Mardones, C., & Zapata, A. (2018). Impact of public support on the i

Anuncio

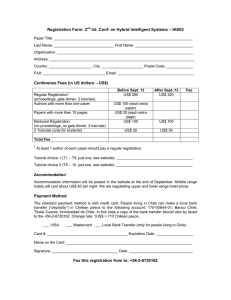

Economics of Innovation and New Technology ISSN: 1043-8599 (Print) 1476-8364 (Online) Journal homepage: http://www.tandfonline.com/loi/gein20 Impact of public support on the innovation probability in Chilean firms Cristian Mardones & Annabella Zapata To cite this article: Cristian Mardones & Annabella Zapata (2018): Impact of public support on the innovation probability in Chilean firms, Economics of Innovation and New Technology, DOI: 10.1080/10438599.2018.1546548 To link to this article: https://doi.org/10.1080/10438599.2018.1546548 Published online: 19 Nov 2018. Submit your article to this journal Article views: 2 View Crossmark data Full Terms & Conditions of access and use can be found at http://www.tandfonline.com/action/journalInformation?journalCode=gein20 ECONOMICS OF INNOVATION AND NEW TECHNOLOGY https://doi.org/10.1080/10438599.2018.1546548 Impact of public support on the innovation probability in Chilean firms Cristian Mardones and Annabella Zapata Department of Industrial Engineering, University of Concepción, Concepción, Chile ABSTRACT ARTICLE HISTORY This research evaluates the impact of public funding on the probability of performing various innovative activities in Chilean firms during the period of 2007–2014, using binary choice models applied to a pseudo-data panel. The results indicate that public support for innovation has a positive and statistically significant effect on internal and external Research and Development (R&D) and also increases the probability of having a formal R&D department. However, the results are not robust regarding innovation for products, services, processes, logistics, marketing and organizational innovation. On the other hand, collaborative actions were shown to positively impact the realization of all types of innovation and stimulate internal and external R&D. Thus, it is concluded that public support programs could be more successful if they promote cooperation with public and / or private actors. Received 14 May 2018 Accepted 2 November 2018 KEYWORDS Pseudo-panel; probit; R&D JEL CODE C23; O3 1. Introduction The innovation process is complex because of the diversity of ways that firms can innovate. However, it is possible to distinguish different types of innovations, which are classified as technological and non-technological. Product, service and process innovations are technological innovations; meanwhile marketing and organizational innovations are non-technological innovations (Geldes, Felzensztein, and Palacios 2017).1 R&D plays a fundamental role in innovation, and although the concept is treated as a whole, three activities can be distinguished, including basic innovation, applied innovation and experimental development. Additionally, it is possible to distinguish between internal R&D that is systematically carried out in the firm to increase knowledge and use it to develop and introduce innovations, while external R&D is acquired from public or private research organizations as well as from other firms or units established abroad. Firms can make innovative efforts for a number of reasons, such as having greater competition in the market, improving efficiency, and raising product quality, among other types of efforts. However, these efforts are hindered by internal and external factors, including the high costs of investing in innovation and the difficulty of obtaining public and / or private support. Therefore, there are numerous programs in different countries that seek to promote innovative activities and boost R&D, although in most cases, there is no scientific evidence to determine the effectiveness of these programs. Thus, this research seeks to evaluate the public policies associated with the financing of innovation in Chile since there are a large number of existing funding instruments, which makes it necessary to prove their effectiveness.2 Specifically, it seeks to determine CONTACT Cristian Mardones crismardones@udec.cl Edmundo Larenas 219, 4th floor, Concepción, Chile © 2018 Informa UK Limited, trading as Taylor & Francis Group Department of Industrial Engineering, University of Concepción, 2 C. MARDONES AND A. ZAPATA whether public support raises the probability of realizing various types of innovations and the probability of undertaking R&D activities in firms. For this, a pseudo-panel methodology is used because in Chile, as in other developing countries, there is no availability of data that follows the same firms over time in innovation topics. This study complements the international literature that analyzes government incentives to drive innovative activities with data panel at the firm level. For example, Dai and Cheng (2015) used the generalized propensity score matching method with panel data obtained for Chinese firms between 2005 and 2007 to determine the optimal level of public subsidies for investment in R&D. Guan and Yam (2015) investigated the effect of subsidies, loans and government support for entrepreneurship based on the exemption or reduction of tax payments using a survey conducted in Beijing between 1993 and 1995, concluding that subsidies have an insignificant impact on innovative sales, but loans and support for entrepreneurship have a positive effect. Young and Cheol (2010) analyzed panel data from small and medium-sized Korean firms and determined that subsidies helped SMEs to overcome financial barriers to R&D, reduce capital costs and share the risk of these activities with the government. Lee (2011) assessed the effect of public support on R&D using firm-level data in six countries (i.e. Canada, Japan, Korea, Taiwan, India and China); their results show that public support has a complementary effect on the R&D of private firms with low technological base and are highly competent in the market; however, the effect is opposite for firms that present a quick growth in sales, are not part of collaborative agreements for R&D and belong to some industrial cluster. González and Pazó (2008) used data from Spanish manufacturing firms between 1990 and 1999 and determined that firms receiving public support are more likely to carry out R&D activities. Huergo, Trenado, and Ubierna (2015) showed that after receiving public support for R&D activities, the firms are more likely to continue these activities with their own resources in later years. Afcha (2012) found that public subsidies have a positive effect on external R&D, but the effect is negative on internal R&D; furthermore, these authors determined that internal R&D is positively influenced by external sources of knowledge and that external R&D is negatively affected by these types of cooperation. Acosta, Coronado, and Romero (2015) determined that public support plays a fundamental role in the decision to invest in R&D and that the probability of engaging in these activities increases with the size, age of firms, number of university personnel and cooperation networks with other firms. King and Woolley (2014) showed that government subsidies in the United Kingdom increase innovation in firms regardless of their size. Cappelen, Raknerud, and Rybalka (2012) used panel data from 1999 to 2004 in Norway to determine that firms that receive tax credits develop new production processes; in some cases, they develop new products for the firm but do not contribute to patenting or introducing new products to the market. Furthermore, Cappelen, Raknerud, and