if the daily VaR of an institution’s trading portfolio is £ 100 million at the 95% confidence, there is a chance of 5 in a 100 that the loss could exceed £ 100 million. The advantage is that VaR is an aggregated measure which takes into account correlations and current positions within a portfolio. VaR can be computed by taking into account either the actual empirical distribution of returns of the portfolio to be assessed (“Historical” VaR) or by assuming a Normal distribution (“Parametric” VaR) (Jorion, P., 2007). In addition, distributions can be simulated by using Monte Carlo experiments (“Monte Carlo” VaR). Madura, J. et al (2007) has developed some examples on how to use VaR models to asses transaction exposure of MNCs derived from FX risk. However, authors like Shimko, D. (1998), Jorion, P. (2007) and Blair, N. (2008) have studied the suitability of Cash Flow-atRisk (CFAR) instead of the traditional VaR models in the case of Non-financial Corporations or MNCs. The main difference is that VaR consider the company’s market value at a particular point in time and assumed that the portfolio of net assets is fixed over the shortterm horizon during which the risk exposure will be assessed whereas CFAR considers the volatility and risk exposure of a flow of funds. 12 On the other hand, VaR models have shown a number of drawbacks that ultimately could lead to inaccurate risk measurements. As highlighted by Cheng, S. (2004), Hull, J. (2006) and Jorion, P. (2007), VaR measure takes into account only the frequency of losses but not their size hence it doesn’t capture extreme losses with small probability of occurrence. In particular, within a parametric VaR framework the assumption of a normal (and symmetric) distribution doesn’t take into account higher moments like its skewness and kurtosis (i.e. “fat tails”). Even more, as remarked by Stulz, R. (2009), by examining the historical volatility of prices, investor’s could underestimate the probability of a severe drop in prices by underestimating kurtosis and giving a positive skew to the distribution. Furthermore, from an empirical perspective, Basak, S. et al (2001) found that VaR could lead investors to suboptimal investment allocations and in fact they could incur larger losses than non riskadverse investors. From a more analytical perspective, Artzner, P. et al (1999) showed that VaR is not a “coherent” measure of risk7 since it shows to be a not convex and also a not subadditive measure of risk. Non-convexity means that VaR doesn’t take into account potential nonlinear increments of risk relative to the notional position whereas non-subadditivity implies that the risk measure (i.e. VaR) of a portfolio could be larger than the sum of individual risk measures (i.e. individual VaRs) of its components8. As a result, a measure called Conditional-Value-at-Risk (CVaR), Expected Shortfall or Tail Loss was developed by Artzner, P. et al (1999). CVaR, at a given confidence level, is the expected loss over the losses which are higher than the VaR or the expected loss which is equal or higher than the VaR (Rockafellar, R. T. et al, 2000). In other words, is an average of the losses that exceed VaR and hence it takes into consideration the extreme losses 7 These authors defined a number of particular mathematical conditions that a good measure of risk must have to be considered as such. 8 In particular, in the case of a portfolio formed by the securities X and Y, could occurs that: VaR(X+Y)>VaR(X) +VaR(Y). This is particular important for Financial Institutions since it could happen that a well diversified portfolio require more regulatory capital than a less diversified portfolio (See: Cheng, S. et al, 2004). 13 within the distribution. For instance, with a confidence level of 99% and 10 days of time horizon, “CVaR is the average amount we lose over 10 days assuming the 1% worst-case event occurs” (Hull, J., 2006). 14 4. To Hedge or not to Hedge, that is the question After assessing its risk exposure, a company could decide to hedge its positions by operating or financial hedges. However, if we take into account the Modigliani and Miller (M-M) theorem (Modigliani, F. et al, 1958), which states that under some particular conditions companies’ financial policies shouldn’t affect their values, it is not clear if risk management could or not add value to the company. In particular, some theoretical literature has remarked the irrelevance of risk management, as summarized by Hull, J. (2007) and Madura, J. et al (2007); the main arguments are as follows: ▪ Purchase Power Parity (PPP) argument: When markets are in equilibrium with respect to parity conditions, the value of hedging is zero since the effect of exchange risk would be offset by the change in prices. ▪ The investor hedge argument: Shareholders are able to diversify their risk by themselves. If they don’t want to take currency risk in some specific investment, they can diversify their portfolios in order to reduce it; therefore companies don’t need to concern about FX risk. ▪ Currency diversification argument: As long as MNC are already diversified across a number of countries, there is no need to hedge their positions. However, Madura, J. et al (2007) has developed strong contra arguments against those described above. Regarding the PPP for instance, the author highlighted the fact that the parity doesn’t necessarily hold in the short term and even if it holds over a long period of time, managers are always specially concern about the “next period” (e.g. next quarter figures). Moreover, there has been a large research around the empirical testing of the PPP. For instance, Miskhin et al (1984) and Abuaf, N. et al (1990) found significant deviation of exchange that persisted for specific periods. In particular, the latter paper 15 found that deviations from PPP are substantial in the short run and could take about 3 years to be reduced in half. Regarding the investor hedge argument, asymmetric information has to be taken into account. Company managers have comparative advantage in knowing the actual exposure of the firm and, in fact, their expertise allows them to hedge at a lower cost than investors could. Finally, perfect diversification and hence perfect offset between currencies changes is not usually possible since correlations can be volatile and high during particular periods and therefore the need for hedging is still there. Other arguments that proponents of hedging give are more related to the financial management of the company. For instance, by reducing the volatility of cash flows, a firm can improve its planning capability and also reduces the likelihood that firm value fall below a predefined minimum target. Also, Jorion, P. (2007), remarked that the real usefulness of the M-M theorem is that it allows us to remark the actual market imperfections. Therefore, He summarized a number of reasons that different authors have remarked since the appearance of the M-M theorem. For instance, “Hedging can lower the cost of financial distress” by reducing the probability of left-tail results; “Hedging can lower taxes” (only when firm’s tax function is convex) by reducing the volatility of cash flows; “Hedging can lower agency costs” between managers and stakeholders by reducing volatility of earnings and therefore making earnings more informative and easy to evaluate; and “Hedging can facilitate optimal investments” by providing steady cash flows needed for investing in R&D programs, for instance. As we have seen, despite the fact that hedging not only protects a firm against potential losses (i.e. downside risk) but also could eliminates any gain (upside movement), its implementation could reduce the uncertainty about the cash flows of the firm and ultimately increase its value. Precisely, there are a number of empirical studies around the 16 question of “Does risk management add value?” In particular, Smithson, C. et al (2005) made a remarkable effort to summarize the results of the empirical evidence. For instance, under the question “Is the use of Risk management tools associated with lower levels of risk?” They found that in the case of non-financial corporations, almost 90% of the studies showed that the use of financial derivatives reduced the effect of currency’s changes on the volatility of their stock returns. For instance, Guay, W. (1999) by studying the effect of interest rate and FX derivatives of new users (i.e. firms that previously had not reported using derivatives) between 1990 and 1994, found a decline in sensitivities along with a reduction of beta (i.e. market risk). Furthermore, they reported that for the case of nonfinancial companies studied, all of them indicated that hedging by using FX derivatives, added value to the firm (as measured by Tobin Q9). In particular, Allayannis, et al (2004) by studying the impact of the use of FX risk on firm value for 379 firms between 1990 and 1999, they found a significant positive premium for users of derivatives with FX risk exposures. After reviewing the goodness of hedging (i.e. actions that help the company to lower the volatility of cash flows or firm value), firms can opt between, broadly speaking, two ways for hedging: on one hand, a natural or operating hedge which refers to an offsetting operating cash flow with another one that arises from the conduct of business itself and on the other hand, a financial hedge which refers to a money market hedge or a financial derivative like futures, forwards, or options (Madura, J. et al, 2007). In particular, the following paper focuses in the use of currency forwards and options as financial hedge tools against FX risk. Finally, there is some literature related to the comparison between different hedging strategies. For instance, Allayanis, G. et al (2001) by analyzing a sample of U.S. multinational nonfinancial firms between 1996 and 1998, found that operational hedging 9 Ratio of a company’s market value to the replacement value of its assets. 17 (measured by using geographic dispersion metrics as a proxy) didn’t reduce their exchange rate exposure nor added value and neither maximized shareholder value whereas financial hedging (i.e. use of financial derivatives) was related to lower exposures and higher firm values. Furthermore, Maurer, R. et al (2007), found that by using in-the- money options and forwards an investor could build a much more diversified bond and stocks portfolio that when no hedging strategy is taken. Also, He showed that by dedicating a smaller part of the investment in European Options, they have the potential to substitute an optimally forward-hedge portfolio. 18 Chapter 2 RESEARCH QUESTION AND OBJECTIVES 1. Research Questions The main question of the following research document would be “how different risk measures and models could be successfully applied in order to assess and reduce foreign exchange risk of a Multinational Corporation?” In line with the latter general interrogate, the company provided us with the following questions to be analysed during the developing of this project: a. Can we mathematically describe the foreign exchange risks that we face? ▪ How do the specifics of the company funding affect this modelling of risk? ▪ What data do we need to do this? ▪ How can we use the models in the future? b. How can we use this to help us manage our foreign exchange risk? ▪ What risk management tools should we use? (How much can we absorb internally and what external tools should we use?) ▪ How can we reflect this management of risk within our systems? ▪ How do we use market intelligence to help with risk management? 19 2. Objectives The aim of this paper is to develop a comprehensive risk management system in order to identify, measure, monitor and report the foreign exchange risk exposure of a UK MNC by using a number of frameworks and models to finally recommend the best alternative in order to reduce its exposure by using linear and non-linear financial derivative’s hedging. In particular, the paper focuses on the Economic and Transaction FX risk exposure of the company. It will be noted that the Methodology Chapter is extensive given that another particular objective of this project is to serve as a wide-ranging guideline for the company to be able to successfully apply theoretical/mathematical models into a computational system by using Excel and its tools in order to efficiently manage its FX risk. 20 3. A brief description of the Company10 The company analysed is a multinational UK Non-Governmental Organisation (NGO), we call it MNGO hereafter, which works as an international confederation of 14 organizations working together in 99 countries and with partners and allies around the world. As a result of its truly global work, the company manages more than 80 different currencies during its regular operations. Consequently, assessing and controlling its FX exposure in the most efficient and accurate way becomes a vital task for them. It has to be pointed out that the cycle of income and expenditure is different to that of a commercial company. The company’s Income (which increased £8.6m to £308.3m between 2008 and 2009) comes predominantly from the activities of trading (e.g. commercial shops) and fundraising (e.g. donors). Fundraising could be divided in unrestricted and restricted with a regular ratio of 40:60 between them. Unrestricted funding come from regular givers and legacies and could be spent for different purposes whereas restricted funding comes from governments and institutional donors and have to be used for specific projects (programmes) in particular currencies and countries around the world. Even unrestricted income, which is predominantly in GBP, have to be spent mostly in (a very wide range of) non-GBP currencies. Consequently, the company operates in a permanent mismatch between currencies in its “asset” and “liability” side, increasing its exposure to FX risk and the need for its efficient management. 10 Most of the information in this section has been extracted from the Company’s Official Web Page and Annual Report and also from some internal reports provided. 21 Chapter 3 DATA AND METHODOLOGY 1. Data Gathering Data about MNGO’s positions in different currencies was obtained from the reports of monthly Income and Expenditures between 2006 and 2010 financial years, provided by the point of contact. Financial periods run to April up to 2009 and then, they run to March only in 2010. A list of the currencies (plus codes and countries of origin) with which the company operates, could be seen in Appendix A. It should be noted thought that the best approximation for assessing the market risk of a company could be performed by taking into account its balance sheet information (i.e. assets and liabilities). However, the balance sheet of this company in particular doesn’t reflect the difference in domestic and foreign currencies and hence the only meaningful data is on the income/expenditure side. As it will be discussed later, one of the main assumptions is that the flows of income/expenditure funds remain fixed over the period to be analysed (i.e. monthly). The following table summarizes income/expenditure data from 2006 to 2010: Table 1-Income/Expenditure Data Summary - £m Source Item Income From Annual Report Expenditure Income From Currency Analysis Expenditure 2006 310.5 298.0 216.2 216.7 2007 290.7 297.2 203.1 209.9 2008 299.7 298.4 206.8 210.9 2009 308.3 318.6 215.4 227.9 2010 318.0 294.8 232.3 212.8 It should be noted that the currency analysis is only for MNGO’s International Division; therefore, there is a gap between this information and the Organisational Income Statements shown in the financial statements. Since the analysis of this gap is not easy to get, it can be assumed that it be all denominated in Sterling Pounds-GBP (as it will all be 22 UK expenditure) and spread evenly over the 12 months and consequently it doesn’t represent a risk factor for the company in terms of FX risk. Data of daily exchange rates for 80 different currencies relative to GBP was obtained from Thomson Reuters DataStream for a period of 10 years. However, data for Eritrean Nakfa (ERN) was obtained from Oanda.com11 due to the unavailability of a time series in DataStream. All the exchange rates were downloaded as indirect quotes i.e. as a foreign currency price of a unit of home currency or GBP. For instance, on July 30 th the exchange rate U.S dollar to Sterling Pound (USD/GBP) was 1.4949. Also, for the aim of simplicity and availability of data, only mid rates were taken (average between bid and ask rates). Finally, UK Inflation and interest rates were collected from the Office for National Statistics 12 and FT.com, respectively. On the other hand, all of the data analysis was conducted by using Microsoft Excel, its tools complements (e.g. Data Analysis and Solver) and VBA macros. Also, regression analysis was carried out by using E-Views 4.0. In the following sections we will discuss in detail the different methodologies used for assess and measure the economic and transaction exposure of the company along with the model used for hedging the FX portfolio. 11 “OANDA is a market maker and a trusted source for currency data. It has access to one of the world's largest historical, high frequency, filtered currency databases”. (www.oanda.com). 12 http://www.statistics.gov.uk/statbase/TSDdownload2.asp 23 2. Economic Exposure In order to assess the economic FX exposure of the firm, a sensitivity analysis of cash flows to exchange rates is carried out first. As proposed by Madura, J. (2007) this could be done by implementing a regression analysis of cash flows and exchange rates according to the following model: Formula 1-Economic Exposure Regression ∆CFt = α + þERt + et Where, ∆CFt is the percentage change in the inflation-adjusted cash flows measured in GBP for the period t; α and β are the intercept and the slope coefficient, respectively; ER t is the percentage change in the exchange rate of the currency over the period t and, finally, et is the error term. As commented in the last section, monthly data of Net Cash Flows (Income minus Expenditures) from June 2005 to March 2010 was collected giving a total of 58 observations for each variable. The adjusted Cash Flows figures were obtained by the following formula: Formula 2-Adjusted CF ∆CFt = (1 + dCFt) (1 + INFt) Where, dCFt is the monthly percentage change of the firm’s net cash flows and INF t is the monthly UK inflation. Madura, J. (2007) proposed the inclusion of more than one currency as independent variables if that is the case, however, to avoid problems of multicolinearity and 24 autocorrelation (because of the high correlation among all the currencies as show in the next section); a univariate regression is carried out independently for each of the main currencies within the portfolio. This allows us to check the size of the sensitivity of CF to exchange rates by looking at the slope coefficient of the regression. In the following section, we will start the Transaction FX Exposure Analysis by using the Modern Portfolio Theory Framework. In particular, a Mean-Variance Analysis allows us to minimize the variance of the FX portfolio while getting its efficient frontier. 25 3. Portfolio Optimization (MVA) As commented in the Literature Review, Portfolio Optimization framework is developed by minimizing the risk exposure or standard deviation of the portfolio (σp) subject to a given particular level of expected return or E(Rp). Hence, by using Solver tool of MS Excel, we identified the corresponding minimum variance portfolios by increasing the required return of the portfolio in discrete quantities. As a result, the efficient frontier will be a concave function within the expected return-standard deviation plane which extends from the Minimum Variance Portfolio (MVP) to the Maximum Return Portfolio (MRP) (see: Elton, E. et al, 1995) as showed before in Figure 1. In particular, in the case of a portfolio with “N” assets, the Optimisation Problem is given as following: Optimization Problem 1- MVA N N N Minimize: JΣ w 2 o 2 + Σ Σ wi wj oij ii i=1 j=1 i*j i=1 Subject to: N (1) Σ wi R̄i = R̄p i=1 N (2) Σ wi = 1 i=1 (3) wi ≥ 0, i = 1, … , N Where, wi is the weight of asset i in the portfolio, σij is the covariance between asset i and j (i ≠ j) and Ri is the returns of asset i. 26 Restriction (1) simply reflects that the weighted average of given returns is equal to the given return of the portfolio. Also by varying it between the return of the MVP and the return of the MRP, the Efficient Frontier could be obtained (Elton, E. et al, 1995). Restrictions (2) and (3) reflect the assumptions that there is no short selling and no riskless lending and borrowing. However, results obtained when the assumption of no short selling is relaxed, are showed later in this paper. As commented in the last chapter, it has to be noted that the portfolio optimization framework is originally used as a guideline for the optimal selection between different asset classes to be included within a portfolio of investment (i.e. asset allocation) and also for the selection between domestic or foreign investments in order to take advantage of diversification. In this particular case though, our parameter to make the asset allocation will be the currency at which company’s positions are denominated, in other words, different currencies are treated as different asset classes with their own weights, returns, correlations and risk as developed by Cantaluppi, L. (1994) and VanderLinden, D. (2002) and therefore MVA is developed over a Portfolio of Currencies. At first, taking into account the restrictions in the company’s expenditures funds, no short positions will be assumed. Therefore the portfolio optimization is performed by taking only the “asset side” (i.e. income) of the portfolio of currencies of the company at the end of March 2010. Consequently, the weights of different currencies within the portfolio are calculated by using the Income Data which includes operations with 20 different currencies. Daily exchange rate’s returns were calculated by using the continuous compounded return Rt, given by the following formula: 27 Formula 3-Exchange Rate’s Return St R = ln ( ) t St–1 Where, St is the exchange rate at time t and St-1 is the exchange rate at the previous date. Then, the expected return E(Ri) of each currency was obtained from historical data of one year period before the end of June 2010. As a result, the expected return of the portfolio or E(Rp) was calculated by multiplying the vector of weights by the respective expected return of every currency as shown in restriction (2) of the Optimization Problem 1. In terms of matrix algebra the Portfolio Return is calculated as following: Formula 4-Portfolio Return E(Rp) = [W’] [E(Ri)] Where W’ is the transpose of the weight’s vector with a dimension of (1x20) in the case of income position’s weights. It has to be highlighted that in this particular case, as the analysis is done over currencies’ long positions, all returns were calculated after transforming indirect exchange rates quotes into direct exchange rates quotes (i.e. their inverse). So that, a positive change means an appreciation of the foreign currency and therefore a positive return for the company and vice versa. The following table summarizes the calculation of the expected Portfolio Returns: 28 Table 2-Portfolio Return Curr. Code Income£ Weight Exp Return USD EUR PKR BRL INR CAD AUD BDT ZAR TZS ILS SLL YER HTG PHP KES XOF COP AFO NPR Portfolio 7,406,410 6,705,768 331,837 311,944 149,508 146,477 133,848 105,994 73,387 40,654 33,550 29,266 18,623 16,711 8,584 5,420 3,830 972 516 502 15,523,799 47.710% 43.197% 2.138% 2.009% 0.963% 0.944% 0.862% 0.683% 0.473% 0.262% 0.216% 0.189% 0.120% 0.108% 0.055% 0.035% 0.025% 0.006% 0.003% 0.003% 100.000% 0.039% -0.014% 0.019% 0.070% 0.052% 0.071% 0.054% 0.038% 0.046% -0.005% 0.043% -0.029% -0.005% 0.038% 0.054% 0.018% -0.014% 0.084% 0.054% 0.052% 0.016% On the other hand, Portfolio Variance is calculated by using the target of the optimization problem 1 showed before. In matrix algebra the calculation is as follows: Formula 5-Portfolio Variance σ2p = [W’] ∑ [W] Where, ∑ is the variance-covariance matrix of the 20 currencies derived from the correlation matrix which are also attached in Appendix B. Then the standard deviation is obtained from the square root of the variance. Finally, as commented in the previous chapter investor’s utility has to be taken into account as well. In particular, under our portfolio optimization framework, investors are assumed to be both risk averse (i.e. the decision is restricted to the efficient frontier since 29 investors want to minimize variance) and utility maximisers (i.e. non-satiation property) and therefore while keeping risk constant they prefer highest possible return and also the more risk they take, higher the compensation they expect. Finally, investors are indifferent between alternatives that offer the same utility. In particular, as also explained by Elton, E. et al (1995) and Freixas, X. et al (1997), a quadratic utility function is usually used in MVA because the use of it, leads to optimal MVA outcomes. In its general form, a quadratic utility function could be defined as: Formula 6-General Quadratic Utility Function U(W) = W − AW2 And its first and second derivative, respectively, as: U′(W) = 1 − 2AW U"(W) = −2A And therefore, the investor shows risk aversion since the second derivative is negative for all positive “A”. Also, to be consistent with non-satiation property, the first derivative should be positive. That is always true if and only if: 1-2A>0 or W<(A/2). Therefore, as usually used in MVA, the following particular form of a quadratic function is used in this project: Formula 7-Particular Quadratic Utility Function A 2 U = E(Rp) − ( ) op 2 Where, A is the company’s level of risk aversion. This number is subjective and could be assigned so that a comparison between different levels of risk aversion affects the final 30 asset allocation within the portfolio. Therefore, is a relative metric instead of an absolute one. It has to be noted also that the quadratic function exhibits increasing absolute risk aversion (i.e. as wealth increases, the investor holds fewer dollars in risky assets) and also increasing relative risk aversion (i.e. as wealth increases, percentage invested in risky assets declines). Finally, by using Solver the maximization of formula 7 is carried out subject to the parameters of portfolios within the efficient frontier in order to get the portfolio which is optimal (i.e. risk-return combination where the investor’s utility function is tangential to the efficient frontier). As commented in Chapter 1, variance analysis could be a biased or a not accurate measure of risk and therefore in the following sections, we will describe the methodology of a downside risk measure like the Value-at-Risk (VaR) model. 31 4. Value-At-Risk (VaR) Methodology In a formal expression, VaR can be defined as the lower quartile q-th “q” of the inverse return’s distribution function “F” of a portfolio, as showed as follows: Formula 8-VaR, General Form VaR(q) = − F–1(q) As commented in Chapter 1, there are basically three methods to be implemented in order to calculate the VaR of a portfolio. The main difference between them is principally the assumption behind the distribution of the portfolio’s return. In this paper, the Parametric, Historical and Monte Carlo Simulations Approaches are implemented. As a first step in order to calculate VaR the risk factors have to be identified. In this particular case, we need to assess the FX risk of the company’s Cash Flows of Income and Expenditures. Therefore, every currency in which the company has position will be a risk factor and hence the movements of these exchange rates will affect the value of the portfolio. It has to be pointed out again that the calculation of VaR was made originally to take into account of the market risk exposure of an asset’s portfolio (e.g. a portfolio of securities which is affect to market’s prices movements) however, in this particular case we will carried out a sort of Cash-Flow-at-Risk (CFAR) assuming that the only risk which could affect Cash Flows is the FX risk. Moreover, the assumption again is that the flow of income and expenses funds will freeze during the period (i.e. a month). Also, since the company has income and expenditures (i.e. long and short positions), the VaR is calculated over both the gross position (i.e. sum of long and short positions) and absolute net position (i.e. absolute value of the difference between long and short positions). The former calculation takes into the effect of exchange rate volatility without differencing the position, whereas the second one takes 32 into account the offset effect between income and expenditures denominated in the same currency during the period to be analysed. Finally, as commented earlier the latest data available of the company’s currencies positions is as March 2010, however, volatilities and correlations are calculated by taking into account information between June 2009 and June 2010, in order to reflect the effect of recent market (i.e. exchange rates) movements over the Foreign Exchange position of the company. In other words, it has been assumed that March position will be approximately the same as would it be in June. It has to be noted however that the correct way to calculate VaR is by taking both market and position data for the same month but in this particular case that wouldn’t be a good approximation of the current Company’s FX Risk exposure. a. Parametric (Variance-Covariance) VaR The implementation of the Parametric VaR is carried out by following the methodologies explained by Hull, J. (2006), Madura, J. et al (2007) and Jorion, P. (2007). The main assumption is that exchange rates returns follow a normal distribution (i.e. a symmetric distribution) with known mean and variance. Then, it is possible to calculate the lowest percentile of the distribution at a particular level of significance (e.g. 1%, 5% or 10%). The two main components are the mean and the variance of the distribution. These two components are calculated over a period of one year before June 2010 by using formulas 4 and 5 and including weights for both gross and net positions. Also, VaR parameters have to be chosen, the time horizon (T) and the Confidence Level (CL). Regarding the time horizon, as commented before, the FX exposure of the company changes monthly and therefore a T=20 (i.e. 20 working days) is chosen. Finally, regarding the confidence level, Basel Committee (BIS, 1996), proposed a 99% (i.e. 1% probability of loss-level of 33 significance or -2.33 standard deviations) within a period of 10 days whereas JP Morgan (1996) proposed a 95% (i.e. 5% probability of loss or -1.65 standard deviations) within one day. In the following paper we will use predominantly a CL of 99%, 95% and 90% within 1 day and 20 days. Therefore the corresponding VaR of the portfolio will be calculated by using the following formula: VaRp = Formula 9-VaR, Parametric Form £ Position x CL NorNalized