Rybalka (2012) found that firms that collaborate with others are more likely to be successful in their innovative activities. Berubé and Mohnen (2009) found that Canadian firms that obtain tax credits and subsidies are much more innovative than firms that only obtain tax credits and, furthermore, that firms that receive subsidies are able to introduce more innovations to the market and are more successful at commercializing them. Antolín-López et al. (2015) analyzed the relationship between different types of public incentives that promote innovative activities in 29 European countries and determined that programs that encourage participation in fairs and collaboration between firms are efficient tools to promote product innovation in new firms. While subsidies to acquire infrastructure and policies that reduce taxes on R&D expenditures encourage innovation in established firms, they also found that firm size affects the probability of obtaining public support in established firms and that R&D expenditure positively affects this probability both in new and established firms. In the Latin American context, Crespi, Maffioli, and Melendez (2011) evaluated programs that provide financial incentives for R&D in Colombia using data from between the years 1995 and 2007, thus concluding that the benefited firms increased employment, labor productivity and product innovation. Hall and Maffioli (2008) assessed the government funds for technological development in Argentina, Chile, Brazil and Panama. Their results showed that technological development ECONOMICS OF INNOVATION AND NEW TECHNOLOGY 3 funds do not displace private investment. On the contrary, in many cases, the R&D inversion is increased meaningfully. In addition, in the case of Panama and Chile, they found that the programs positively affected the introduction of innovations for products, processes, sales and employment. Most of the empirical studies carried out in Chile have estimated structural models of the CDM type (see Crepon, Duguet, and Mairessec 1998) that relate R&D expenditure, innovation and productivity. For example, Benavente (2005) used this type of model with cross-sectional data obtained from the first three versions of the Innovation Survey, which allowed him to conclude that the firms that receive public financing are more productive and innovative. Bravo-Ortega, Benavente, and Á González (2014) also using cross-section data conclude that public financing complements private resources for R&D, that investing more in R&D increases the probability of exporting, and also that export orientation and R&D activities increase productivity. Álvarez, Bravo-Ortega, and Navarro (2011) determine that higher R&D expenditure generates slow and uncertain productivity gains in Chilean firms. Álvarez, Bravo-Ortega, and Zahler (2015) find a positive effect of technological and non-technological innovation on labor productivity in the manufacturing and services sector. However, the present study does not use a structural model but rather uses an ex – post evaluation approach that tries to identify the effect of public financing on certain outcome variables, which is why the cross – section data of the various surveys of innovation are used to build a pseudo-panel. Thus, this study is important since World Bank (2008) points out that there has not been a systematic approach to monitor and evaluate innovation programs and policies in Chile. To date, only some ex – post evaluations have been carried out at the request of the Budget Office (DIPRES) or through studies financed by the Inter – American Development Bank to analyze specific programs. For example, Benavente and Crespi (2003) concluded that the PROFO program improved management, productivity and access to other financing programs, but did not contribute to product or process innovation. Benavente, Crespi, and Maffioli (2007) showed that the FONTEC program did not contribute to the creation of new products although it improved the interaction with external sources of knowledge and the obtaining of financing. Tan (2009) showed that the FAT and PROFO programs had a positive impact on sales, labor productivity, wages and exports. Álvarez, Crespi, and Conrado (2012) concluded that the FONTEC program generated a positive impact on employment, remunerations and productivity. 2. Innovation policy in Chile In Chile, the innovation policy3 is developed by the Corporation for the Production Promotion (CORFO), which is a state agency that originally aimed at the industrialization of the country. Although for many years CORFO financed several technological diffusion and innovation programs, only since 2005 all these instruments were grouped through InnovaChile (World Bank 2008). Currently, CORFO seeks to support the creation of innovative firms through different programs and instruments that help finance, growth and internationalization of national firms, and also develops initiatives that boost and promote a culture of entrepreneurship. Among the main programs or instruments of CORFO, the following can be mentioned: bank loan guarantees for SMEs provided by the State, the Opportunity Zones Investment Support Contest, the Regional Entrepreneurship Support Program, the known Global Entrepreneurs Competition like StartUp Chile, support for business incubators in higher education institutions, the creation of funds to finance mentoring networks, the promotion of social enterprises with the so-called ‘B Corps’, funds for the creation of technological extension centers, the opening of Start-Up Chile offices at a regional level, creation of seed capital funds, financing for the opening of co-working in different cities, and the creation of early investment funds for dynamic ventures. On the other hand, CORFO develops various events to strengthen innovation and entrepreneurship, supports the creation of critical mass and dissemination of knowledge, as well as funds training to promote change in innovation and entrepreneurship ecosystems. 4 C. MARDONES AND A. ZAPATA Additionally, due to the concentration of entrepreneurial activity in the capital of the country, local resource allocation committees were created to articulate the various private sector development initiatives with regional development strategies, and also, the Territorial Integrated Program was generated to support the coordination of regional development with local governments and other institutions (Goldberg and Palladini 2008). According to Benavente, Crespi, and Maffioli (2007), the evolution of the national innovation strategy in Chile has been remarkable, becoming one of the most dynamic in Latin America. However, the participation of the private sector in national innovation efforts is quite limited, which is explained by market failures such as the impossibility of fully appropriating the benefits from innovation, information asymmetries, moral hazard that limit financing access and the intangibility of the knowledge accumulated in R&D that prevents its use as a guarantee for loans and network externalities. Finally, it can be mentioned that according to Agosin, Grau, and Larrain (2010) Chile’s industrial policy underwent a temporary transition from horizontal policies that sought to correct market failures that affected the entire economy (such as bank loan guarantees for SMEs provided by the State and financing innovative projects) to an emphasis on specific industrial clusters in which already exist or could exist comparative advantages (program of attraction of direct foreign investment in sectors of high technology and Fundación Chile which is a public-private institution that seeks the development of new markets). However, these industrial policy instruments involved few resources to generate substantial changes in the productive structure and the proliferation of programs made it difficult for any program to achieve the scale required to achieve success. Currently, due to the successive changes in government, we have returned to more horizontal policies. 