Factor x op x √T Where, the £ Position is the gross or net position expressed in the domestic currency (i.e. GBP), the CL normalized factor is the critical value (measured in standard deviations) which corresponds to a certain one-tail probability within a normal distribution. The following figure shows the standard deviations and their corresponding probability within a normal distribution: Figure 3-Normal Distribution Probability Values of the Random Variable 68.26% 95.44% 99.74% 34 Finally, σp is the standard deviation of the portfolio and the holding period of the portfolio of currencies are assumed to be 20 days. As explained by Hull, J. (2006), it can we assumed that random variables (as exchange rates) follow a Markov Stochastic Process13 and that its change in the value during 1 day is φ (0, 1), where φ (μ, σ) is a normally distributed probability function with mean μ and standard deviation σ. Therefore, the change in 20 days will be the sum of 20 normal distributions with mean zero and standard deviation of 114 and since the variable follows the Markovian property, these distributions are independent and their addition will result in a normal distribution with the corresponding sum of means and variances. As a result, the change in the variable over 20 days is φ (0,√20) since its mean is zero and its standard deviation is just the square of its variance which is equal to 20. b. Historical VaR In contrast with the previous approach, there is no assumption behind a particular distribution of portfolio’s returns, however, the assumption that historical information is a good proxy of the future, holds. The empirical histogram of historical returns is used to calculate the lower percentiles of losses and the variance-covariance patterns of different assets are incorporated in the procedure itself. Historical VaR is implemented by following the methodology described by Hull, J. (2006). The first step is to again identify the risk factors or market variables affecting the portfolio which is in our case are the exchange rates movements within the company’s portfolio. Then, 500 observations before June 30th 2010 (starting on July, 30th 2008 as Day 0) were selected. As commented by Jorion, P. (2007), there is always a trade-off between take a series longer enough to be precise but not too long to become irrelevant, therefore, a series between 250 and 750 observations is usually recommended. The daily percentage 13 14 Particular type of stochastic process where only the present value of the variable is relevant to predict the future (Hull, J., 2006). And a variance of 1 since variance= σ2 35 changes in exchange rates values during that period are assumed to occur again during the following 500 days starting on July, 1st 2010. For example, if EUR changed from 1.2723 in Day 0 to 1.2717 in Day 1 hence the change on our first scenario will be the change percentage of the exchange rate multiplied by the exchange rate on our last day of observations (1.2218 on June, 30th 2010) as following: 1.2218 x 1.2717 = 1.2212 1.2723 The same method is assumed for each exchange rate during the following 499 scenarios. Thirdly, the whole portfolio is revaluated by using the corresponding weights (net and gross) and exchange rates for each currency. Appendix C shows the frequency distribution of net position weighted portfolio’s values over the scenarios generated for 500 days ahead. Finally, taking into account the empirical distribution of portfolio’s changes the lower 1, 5 or 10-percentile within the left tail of the distribution (i.e. losses) could be taken. For instance, in the case of 1% (5 out of 500 scenarios), the fifth worst number from value’s changes will be taken. It should be pointed out that this is a daily or 1-day VaR and therefore the 20-day VaR is calculated by multiplying the result by √20 as in the previous approach. c. Monte Carlo VaR In contrast with the previous framework, the assumption that historical information is a good proxy of the future doesn’t hold. We can actually randomly generate a probability distribution for changes in the portfolio’s value and then calculate the lower percentiles of losses. 36 Monte Carlo simulations are implemented by following the methodology explained by Hull, J. (2006) and Jorion, P. (2007). As explained by the latter author, the first step is to assume a particular stochastic behaviour for the financial variable’s prices to be analyzed (i.e. exchange rates in this particular case). In particular, a Geometric Brownian Motion Model will be assumed in this paper. This model is commonly used in order to characterize a stock price process and includes most of the assumptions behind option pricing theory (i.e. Black Scholes model). The model assumes that small changes in prices could be described by the following formula: Formula 10-Geometric Brownian motion Model dSt = µtStdt + otStdz Where, St is the price at time t, µt and ot stand for the expected return and volatility, respectively and dz is a normally distributed random variable with mean zero and variance dt. As explained by the author the model is Brownian in the sense that the variance decrease continuously with time (i.e. there are no jumps) and it is geometric since all other parameters are scaled by the current price. Then, in order to generate scenarios for exchange rates over the assumed time horizon for the company (i.e. 20 days), we can assume that exchange rates follow a lognormal distribution15 and hence, after integrated the last formula (dS/S) over a finite period of time, future exchange rates can be generated by using the following formula 16: Formula 11-Simulated Return’s Generator ST = Stexp ((µ − 0.5o2)T + so√T) 15 However, as described by Hull, J. (2006), it has to be noticed that the lognormal assumption could be not suitable for exchange rates since they usually exhibit jumps (the price doesn’t change smoothly) and it doesn’t exhibit constant volatility. 16 dS is obtained by (ST-St)/St and therefore, the right hand side of the formula will be given by exp ((µ − 0.5o2)T + so√T)-1. 37 Where, μ is the annual expected returns and σ is the annual standard deviation of exchange rates, T is the time horizon and ε is the standard normal random variable. As explained by Hull, J. (2006) a univariate standardized normal distribution could be obtained by the following formula: Formula 12-Univariate Standardized Normal Distribution 12 s = Σ Ri − 6 i=1 Where, Ri are the independent random numbers between 0 and 1. In this paper, as an alternative way, single random numbers are created in excel by using the formula = RAND() and hence a random sample from a standard normal distribution was obtained by using =NORMSINV(RAND()). Then, in order to generate correlated random numbers among all the currencies company’s portfolio (while using net positions), Cholesky decomposition or factorization will be used. This procedure was named after the French mathematician André-Louis Cholesky and stated that any positive definite symmetric matrix (R) can be decomposed into R = LL’ where L is the lower triangular matrix with zeros in the upper right corners. As explained by Hull, J. (2006), the coefficients of the lower matrix have to be selected so that correlations and variances are correct. For instance, if we define three correlated random samples, with the correlation between sample i and j being ρij, as follows: s1 = α11x1, s2 = α21x1 + α22x2 and s3 = α31x1 + α32x2 + α33x23. Hence, we have to set α11 = 1, choose α21 so that α21α11 = q21, choose α22 so that α2 + α2 = 1 and so 21 22 on till choosing α33 so that α2 + α2 + α2 = 1. Then, correlated random numbers can 31 32 33 38 be generated by using: rxL’ where, r is the row vector of random numbers generated for each currency. After generating 500 scenarios by using formula 11, we obtained the change in the portfolio’s value by multiplying changes of each individual exchange rate change by its corresponding weight within the portfolio. Finally, a simulated distribution is obtained and the specific lower quartile is calculated in order to get Monte Carlo VaR for 20 days. The frequency of the resulted distribution for the value of net position weighted portfolio is included in Appendix D. 39 5. Improving VaR: Conditional Value-at-Risk (CVaR) and Stress Testing As mentioned in Chapter 1, VaR doesn’t capture extreme losses with small probability of occurrence and in fact, could have be seen as the minimum loss that could happen since it doesn’t say anything about losses when the threshold given by the selected confidence level is trespassed. Therefore, taking into account the scenarios build for the Historical approach, the Conditional-Value-at-Risk (CVAR) is calculated, at a given confidence level, as the expected loss over the losses which are higher than the historical VaR. In other words, it will be an average of the losses that exceed VaR and hence it will take into consideration the extreme losses (i.e. “fat tails”) within the empirical distribution. As explained by McNeil, A. (1999), the expected shortfall (ES) or CVaR is related to VaR by the following formula: Formula 13-Conditional VaR CVaRq = VaRq + E[X − VaRq|X > VaRq] Where, X corresponds to the losses that occur when the particular quartile q-th is trespassed. Hence the second term of the formula reflects the expected excess losses distribution above the VaRq. Following this methodology, the mean of the excess losses is calculated and added to the original Historical VaR calculated. Another option in order to measure the impact of extreme events over the portfolio of the company is by using a non-statistical risk measure such as Stress Testing. Stress Testing is a sort of Scenario or Sensitivity Analysis to measure the risk under non-normal market conditions (see; Jorion, P., 2007). For instance, a historical scenario of financial turmoil could be taking into account in order to re-evaluate potential losses of the portfolio. 40 In our particular case, for example, the last few years have been a scenario of global market turmoil and therefore the period between July 2008 and July 2009 is taken. The following figure demonstrates that in fact, this period shows the largest episode of volatility (measured by both monthly and yearly standard deviation of exchange rate’s returns) for the two main currencies within the company’s portfolio (i.e. EUR and USD) during almost the last 10 years: Volatility Figure 4-Exchange Rate’s Volatilities Consequently, this period is used in order to calculate the standard deviation and correlations of the portfolio’s currencies. Finally, a Parametric VaR is obtained by using current weights along with these stressed parameters. 41 6. Hedging the Portfolio: Options and Forwards a. Definitions EUR/GBP and USD/GBP are not only two of the most liquid exchange rates traded in the FX markets but also they are the main FX risk factors of the company’s portfolio. In fact, as the correlation matrix, used for portfolio optimization, shown (Attached in Appendix E), all of the currencies including in the portfolio have a positive and relatively high correlation with USD and EUR. For the previous reasons, for the purpose of hedging the company’s portfolio against exchange risk, only EUR and USD financial instruments are considered. In particular, we will analyse the case of hedging with both FX Options and FX Forwards. Both of them are financial derivatives and therefore their values are derived from the price’s movements of a particular underlying asset (i.e. exchange rates in this particular case). It also involves a transaction today but with a future settlement date at a pre- established price. In the case of forwards, a company agrees with a commercial bank to exchange a specified amount of a currency at a specified exchange rate (i.e. forward rate) on a specified date in the future. Forward contracts are often valued at £ 1 million and trade in maturities up to 12 months and in the over-the-counter (OTC) market (i.e. private agreement between two parties like banks and companies). When a company anticipated need of hedging for a future receipt (i.e. long position) or payment (i.e. short position) of foreign currency, they can sell forward contracts or buy forwards contracts, respectively in order to “lock in” the exchange rate in the future. It has to be noted that futures contracts have the same dynamic as forwards however, they differ from forwards since future contracts are standardized in terms of size, futures have fixed maturities, and they are traded in organized exchanges with a need for initial margins. 42 On the other hand, a FX option is a contract giving the company (the buyer) the right, but not the obligation, to buy (i.e. call option) or sell (i.e. put option) a given amount of currency at a fixed price (i.e. exercise or strike price) until the maturity date. There is a difference between European Options and American options since the first one could be exercised only on its expiration date and not before as in the case of the American options. Currency options are traded in the OTC market and in the Philadelphia Stock Exchange in the U.S. When a company is due to receive foreign currency in the future, it can hedge its FX exposure by buying FX put options in that currency with the same maturity date in the future while when the company is due to pay in foreign currency, the hedge can be done by buying call options. In the particular case of this company, it has a long position of EUR and a short position of USD and hence they will be hedge by short forwards/long a put and long forwards/long a call, respectively. The length of the contracts will be assumed to be one month as the company resets its position (income/expenditures) on a monthly basis. Finally it has to be highlighted that by hedging with forwards, futures or options, the company is able to guarantee the value or cost of the foreign currency at a certain point in time in the future. However, since the FX option gives the company the right but not the obligation to buy or sell the foreign currency, it also allows the company to benefit from favorable exchange rate movement while forwards or futures don’t give that flexibility. This sort of insurance given by options has a cost which is reflected in the premium, cost or price of the option. 