3. Data The research is based on data obtained from the different versions of the Innovation Survey.4 This survey shows inputs, results and strategies for innovation and also characterizes the factors that influence the capacity of innovation and the economic performance of Chilean firms. Currently, nine versions of this survey are available that are representative by the economic sector, region and size of firms in each period. The data have a repeated cross-sectional structure since the firms surveyed are not the same for each period nor is it possible to track over time some of the subsets. In addition, the variables of interest for the present study are not fully available in the first four versions of the survey; therefore, it was decided to work only with the last five versions. As a result, the consolidated database used for this research contains observations covering the period 2007–2014. Table 1 summarizes the variables used in the study and how they were coded. The consolidated database shows that the most innovative activity performed by Chilean firms over the years is organizational innovation (21%), followed by process innovation (18.9%), product innovation (11.8%), service innovation (10.9%), logistics innovation (9.6%) and marketing innovation (8.1%). In addition, 10.3% of the firms carry out internal R&D, 4.5% carry out external R&D, and 6.6% have a formal R&D department, while 8.6% of the firms collaborate with partners in innovation. On the other hand, 15.2% of the firms acquire external knowledge (i.e. patents, licenses or know-how agreements), and 29.2% acquire some equipment, machines or software to funding the innovative activities. Furthermore, it should be noted that 5.4% of the firms state that they have obtained a public financing instrument to carry out innovative activities.5 Many of these instruments aim to promote innovation in SMEs. Figure 1 shows the number of firms surveyed according to the technological classification used by Eurostat.6 In the particular case of Chile, the low number of firms classified in the higher-level of technological manufacturing sectors as well as in the knowledge intensive services (KIS) sectors is very evident. On the contrary, the majority of manufacturing firms are classified in low-technology sectors and service firms in the less knowledge-intensive services (LKIS) sectors. However, the most recent surveys show that the number of firms with a higher technological profile and knowledge intensity have increased. ECONOMICS OF INNOVATION AND NEW TECHNOLOGY 5 Table 1. Variables used in the study. Variable Product innovation Service innovation Process innovation Logistics innovation Marketing innovation Organizational innovation Internal R&D External R&D Department of R&D Public support Cooperation Eurostat classification of economic activities Size Holding Type of property External knowledge Equipment for innovation Total sales Exports Number of workers Source: Own elaboration. Definition Dummy = 1 if the firm introduced product innovation in the last two years or 0 otherwise Dummy = 1 if the firm introduced service innovation in the last two years or 0 otherwise Dummy = 1 if the firm introduced process innovation in the last two years or 0 otherwise Dummy = 1 if the firm introduced logistical innovation in the last two years or 0 otherwise Dummy = 1 if the firm introduced marketing innovation in the last two years or 0 otherwise Dummy = 1 if the firm introduced organizational innovation in the last two years 0 or otherwise Dummy = 1 if the firm performed R&D in the firm itself in the last two years or 0 in another case Dummy = 1 if the firm performed R&D outside the firm in the last two years or 0 otherwise Dummy = 1 if the firm has a formal unit, department or laboratory of R&D or 0 otherwise Dummy = 1 if the firm has used public support for innovation or 0 otherwise Dummy = 1 if the firm has carried out cooperative actions for innovation or 0 in otherwise 11 dummy variables = 1 if the firm belongs to a particular economic activity or 0 otherwise 3 dummy variables = 1 if variables that identify the size of the firm according to sales (i.e. if the signature is large, medium or small) or 0 otherwise Dummy = 1 if the signature is part of a holding firm or 0 otherwise 3 dummy variables that identify the type of ownership of the firm (i.e. foreign, private or mixed ownership) or 0 otherwise. Dummy = 1 if the firm acquired external knowledge in the form of patents, licenses or knowhow agreements, or 0 otherwise Dummy = 1 if the firm acquired equipment, machines or software for innovation or 0 otherwise Total sales in thousands of Chilean pesos Dummy = 1 if the firm made exports or 0 otherwise Total employees (i.e. contractors, fees and subcontractors) Figure 2 shows that the greatest R&D expenditure intensity is in the High-tech, KIS3, KIS4 and Lowtech sectors. However, these intensities are quite variable through the surveys, which reflects a lack of constant efforts to carry out R&D in Chilean firms. The above cannot be attributed to a drastic change in the characteristics of the firms that are part of the sample, since, as can be seen in Figure 3, the size of the firms has remained relatively constant in the different versions of the survey. Figure 1. Number of firms surveyed according to Eurostat technology classification. 6 C. MARDONES AND A. ZAPATA Figure 2. R&D expenditure intensity of firms surveyed according to the Eurostat technology classification. 4. Methodology The difficulty and cost of periodically surveying the same firms prevents many developing countries from having panel data. However, repeated cross-sectional surveys are often available, which include different firms in each period. In this scenario, Deaton (1985) suggests dividing the population into groups or cohorts based on certain characteristics and making estimates using the average of the cohorts instead of individual observations. This alternative is known as pseudo-panel data, which does not suffer from attrition of the sample, and also allows for observations for much longer periods of time in comparison to a genuine panel data (Baltagi 2005). To illustrate the estimation of a pseudo-panel, we need a set of T independent cross-sections represented by (1): yit = xit′ b + mi + nit , t = 1, . . . , T (1) where β is the parameter vector of interest, and xit denotes a vector of explanatory variables of K dimension. The subscript i refers to firms, and since it is assumed that the set of available data is a series of independent cross-sections, there are N firms in each period. Figure 3. Percentage of firms surveyed according to size and version of the innovation survey. ECONOMICS OF INNOVATION AND NEW TECHNOLOGY 7 To obtain an estimator of β, it can define C cohorts that group together firms that share common characteristics. Each firm belongs exactly to a group, and averaging the individual observations in each