43 b. Derivatives Valuation and Optimal Hedge The value of a forward exchange rate is derived from the interest rate parity condition, by adjusting the spot rate with the interest rate differential between the foreign and domestic currencies, as described in the following formula: Formula 14-Forward Exchange Rate FO = SO e (r–rf )T Where, F0 is the forward exchange rate, S0 is the spot exchange rate, r the domestic interest rate, rf is the foreign interest rate and T the time of the contract. On the other hand, as showed by Hull, J. (2006), the optimal hedge ratio-h* (or the minimum variance hedge ratio) while using futures, is obtained by the following formula: Formula 15-Optimal Hedge ℎ∗ = q oS oF Where, ρ is the coefficient of correlation between the change in spot rate and the change in forward rates, σS and σF is the standard deviation of the change in the spot and forward rate respectively. In this particular case, an h*= 1 can be assumed i.e. It is assumed that futures price mirrors the spot price perfectly and hence has a delta “δ” (defined as the rate of change in the value of the derivative with respect to the change of the underlying asset, dF/dS) of 1. In fact, Hull, J. (2006) has demonstrated that in the case of a forward contract on a non- dividendpaying stock, the value of delta is always equal to one and there is no need of change the hedge ratio during the life of the contract (this is called hedge-and-forget 44 schemes). Moreover, in the case of FX forwards the same author shows that the forward contract’s delta is e –rf T and as it will be shown in a following Chapter, a delta of 1 is found for both EUR and USD forward contracts. On the other hand, in order to value FX options, the Black-Scholes Model (BSM) is used. As showed by Hull, J. (2006), the following model provides the pricing formulas for currency options: Formula 16-Call and Put Valuation Model (BSM) c = SO e –rf T N(d1 ) − Ke –rT N(d2 ) p = Ke –rT N(−d2 ) − SO e –rf T N(d1 ) Where, d1 = ln(SO/K) + (r − rf − o/2)T o√T d2 = d1 − o√T And, S0 is the spot exchange rate, K is the strike price, c is the call option price, p is the put option price, r is the domestic risk-free interest rate, rf is the foreign risk-free interest rate, T is the time to maturity (in years), σ is the Standard deviation of exchange rates (annualized) and N (.) is the Cumulative Normal Probability Distribution. As in the case of forwards, a delta hedge will be assumed for the case of options. Therefore, as showed in Hull, J. (2006), the delta of a FX call option is calculated by using e –rf T N(d1 ) and the delta of a put option on a currency will be given by[N(d1 ) − 1]e –rf T . 45 c. Reassessing the risk of the hedged portfolio Two approaches are implemented in order to recalculate the VaR of both a portfolio hedged with forwards and a second one hedged with options. First, the Linear Model and Options developed by Hull, J. (2007) is applied and hence the change of the portfolio’s value, ∆P, is given by the following formula: Formula 17-Portfolio Value, Linear Model n ∆P = Σ Siði∆xi i=1 Where, Si is the current exchange rate for currency i, δi is the delta of the portfolio with respect to currency i and ∆Xi is the GBP change of the exchange rate. Therefore, the original weights (as in June, 30th 2010) could be adjusted by the delta of forwards and options to be bought. After that, the standard deviation of the portfolio could be calculated by using formula 5 and, finally, by setting a confidence level, Parametric VaR could be obtained for both cases (i.e. forwards and options). For instance, in the case of forwards, a full hedge will be assumed at the beginning of the contract. Therefore, current position’s weights in EUR and USD within the portfolio will be fully offset by taking the inverse positions in forwards. While in the case of options, the short position in USD will be partially offset by a positive delta of a call option whereas the long position will be partially offset by the negative delta of a put option. However, it has to be pointed out that by assuming this linear approach, only a static analysis could be done and moreover, this new risk measure will include only the hedge of the current portfolio without taking into account potential profit/losses generated by new positions in the portfolios of forwards and options. Therefore, also a scenario/dynamic hedge approach is implemented by taking the scenarios already built for the calculation of 46 the Historical VaR. This method is in line with the difference between partial valuation and full valuation VaR models explained by Jorion, P. (2007). The first type of models such us the parametric VaR (delta-normal approach) doesn’t take into account non-linear pay-offs of financial instruments (e.g. options and mortgages) and therefore underestimate the VaR measure whereas full valuation models like Historical or Monte Carlo VaR do take into consideration non-linear exposures and even capture Gamma and Vega risk17. Therefore, by assuming a full hedge made at the end of June 2010, the payoffs of both forwards and options are calculated during the life of the monthly contracts across the daily 500 scenarios and then the portfolio’s value is adjusted by including any gain or loss derived from the derivative’s portfolio. In particular, the payoff on a long call and a long put at time T are calculated by the following formulas: max (ST – K, 0) and max (K – ST, 0), respectively where, ST is the spot exchange rate at time T, and K is the strike price. Whereas the payoffs of a long and short forward are calculated by the following differences: ST - F and F - ST, respectively and where, F is the forward exchange rate. So that, the flexibility embedded in the options contracts will be taken into account since any spot exchange rate’s movement against the strike price will have a payoff of zero whereas in the case of forwards this movement will have a negative impact over the forwards portfolio’s value. The following figure shows the limited potential loss (downside protection) given by call options and the larger potential lose that could occur when hedging by buying forwards (the blue line represents the pay-offs given by the option and the pointed line represented the pay-offs derived from the forward): 17 Gamma is defined as the second derivative of the value function with respect to the underlying asset and Vega as the derivative of the option value with respect to the volatility of the underlying asset. 47 Figure 5-Derivative’s Pay-offs Pay-off Unlimited potential gain Premium Option Limited potential loss Breakeven price Forward Potential Loss 48 Chapter 4 ANALYSIS OF RESULTS AND DISCUSSION 1. Regression Analysis Results By looking at the first ten main currencies within the firm’s portfolio (approximately 80% of portfolio’s gross position), we found that all the coefficients are significant at 1% with only two exceptions (BRL and ZAR). Not surprisingly, USD and EUR are within the top 5 currencies which variation has a positive effect over the variation of Cash Flows with coefficients of 0.98 and 0.51, respectively. This result is positively correlated with the large weights of these currencies within the portfolio. However, in the case of currencies like BDT, PKR, PHP, KES and XOF, their considerable positive effect over the variability of Cash Flows might be explained by their particular importance within receiving funding (income) or projects implementations (expenditure). It has to be noted that all coefficients are positive since all exchange rate’s variations were calculated from indirect quotes (as explained in the third chapter) and therefore an exchange rate’s positive movement means a depreciation of the foreign currency in relation to GBP and consequently a positive effect over cash flows (denominated in GBP). As explained by Madura, J. (2007), these sensitivities of cash flows to exchange rates could be a good proxy of future relationships as long as the operating structure (income/expenditure structure) of the company doesn’t suffer big changes. That seems to be the case of this particular company since both the origin of funding and project’s implementation expenditures, seems to be stable during long periods of time. The following table summarizes main findings of the analysis: 49 Currency USD BDT PKR PHP EUR KES XOF UGX BRL ZAR Coefficient 0.976513 0.771494 0.767494 0.569952 0.513695 0.482161 0.45889 0.42862 0.141711 0.037586 Table 3-Regression Results Std. Error t-Statistic 0.113087 8.635023 0.115368 6.687223 0.145406 5.278267 0.14217 4.008947 0.183969 2.792295 0.130344 3.69914 0.179002 2.563598 0.129914 3.29926 0.119961 1.181314 0.114259 0.328956 Prob. 0.00000 0.00000 0.00000 0.00020 0.00750 0.00060 0.01360 0.00190 0.24330 0.74360 Weight 43.4% 1.7% 3.1% 3.5% 18.8% 3.1% 2.5% 2.1% 2.3% 1.9% Finally, Appendix F includes individual E-views outcomes of regression analysis. All the models show to be significant as a whole by looking at the F-test and there seems to be no serial correlation problems by looking at the Durbin-Watson tests (i.e. all values near to 2). Also, independent variables show good explanatory power since models show high R 2 results are higher (at least for the main currencies in terms of weight within the portfolio). However, this analysis is not taking into account the joint effect of exchange rates over cash flow’s variation and hence R2 is not a key reference. 50 2. Portfolio Optimisation Results Daily Returns and Standard Deviations of the company’s current portfolio were calculated by using formulas 4 and 5, showed in the previous chapter. Currently, the company’s currency portfolio has a return of 0.016% with a standard deviation of 0.54%. Then, and as commented in the Methodology section, the first optimisation exercise was carried out by taking Income positions as weights of the currencies’ portfolio. At first short selling is constrained. The following table show the combination of σp and E(Rp) for different portfolios sorted from the MVP to the MRP. The last three portfolios show the optimal portfolios when the level of risk aversion is 10, 5 and 1, respectively: Table 4-MVA, Income Weights σ 0.47% E(Rp) 0.020% 0.48% 0.025% 0.48% 0.030% 0.49% 0.040% 0.51% 0.050% 0.54% 0.060% 0.61% 0.070% 0.66% 0.79% 0.89% 0.074% 0.081% 0.084% Graphically, the efficient frontier is defined by the following concave function. Blue points show the optimal portfolios for the three different levels of risk aversion: 51 Figure 6-Efficient Frontier, Income Weights Expected Return Efficient Frontier and Optimal Portfolios (under short selling constraints) Current Portfolio It has to be pointed out that the MRP is the same as the portfolio with lower level of risk aversion (i.e. when A=1). That is explained by the fact that a higher expected return is always accompanied for the corresponding higher level of risk taken. Results also show that the current portfolio of the Company is inefficient since with the same level of risk already taken by the company (i.e. σ=0.54%), a higher level of return could be obtained (i.e. 0.06% vs. 0.016%). In other words, a lower level of risk (less than 0.47%) could be taken in order to get the same level of return (0.15%). The following table show the comparison between the current weights and the ones needed to get an efficient riskreturn combination (i.e. 0.054%, 0.06%)18. 18 Appendix G shows all the optimal weights for every corresponding level of Expected Return. 52 Table 5-MVA, Efficient Income Weights Curr. Code Original Weight Rp=0.06% AFO AUD BDT BRL CAD COP EUR HTG ILS INR KES NPR PHP PKR SLL TZS USD XOF YER ZAR 0.00% 0.86% 0.68% 2.01% 0.94% 0.01% 43.20% 0.11% 0.22% 0.96% 0.03% 0.00% 0.06% 2.14% 0.19% 0.26% 47.71% 0.02% 0.12% 0.47% 25.9% 8.9% 6.7% 16.3% 13.1% 10.3% 0.0% 4.7% 0.0% 0.0% 0.0% 10.2% 3.8% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% TOTAL 100.00% 100.00% It is clear that due to their higher historical returns and lower correlations, the company could start investing more in currencies like Brazilian Pesos (BRL), Canadian Dollars (CAD) or Colombian Pesos (COP). In fact, as showed in Appendix G, even if we assumed a high level of risk aversion for the company (i.e. A=10), the optimal portfolio with a risk-return combination of 0.66%-0.074% indicates that approximately 85% of the funding received by the company should be invested in these three currencies. However, considering that i) FX trading is not a core competence of the company, ii) the difficulties which could arise when looking for a liquid market makers in order to trade with emerging economies’ currencies and that iii) Euro (EUR) and U.S Dollars (USD) represents more than 90% of its assets, optimal portfolios were also found by using the four main currencies within the current portfolio (only EUR, UDS, BRL and Pakistan Rupee- PKR counts for approximately 95% of total assets within the portfolio). 53 The risk-return combination of the current portfolio of these four currencies is 0.61%0.015% (even lower than the whole portfolio return). Again, after solving the optimisation problem we found that the current company’s portfolio is inefficient since a higher level of return could be obtained (0.052%) by taking the same level of risk. Also, we found that the optimal portfolio with high level of risk aversion (i.e. A=10) has a risk-return combination of 0.66%-0.06%. Once more, a suggested switch from a currency with negative short term historical return (i.e. EUR) to a more profitable asset like BRL is the main finding. However, in any case, MNGO could minimize its current risk and even increase its return by allocating the investments according to the structure of the MVP which would give risk- return combination of 0.52%-0.019% and which also includes less risky currencies such us EUR. The following table shows a summary of the results including the weights obtained by solving the optimisation problem: Portfolios Current W Efficient W MVP MRP Max U (A=10) USD 50.19% 56.89% 14.16% 0.00% 3.26% Table 6- MVA, Main Currencies EUR PKR BRL 45.44% 2.25% 2.11% 0.00% 0.00% 43.11% 51.38% 6.31% 28.15% 0.00% 0.00% 100.00% 0.00% 0.00% 96.74% σ 0.61% 0.61% 0.52% 0.675% 0.659% Rp 0.015% 0.052% 0.019% 0.070% 0.069% Also, the following figure shows the potential strategies that the company could follow to optimise its FX portfolio. They can move from their current portfolio to either an MVP (which reduces its risk considerable and even increases its return) or to a more efficient portfolio (i.e. more return for the same current level of risk taken): 54 Figure 7-Portfolio’s Comparison, Main Currencies Expected Return Main Currencies' Portfolio Comparison a. Allowing Short Selling As we have seen in both of the cases analysed earlier, MRP are obtained by investing all the income funding in currencies with the highest historical return such us COP (0.084%) and BRL (0.07%). The reason is due to short selling constraints. By relaxing this restriction, a company theoretically could take a short position in one currency (e.g. borrow a specific amount of money in that currency) and then invest more money in a more profitable asset. Both the following table and figure show the different combinations of risk-return for each corresponding efficient portfolio (sorted from the MVP to the MRP) within the efficient frontier: 55 Table 7-MVA, short selling σ 0.467% 0.468% 0.469% 0.472% 0.476% 0.481% 0.484% E(Rp) 0.030% 0.040% 0.050% 0.060% 0.070% 0.080% 0.084% Figure 8-Efficient Frontier, Short Selling Expected Return Efficient Frontier and Optimal Portfolios (without short selling constraints) It is possible to see that by allowing for short selling strategies, a company could obtain even higher levels of return by taken the same levels of risk while comparing with the constrained efficient frontier (Figure 6). For instance, the MRP could be obtained by assuming a standard deviation of only 0.49% vs. the 0.89% needed when restricted for short selling. 56 In fact, the current portfolio is still inefficient (and even more far from the efficient frontier) since a well higher return (0.13% vs. 0.015%) could be obtained by taking the same level of risk according to the optimization solution. The weights obtained for the latter comparison are showed in the following table while the total numbers of portfolios within the efficient frontier is show in Appendix H. Table 8-Efficient Income Weights, Short Selling Curr. Code Income Current W Rp= 0.13% AFO AUD BDT BRL CAD COP EUR HTG ILS INR KES NPR PHP PKR SLL TZS USD XOF YER ZAR £ 516.19 £ 133,847.74 £ 105,993.66 £ 311,944.46 £ 146,476.86 £ 971.53 £ 6,705,768.16 £ 16,711.34 £ 33,549.55 £ 149,507.61 £ 5,420.38 £ 501.82 £ 8,583.53 £ 331,836.58 £ 29,266.44 £ 40,654.23 £ 7,406,410.15 £ 3,829.68 £ 18,622.95 £ 73,386.52 0.00% 0.86% 0.68% 2.01% 0.94% 0.01% 43.20% 0.11% 0.22% 0.96% 0.03% 0.00% 0.06% 2.14% 0.19% 0.26% 47.71% 0.02% 0.12% 0.47% 18.1% 9.2% 96.1% 13.1% 3.5% -1.2% -14.4% 95.5% -1.8% -9.7% -15.9% 11.3% 7.1% -4.7% -31.5% -18.3% 57.1% 41.3% -160.8% 6.2% TOTAL £15,523,799.38 100.00% 100.0% As commented before, the company could take short positions in a number of different currencies in order to invest more in more profitable currencies. 