cohort provides by (2): y ct = x ′ct b + m ct + nct , c = 1, . . . , C; t = 1, . . . , T (2) where y ct is the average of yit on all firms belonging to the cohort c in period t, and the same logic applies to all other variables in the model. Thus, the resulting dataset is a pseudo-panel with repeated observations for T periods and C cohorts. Moffitt (1993) states that repeated cross-sectional data estimates can be interpreted as a procedure of instrumental variables. To illustrate this idea, a simple extension of (1) is used, in which the individual effect mi is decomposed into a cohort effect mc and into the individual deviation of this effect as follows: mi = C mc zci + hi (3) c=1 where zci is a dummy variable that takes the value of 1 if unit i is a member of cohort c and is 0 otherwise. Replacing (3) in (1) yields yit = xit′ b + C mc zci + hi + nit (4) c=1 If mi is correlated with xit , it can be expected that hi and xit are correlated too. Because of this expectation, estimating (4) with ordinary least squares would yield inconsistent estimates for β. However, assuming that the instruments for xit are not correlated with hi + nit , an estimator of instrumental variables can produce consistent estimates for β and mc . A natural choice is to define dummy variables of time, Dst = 1 if s = t and is 0 otherwise, to interact with cohort dummies as instruments for xit , so a linear predictor is derived in a reduced form, as follows: xit = C T g1,ct zci Dst + c=1 s=1 C g2,c zci + vit (5) c=1 The linear predictor for xit is given by x̂it = x ct , which corresponds to the average value of xit in the cohort c and period t. Thus, we obtain the instrumental variable estimator for β, which is given by −1 C T C T ′ b̂IV = (x ct − x c )xit (x ct − x c )yit (6) c=1 t=1 c=1 t=1 To ensure the consistency of b̂IV , the instruments for xit are required to vary with t and not be (i.e. asymptotically) correlated with hi y nit when the size of the cohorts tends to infinity. According to Moffitt (1993), it is possible to extend this same approach of instrumental variables to the binary choice model in which a latent variable yit∗ is defined as follows: yit∗ = xit′ b + mi + nit , t = 1, . . . , T (7) yit = 1 , if yit∗ . 0 (8) yit = 0 , if yit∗ ≤ 0 (9) In this model, only an additional normality assumption is required for mi + nit . It should be noted that in the pseudo-panel methodology there is a trade-off between the number of cohorts and the number of individuals per cohort. For example, if cohorts were constructed by economic activity, region and firm size, the number of observations in each cohort would be significantly reduced, which implies that the sample averages of each cohort are not accurate estimates of 8 C. MARDONES AND A. ZAPATA the population averages of the cohorts. In contrast, a pseudo-panel constructed with a smaller number of cohorts includes more individuals per cohort, which allows obtaining a smaller pseudopanel with more precise observations. Verbeek and Nijman (1992) studied the consistency properties of the previous estimators, finding that nc 1 is an essential condition for the consistency of the estimator. Therefore, it was decided to use the Eurostat classification to construct the cohorts7 since this allows obtaining groups with more homogeneous units according to the technological intensity of the firms belonging to every economic activity. 5. Results This section presents the results of econometric models that evaluate the impact of public financing on innovation and R&D activities. It should be noted that six empirical specifications are estimated that include different explanatory variables, which allows testing the robustness of the estimates. Specifically, in order to analyze the effect on the probability of carrying out some type of innovation, model 1 includes public financing as an explanatory variable; model 2 also controls by cooperation and economic activity according to Eurostat classification; model 3 also controls by firm size (large, medium and small, leaving as a base the microenterprises), belonging to a holding company and the type of property (private, foreign and mixed, leaving as a public firm base); model 4 also adds a control for the holding of an R&D department, realization of internal R&D and realization of external R&D; model 5 additionally controls for expenses in external knowledge and expenses in equipment for innovation; and model 6 also controls for total sales, number of workers and exports. Some studies present evidence of endogeneity in the cooperation variable, so it is necessary to use some strategy to face this problem such as the estimation of a bivariate probit model or through instrumental variables. In this sense, it can be mentioned that the methodology used in this study does not directly use the cooperation variable, but Moffit’s proposal uses instrumental variables to construct the cohorts in the pseudo-panel (see equation 4). Thus, in this study the cooperation variable is already instrumentalized, which allows controlling for some possible endogeneity. However, the grouping variables must satisfy the appropriate conditions for an estimator of instrumental variables to be consistent. This requires that the instrument be relevant, that is, that it be properly correlated with the endogenous explanatory variables of the model. If they are weakly correlated with the explanatory variables, the estimators could have a low performance due to the problem of weak instruments. Therefore, in this study an F test was performed to detect weak instruments, obtaining a statistic of 16.2, which exceeds the criterion established by Stock and Yogo (2005) of a value lower than 10, for this reason a weak instrument hypothesis is rejected. In addition, all models were re-estimated excluding the variable cooperation and also bivariate probit were estimated to analyze how the results obtained changed, in both cases it is concluded that the estimated effects of public financing are maintained (they are not reported due to space limitations). Consequently, it is possible to affirm that after addressing different strategies, the effects found in section 5.1 and 5.2 are maintained by the pseudo-panel model, and also that the instrumental variables used to construct the cohorts are relevant for controlling endogeneity of the variable cooperation. 5.1. Impact on the different types of innovation The results presented in Table 2 indicate that public support only has a positive and statistically significant impact at 1% on product innovation in three of the six proposed specifications. This impact is most significant when the model only includes public support as an explanatory variable, then the magnitude decreases but continues to be significant when controlled by economic activity, size and type of ownership of the firms. However, the effect of public support ceases to be significant when controlling for variables related to R&D activities, acquisition of equipment and external ECONOMICS OF INNOVATION AND NEW TECHNOLOGY 9 Table 2. Results of the impact of public support on product innovation. Public support Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 3.094** [0.241] 1.717** [0.313] 2.345** [0.249] 0.287 [0.171] 0.221* [0.0974] −0.146 [0.132] 0.104 [0.0667] −1.501 [1.156] −0.193 [0.107] −0.521** [0.185] −0.195 [0.153] −0.453** [0.0829] −0.300 [0.241] 1.150* [0.447] 1.543** [0.392] −0.0443 [0.198] −0.00503 [0.124] −0.543** [0.157] −0.183 [0.0947] −3.687 [12.22] −0.542** [0.151] −0.340 [0.217] −0.394* [0.189] −0.560** [0.102] −0.588* [0.256] 4.274** [1.102] 3.217** [0.825] 4.370** [1.367] −1.466** [0.342] −2.524 [1.715] 2.497 [1.957] −4.605* [2.058] 1.200 [0.806] 1.591** [0.510] −0.0426 [0.198] −0.145 [0.164] −0.475** [0.160] −0.202* [0.0948] −1.967 [2.246] −0.593** [0.178] −0.424 [0.217] −0.282 [0.182] −0.538** [0.106] −0.441 [0.268] 3.656** [1.191] 2.071 [1.073] 3.034* [1.528] −1.245** [0.367] −2.752 [1.669] 0.583 [2.028] −6.414** [2.437] 1.622 [1.232] 0.337 [1.067] −2.525 [1.352] 0.500 [0.861] 1.885** [0.653] 0.139 [0.214] −0.301 [0.205] −0.389* [0.164] −0.202* [0.0984] −29.01 [25.26] −0.620** [0.227] −0.364 [0.225] 0.0298 [0.234] −0.380** [0.122] −0.228 [0.284] 0.0722 [1.737] −1.978 [2.023] −1.084 [2.121] −1.718** [0.584] 2.894 [2.968] 8.201* [4.172] −2.672 [3.282] 2.209 [1.999] 0.688 [1.256] −3.233 [2.102] −3.438** [1.170] 3.421** [1.189] −1.382** [0.0192] 21875 0.010 −1.421** [0.0487] 21875 0.022 −2.365 [1.863] 21875 0.026 −1.158 [1.958] 21875 0.026 −3.411 [2.519] 21875 0.027 3.294 [1.881] 3.335** [0.981] 0.265 [0.229] −0.541 [0.226] −0.151 [0.190] −0.222 [0.135] −32.75 [25.43] −0.837* [0.343] −0.520* [0.259] 0.252 [0.253] −0.129 [0.176] 0.180 [0.359] −1.893 [1.865] −2.939 [2.023] −2.597 [2.165] −1.136 [0.880] 2.494 [3.635] 7.171 [5.327] −5.263 [4.269] 6.652* [2.909] −3.295 [2.567] −4.798* [2.264] −4.205** [1.231] 3.996** [1.243] 3.36e-09 [2.06e-09] 0.000817 [0.000658] 0.293 [0.636] −2.131 [3.297] 21875 0.027 Cooperation High-technology industry Medium-high-technology industry Medium-low-high technology industry Low-tech-technology industry Knowledge-intensive market services High-tech knowledge-intensive services Knowledge-intensive financial services Other knowledge-intensive services Less knowledge-intensive market services Other less knowledge-intensive services Large firm Medium firm Small firm Holding Private property Foreign property Mixed property R&D department Perform internal R&D Performs external R&D External knowledge Equipment for innovation Total sales Number of workers Exports Constant Number of obs. Pseudo R2 Source: Own elaboration. Note: (*) significant at 5% and (**) significant at 1%. 10 C. MARDONES AND A. ZAPATA knowledge for innovation, total sales, exports and number of workers. This result is somewhat disappointing since in 2007 the OECD recommended that Chile promote productive diversification through an effective innovation policy that would allow it to expand and consolidate its long-term growth.8 On the other hand, it is interesting to note that cooperative actions with other firms or institutions to carry out innovation activities have a positive and statistically significant impact on all the specifications that include this explanatory variable. It is worth mentioning that in Chile the R&D capacities tend to be highly concentrated within universities and public research institutes, but there is a low transfer of technologies from these institutions to the private sector. In addition, it is observed that the acquisition of external knowledge has a negative and statistically at 5%. It also notes that the acquisition of machinery, equipment and software for innovation has a positive and statistically significant effect at 5%. The results presented in Table 3 demonstrate that public support does not contribute to service innovation since the estimated coefficients are not robust in the different specifications, showing positive and significant effects only in two specifications. However, cooperative actions have a positive and statistically significant effect at 1% for this type of innovation. This result can be related to the findings of Álvarez, Bravo-Ortega, and Zahler (2015) who, conclude that cooperation is a more important determinant for expenditure on innovative activities carried out in the services sector when analyzing the determinants of inputs, innovative outputs and labor productivity in the services sector and the manufacturing sector. On the other hand, exports have a negative and statistically significant impact at 5%, this last result is quite reasonable since Chilean firms tend to export more goods than services, so an exporting firm should be less likely to innovate in services. In terms of process innovation, the results presented in Table 4 show that the use of public support has a positive and statistically significant impact on the first three specifications that are controlled by economic activity, size and type of property, but in the following specifications, the effect changes sign and it is no longer significant. The cooperative actions again show a positive and statistically significant effect at 1% in all specifications that include this explanatory variable. Knowledge-intensive financial services, Other knowledge-intensive services, and Less knowledge-intensive market services have a negative and statistically significant impact on all specifications, this is reasonable because service sectors are on average less likely to innovate in processes than the rest of the economic activities. Regarding size and property type, there is no statistical evidence that any of these characteristics increases or decreases the probability of process innovation. Performing internal R&D and acquisition of machines, equipment and software for innovation have a statistically significant and positive effect, while the acquisition of external knowledge (i.e. patents, licenses and know-how) tends to reduce the probability of innovating in processes. The results related to logistics innovation shown in Table 5 that public support does not have a robust impact on this type of innovation. In addition, it is not possible to observe a robust effect of cooperative actions since although the coefficients are positive in all the specifications, only four specifications have statistical significance. There is no economic activity that is more or less likely to innovate in logistics. The acquisition of external knowledge has a negative impact on this type of innovation, while the purchase of machinery, equipment and software for innovation has a positive effect, in both cases with coefficients that are statistically significant at 1% or 5%. The negative effect of the acquisition of patents, licenses and / or know-how indicates that external knowledge becomes a barrier to logistics innovation. One possible explanation for the lack of impact on logistics innovation is the immense geographical concentration of the country, which means that successful firms that start in other regions could end up migrating to the capital for access to a larger market and capital of risk.9 Table 6 shows that the impact of public support on marketing innovation is not robust in the six estimated specifications. Cooperative actions increase the probability of innovating in marketing with coefficients that are statistically significant at 1% in all specifications that include this variable. In addition, exports have a negative and statistically significant impact at 1%. This could be explained ECONOMICS OF INNOVATION AND NEW TECHNOLOGY 11 Table 3. Results of the impact of public support on service innovation. Public fundiong Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 2.054** [0.251] −0.100 [0.317] 3.054** [0.247] 0.0457 [0.181] −0.303* [0.118] −0.588** [0.156] −0.672** [0.0890] −0.775 [0.447] 0.0998 [0.0920] −0.378* [0.154] −0.551** [0.166] −0.357** [0.0756] −0.133 [0.209] 1.221** [0.420] 1.521** [0.357] 0.238 [0.207] 0.0348 [0.138] −0.0256 [0.173] −0.0910 [0.112] −1.360** [0.434] 0.197 [0.139] −0.0543 [0.158] −0.159 [0.162] −0.123 [0.0957] 0.193 [0.224] −1.226 [1.048] 0.660 [0.750] 0.633 [1.302] 1.931** [0.324] −11.43** [1.628] −9.903** [1.767] −8.775** [1.984] 1.043 [0.744] 1.709** [0.469] 0.226 [0.210] 0.164 [0.183] 0.0623 [0.177] −0.0694 [0.115] −0.930* [0.454] 0.381* [0.176] −0.152 [0.168] −0.136 [0.174] −0.0558 [0.0994] 0.319 [0.235] −1.680 [1.134] −0.274 [0.992] −0.735 [1.449] 1.658** [0.362] −10.94** [1.658] −11.50** [1.938] −7.177** [2.374] −1.280 [1.269] 2.709** [1.007] −4.647** [1.390] 0.601 [0.808] 1.403** [0.532] 0.272 [0.213] 0.194 [0.216] 0.0868 [0.179] −0.0483 [0.117] −0.932 [0.476] 0.481* [0.211] −0.0893 [0.176] −0.0990 [0.185] −0.000475 [0.108] 0.305 [0.249] −1.887 [1.616] −0.0789 [1.672] −0.926 [1.919] 1.819** [0.385] −10.22** [1.950] −10.61** [2.249] −7.362** [2.423] −1.901 [1.707] 3.228** [1.121] −2.965 [2.068] −0.702 [0.817] 0.531 [0.833] −1.361** [0.0195] 21875 0.004 −1.335** [0.0482] 21875 0.026 9.235** [1.793] 21875 0.034 9.731** [1.929] 21875 0.035 8.981** [2.009] 21875 0.035 2.357 [1.966] 2.359** [0.903] 0.310 [0.233] −0.0358 [0.235] −0.00425 [0.203] −0.231 [0.152] −0.880 [0.481] −0.328 [0.323] −0.454* [0.211] −0.0983 [0.201] −0.217 [0.166] −0.0393 [0.328] −1.013 [1.847] −1.048 [1.702] 0.0926 [2.050] −0.0199 [0.778] −3.478 [2.922] −0.424 [4.097] 0.0444 [3.811] 2.839 [2.642] −0.234 [2.583] −5.442* [2.204] −1.828* [0.904] 1.657 [0.906] 4.13e-10 [2.10e-09] 0.000952 [0.000610] −1.789** [0.660] 2.178 [3.043] 21875 0.035 Cooperation High-technology industry Medium-high-technology industry Medium-low-high technology industry Low-tech-technology industry Knowledge-intensive market services High-tech knowledge-intensive services Knowledge-intensive financial services Other knowledge-intensive services Less knowledge-intensive market services Other less knowledge-intensive services Large firm Medium firm Small firm Holding Private property Foreign property Mixed property R&D department Perform internal R&D Performs external R&D External knowledge Equipment for innovation Total sales Number of workers Exports Constant Number of obs. Pseudo R2 Source: Own elaboration. Note: (*) significant at 5% and (**) significant at 1%. 12 C. MARDONES AND A. ZAPATA Table 4. Results of the public support impact on process innovation. Public support Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 3.069** [0.221] 0.804** [0.281] 1.704** [0.234] −0.232 [0.172] −0.139 [0.0924] −0.308** [0.112] −0.186** [0.0609] −1.699* [0.763] −0.513** [0.0999] −0.544** [0.139] −0.515** [0.139] −0.810** [0.0736] −0.649** [0.221] 0.900* [0.376] 1.719** [0.340] −0.271 [0.193] −0.220 [0.113] −0.383** [0.134] −0.209* [0.0842] −1.795* [0.864] −0.571** [0.136] −0.577** [0.158] −0.558** [0.151] −0.874** [0.0899] −0.650** [0.233] −1.160 [0.900] −1.159 [0.671] −1.557 [1.116] −0.366 [0.282] 1.730 [1.514] 2.805 [1.645] −0.00166 [1.832] −0.0632 [0.648] 1.537** [0.430] −0.275 [0.195] 0.210 [0.151] −0.337* [0.138] −0.140 [0.0870] −1.664 [1.122] −0.141 [0.163] −0.546** [0.168] −0.691** [0.171] −0.772** [0.0938] −0.718** [0.243] −0.517 [0.968] −0.218 [0.868] −1.274 [1.239] −0.992** [0.318] 2.965 [1.546] 2.780 [1.817] 4.345* [2.191] −4.735** [1.093] 4.254** [0.894] −1.871 [1.191] −0.689 [0.693] 1.659** [0.489] −0.132 [0.198] −0.133 [0.180] −0.216 [0.141] −0.152 [0.0893] −1.430 [1.738] −0.362 [0.194] −0.547** [0.175] −0.481* [0.191] −0.644** [0.101] −0.433 [0.256] −4.895** [1.386] −4.988** [1.505] −5.959** [1.634] −1.098** [0.340] 7.282** [1.802] 7.917** [2.099] 5.983** [2.238] −1.791 [1.512] 3.753** [1.008] −3.611* [1.797] −3.486** [0.745] 3.589** [0.767] −1.072** [0.0171] 21875 0.009 −0.873** [0.0431] 21875 0.022 −1.212 [1.633] 21875 0.023 −2.866 [1.749] 21875 0.024 −3.231 [1.797] 21875 0.025 −0.667 [1.668] 1.720* [0.795] −0.127 [0.209] −0.168 [0.196] −0.143 [0.163] −0.163 [0.122] −1.493 [1.785] −0.315 [0.293] −0.559** [0.204] −0.443* [0.203] −0.551** [0.147] −0.316 [0.317] −5.613** [1.509] −5.038** [1.525] −6.447** [1.687] −0.663 [0.685] 6.252* [2.662] 5.899 [3.718] 4.533 [3.420] −1.567 [2.358] 3.742 [2.247] −3.645 [1.923] −3.536** [0.814] 3.538** [0.831] 2.33e-10 [1.80e-09] 0.000352 [0.000555] 0.421 [0.558] −1.996 [2.681] 21875 0.025 Cooperation High-technology industry Medium-high-technology industry Medium-low-high technology industry Low-tech-technology industry Knowledge-intensive market services High-tech knowledge-intensive services Knowledge-intensive financial services Other knowledge-intensive services Less knowledge-intensive market services Other less knowledge-intensive services Large firm Medium firm Small firm Holding Private property Foreign property Mixed property R&D department Perform internal R&D Performs external R&D External knowledge Equipment for innovation Total sales Number of workers Exports Constant Number of obs. Pseudo R2 Source: Own elaboration. Note: (*) significant at 5% and (**) significant at 1%. ECONOMICS OF INNOVATION AND NEW TECHNOLOGY 13 Table 5. Results of the impact of public support on logistics innovation. Public support Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 0.480 [0.276] −1.193** [0.345] 1.324** [0.279] −0.321 [0.218] −0.252* [0.117] −0.288* [0.133] −0.300** [0.0766] −0.719 [0.395] −0.235* [0.109] −0.325* [0.151] −0.153 [0.147] −0.517** [0.0809] −0.366 [0.237] −0.657 [0.466] 0.909* [0.412] −0.125 [0.247] −0.114 [0.146] −0.0435 [0.164] −0.166 [0.108] −1.007* [0.432] −0.0261 [0.160] −0.322 [0.174] −0.0455 [0.168] −0.279** [0.105] −0.156 [0.257] 3.597** [1.129] 2.797** [0.798] 3.319* [1.404] 0.874* [0.344] −6.796** [1.735] −5.520** [1.905] −6.191** [2.173] 0.528 [0.807] 1.749** [0.531] −0.0553 [0.254] 0.443* [0.199] 0.0543 [0.171] −0.0156 [0.114] −0.905 [0.463] 0.408* [0.198] −0.301 [0.190] −0.270 [0.196] −0.202 [0.111] −0.148 [0.272] 3.530** [1.254] 3.012** [1.090] 3.353* [1.607] 0.101 [0.390] −5.691** [1.785] −4.093 [2.094] 1.219 [2.668] −5.115** [1.406] 2.359* [1.123] −2.972 [1.537] −0.692 [0.878] 1.001 [0.608] 0.0789 [0.258] 0.439 [0.235] 0.143 [0.175] 0.0326 [0.117] −0.779 [0.494] 0.597* [0.235] −0.145 [0.201] −0.125 [0.214] −0.0357 [0.120] −0.118 [0.289] 2.194 [1.746] 2.505 [1.847] 1.955 [2.086] 0.451 [0.411] −3.107 [2.129] −0.896 [2.424] 0.952 [2.701] −5.951** [1.917] 3.622** [1.257] 0.560 [2.279] −2.450** [0.900] 2.053* [0.923] −1.332** [0.0204] 21875 0.000 −1.203** [0.0513] 21875 0.008 1.897 [1.916] 21875 0.011 0.813 [2.074] 21875 0.013 −1.063 [2.154] 21875 0.014 3.813 [2.097] 3.039** [0.985] 0.257 [0.278] 0.167 [0.261] 0.150 [0.202] −0.0760 [0.155] −0.812 [0.499] −0.308 [0.351] −0.515* [0.235] −0.0152 [0.231] −0.155 [0.179] −0.263 [0.368] 3.140 [2.086] 1.619 [1.895] 3.025 [2.299] −1.352 [0.847] 4.057 [3.197] 10.81* [4.482] 6.813 [4.128] 1.487 [2.888] −3.282 [2.770] −2.028 [2.413] −3.877** [1.012] 3.457** [1.014] 3.60e-09 [2.26e-09] 0.000704 [0.000660] −2.171** [0.727] −8.484* [3.344] 21875 0.015 Cooperation High-technology industry Medium-high-technology industry Medium-low-high technology industry Low-tech-technology industry Knowledge-intensive market services High-tech knowledge-intensive services Knowledge-intensive financial services Other knowledge-intensive services Less knowledge-intensive market services Other less knowledge-intensive services Large firm Medium firm Small firm Holding Private property Foreign property Mixed property R&D department Perform internal R&D Performs external R&D External knowledge Equipment for innovation Total sales Number of workers Exports Constant Number of obs. Pseudo R2 Source: Own elaboration. Note: (*) significant at 5% and (**) significant at 1%. 