57 3. Value-at-Risk Results a. Parametric VaR results According to the Parametric VaR results, there is 99% chance that the portfolio will not lose more than £295k (1.25%) in the following day and not more than £1.3m (5.6%) over the following 20 working days (i.e. month) after the end of the analyzed period. In other words, there is 1% chance than the portfolio could lose more than these amounts over 1 and 20 days, respectively. The following table summarizes the findings of the current VaR of the company in terms of FX risk exposure. As commented in the last chapter, the analysis of VaR in terms of GBP would be more accurate if we take values as a percentage of the absolute net position since it does take into account the offset effect between income and expenditures denominated in the same currency during the analyzed period. Table 9-Parametric VaR Results Position Denom. % GBP Gross % Net GBP 90% (Factor: 1.28σ) Daily Monthly 0.7% 3.2% 314,415 1,406,106 0.7% 3.1% 163,006 728,987 95% (1.64σ) Daily Monthly 0.9% 4.1% 403,547 1,804,718 0.9% 4.0% 209,217 935,645 99% (2.33σ) Daily Monthly 1.3% 5.9% 570,744 2,552,447 1.3% 5.6% 295,899 1,323,300 The table shows that the VaR increases while moving to the left hand side of the assumed normal distribution (from 90% to 99% of confidence level) of the FX returns of the company. For instance, daily VaR increases from £163k (0.7%) to £295k (1.3%). Graphically, after assume that 1-day exchange rate’s returns within the portfolio are normally distributed, we can look at the values that corresponds to 1%, 5% and 10% left tails: 58 Figure 9- Parametric VaR Results, Distribution Probability 1-day : -1.3% -0.9% -0.7% 20-day: -5.6% -4% -3.1% Portfolio’s Returns It has to be noted that the figures presented here are Relative VaR figures since the actual expected return of the portfolio is ignored (i.e. the mean of returns is assumed as zero). However, the expected return can be incorporated by calculating the Absolute VaR which is just the difference between the Relative VaR and the expected return and therefore typically makes a small difference. For instance, since the expected return of the portfolio is 0.023%, the Absolute 20-day 99% VaR for the portfolio would be: 5.61%-0.023%*20 = 5.15%. Finally, from the analysis of the data it is possible to calculate the benefits of diversification given by the current portfolio of the firm. As we have seen in the first chapter of this paper, Markowitz, H. (1952) has been one of the first authors to study the benefits of diversification. If the correlation between all of the currencies within the firm’s portfolio were perfect (i.e. equal to 1), the VaR of the portfolio including these currencies should be equal to the sum of the individual VaRs for each currency (See also: Hull, J., 2006). However, as Markowitz showed, since the correlation between all the currencies is less than 1, there is a benefit of diversification as showed in the following table. All individual VaR’s results are shown in Appendix I. 59 Table 10-Parametric VaR, Benefits of Diversification VaR Sum of individual VaRs VaR of the Portoflio Benefits of diversification 1-day 99% VaR£ £ 390,258 £ 295,899 £ 94,359 20-day 99% VaR£ £ 1,745,288 £ 1,323,300 £ 421,988 Therefore, there is a benefit of diversification of around £94k and £422k for 1-day and 20day VaR, respectively. This is obtained by calculating the difference between the sum of individual VaRs and the VaR of the diversified portfolio19. b. Historical VaR results According to the Historical VaR, firm’s FX risk exposure is even higher than the one obtained with the previous approach20. For instance, by analyzing net positions, the 1-day 99% VaR is around £420k (1.8%) whereas the 20-day 99% VaR falls around £1.9m (8.0%). So that there is 1% chances that the portfolio could lose more than these amounts over 1 and 20 days, respectively. The following table summarizes the findings of the current VaR of the company in terms of FX risk exposure. Table 11-Historical VaR Results Position Denom. % GBP Gross % GBP Net 90% (Factor: 1.28σ) Daily Monthly 0.6% 2.7% 262,785 1,175,209 1.0% 4.3% 227,675 1,018,195 95% (1.64σ) Daily Monthly 0.9% 4.0% 386,993 1,730,684 1.3% 5.9% 311,756 1,394,217 99% (2.33σ) Daily Monthly 1.4% 6.3% 610,208 2,728,933 1.8% 8.0% 420,347 1,879,849 As under the parametric approach, the previous table shows that the VaR increases while moving to the left hand side of the distribution (from 90% to 99% of confidence level) of the FX returns of the company. As an example, daily VaR increases from £228k (1.0%) to 19 However, as showed in the first Chapter, sin VaR is not a “coherent” measure of risk; it could happen that the VaR of a portfolio could be larger than the sum of risk measures VaRs of its components. 20 A further comparison between each approach is included in a following section. 60 £312k (1.3%) while moving from a 90% to a 95% of confidence level. However, in contrast with the parametric approach, the distribution is not assumed as normal but instead it assumes an empirical distribution taken from historical information of exchange rate’s movements. Therefore, we can look at the values that correspond to 1%, 5% and 10% left tails of this particular distribution. In particular, the following figure shows the 1% tail with the corresponding 1-day 99% VaR and the observations that lie in the space after the threshold of 1% (i.e. evidence of “fat tail”): Figure 10-Historical VaR Results, Distribution Empirical Histogram 90 80 70 Frequency 60 50 40 30 1-Day 99%VaR: -£420k 20 10 "Fat Tail" 1% Portfolio's Value in GBP 61 c. Monte Carlo VaR results The implementation of Monte Carlo simulations was done by taking only net position weights within the firm’s portfolio. The following table summarizes the main results at 90%, 95% and 99% of confidence level: Table 12-Monte Carlo VaR Results monthly Conf. Level 90% (1.28σ) 95% (1.64σ) 99% (2.33σ) % 2.5% 3.7% 5.3% daily GBP 589,629 876,764 1,241,011 % 0.6% 0.8% 1.2% GBP 131,845 196,050 277,498 The results show that the Parametric and Monte Carlo approaches give virtually the same current firm’s FX risk exposure. According to the latter, there is 1 in 100 chance that the portfolio could lose more than £ 277k (1.2%) on a daily basis and more than £1.2m (5.3%) over the following 20 working days (i.e. monthly basis) after the end of June 2010. As in the historical approach there is no assumption behind the distribution of exchange rate’s returns (i.e. it could be non-normal). As explained in Chapter 3, the first step was to choose a model in order to simulate the stochastic behaviors of exchange rates and finally according to the simulations, the distribution could be obtained. For instance, the following figure shows the simulated distributions of portfolio’s returns and the 1% left tail with the corresponding VaR value (as in the previous case, there is evidence of a “fat tail” with values lower than -5.3%): 62 Figure 11-Monte Carlo VaR Results, Distribution Simulated Histogram 60 50 Frequency 40 30 20 1-Day 99%VaR: -5.3% 10 %Changes in Portfolio's Value d. A comparison between different approaches and their results In terms of practicability, the parametric approach is the easiest and fastest way to implement a VaR model while keeping it easily updated with latest market information and also its concept is easy to understand when explaining it to different levels of professionals within the company. On the other hand, both the Historical and Monte Carlo approaches involve quite large computational and programming effort and even more they could lead to operational risks derived from human errors where implementing them. However, the main disadvantage of the Parametric VaR is the assumption of normality behind the distributions of asset’s returns. In fact, as we have seen in the previous section, both historical and simulated distributions are able to capture “fat tails” since they are not normal distributions by construction as in the case of the parametric one. 63 In terms of our results, the Historical VaR seems to be the highest since the outcome rely on recent historical information. As we have seen in figure 4, the period taken for this approach includes most of the last crisis volatilities and therefore the higher VaR is related to the higher standard deviation of the portfolio. On the other hand, Parametric and Monte Carlo approaches show pretty much the same level of risk. This is explained by the fact that the portfolio doesn’t include non-linear instruments (i.e. options) and therefore, in this particular case, there is no difference between partial and full valuation VaR models as explained in the previous Chapter. However, as it could be seen in the previous section, Monte Carlo approach allows us to assess potential “fat tails” of the distribution whereas Parametric VaR doesn’t. The following table and figure summarize the latter comparison between models. For instance, the 99% Monthly Historical VaR (red bar) is around 8% while the Parametric and Monte Carlo (blue and green bars) are around 5.6% and 5.3%, respectively: Table 13-Comparison of VaR Results Approach Parametric Historical Monte Carlo 90% (Factor: 1.28σ) Daily Monthly 0.7% 3.1% 1.0% 4.3% 0.6% 2.5% 95% (1.64σ) Daily Monthly 0.9% 4.0% 1.3% 5.9% 0.8% 3.7% 64 99% (2.33σ) Daily Monthly 1.3% 5.6% 1.8% 8.0% 1.2% 5.3% Figure 12-VaR % Results Comparison VaR % VaR Results Comparison Monthly Monthly Historical 65 Monthly 4. CVaR and Stress Testing results As commented in Chapter 3, CVaR is calculated in order to take into account potential extreme losses or “fat tails” in the distributions of the portfolio returns and as it could have been seen in figures 10 and 11, firm’s current portfolio show this situation. By using the methodology already explained before, we define VaRq (where q=1%) as the 1-day 99% Historical VaR (i.e. around £420k). The, we define the vector X as all the losses that are higher than VaR as shown in the following table: Table 14-CVaR Results X£ Diff: X-VaR1% 587,958 167,611 484,559 64,212 482,047 61,700 470,637 50,290 444,029 23,682 E[Diff] 73,499 VaR1% 1-day CVaR 20-day CVaR 420,347 493,846 2,208,547 The expected (i.e. mean) difference between the vector of these extreme losses and the actual VaR is the additional Expected Shortfall which is added to the traditional VaR. As a result, a higher and therefore more conservative measure of risk is obtained. As showed in the previous table the 1-Day CVaR is now around £494K and the corresponding monthly CVaR is approximately £2.2m (vs. £1.9m obtained by using the “normal” measure of VaR). CVaR is a way to answer the question: “how much can we expect to lose if things go bad?” and is important for a more prudent company’s FX risk management. Another important non-statistical approach to risk that could help to improve firm’s risk management systems is the Stress Testing. As commented in the previous Chapter, the 66 period between July 2008 and July 2009 is taken as the stress scenario and the portfolio variance is recalculated by using the Parametric VaR framework. The results showed an increase of 0.17% in the daily portfolio variance by moving from 0.54% to 0.71% under the stress scenario. Moreover, the daily VaR and monthly VaR increases in 95k and 423k, respectively under the new scenario as showed in the following table and figure: Table 15-Stress Testing Results VaR 1-Day 99%VaR 20-Day 99%VaR Stressed VaR % GBP 1.7% 390,456 7.4% 1,746,174 Differences % GBP 0.4% 94,558 1.8% 422,874 Figure 13-Stress Testing Results Thousands GPB Stress Testing Therefore, if the last crisis scenario repeats in the near future, there is 1% chance that the company loses an additional 1.8% of its net positions during the following month. Again, the company could set a number of different scenarios in order to build a more prudent risk management system. 67 5. Portfolio Hedging Results a. Valuation The following table summarizes the results obtained for the valuation of USD and EUR options and forwards: Table 16-Derivative’s Valuation Derivatives S X USD 0.6689 0.6689 EUR 0.8185 0.8185 rd 0.67% 0.67% rf T σ N(d1) N(d2) Call Value Put Value Delta Call Delta Put 0.45% 0.0833 10.71% 50.85% 49.62% 0.83% -0.83% 50.83% -49.13% 0.78% 0.0833 9.12% 50.39% 49.34% 0.86% -0.86% 50.35% -49.58% Forward Price Delta Forward 0.6691 100.0% 0.8184 99.9% By using formulas 14 and 15, forward exchange rate is obtained (very close to the current spot price, since the period taken is only one month or 0.083 years) along with the optimal hedge which, as commented earlier, is almost 1 for both cases. Also, by using BSM (formula 16), a value of a USD call options is found to be 0.83 and the value of a EUR put option is found to be 0.86. Also, Delta of the USD call option is around 51% and delta of the EUR put option is around -50%. Volatility figure has been annualized and rf shows the risk free rate for USD and EUR, respectively. 68 b. Risk measures after hedging Results show that after hedging the portfolio with either FX Forwards or FX Options for USD and EUR net positions, the VaR measure diminishes considerable. The following table summarizes these results for both the Parametric and the Historical approaches: Table 17-Hedged VaR Comparison VaR Parametric VaR Options VaR Forward VaR Historical VaR Options VaR Forward VaR 1-Day 99% VaR £ 295,899 £ 240,033 £ 187,140 20-Day 99% VaR £ 1,323,300 £ 1,073,462 £ 836,917 £ £ £ £ £ £ 420,347 370,538 413,255 1,879,849 1,657,095 1,848,133 It is showed that, by using the linear model and the parametric (delta-normal) VaR, forwards reduce the monthly FX risk exposure of the currency firm’s portfolio in approximately £489k whereas by hedging with options, the hedge is only around £250k. On the other hand, when implementing the full valuation methodology by using Historical VaR approach, the GBP hedge reached by using a portfolio of options is still around £223k while the hedge given by forwards reduces to only £31k of the monthly FX firm’s exposure. As explained in the previous chapter, the latter methodology allow us to take into account non-linear payoff as those calculated in the case of options and therefore it takes into consideration the fact that by using options, the company could limit a potential downside loss and take benefit from favorable exchange rates movements. The following figure remarks the latter difference, it could be seen that under a partial valuation model, hedging with forwards seems to be the best option by reducing VaR in 0.46% of net positions, however, by using a full valuation model, the best choice is hedging by options since it reduces the value-at-risk of the portfolio in 0.21%: 69 Figure 14-Hedged and Non-hedged Portfolio Comparison Hedged Portfolio VaR 2.00% 1.78% 1.75% 1.75% 1.57% % Net Position 1.50% 1.25% 1.25% 1.02% 1.00% 0.79% 0.75% 0.50% 0.25% 0.00% Unhedged VaR Options VaR Forward VaR Unhedged VaR Options VaR Partial-Valuation Model Forward VaR Full-Valuation Model One real-life example could be useful to show not only hedging tools and mechanisms but also to clearly state the difference between options and forwards. In particular, MNGO has a current short position of -USD 5,979,600 (GBP 4m converted at the spot price on June, 30th). If the company decides to hedge the position it should take the inverse position (i.e. long/buy) in derivatives. Therefore, a long position in call options and forwards is analyzing along with the decision of not to hedge. In the case of Options, the company has to pay a premium for that. According to the Nasdaq stock exchange21 each contract of USD/GBP Options is of USD 10,000 (we rounded to 600 contracts as the amount to be hedged is around USD 6m) and a premium of approximately USD 100 (100 points) per contract. In the case of forwards there is no need for premiums except for potential commissions in the OTC market (private agreements with commercial banks) that won’t be taking into consideration. Finally, we assume a 21 http://www.nasdaq.com/includes/british-pound-specifications.stm 70 strike price equal to the current spot price to make the comparison straightforward. The results of the scenario analysis are summarized in the following table. The figures showed in both scenarios are the amounts of USD received in each case whereas the “Hedge Payoff” is the difference between these amounts and the original position for each scenario. Table 18-Derivative’s Hedging So = 0.6689 K (GBP/USD) No. Contracts Premium Scenario 1 (+5%) Scenario 2 (-5%) Hedge Pay-off S1 Hedge Pay-off S2 Unhedge - Options 0.6689 600 60,000 5,694,857 5,979,600 6,294,316 6,294,316 284,743 60,000 314,716 254,716 Forwards 0.6689 Customized 5,979,600 5,979,600 - As showed in the table, under the scenario of a 5% appreciation of the USD (or a higher GBP/USD exchange rate), the company fully off-set its short position in USD by buying USD at a cheaper (strike/forward) price than the spot price (0.7024) in the case of both derivatives (with a premium paid up front for Options) whereas if the company decides not to hedge, it could lose USD 285k in regards of FX Risk by buying dollars at a more expensive price than in the spot market. On the other hand, an appreciation of USD shows that by hedging with forwards, the position continues to be fully offset in comparison with the position and time zero (that means actually a negative payoff in the forward transaction, obtained by calculating the difference between ST and K); however, by using Options, the company could actually make a profit by not exercising the option and go to the spot market. It has to be highlighted though that counterparty risk22 should be also considered in the risk assessment of this operation. This profit equals the money exchanged at a 5% cheaper 22 Is the possibility that one of the parties within the contract could default on its debt obligations before or at the liquidation’s date. In the case of derivatives, this is a bilateral risk since derivatives market value could be positive or negative for both counterparties, irrespectively. 71 price in the spot market minus the USD 60k premium paid up front (resulting in USD 255k approximately). Therefore, as noted earlier, while considered all the scenarios and taking into consideration the non-linear pay-offs of FX options, it is possible to realize that Options, after paying a premium, could give the MNGO the flexibility of protecting its downside risk while also taking the benefits of an upside movement in exchange rates. In the following Chapter, we will discuss main conclusions, recommendations and limitations derived from the comprehensive analysis made throughout this paper. 72 Chapter 5 CONCLUSIONS, RECOMMENDATIONS AND CRITIQUE According to their weights within the portfolio and also from the sensitivity analysis’ results, it is clear that the main FX risk factors for the company are exchange rate movements in EUR and USD hence, and taking advantage of the liquid markets for those currencies, an efficient hedge in EUR and USD could protect the entire firm’s portfolio from FX risk. However, since the portfolio includes a large number of currencies, the assessment of firm’s FX risk also includes correlations and dynamics between all the currencies within the portfolio. First, MVA results show that the current distribution of the portfolio is not efficient (i.e. a higher level of return could be obtained by taking the same current level of risk and by switching the composition of the portfolio). Despite the fact that it is usually complicated for the company to select the currency of donations and that FX trading is not its core competence, it is pertinent to recommend that the company uses MVA as a guideline of FX portfolio’s efficiency. In fact, when analyzing the portfolio of main currencies, the company could reduce its current FX risk exposure from 9.7% p.a. to 8.2% p.a. by taking the composition suggested by the Minimum Variance Portfolio (MVP) which even could give MNGO an annual return of 4.8% (higher than the current 3.8%). This new portfolio includes approximately 65% of its weights distributed between USD and EUR as showed in table 6. Even more, the company could receive a 13.2% of annual return with the current level of risk by compose the portfolio as suggested by the optimization problem solution. Second, as commented before, parametric VaR could be the easiest way to implement an FX risk measure, however, Historical and Monte Carlo VaR would help to identify potential kurtosis of the distribution (i.e. the presence of “fat tails”) since they don’t assume return’s normal distribution. In terms of results, the Historical VaR seems to be the highest since the outcome rely on recent historical information (i.e. last financial crisis). 1-day 99% 73 historical VaR is around £420k (1.8%) whereas the 20-day 99% VaR falls around £1.9m (8.0%). So that there is 1% chances that the portfolio could lose, because exchange rate movements, more than these amount over 1 and 20 days, respectively. On the other hand, Parametric and Monte Carlo approaches show pretty much the same level of risk. This is explained by the fact that the portfolio doesn’t include non-linear instruments. According to the Parametric VaR results, there is 99% chance that the portfolio will not lose more than £295k (1.25%) in the following day and not more than £1.3m (5.6%) over the following 20 working days (i.e. month) after the end of the analyzed period. According to the Monte Carlo simulation, there is 1 in 100 chance that the portfolio could lose more than £ 277k (1.2%) on a daily basis and more than £1.2m (5.3%) over the following 20 working days (i.e. monthly basis). To take into account “fat tails”, CVaR is also calculated and the results showed that the 1Day CVaR is now around £494K and the corresponding monthly CVaR is approximately £2.2m (vs. £1.9m obtained by using the “normal” measure of Historical VaR). Another important non-statistical approach to risk that could help to improve firm’s risk management systems is the Stress Testing. Hence, we found that if the last crisis scenario repeats in the near future, there is 1% chance that the company loses an additional 1.8% of its net positions during the following month. These results are meaningful in terms of applicability for the company since they could serve as a reference of the potential losses derived from FX risk. In fact, nowadays, financial institutions use VaR measures to set aside their minimum regulatory capital requirements. The current capital standard (i.e. Basel II) typically requires banks to set aside at least 3 times a 10-day 99% VaR (which is currently £2.8m for this company). This capital could serve as a “cushion” for the company in order to “absorb” some potential losses (in terms of GBP) derived from foreign exchange rates movements. 74 Third, in terms of hedging, a Full-Valuation model allow us to compare the effectiveness of the use of either options or forwards by taking into account the non-linear pay-offs of the former. The GBP hedge reached by using a portfolio of EUR and USD options is around £223k while the hedge given by forwards is only around £31k of the monthly FX firm’s net exposure. Therefore, it is advisable for the company that its hedging strategy takes into account that options would allow them to limit its potential downside loss while taking benefit from favorable exchange rates movements. In any case, as commented earlier, the company should hedge its portfolio by using only EUR and USD forwards or European options. This could be done either on a monthly basis or on a longer period basis. In the former case, MNGO should take care of roll-over risk or the risk that market conditions and prices would change between renovations of derivatives contracts (see: Hull, J., 2006) and in the latter case, the company has to be able to estimate its potential positions in both currencies during the following quarter, semester or year. Fourth, in terms of the research questions stated in Chapter 2, as showed in the paper, different risk measures could be applied by implementing models in MS Excel that could be easily updated with new market information. In particular, MVA could serve not only as a tool to find a Minimum Variance Portfolio but also a reference to increase return derived from FX positions. Also, VaR calculations and stress testing could serve as a reference to set aside some reserve in order to face potential Foreign Exchange losses. Regarding the questions formulated by the company, along this document it has been showed that indeed it is possible to mathematically describe the FX risk faced by them by using a number of different models. The specificity of the company funding affects the modeling of risk since instead of a Value-at-Risk, the measuring of FX risk could be done by implementing a sort of Cash Flow-at-Risk on a monthly basis and taking into consideration Income/Expense figures and foreign exchange market information. Also, these models could be easily updated by including new market data. Finally, these models could 75 become an effective tool for the company in order to manage its FX risk. As commented before, MVA could help the company to get an efficient portfolio in terms of risk-return and the VaR could serve as a guideline to set aside a reserve to face potential losses derived from FX positions (Internal absorption of FX risk) and also to assess how effective is the use of financial hedging by using FX options or forwards (External absorption of FX risk). Also, these FX risk management tools could be included in the company’s systems by the means of permanent calculation of FX reserve and/or limits in certain currency’s positions. Moreover, the company could use market intelligence in terms of foreign exchange forecasting and even in terms of some currency trading operations (by using Portfolio Optimization as a framework). Finally, it should be pointed out that there is always some space for improvements within a project of this nature. For instance, the regression analysis could be improved in order to look at the joint effect of exchange rates on the variability of cash flows (e.g. a composite index of currencies could be constructed or found in order to serve as an independent variable of the regression). In the case of MVA and VaR measures, there could be a mix of these models by including VaR figures as a measure of risk (instead of variance) and look at the optimal weights of portfolios in order to minimize VaR. Also, VaR results need to be Back Tested in the future to check for the accuracy and robustness of the model. In addition, a more comprehensive scenario analysis could be included within the stress testing and derivative’s hedging valuation by, for instance, implementing an exchange rate’s forecasting model. Last but not least, the MNGO has to bear always in mind that each of these models are just an approximation of real figures. As commented all over this paper, they have many drawbacks since they rely on historical information and/or distribution’s assumptions. Therefore, quantitative tools have to be analyzed along with an adequate professional judgment and a comprehensible reporting of FX risk exposures across the whole organization. 76 REFERENCES Abuaf, N and Jorion, P. (1990), “Purchasing Power in the Long Run”, Journal of Finance, March, 15774. Allayanis, G., Ihrig, J. andf Weston, J. (2001), “Exchange rate Hedging: Financial versus Operating Strategies”, American Economic Review Papers and Proceedings, 91, 391-95. Allayannis, G, Lei, G. and Miller, D. (2004), “Corporate Governance and the Hedging Premium around The World”, Working Paper, Darden School of Business (University of Virgnia) and Kelly School of Business (Indiana University). Artzner, P., Delbaen, F., Eber, J., Heath, D. (1999), “Coherent Measures of Risk”, Mathematical Finance, 9, 203-28. Basak, S. and Shapiro, A. (2001). Value-at-Risk-based Risk Management: Optimal Policies and Asset Prices. The Reveiw of Financial Studies, 14 (2) , 371-405. BIS-Bank of International Settlements-(1996), “Amendment to the Capital Accord to Incorporate Markets Risk”, Basel Committee, Basel. Blair, N. (2008), “Corporate Risk Management: VaR or CFaR”. http://www.beymarglobal.com/nazanblair/nazanblair-risk2.pdf Buehler, K., Freeman, A. and Hulme, R. (2008), “The New Arsenal of Risk Management”, Harvard Business Review, 93-100. Cheng, S. Liu, Y. And Wang, S. (2004), “Progress in Risk Measurement”, Advanced Modeling and Optimization, Volume 6, Number 1. 77 Collins, R. and Gbur, E. (1991), “Quadratic Utility and Linear Mean-Variance: A Pedagogic Note”, Review of Agricultural Economics, Vol. 13, 2, 289-291. Elton, E. and Gruber, M. (1995), Modern Portfolio Theory and Investment Analysis, Fifth Edition, Jhon Wiley & Sons, Inc. Freixas, X. and Rochet, J. (1997), Microeconomics of Banking, Massachusetts Institute of Technology. Guay, W. (1999), “The impact of derivatives on Firm Risk: An Empirical Examination of New Derivatives Users”, Journal of Accounting and Economics, Vol. 26, 319-51. Harlow, V. W. (1991). Asset Allocation in a Downside-Risk Framework. Financial Analysts Journal , 28-40. Harvey, C., Liechty, J., Liechty, M., and Müller, P, (2010), “Portfolio Selection with Higher Moments”, Quantitative Finance, 10(5), 469. Hull, J. (2006), Options, Futures and Other Derivatives, Sixth Edition, Pearson-Prentice Hall. Hull, J. (2007), Risk Management and Financial Institutions, Pearson-Prentice Hall. J. P. Morgan Co. (1996), Riskmetrics-Technical Document, 4th ed, New York. Jorion, P. (2007), Value at Risk: The New Benchmark for Managing Financial Risk, Third Edition, McGraw-Hill. Khaneman, D. and Tversky, A. (1979), “Prospect Theory and Analysis of Decisions under Risk”, Econometrica, 47, 2, 263-91. 78 Lintner, J. (1965), “The Valuation of Risk Assets and the Selection of Risky Investments in Stock Portfolios and Capital Budgets”, The Review of Economics and Statistics, Vol. 47, 1, 13-37. McNeil, A. (1999), “Extreme Value Theory for Risk Managers”, Department of Mathematics, ETH Zentrum, Zurich. Madura, J. and Fox, R. (2007), International Financial Management, Thomson Learning. Markowitz, H. (1952), “Portfolio Selection”, Journal of Finance, 7, 1, 77-91. Markowitz, H. (1959), Portfolio Selection: Efficient Diversification of Investments, Second edition, Blackwell: Malden. Markowitz, H., Todd, P., Xu, G. and Yamane, Y., (1993), “Computation of mean–semivariance efficient sets by the critical line algorithm”, Ann. Oper. Res., 45, 307–317. Mishkin, F.S. (1984), “Are Real Interest Rates Equal Across Countries? An Empirical Investigations of International Parity Conditions”, Journal of Finance, December, 1345-57. Modigliani, F. and Miller, M. (1958), “The Cost of Capital, Corporation Finance and the Theory of Investment”, American Economic Review, 48, 261-97. Rockafellar, R. T. and Uryasev, S. (2000) “Optimization of conditional Value-at-Risk”, Journal of Risk, 2, 21-41. Roy, A., (1952), “Safety First and the Holding of Assets”, Econometrica, 20(3), 431. Sharpe, W. (1964), “Capital Assets Prices: A theory of Market Equilibrium”, Journal of Finance, 425442. Shimko, D. (1998) “Cash before value”, Risk Magazine, Jul 1998. 