14 C. MARDONES AND A. ZAPATA Table 6. Results of the impact of public support on marketing innovation. Public support Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 1.675** [0.276] −0.0123 [0.350] 3.114** [0.264] 0.101 [0.200] −0.0798 [0.122] −0.313* [0.159] −0.0521 [0.0776] −1.202 [0.981] −0.167 [0.117] −0.136 [0.164] −0.0965 [0.164] −0.502** [0.0960] −0.660 [0.365] −1.177* [0.487] 3.535** [0.439] 0.0911 [0.234] −0.111 [0.152] −0.673** [0.191] −0.371** [0.109] −1.440 [1.767] −0.354* [0.173] −0.205 [0.192] −0.250 [0.189] −0.726** [0.121] −0.978* [0.393] 3.915** [1.230] 1.324 [0.876] 4.096** [1.534] −1.087** [0.371] 4.456* [1.958] 6.112** [2.147] 1.944 [2.438] −0.905 [0.869] 3.823** [0.561] 0.120 [0.237] 0.0829 [0.203] −0.650** [0.196] −0.330** [0.112] −2.047 [5.263] −0.208 [0.206] −0.210 [0.206] −0.328 [0.208] −0.706** [0.126] −0.998* [0.410] 4.090** [1.353] 1.436 [1.203] 4.281* [1.747] −1.396** [0.423] 4.919* [2.007] 6.677** [2.459] 4.651 [2.935] −1.826 [1.434] 1.003 [1.159] −1.082 [1.583] −1.209 [0.940] 3.356** [0.623] 0.156 [0.240] 0.318 [0.250] −0.644** [0.198] −0.279* [0.116] −2.003 [3.485] 0.0693 [0.258] −0.103 [0.216] −0.367 [0.211] −0.663** [0.135] −1.132** [0.418] 5.837** [2.047] 3.865 [2.032] 6.201** [2.404] −1.116* [0.445] 3.993 [2.361] 5.592 [2.933] 3.684 [3.010] −4.232* [1.956] 2.122 [1.324] 2.101 [2.380] 0.401 [0.999] −0.719 [1.008] −1.505** [0.0214] 21875 0.003 −1.586** [0.0534] 21875 0.021 −8.733** [2.084] 21875 0.023 −9.322** [2.287] 21875 0.024 −10.30** [2.350] 21875 0.024 −2.008 [2.204] 3.050** [1.066] 0.155 [0.256] 0.288 [0.279] −0.339 [0.232] −0.178 [0.162] −2.197 [4.047] 0.706 [0.424] 0.0969 [0.266] −0.198 [0.234] −0.212 [0.207] −0.492 [0.493] 2.684 [2.223] 3.886 [2.101] 3.336 [2.431] 1.419 [0.966] −3.432 [3.588] −7.192 [5.300] −6.010 [4.748] −5.755 [3.278] 3.838 [3.014] 3.300 [2.635] 0.831 [1.113] −1.429 [1.113] 8.93e-10 [2.41e-09] 0.000285 [0.000741] 2.337** [0.766] −1.711 [3.609] 21875 0.025 Cooperation High-technology industry Medium-high-technology industry Medium-low-high technology industry Low-tech-technology industry Knowledge-intensive market services High-tech knowledge-intensive services Knowledge-intensive financial services Other knowledge-intensive services Less knowledge-intensive market services Other less knowledge-intensive services Large firm Medium firm Small firm Holding Private property Foreign property Mixed property R&D department Perform internal R&D Performs external R&D External knowledge Equipment for innovation Total sales Number of workers Exports Constant Number of obs. Pseudo R2 Source: Own elaboration. Note: (*) significant at 5% and (**) significant at 1%. ECONOMICS OF INNOVATION AND NEW TECHNOLOGY 15 Table 7. Results of the impact of public support on organizational innovation. Public support Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 1.699** [0.221] 0.153 [0.281] 2.650** [0.231] −0.117 [0.167] 0.0355 [0.0890] −0.240* [0.110] −0.266** [0.0626] −0.385 [0.266] −0.102 [0.0866] −0.119 [0.118] −0.379** [0.132] −0.287** [0.0627] −0.380 [0.197] 0.672 [0.376] 2.127** [0.333] 0.0701 [0.190] 0.121 [0.111] −0.138 [0.133] −0.122 [0.0867] −0.454 [0.296] −0.131 [0.127] −0.0925 [0.132] −0.366* [0.143] −0.304** [0.0815] −0.259 [0.210] −1.534 [0.913] −1.925** [0.664] −1.227 [1.133] 0.138 [0.285] −3.472* [1.481] −2.040 [1.620] −4.465* [1.811] 0.606 [0.660] 2.249** [0.423] 0.0799 [0.191] 0.344* [0.149] −0.0957 [0.136] −0.0762 [0.0896] −0.289 [0.317] 0.0769 [0.154] −0.0841 [0.141] −0.436** [0.156] −0.251** [0.0847] −0.258 [0.219] −1.431 [0.977] −1.774* [0.867] −1.311 [1.251] −0.192 [0.315] −2.925 [1.505] −2.059 [1.765] −1.821 [2.155] −2.254* [1.076] 1.871* [0.889] −1.631 [1.196] 0.147 [0.707] 2.049** [0.477] 0.137 [0.193] 0.279 [0.180] −0.0471 [0.138] −0.0604 [0.0918] −0.160 [0.340] 0.0933 [0.188] −0.0368 [0.148] −0.356* [0.165] −0.177 [0.0924] −0.198 [0.231] −2.756 [1.417] −2.826 [1.483] −2.705 [1.668] −0.111 [0.335] −1.413 [1.746] −0.237 [2.036] −1.469 [2.198] −2.006 [1.482] 2.137* [1.001] −0.866 [1.785] −1.344 [0.721] 1.250 [0.737] −0.911** [0.0166] 21875 0.003 −0.948** [0.0429] 21875 0.013 3.874* [1.610] 21875 0.014 3.342 [1.724] 21875 0.014 2.861 [1.778] 21875 0.015 −0.741 [1.692] 1.580* [0.794] 0.139 [0.205] 0.390* [0.197] 0.0855 [0.161] 0.0560 [0.125] −0.229 [0.345] 0.639* [0.294] 0.185 [0.183] −0.304 [0.180] 0.0461 [0.142] 0.140 [0.299] −3.875* [1.553] −2.279 [1.512] −3.741* [1.730] 1.453* [0.700] −6.562* [2.645] −8.345* [3.729] −7.634* [3.450] −4.517 [2.364] 4.012 [2.270] 0.687 [1.926] −0.720 [0.791] 0.532 [0.803] 2.20e-10 [1.82e-09] −0.000351 [0.000556] 1.451* [0.575] 8.190** [2.702] 21875 0.015 Cooperation High-technology industry Medium-high-technology industry Medium-low-high technology industry Low-tech-technology industry Knowledge-intensive market services High-tech knowledge-intensive services Knowledge-intensive financial services Other knowledge-intensive services Less knowledge-intensive market services Other less knowledge-intensive services Large firm Medium firm Small firm Holding Private property Foreign property Mixed property R&D department Perform internal R&D Performs external R&D External knowledge Equipment for innovation Total sales Number of workers Exports Constant Number of obs. Pseudo R2 Source: Own elaboration. Note: (*) significant at 5% and (**) significant at 1%. 16 C. MARDONES AND A. ZAPATA Table 8. Results of the impact of public support on the performance of internal R&D. Public support Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 4.580** [0.239] 3.726** [0.317] 2.183** [0.255] 0.307 [0.183] 0.278** [0.102] −0.0426 [0.141] 0.100 [0.0718] −0.338 [0.415] 0.285** [0.0951] −0.0133 [0.161] −0.535** [0.193] −0.287** [0.0864] 0.166 [0.206] 3.172** [0.428] 1.579** [0.385] 0.153 [0.211] 0.116 [0.129] −0.184 [0.165] 0.0313 [0.0972] −0.866 [0.449] −0.0702 [0.140] −0.213 [0.184] −0.468* [0.203] −0.454** [0.104] 0.0226 [0.222] −0.777 [1.112] −1.337 [0.834] −0.222 [1.387] −0.475 [0.333] 1.434 [1.926] 5.455** [2.050] 3.486 [2.264] 2.550** [0.493] 1.412** [0.393] 0.0435 [0.214] 0.119 [0.129] −0.294 [0.168] −0.0303 [0.0986] −0.937* [0.450] −0.178 [0.145] −0.217 [0.183] −0.501* [0.196] −0.539** [0.108] −0.117 [0.227] 0.553 [1.412] −0.203 [1.142] 1.477 [1.638] −0.723* [0.368] 0.561 [2.187] 4.330 [2.507] 3.491 [2.549] 1.242 [0.733] −0.974 [0.737] 2.550** [0.493] 1.413** [0.393] 0.0405 [0.214] 0.117 [0.130] −0.300 [0.170] −0.0364 [0.103] −0.928* [0.452] −0.185 [0.149] −0.219 [0.184] −0.507* [0.198] −0.543** [0.110] −0.124 [0.229] 0.581 [1.420] −0.196 [1.144] 1.518 [1.652] −0.751 [0.393] 0.525 [2.195] 4.254 [2.538] 3.539 [2.561] 1.263 [0.742] −0.985 [0.739] −0.00133 [0.00677] −1.561** [0.0199] 21875 0.024 −1.659** [0.0508] 21875 0.034 −2.369 [2.026] 21875 0.035 −2.615 [2.062] 21875 0.036 −2.594 [2.065] 21875 0.036 4.249** [0.646] 1.923** [0.448] 0.254 [0.223] 0.313* [0.141] −0.00406 [0.232] 0.220 [0.149] −0.699 [0.474] 0.378 [0.311] −0.0291 [0.217] −0.222 [0.238] −0.130 [0.228] 0.395 [0.407] 0.606 [1.981] 0.911 [1.316] 0.516 [2.172] 0.259 [1.137] −1.009 [3.394] 0.676 [5.002] −2.749 [4.956] 0.857 [0.779] −0.773 [0.789] 0.00960 [0.00977] 4.84e-09** [1.32e-09] −0.000881 [0.000568] 0.208 [0.807] −1.370 [3.860] 21875 0.037 Cooperation High-technology industry Medium-high-technology industry Medium-low-high technology industry Low-tech-technology industry Knowledge-intensive market services High-tech