79 Smithson, C. and Simkins, B. (2005), “Does Risk Management Add Value? A survey of the Evidence”, Journal of Applied Corporate Finance, Volume 17, Number 3. Sortino, F. and Price, L., (1994), “Performance measurement in a downside risk framework”. J. Invest., 3, 50–58. Stulz, R. (2009), “Six Ways Companies Mismanage Risk”, Harvard Business Review, March 2009, p. 86-94. VanderLinden, D. (2002), “Conditional Hedging and Portfolio Performance”, Financial Analysts Journal, 58, 4, p.72. WEBPAGES: www.ft.com www.nasdaq.com www.oanda.com www.statistics.gov.uk 80 APPENDICES a. Appendix A: List of Currencies No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 Code USD EUR AFO ALL AON AMD AUD AZN BDT BBD BOB BRL BIF KHR CAD CLP COP XOF XAF CDF DKK DOP XCD EGP SVC ERN ETB GEL GHS GTQ GYD HTG HNL HKD Country USA Euro Afghanistan Albania Angola Armenia Australia Azerbaijan Bangladesh Barbados Bolivia Brazil Burundi Cambodia Canada Chile Colombia Communauté Financière Africaine BCEAO Communauté Financière Africaine BEAC DR Congo (Congo - Kinshasa) Denmark Dominican Republic East Caribbean Dollar Egypt El Salvador Eritrea Ethiopia Georgia Ghana Guatemala Guyana Haitia Honduras Hong Kong 81 Currency US Dollar Euro Afghan Afghani (Official) Albanian Lek Angolan New Kwanza Armenian Dram Australian Dollar Azerbaijan New Manat Bangladesh Taka Barbados Dollar Boliviano Brazilian Real Burundi Franc Cambodian Riel Canadian Dollar Chilean Peso Colombian Peso CFA Franc BCEAO CFA Franc BEAC Franc Congolais Danish Krone Dominican Peso East Caribbean Dollar Egyptian Pound El Salvador Colon Eritrean Nakfa Ethiopian Birr Georgian Lari Ghana Cedi (New) Guatemalan Quetzal Guyana Dollar Haitian Gourde Honduran Lempira Hong Kong Dollar 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 INR IDR IRR IQD ILS JMD JPY JOD KES KWD LBP LRD MWK MYR MRO MXN India Indonesia Iran Iraq Israel Jamaica Japan Jordan Kenya Kuwait Lebanon Liberia Malawi Malaysia Mauritania Mexico 51 52 53 54 55 56 57 58 59 60 61 MZN MMK NPR NZD NIO NGN NOK PGK PKR PEN PHP Mozambique Myanmar Nepal New Zealand Nicaragua Nigeria Norway Papua New Guinea Pakistan Peru Philippines 62 63 64 65 66 67 68 69 70 71 72 RUR RWF SLL SGD SOS ZAR LKR SDG SEK CHF SYP Russia Rwanda Sierra Leone Singapore Somalia South Africa Sri Lanka Sudan Sweden Switzerland Syria 82 Indian Rupee Indonesian Rupiah Iranian Rial Iraqi Dinar New Israeli Sheqel Jamaican Dollar Japanese Yen Jordanian Dinar Kenyan Shilling Kuwaiti Dinar Lebanese Pound Liberian Dollar Malawian Kwacha Malaysian Ringgit Mauritainian Ouguiya Mexican Peso Mozambique New Metical Myanmar Kyat Nepalese Rupee New Zealand Dollar Nicaraguan Cordoba Oro Nigerian Naira Norwegian Krone Kino Pakistan Rupee Peruvian Nuevo Sol Philippine Peso Russian Federation Rouble Rwanda Franc Leone Singapore Dollar Somali Shilling South African Rand Sri Lanka Rupee Sudanese Pounds Swedish Krona Swiss Franc Syrian Pound 73 74 75 76 77 78 79 80 TJS TZS THB UGX GBP VND YER ZMK Tajikistan Tanzania Thailand Uganda United Kingdom Vietnam Yemen Zambia 83 Tajik Somoni Tanzanian Shilling Thai Baht Uganda Shilling Pound Sterling Vietnamese Dong Yemeni Rial Zambian Kwacha b. Currency AFO AUD BDT BRL CAD COP EUR HTG ILS INR KES NPR PHP PKR SLL TZS USD XOF YER ZAR Appendix B: Variance-Covariance Matrix AFO 0.00606% 0.00034% 0.00270% 0.00091% 0.00127% 0.00240% 0.00118% 0.00270% 0.00235% 0.00240% 0.00245% 0.00218% 0.00288% 0.00315% 0.00288% 0.00295% 0.00319% 0.00100% 0.00275% 0.00115% AUD 0.00034% 0.00681% 0.00101% 0.00464% 0.00459% 0.00290% 0.00240% 0.00101% 0.00237% 0.00302% 0.00188% 0.00255% 0.00179% 0.00110% 0.00091% 0.00187% 0.00114% 0.00202% 0.00095% 0.00450% BDT 0.00270% 0.00101% 0.00463% 0.00112% 0.00192% 0.00227% 0.00186% 0.00463% 0.00257% 0.00229% 0.00287% 0.00347% 0.00280% 0.00351% 0.00478% 0.00385% 0.00355% 0.00200% 0.00471% 0.00109% BRL 0.00091% 0.00464% 0.00112% 0.00725% 0.00420% 0.00351% 0.00247% 0.00112% 0.00188% 0.00246% 0.00170% 0.00199% 0.00171% 0.00114% 0.00095% 0.00175% 0.00117% 0.00182% 0.00107% 0.00446% CAD 0.00127% 0.00459% 0.00192% 0.00420% 0.00588% 0.00383% 0.00240% 0.00192% 0.00285% 0.00306% 0.00258% 0.00253% 0.00248% 0.00212% 0.00206% 0.00261% 0.00224% 0.00196% 0.00193% 0.00378% COP 0.00240% 0.00290% 0.00227% 0.00351% 0.00383% 0.00799% 0.00224% 0.00227% 0.00341% 0.00379% 0.00346% 0.00275% 0.00389% 0.00330% 0.00230% 0.00345% 0.00330% 0.00198% 0.00230% 0.00309% EUR 0.00118% 0.00240% 0.00186% 0.00247% 0.00240% 0.00224% 0.00330% 0.00186% 0.00221% 0.00210% 0.00190% 0.00211% 0.00199% 0.00188% 0.00191% 0.00220% 0.00188% 0.00267% 0.00191% 0.00215% HTG 0.00270% 0.00101% 0.00463% 0.00112% 0.00192% 0.00227% 0.00186% 0.00463% 0.00257% 0.00229% 0.00287% 0.00347% 0.00280% 0.00351% 0.00478% 0.00385% 0.00355% 0.00200% 0.00471% 0.00109% ILS 0.00235% 0.00237% 0.00257% 0.00188% 0.00285% 0.00341% 0.00221% 0.00257% 0.00487% 0.00328% 0.00338% 0.00281% 0.00345% 0.00336% 0.00255% 0.00403% 0.00342% 0.00189% 0.00255% 0.00237% INR 0.00240% 0.00302% 0.00229% 0.00246% 0.00306% 0.00379% 0.00210% 0.00229% 0.00328% 0.00506% 0.00362% 0.00386% 0.00397% 0.00337% 0.00232% 0.00435% 0.00345% 0.00195% 0.00231% 0.00268% 84 KES 0.00245% 0.00188% 0.00287% 0.00170% 0.00258% 0.00346% 0.00190% 0.00287% 0.00338% 0.00362% 0.00533% 0.00283% 0.00392% 0.00398% 0.00282% 0.00453% 0.00412% 0.00167% 0.00287% 0.00181% NPR 0.00218% 0.00255% 0.00347% 0.00199% 0.00253% 0.00275% 0.00211% 0.00347% 0.00281% 0.00386% 0.00283% 0.00483% 0.00324% 0.00294% 0.00351% 0.00410% 0.00293% 0.00238% 0.00352% 0.00239% PHP 0.00288% 0.00179% 0.00280% 0.00171% 0.00248% 0.00389% 0.00199% 0.00280% 0.00345% 0.00397% 0.00392% 0.00324% 0.00602% 0.00398% 0.00291% 0.00488% 0.00399% 0.00174% 0.00281% 0.00179% PKR 0.00315% 0.00110% 0.00351% 0.00114% 0.00212% 0.00330% 0.00188% 0.00351% 0.00336% 0.00337% 0.00398% 0.00294% 0.00398% 0.00507% 0.00362% 0.00477% 0.00443% 0.00152% 0.00355% 0.00098% SLL 0.00288% 0.00091% 0.00478% 0.00095% 0.00206% 0.00230% 0.00191% 0.00478% 0.00255% 0.00232% 0.00282% 0.00351% 0.00291% 0.00362% 0.00648% 0.00387% 0.00364% 0.00210% 0.00483% 0.00098% TZS 0.00295% 0.00187% 0.00385% 0.00175% 0.00261% 0.00345% 0.00220% 0.00385% 0.00403% 0.00435% 0.00453% 0.00410% 0.00488% 0.00477% 0.00387% 0.00931% 0.00487% 0.00221% 0.00391% 0.00159% USD 0.00319% 0.00114% 0.00355% 0.00117% 0.00224% 0.00330% 0.00188% 0.00355% 0.00342% 0.00345% 0.00412% 0.00293% 0.00399% 0.00443% 0.00364% 0.00487% 0.00455% 0.00161% 0.00357% 0.00113% XOF 0.00100% 0.00202% 0.00200% 0.00182% 0.00196% 0.00198% 0.00267% 0.00200% 0.00189% 0.00195% 0.00167% 0.00238% 0.00174% 0.00152% 0.00210% 0.00221% 0.00161% 0.00328% 0.00206% 0.00173% YER 0.00275% 0.00095% 0.00471% 0.00107% 0.00193% 0.00230% 0.00191% 0.00471% 0.00255% 0.00231% 0.00287% 0.00352% 0.00281% 0.00355% 0.00483% 0.00391% 0.00357% 0.00206% 0.00495% 0.00114% ZAR 0.00115% 0.00450% 0.00109% 0.00446% 0.00378% 0.00309% 0.00215% 0.00109% 0.00237% 0.00268% 0.00181% 0.00239% 0.00179% 0.00098% 0.00098% 0.00159% 0.00113% 0.00173% 0.00114% 0.00777% c. Appendix C: Historical VaR, Portfolio’s values distribution Value Frequency -£587,957.84 1 -£528,976.22 0 -£469,994.61 3 -£411,013.00 2 -£352,031.38 9 -£293,049.77 15 -£234,068.16 17 -£175,086.55 54 -£116,104.93 72 -£ 57,123.32 83 £ 1,858.29 69 £ 60,839.91 72 £119,821.52 44 £178,803.13 16 £237,784.74 17 £296,766.36 10 £355,747.97 8 £414,729.58 2 £473,711.20 2 £532,692.81 1 £591,674.42 0 £650,656.03 2 and higuer… 1 Scenarios 500 85 d. Appendix D: Monte Carlo VaR, Portfolio’s values distribution Value's Changes Frequency -6.9% 1 -6.2% 0 -5.5% 2 -4.8% 4 -4.1% 8 -3.4% 16 -2.8% 11 -2.1% 32 -1.4% 41 -0.7% 39 0.0% 53 0.7% 47 1.4% 54 2.0% 46 2.7% 40 3.4% 47 4.1% 20 4.8% 16 5.5% 11 6.1% 3 6.8% 5 7.5% 3 8.2% 1 Scenarios 500 86 e. Appendix E: Correlation Matrix code AFO ALL AMD AON AUD AZN BBD BDT BOB BRL CDF CHF CLP COP DOP EGP ERN ETB EUR GEL GHS GTQ HNL HTG IDR ILS INR JOD KES KHR LBP LKR LRD MMK MRO MWK M XN MZN NGN NIO NPR PEN PHP PKR RUR RWF SDG SLL THB TJS TZS UGX USD VND XOF YER ZAR ZMK CAD HKD JMD JPY AFO 1.000 0.251 0.395 0.553 0.053 0.509 0.580 0.510 0.510 0.137 0.373 0.294 0.328 0.344 0.340 0.591 0.508 0.305 0.263 0.433 0.475 0.520 0.510 0.510 0.456 0.432 0.434 0.592 0.431 0.542 0.602 0.582 0.430 0.601 0.311 0.360 0.201 0.226 0.470 0.509 0.403 0.505 0.477 0.568 0.296 0.500 0.508 0.460 0.562 0.315 0.393 0.429 0.606 0.537 0.224 0.503 0.168 0.255 0.213 0.604 0.505 0.470 ALL 1.000 0.496 0.421 0.353 0.597 0.484 0.598 0.598 0.303 0.471 0.643 0.476 0.333 0.463 0.468 0.381 0.356 0.722 0.556 0.568 0.563 0.598 0.598 0.409 0.502 0.441 0.453 0.382 0.404 0.454 0.438 0.390 0.477 0.264 0.314 0.372 0.341 0.416 0.597 0.595 0.599 0.368 0.410 0.442 0.600 0.381 0.512 0.464 0.173 0.418 0.338 0.462 0.441 0.863 0.601 0.248 0.278 0.405 0.459 0.569 0.353 AMD 1.000 0.589 0.066 0.812 0.591 0.812 0.812 0.098 0.641 0.346 0.467 0.277 0.661 0.588 0.474 0.556 0.326 0.711 0.768 0.783 0.812 0.812 0.377 0.388 0.339 0.603 0.428 0.559 0.599 0.588 0.474 0.604 0.351 0.390 0.261 0.435 0.507 0.812 0.561 0.724 0.384 0.585 0.225 0.809 0.474 0.750 0.564 0.299 0.459 0.408 0.609 0.559 0.404 0.800 0.048 0.274 0.236 0.602 0.774 0.434 AON 1.000 0.211 0.736 0.790 0.736 0.736 0.220 0.539 0.471 0.474 0.431 0.583 0.835 0.711 0.580 0.414 0.612 0.674 0.712 0.736 0.736 0.684 0.616 0.588 0.840 0.691 0.783 0.843 0.826 0.642 0.853 0.514 0.569 0.354 0.376 0.680 0.735 0.571 0.687 0.608 0.798 0.402 0.721 0.711 0.649 0.810 0.193 0.618 0.660 0.854 0.790 0.357 0.714 0.180 0.512 0.370 0.849 0.734 0.594 AUD 1.000 0.179 0.236 0.181 0.181 0.660 0.132 0.410 0.340 0.392 0.132 0.228 0.182 0.095 0.506 0.167 0.166 0.162 0.181 0.181 0.364 0.411 0.514 0.215 0.312 0.181 0.183 0.195 0.134 0.216 0.128 0.105 0.630 0.115 0.196 0.177 0.444 0.279 0.280 0.187 0.487 0.182 0.182 0.137 0.277 0.051 0.235 0.253 0.205 0.212 0.428 0.164 0.618 0.246 0.725 0.206 0.181 -0.017 AZN 1.000 0.731 1.000 1.000 0.191 0.802 0.486 0.593 0.373 0.815 0.750 0.606 0.689 0.473 0.878 0.927 0.953 1.000 1.000 0.541 0.540 0.475 0.759 0.575 0.711 0.757 0.745 0.602 0.766 0.429 0.474 0.360 0.530 0.607 0.998 0.735 0.928 0.530 0.723 0.328 0.994 0.606 0.872 0.728 0.331 0.585 0.535 0.772 0.714 0.511 0.982 0.181 0.384 0.366 0.763 0.970 0.576 BBD 1.000 0.731 0.731 0.222 0.567 0.566 0.478 0.513 0.539 0.903 0.733 0.528 0.506 0.608 0.677 0.699 0.731 0.731 0.754 0.703 0.683 0.903 0.789 0.837 0.896 0.903 0.685 0.913 0.562 0.621 0.375 0.395 0.753 0.728 0.637 0.695 0.687 0.858 0.509 0.722 0.733 0.641 0.889 0.209 0.707 0.716 0.919 0.851 0.431 0.714 0.203 0.569 0.419 0.915 0.719 0.661 BDT 1.000 1.000 0.193 0.802 0.489 0.594 0.372 0.815 0.749 0.606 0.690 0.476 0.878 0.928 0.954 1.000 1.000 0.541 0.540 0.474 0.759 0.577 0.712 0.757 0.745 0.602 0.766 0.430 0.474 0.361 0.529 0.607 0.999 0.734 0.928 0.530 0.723 0.329 0.995 0.606 0.873 0.729 0.335 0.586 0.534 0.772 0.714 0.512 0.982 0.182 0.384 0.368 0.763 0.970 0.577 BOB 1.000 0.193 0.802 0.489 0.594 0.372 0.815 0.749 0.606 0.690 0.476 0.878 0.928 0.954 1.000 1.000 0.541 0.540 0.474 0.759 0.577 0.712 0.757 0.745 0.602 0.766 0.430 0.474 0.361 0.529 0.607 0.999 0.734 0.928 0.530 0.723 0.329 0.995 0.606 0.873 0.729 0.335 0.586 0.535 0.772 0.714 0.512 0.982 0.182 0.384 0.368 0.763 0.970 0.577 BRL 1.000 0.149 0.368 0.256 0.462 0.162 0.223 0.208 0.083 0.504 0.213 0.168 0.198 0.192 0.193 0.282 0.317 0.406 0.228 0.273 0.201 0.186 0.191 0.122 0.212 0.054 0.134 0.649 0.142 0.167 0.192 0.337 0.276 0.259 0.189 0.413 0.190 0.208 0.138 0.228 0.073 0.213 0.193 0.204 0.200 0.374 0.179 0.594 0.220 0.643 0.199 0.197 -0.087 CDF 1.000 0.379 0.474 0.258 0.666 0.546 0.426 0.536 0.367 0.701 0.753 0.762 0.802 0.802 0.375 0.383 0.343 0.554 0.394 0.529 0.559 0.558 0.503 0.567 0.244 0.345 0.277 0.430 0.423 0.802 0.558 0.741 0.346 0.542 0.181 0.798 0.426 0.747 0.523 0.258 0.425 0.397 0.573 0.558 0.374 0.785 0.134 0.249 0.303 0.560 0.777 0.434 CHF 1.000 0.396 0.470 0.346 0.555 0.428 0.338 0.850 0.408 0.460 0.466 0.489 0.489 0.514 0.557 0.555 0.552 0.490 0.497 0.539 0.535 0.415 0.562 0.334 0.363 0.413 0.313 0.511 0.491 0.530 0.517 0.506 0.522 0.519 0.485 0.428 0.439 0.587 0.122 0.421 0.421 0.560 0.541 0.705 0.489 0.399 0.327 0.483 0.554 0.491 0.552 CLP 1.000 0.364 0.471 0.506 0.366 0.382 0.416 0.544 0.557 0.577 0.594 0.594 0.419 0.413 0.456 0.489 0.416 0.443 0.489 0.481 0.418 0.500 0.336 0.277 0.430 0.298 0.397 0.590 0.578 0.614 0.404 0.485 0.404 0.598 0.366 0.497 0.496 0.183 0.425 0.383 0.501 0.449 0.442 0.598 0.307 0.346 0.422 0.503 0.575 0.307 COP 1.000 0.248 0.550 0.423 0.192 0.435 0.335 0.341 0.358 0.372 0.372 0.562 0.546 0.597 0.547 0.530 0.477 0.535 0.526 0.382 0.544 0.371 0.349 0.497 0.250 0.394 0.377 0.443 0.446 0.561 0.518 0.464 0.359 0.423 0.319 0.561 0.116 0.400 0.425 0.548 0.498 0.387 0.365 0.392 0.390 0.559 0.549 0.371 0.305 DOP 1.000 0.565 0.488 0.572 0.365 0.669 0.746 0.775 0.815 0.815 0.403 0.432 0.319 0.570 0.403 0.548 0.561 0.568 0.420 0.582 0.349 0.384 0.286 0.461 0.456 0.813 0.573 0.747 0.343 0.527 0.206 0.812 0.488 0.718 0.539 0.267 0.477 0.386 0.580 0.536 0.384 0.791 0.162 0.271 0.257 0.569 0.792 0.418 EGP 1.000 0.798 0.559 0.489 0.631 0.685 0.717 0.749 0.749 0.848 0.729 0.744 0.972 0.841 0.894 0.975 0.963 0.734 0.984 0.628 0.652 0.404 0.386 0.773 0.748 0.640 0.718 0.774 0.914 0.521 0.740 0.798 0.649 0.969 0.224 0.752 0.758 0.989 0.918 0.431 0.731 0.205 0.630 0.440 0.989 0.745 0.707 ERN 1.000 0.453 0.401 0.505 0.556 0.593 0.606 0.606 0.700 0.588 0.553 0.794 0.712 0.761 0.792 0.766 0.618 0.811 0.533 0.541 0.303 0.296 0.650 0.605 0.480 0.604 0.621 0.757 0.411 0.597 1.000 0.488 0.783 0.192 0.601 0.604 0.807 0.752 0.338 0.587 0.184 0.538 0.332 0.803 0.606 0.544 ETB 1.000 0.319 0.597 0.629 0.659 0.690 0.690 0.443 0.372 0.375 0.562 0.467 0.534 0.563 0.530 0.447 0.572 0.313 0.358 0.244 0.371 0.472 0.691 0.514 0.633 0.411 0.613 0.248 0.685 0.453 0.594 0.559 0.249 0.452 0.373 0.577 0.520 0.307 0.682 0.109 0.346 0.211 0.569 0.671 0.456 EUR 1.000 0.443 0.445 0.458 0.476 0.476 0.474 0.552 0.513 0.486 0.452 0.434 0.464 0.473 0.354 0.499 0.244 0.342 0.489 0.286 0.452 0.477 0.527 0.513 0.447 0.459 0.533 0.475 0.401 0.412 0.515 0.120 0.397 0.410 0.486 0.478 0.810 0.473 0.425 0.306 0.545 0.478 0.477 0.404 GEL 1.000 0.826 0.837 0.878 0.878 0.451 0.461 0.407 0.629 0.511 0.609 0.638 0.627 0.506 0.643 0.343 0.383 0.332 0.475 0.499 0.877 0.656 0.813 0.489 0.593 0.311 0.874 0.505 0.745 0.617 0.272 0.482 0.466 0.649 0.589 0.497 0.868 0.171 0.406 0.343 0.642 0.848 0.486 GHS 1.000 0.880 0.928 0.928 0.504 0.495 0.427 0.693 0.511 0.639 0.694 0.677 0.548 0.702 0.387 0.443 0.342 0.499 0.557 0.927 0.672 0.857 0.502 0.658 0.301 0.925 0.556 0.800 0.663 0.321 0.538 0.527 0.707 0.653 0.479 0.908 0.156 0.347 0.330 0.699 0.900 0.515 GTQ 1.000 0.954 0.954 0.519 0.524 0.452 0.724 0.555 0.691 0.732 0.716 0.581 0.737 0.428 0.447 0.360 0.486 0.584 0.952 0.693 0.886 0.503 0.694 0.321 0.948 0.593 0.848 0.701 0.345 0.563 0.501 0.743 0.682 0.472 0.933 0.180 0.343 0.362 0.733 0.925 0.562 HNL 1.000 1.000 0.541 0.540 0.474 0.759 0.577 0.712 0.757 0.745 0.602 0.766 0.430 0.475 0.361 0.529 0.608 0.999 0.734 0.928 0.529 0.723 0.329 0.995 0.606 0.873 0.729 0.335 0.586 0.534 0.772 0.714 0.512 0.982 0.182 0.384 0.368 0.763 0.970 0.577 HTG 1.000 0.541 0.540 0.474 0.759 0.577 0.712 0.757 0.745 0.602 0.766 0.430 0.474 0.361 0.529 0.607 0.999 0.734 0.928 0.530 0.723 0.329 0.995 0.606 0.873 0.729 0.335 0.586 0.534 0.772 0.714 0.512 0.982 0.182 0.384 0.368 0.763 0.970 0.577 IDR 1.000 0.710 0.795 0.810 0.778 0.758 0.813 0.804 0.621 0.818 0.556 0.566 0.414 0.237 0.641 0.541 0.647 0.552 0.789 0.775 0.565 0.531 0.700 0.485 0.848 0.181 0.663 0.694 0.825 0.775 0.425 0.524 0.320 0.640 0.491 0.833 0.538 0.545 ILS 1.000 0.661 0.713 0.664 0.601 0.719 0.723 0.533 0.715 0.473 0.485 0.464 0.285 0.548 0.545 0.580 0.559 0.638 0.676 0.566 0.535 0.588 0.453 0.722 0.168 0.599 0.598 0.727 0.689 0.472 0.519 0.386 0.460 0.532 0.723 0.540 0.429 INR 1.000 0.716 0.696 0.650 0.702 0.690 0.567 0.711 0.510 0.504 0.537 0.255 0.604 0.472 0.781 0.529 0.719 0.665 0.616 0.469 0.553 0.405 0.754 0.181 0.635 0.634 0.718 0.703 0.479 0.462 0.427 0.565 0.561 0.726 0.462 0.426 JOD 1.000 0.808 0.893 0.970 0.950 0.744 0.980 0.618 0.664 0.402 0.392 0.762 0.758 0.620 0.720 0.752 0.913 0.480 0.749 0.794 0.664 0.955 0.214 0.751 0.723 0.983 0.916 0.403 0.742 0.201 0.599 0.426 0.981 0.757 0.707 KES 1.000 0.752 0.817 0.800 0.604 0.835 0.570 0.549 0.432 0.295 0.710 0.578 0.557 0.571 0.693 0.766 0.544 0.565 0.712 0.481 0.843 0.135 0.644 0.720 0.837 0.777 0.400 0.559 0.282 0.657 0.460 0.844 0.572 0.536 KHR 1.000 0.907 0.887 0.708 0.913 0.550 0.655 0.357 0.390 0.693 0.706 0.573 0.675 0.676 0.834 0.418 0.704 0.761 0.609 0.884 0.220 0.702 0.678 0.907 0.845 0.365 0.703 0.174 0.556 0.367 0.906 0.706 0.669 LBP 1.000 0.955 0.758 0.980 0.613 0.662 0.374 0.402 0.777 0.756 0.596 0.720 0.748 0.911 0.479 0.747 0.792 0.654 0.956 0.234 0.747 0.718 0.985 0.920 0.403 0.739 0.175 0.588 0.410 0.983 0.755 0.714 LKR 1.000 0.728 0.964 0.615 0.648 0.359 0.383 0.758 0.743 0.603 0.694 0.742 0.893 0.475 0.736 0.766 0.656 0.943 0.216 0.724 0.730 0.970 0.901 0.400 0.723 0.166 0.566 0.432 0.968 0.741 0.707 LRD 1.000 0.755 0.444 0.542 0.302 0.296 0.575 0.601 0.480 0.556 0.581 0.697 0.366 0.599 0.618 0.529 0.717 0.194 0.600 0.521 0.753 0.697 0.318 0.585 0.103 0.436 0.359 0.748 0.547 0.581 MMK 1.000 0.619 0.673 0.398 0.400 0.782 0.766 0.617 0.731 0.749 0.915 0.495 0.756 0.811 0.665 0.967 0.232 0.746 0.741 0.994 0.923 0.434 0.746 0.192 0.600 0.437 0.992 0.763 0.724 MRO 1.000 0.493 0.199 0.247 0.513 0.431 0.447 0.424 0.499 0.572 0.358 0.429 0.533 0.356 0.628 0.073 0.516 0.492 0.625 0.571 0.258 0.412 0.094 0.433 0.230 0.633 0.429 0.452 MWK 1.000 0.238 0.327 0.524 0.467 0.400 0.447 0.476 0.598 0.297 0.460 0.541 0.402 0.648 0.099 0.530 0.538 0.669 0.628 0.319 0.446 0.110 0.411 0.284 0.666 0.471 0.456 MXN 1.000 0.199 0.313 0.359 0.458 0.448 0.385 0.354 0.449 0.361 0.303 0.296 0.431 0.029 0.315 0.352 0.391 0.364 0.393 0.350 0.583 0.276 0.696 0.388 0.353 0.065 MZN 1.000 0.316 0.529 0.374 0.500 0.240 0.379 0.203 0.521 0.296 0.457 0.386 0.186 0.307 0.245 0.403 0.381 0.336 0.530 0.049 0.209 0.252 0.400 0.524 0.327 NGN 1.000 0.607 0.513 0.588 0.579 0.720 0.447 0.603 0.650 0.521 0.780 0.219 0.600 0.580 0.787 0.735 0.374 0.594 0.159 0.473 0.392 0.787 0.615 0.588 NIO 1.000 0.732 0.928 0.529 0.725 0.331 0.993 0.605 0.871 0.728 0.331 0.584 0.536 0.771 0.712 0.512 0.981 0.182 0.382 0.368 0.762 0.969 0.576 NPR 1.000 0.750 0.601 0.594 0.556 0.736 0.480 0.627 0.642 0.253 0.611 0.547 0.624 0.587 0.598 0.720 0.390 0.488 0.475 0.626 0.699 0.396 PEN 1.000 0.540 0.684 0.397 0.926 0.604 0.787 0.714 0.324 0.564 0.524 0.735 0.694 0.545 0.919 0.273 0.367 0.451 0.727 0.907 0.514 PHP 1.000 0.721 0.541 0.523 0.621 0.466 0.774 0.219 0.652 0.632 0.763 0.705 0.392 0.515 0.262 0.548 0.417 0.767 0.510 0.521 PKR 1.000 0.476 0.713 0.757 0.631 0.896 0.231 0.694 0.702 0.923 0.851 0.374 0.709 0.156 0.589 0.389 0.920 0.711 0.660 RUR 1.000 0.326 0.411 0.283 0.528 0.036 0.474 0.474 0.494 0.485 0.494 0.311 0.406 0.394 0.515 0.498 0.332 0.263 RWF 1.000 0.597 0.868 0.722 0.339 0.583 0.525 0.762 0.704 0.514 0.977 0.177 0.385 0.365 0.753 0.963 0.575 SDG 1.000 0.488 0.783 0.192 0.601 0.604 0.807 0.752 0.338 0.587 0.184 0.538 0.332 0.803 0.606 0.544 SLL 1.000 0.627 0.350 0.499 0.418 0.670 0.616 0.455 0.852 0.138 0.305 0.334 0.663 0.838 0.520 THB 1.000 0.210 0.733 0.739 0.973 0.907 0.442 0.711 0.231 0.607 0.483 0.972 0.724 0.730 TJS 1.000 0.131 0.140 0.231 0.221 0.135 0.331 0.098 0.044 0.126 0.230 0.333 0.166 TZS 1.000 0.600 0.748 0.684 0.399 0.576 0.187 0.508 0.352 0.742 0.570 0.524 UGX 1.000 0.746 0.719 0.353 0.511 0.161 0.592 0.351 0.749 0.521 0.497 USD 1.000 0.929 0.416 0.752 0.190 0.605 0.434 0.998 0.768 0.729 VND 1.000 0.392 0.692 0.194 0.565 0.422 0.928 0.713 0.662 XOF 1.000 0.510 0.342 0.264 0.447 0.415 0.491 0.332 YER 1.000 0.184 0.382 0.357 0.744 0.952 0.569 ZAR 1.000 0.147 0.559 0.190 0.196 0.012 ZMK 1.000 0.311 0.611 0.372 0.347 CAD 1.000 0.430 0.374 0.128 HKD 1.000 0.760 0.726 JMD 1.000 0.575 JPY 1.000 87 f. Appendix F: Regressions Results Dependent Variable: CF Method: Least Squares Date: 08/03/10 Time: 19:23 Sample(adjusted): 2005:06 2009:06 Included observations: 49 after adjusting endpoints Variable C USD R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat Coefficient 1.000147 0.976513 0.613371 0.605145 0.023593 0.026161 115.0868 1.983074 Std. Error t-Statistic 0.003375 296.3344 0.113087 8.635023 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion F-statistic Prob(F-statistic) Prob. 0.0000 0.0000 0.998617 0.037546 -4.615787 -4.538570 74.56363 0.000000 Dependent Variable: CF Method: Least Squares Date: 08/03/10 Time: 19:55 Sample(adjusted): 2005:06 2009:07 Included observations: 50 after adjusting endpoints Variable C BDT R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat Coefficient 0.998034 0.771494 0.482306 0.471521 0.027016 0.035034 110.6397 1.957506 Std. Error t-Statistic 0.003821 261.1655 0.115368 6.687223 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion F-statistic Prob(F-statistic) Prob. 0.0000 0.0000 0.998560 0.037163 -4.345589 -4.269109 44.71895 0.000000 Dependent Variable: CF Method: Least Squares Date: 08/03/10 Time: 19:53 Sample(adjusted): 2005:06 2009:07 Included observations: 50 after adjusting endpoints Variable C PKR R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat Coefficient 0.994432 0.767494 0.367256 0.354074 0.029868 0.042820 105.6227 1.706050 Std. Error t-Statistic 0.004296 231.4945 0.145406 5.278267 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion F-statistic Prob(F-statistic) 88 Prob. 0.0000 0.0000 0.998560 0.037163 -4.144907 -4.068427 27.86011 0.000003 Dependent Variable: CF Method: Least Squares Date: 08/03/10 Time: 19:27 Sample(adjusted): 2005:06 2009:07 Included observations: 50 after adjusting endpoints Variable C PHP R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat Coefficient 1.000642 0.569952 0.250839 0.235231 0.032499 0.050698 101.4005 1.656630 Std. Error t-Statistic 0.004625 216.3400 0.142170 4.008947 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion F-statistic Prob(F-statistic) Prob. 0.0000 0.0002 0.998560 0.037163 -3.976019 -3.899538 16.07165 0.000212 Dependent Variable: CF Method: Least Squares Date: 08/03/10 Time: 19:24 Sample(adjusted): 2005:06 2009:07 Included observations: 50 after adjusting endpoints Variable C EUR R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat Coefficient 1.000724 0.513695 0.139737 0.121815 0.034826 0.058216 97.94338 1.711171 Std. Error t-Statistic 0.004986 200.7182 0.183969 2.792295 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion F-statistic Prob(F-statistic) Prob. 0.0000 0.0075 0.998560 0.037163 -3.837735 -3.761254 7.796911 0.007493 Dependent Variable: CF Method: Least Squares Date: 08/03/10 Time: 19:28 Sample(adjusted): 2005:06 2009:07 Included observations: 50 after adjusting endpoints Variable C KES R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat Coefficient 0.999108 0.482161 0.221836 0.205624 0.033122 0.052661 100.4509 1.612041 Std. Error t-Statistic 0.004687 213.1860 0.130344 3.699140 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion F-statistic Prob(F-statistic) 89 Prob. 0.0000 0.0006 0.998560 0.037163 -3.938035 -3.861554 13.68363 0.000556 Dependent Variable: CF Method: Least Squares Date: 08/04/10 Time: 05:01 Sample(adjusted): 2005:06 2009:06 Included observations: 49 after adjusting endpoints Variable C XAF R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat Coefficient 1.000560 0.458890 0.122677 0.104010 0.035540 0.059364 95.01122 1.690601 Std. Error t-Statistic 0.005133 194.9125 0.179002 2.563598 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion F-statistic Prob(F-statistic) Prob. 0.0000 0.0136 0.998617 0.037546 -3.796376 -3.719159 6.572033 0.013618 Dependent Variable: CF Method: Least Squares Date: 08/03/10 Time: 19:54 Sample(adjusted): 2005:06 2009:06 Included observations: 49 after adjusting endpoints Variable C UGX R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat Coefficient 0.997786 0.428620 0.188047 0.170771 0.034190 0.054941 96.90833 1.575568 Std. Error t-Statistic 0.004891 204.0146 0.129914 3.299260 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion F-statistic Prob(F-statistic) Prob. 0.0000 0.0019 0.998617 0.037546 -3.873809 -3.796592 10.88511 0.001854 Dependent Variable: CF Method: Least Squares Date: 08/03/10 Time: 19:54 Sample(adjusted): 2005:06 2009:07 Included observations: 50 after adjusting endpoints Variable C BRL R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat Coefficient 0.999389 0.141711 0.028252 0.008007 0.037014 0.065761 94.89690 1.391240 Std. Error t-Statistic 0.005281 189.2322 0.119961 1.181314 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion F-statistic Prob(F-statistic) 90 Prob. 0.0000 0.2433 0.998560 0.037163 -3.715876 -3.639395 1.395503 0.243298 Dependent Variable: CF Method: Least Squares Date: 08/03/10 Time: 19:55 Sample(adjusted): 2005:06 2009:07 Included observations: 50 after adjusting endpoints Variable C ZAR R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat Coefficient 0.998485 0.037586 0.002249 -0.018537 0.037506 0.067521 94.23674 1.554463 Std. Error t-Statistic 0.005309 188.0721 0.114259 0.328956 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion F-statistic Prob(F-statistic) 91 Prob. 0.0000 0.7436 0.998560 0.037163 -3.689469 -3.612989 0.108212 0.743620 g. Appendix G: Optimal Weights (Without short selling) Code Current Income Original Weight 0.020% 0.025% 0.030% 0.040% 0.050% 0.060% 0.070% 0.074% 0.081% 0.084% AFO AUD BDT BRL CAD COP EUR HTG ILS INR KES NPR PHP PKR SLL TZS USD XOF YER ZAR £ 516.19 £ 133,847.74 £ 105,993.66 £ 311,944.46 £ 146,476.86 £ 971.53 £ 6,705,768.16 £ 16,711.34 £ 33,549.55 £ 149,507.61 £ 5,420.38 £ 501.82 £ 8,583.53 £ 331,836.58 £ 29,266.44 £ 40,654.23 £ 7,406,410.15 £ 3,829.68 £ 18,622.95 £ 73,386.52 TOTAL £15,523,799.38 0.00% 0.86% 0.68% 2.01% 0.94% 0.01% 43.20% 0.11% 0.22% 0.96% 0.03% 0.00% 0.06% 2.14% 0.19% 0.26% 47.71% 0.02% 0.12% 0.47% 100.00% 19.7% 8.5% 3.7% 5.4% 0.0% 0.0% 9.8% 3.7% 0.0% 0.0% 4.3% 0.0% 0.0% 5.8% 0.0% 0.0% 0.0% 33.8% 0.0% 5.3% 20.4% 9.7% 4.7% 7.3% 0.0% 0.0% 6.0% 4.7% 1.2% 0.0% 2.6% 0.0% 0.7% 2.9% 0.0% 0.0% 2.9% 32.1% 0.0% 4.9% 20.9% 10.8% 5.3% 9.0% 0.0% 0.0% 2.2% 5.3% 2.5% 0.0% 0.0% 0.0% 2.1% 0.0% 0.0% 0.0% 6.7% 30.5% 0.0% 4.7% 22.8% 11.6% 8.0% 11.4% 3.5% 1.7% 0.0% 8.0% 4.3% 0.0% 0.0% 0.0% 5.0% 0.0% 0.0% 0.0% 0.0% 20.3% 0.0% 3.4% 23.8% 12.4% 8.8% 13.7% 6.4% 4.6% 0.0% 8.8% 3.9% 0.0% 0.0% 2.4% 5.0% 0.0% 0.0% 0.0% 0.0% 7.9% 0.0% 2.3% 25.9% 8.9% 6.7% 16.3% 13.1% 10.3% 0.0% 4.7% 0.0% 0.0% 0.0% 10.2% 3.8% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 23.1% 0.0% 0.0% 18.1% 24.5% 30.1% 0.0% 0.0% 0.0% 0.0% 0.0% 4.3% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 14.7% 0.0% 0.0% 16.8% 24.8% 43.7% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 9.9% 15.4% 74.7% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 100.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 92 h. Appendix H: Optimal Weights (With short selling) Code Income AFO AUD BDT BRL CAD COP EUR HTG ILS INR KES NPR PHP PKR SLL TZS USD XOF YER ZAR £ 516.19 £ 133,847.74 £ 105,993.66 £ 311,944.46 £ 146,476.86 £ 971.53 £ 6,705,768.16 £ 16,711.34 £ 33,549.55 £ 149,507.61 £ 5,420.38 £ 501.82 £ 8,583.53 £ 331,836.58 £ 29,266.44 £ 40,654.23 £ 7,406,410.15 £ 3,829.68 £ 18,622.95 £ 73,386.52 Current W 0.030% 0.040% 0.050% 0.060% 0.070% 0.080% 0.084% 0.13% 0.00% 0.86% 0.68% 2.01% 0.94% 0.01% 43.20% 0.11% 0.22% 0.96% 0.03% 0.00% 0.06% 2.14% 0.19% 0.26% 47.71% 0.02% 0.12% 0.47% 18.4% 10.1% 20.5% 6.1% -2.5% -5.2% 6.6% 19.9% 1.5% 3.9% 5.6% -12.0% 3.7% 11.0% -5.0% -8.5% -0.1% 40.1% -20.8% 6.7% 18.6% 18.7% 18.9% 19.1% 19.3% 19.3% 9.7% 9.3% 9.0% 8.6% 8.3% 8.2% 28.8% 37.2% 45.6% 54.0% 62.5% 66.1% 6.3% 6.3% 6.4% 6.5% 6.5% 6.5% -1.6% -0.8% 0.1% 0.9% 1.7% 2.2% -4.8% -4.4% -4.0% -3.5% -3.1% -2.9% 5.6% 4.5% 3.4% 2.2% 1.0% 0.4% 28.2% 36.6% 45.0% 53.4% 61.9% 65.5% 1.3% 1.2% 1.2% 1.0% 1.0% 0.9% 3.8% 3.9% 4.0% 4.0% 4.2% 4.3% 4.5% 3.4% 2.2% 1.0% -0.1% -0.7% -11.1% -10.3% -9.5% -8.7% -8.1% -7.8% 4.2% 4.6% 5.0% 5.5% 5.9% 6.1% 9.9% 8.9% 7.8% 6.7% 5.8% 5.5% -7.7% -10.5% -13.2% -16.0% -18.7% -19.9% -9.1% -9.7% -10.3% -10.9% -11.5% -11.7% 1.7% 3.4% 4.9% 6.7% 8.1% 8.6% 39.6% 39.1% 38.6% 38.2% 37.8% 37.8% -34.5% -48.2% -61.9% -75.6% -89.3% -95.2% 6.6% 6.6% 6.7% 6.7% 6.8% 6.8% 18.1% 9.2% 96.1% 13.1% 3.5% -1.2% -14.4% 95.5% -1.8% -9.7% -15.9% 11.3% 7.1% -4.7% -31.5% -18.3% 57.1% 41.3% -160.8% 6.2% 1.88% 3.74% 18.56% 49.8% -54.2% 1578.0% 21.0% 154.6% 72.4% -201.9% 1577.3% -17.5% 15.9% -207.4% 135.1% 84.2% -181.6% -513.9% -119.3% 302.4% -43.8% -2561.2% 10.1% 81.2% -118.5% 3135.6% 35.8% 311.6% 150.0% -409.7% 3134.7% -36.3% 28.4% -420.4% 281.7% 165.0% -375.1% -1022.6% -230.1% 604.7% -128.4% -5101.1% 13.5% 332.5% -632.8% 15594.1% 154.6% 1568.2% 770.9% -2076.3% 15592.5% -187.8% 124.1% -2123.8% 1459.1% 808.9% -1916.5% -5092.7% -1116.8% 3023.1% -800.8% -25421.8% 41.2% 100.0% 100.0% TOTAL £15,523,799.38 100.00% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 93 i. Appendix I: Individual VaRs Currency EUR USD PHP KES XOF UGX PKR MWK ZAR IDR ILS BDT TZS LKR BRL COP ERN AFO HTG THB NPR SDG CAD VND INR ZMK YER AUD NGN SLL RUR PEN AZN GEL BOB MMK AMD ALL KHR TJS DOP GHS CLP RWF HNL AON GTQ ETB MXN NIO BBD CDF MZN HKD EGP JPY JMD JOD LRD CHF LBP MRO 1-day 99% VaR% W£ 1-day 99% VaR£ 20-day VaR£ 1.34% 5,228,008 69,907 312,636 1.57% 4,117,599 64,633 289,049 1.80% 1,489,799 26,888 120,246 1.70% 1,348,670 22,912 102,464 1.33% 1,101,435 14,679 65,645 2.04% 909,554 18,531 82,873 1.66% 682,061 11,301 50,540 2.68% 681,116 18,251 81,621 2.05% 660,489 13,548 60,590 1.74% 645,507 11,222 50,187 1.62% 579,390 9,407 42,070 1.58% 547,030 8,662 38,738 2.24% 466,827 10,477 46,854 1.63% 394,478 6,421 28,715 1.98% 377,319 7,474 33,423 2.08% 351,073 7,302 32,657 1.35% 334,229 4,497 20,112 1.81% 332,637 6,024 26,938 1.58% 306,556 4,854 21,709 1.56% 256,334 3,998 17,878 1.62% 249,588 4,037 18,053 2.08% 242,315 5,034 22,513 1.78% 146,477 2,613 11,687 1.66% 141,035 2,347 10,495 1.65% 139,950 2,316 10,356 2.19% 138,361 3,025 13,527 1.64% 131,983 2,161 9,664 1.92% 131,911 2,533 11,328 2.02% 128,883 2,598 11,620 1.87% 127,296 2,383 10,658 1.71% 117,100 2,002 8,955 1.53% 112,095 1,716 7,674 1.58% 103,243 1,634 7,306 1.92% 102,133 1,959 8,763 1.58% 95,291 1,509 6,748 1.57% 82,641 1,294 5,788 1.95% 77,162 1,504 6,726 1.39% 60,129 838 3,745 1.67% 59,809 999 4,468 1.82% 58,019 1,058 4,730 1.91% 55,160 1,053 4,710 1.69% 51,446 867 3,878 1.86% 51,259 954 4,268 1.60% 45,353 725 3,241 1.58% 42,090 667 2,981 1.91% 23,715 452 2,021 1.68% 16,679 281 1,256 2.15% 9,553 205 918 1.77% 8,092 143 639 1.59% 6,936 110 492 1.56% 6,196 97 433 1.98% 2,745 54 243 3.05% 2,014 61 274 1.57% 684 11 48 1.57% 560 9 39 2.39% 366 9 39 1.62% 252 4 18 1.60% 244 4 17 1.93% 241 5 21 1.40% 18 0 1 1.56% 2 0 0 2.20% Total 23,579,136 390,258 1,745,288 99% VaR of the Portoflio 295,899 1,323,300 Benefits of diversification 94,359 421,988 94