knowledge-intensive services Knowledge-intensive financial services Other knowledge-intensive services Less knowledge-intensive market services Other less knowledge-intensive services Large firm Medium firm Small firm Holding Private property Foreign property Mixed property External knowledge Equipment for innovation Number IPRs owned Total sales Number of workers Exports Constant Number of obs. Pseudo R2 Source: Own elaboration. Note: (*) significant at 5% and (**) significant at 1%. because Chile is mainly characterized by the export of commodities, fruits, wine, food or other products with low technological complexity that do not require significant marketing innovations. The results related to organizational innovation presented in Table 7 show that the coefficients are not robust in the different specifications. The implementation of cooperative actions has a positive and statistically significant impact in all estimated specifications. In addition, organizational ECONOMICS OF INNOVATION AND NEW TECHNOLOGY 17 Table 9. Results of the impact of public support on the implementation of external R&D. Public support Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 3.355** [0.299] 3.139** [0.399] 1.363** [0.328] −0.290 [0.369] 0.266* [0.131] 0.125 [0.172] 0.149 [0.0927] 0.0623 [0.412] 0.106 [0.134] 0.0862 [0.205] 0.0964 [0.199] −0.163 [0.111] 0.319 [0.244] 3.020** [0.571] 2.006** [0.558] −0.151 [0.412] 0.132 [0.169] 0.121 [0.211] 0.105 [0.129] 0.429 [0.487] 0.132 [0.206] −0.315 [0.253] −0.0382 [0.229] −0.187 [0.144] 0.421 [0.272] −3.130* [1.427] −4.250** [1.111] −4.696** [1.808] −0.704 [0.465] 2.279 [2.578] 1.277 [2.884] 3.453 [2.958] 1.773** [0.657] 1.795** [0.550] −0.259 [0.410] 0.0832 [0.170] −0.0228 [0.214] 0.0289 [0.130] 0.439 [0.484] −0.0735 [0.210] −0.299 [0.254] −0.103 [0.232] −0.273 [0.144] 0.276 [0.276] −3.270 [1.866] −4.525** [1.610] −4.145 [2.117] −1.357** [0.525] 3.525 [2.969] 3.476 [3.641] 6.162 [3.397] 0.234 [0.963] 0.214 [0.973] 1.771** [0.657] 1.806** [0.553] −0.262 [0.411] 0.0811 [0.170] −0.0309 [0.216] 0.0183 [0.136] 0.461 [0.491] −0.0826 [0.213] −0.305 [0.256] −0.113 [0.235] −0.279 [0.145] 0.264 [0.279] −3.215 [1.882] −4.518** [1.616] −4.072 [2.137] −1.405* [0.555] 3.448 [2.983] 3.286 [3.723] 6.272 [3.422] 0.278 [0.979] 0.191 [0.980] −0.00225 [0.00830] −1.917** [0.0254] 21875 0.015 −2.041** [0.0657] 21875 0.019 −0.311 [2.678] 21875 0.022 −1.457 [2.763] 21875 0.024 −1.408 [2.767] 21875 0.024 2.330** [0.889] 2.014** [0.633] −0.198 [0.419] 0.152 [0.187] 0.0497 [0.295] 0.0854 [0.198] 0.560 [0.541] 0.0829 [0.426] −0.258 [0.305] −0.0393 [0.287] −0.162 [0.299] 0.392 [0.520] −2.924 [2.601] −3.982* [1.853] −4.145 [2.843] −1.194 [1.479] 3.165 [4.577] 2.213 [6.849] 4.674 [6.809] 0.262 [1.019] 0.151 [1.045] 0.000156 [0.0125] 1.48e-09 [1.85e-09] −0.000248 [0.000799] −0.0195 [1.042] −1.400 [5.158] 21875 0.024 Cooperation High-technology industry Medium-high-technology industry Medium-low-high technology industry Low-tech-technology industry Knowledge-intensive market services High-tech knowledge-intensive services Knowledge-intensive financial services Other knowledge-intensive services Less knowledge-intensive market services Other less knowledge-intensive services Large firm Medium firm Small firm Holding Private property Foreign property Mixed property External knowledge Equipment for innovation Number IPRs owned Total sales Number of workers Exports Constant Number of obs. Pseudo R2 Source: Own elaboration. Note: (*) significant at 5% and (**) significant at 1%. innovation is positively influenced by exports. It is important to remark that the state agency CORFO has tried to generate a boost in the areas of innovation, networking business and administrative training through the subcontracting of public agencies and private partners (agents), but also through a network of regional offices CORFO directly manages a set of instruments dedicated to the promotion of innovation and regional development. 18 C. MARDONES AND A. ZAPATA Table 10. Results of the impact of public support on the probability of having a formal R&D department or laboratory. Public support Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 3.234** [0.270] 3.809** [0.377] 1.924** [0.292] 0.744** [0.182] 0.951** [0.0966] 0.368* [0.143] 0.512** [0.0763] 0.324 [0.335] 0.890** [0.0926] 0.318 [0.168] −0.821** [0.268] 0.105 [0.0927] 0.358 [0.230] 2.024** [0.535] 1.353** [0.480] −0.00533 [0.214] 0.468** [0.128] −0.0628 [0.171] 0.166 [0.105] −0.366 [0.389] 0.232 [0.154] 0.201 [0.193] −0.663* [0.264] −0.0929 [0.115] −0.151 [0.250] 0.577 [1.308] 1.489 [1.043] 1.433 [1.641] −1.477** [0.394] 3.764 [2.512] 7.674** [2.586] 11.50** [2.987] 1.761** [0.640] 1.191* [0.500] −0.148 [0.218] 0.509** [0.130] −0.165 [0.175] 0.109 [0.107] −0.570 [0.398] 0.184 [0.169] 0.148 [0.192] −0.628** [0.231] −0.212 [0.122] −0.312 [0.254] 3.196* [1.624] 3.929** [1.374] 4.218* [1.892] −1.354** [0.437] 1.288 [2.788] 3.761 [3.250] 9.721** [3.338] 2.422** [0.890] −2.248* [0.896] 1.781** [0.641] 1.175* [0.499] −0.138 [0.219] 0.514** [0.130] −0.146 [0.178] 0.130 [0.113] −0.598 [0.401] 0.206 [0.172] 0.153 [0.192] −0.607** [0.233] −0.198 [0.124] −0.285 [0.259] 3.021 [1.648] 3.844** [1.376] 3.986* [1.932] −1.265** [0.463] 1.415 [2.795] 4.039 [3.272] 9.506** [3.355] 2.323* [0.904] −2.188* [0.899] 0.00445 [0.00789] −1.716** [0.0224] 21875 0.013 −2.036** [0.0618] 21875 0.037 −6.559* [2.578] 21875 0.043 −6.278* [2.632] 21875 0.044 −6.277* [2.632] 21875 0.044 3.664** [0.939] 2.092** [0.654] 0.176 [0.241] 0.680** [0.155] 0.458 [0.272] 0.561** [0.179] −0.370 [0.473] 1.369** [0.435] 0.526* [0.234] −0.101 [0.281] 0.576* [0.287] 0.949 [0.492] 0.612 [2.200] 4.446** [1.701] 0.295 [2.366] 2.304 [1.414] −7.308 [4.374] −11.84 [7.015] −6.850 [6.482] 2.640* [1.041] −2.822** [1.060] 0.0271* [0.0111] 6.14e-09** [1.86e-09] −0.00125 [0.000756] 2.120* [0.956] 3.292 [4.685] 21875 0.045 Cooperation High-technology industry Medium-high-technology industry Medium-low-high technology industry Low-tech-technology industry Knowledge-intensive market services High-tech knowledge-intensive services Knowledge-intensive financial services Other knowledge-intensive services Less knowledge-intensive market services Other less knowledge-intensive services Large firm Medium firm Small firm Holding Private property Foreign property Mixed property External knowledge Equipment for innovation Number IPRs owned Total sales Number of workers Exports Constant Number of obs. Pseudo R2 Source: Own elaboration. Note: (*) significant at 5% and (**) significant at 1%. 5.2. Impact on R&D activities In relation to the R&D activities carried out by Chilean firms, the effect of public support on internal and external R&D performance is presented in Tables 8 and 9, respectively. Both types of R&D show that public support for innovation has a positive and statistically significant impact at 1% in all ECONOMICS OF INNOVATION AND NEW TECHNOLOGY 19 estimated specifications. Additionally, in both cases, it is possible to observe that carrying out cooperative actions with different actors increases the probability of carrying out R&D, and this effect is statistically significant in all the estimated specifications. Unfortunately, it is not possible to obtain conclusive results regarding size, property type and other innovative variables because the coefficients are not robust in the different specifications and the statistical significance for internal and external R&D activities is not maintained. For internal R&D, the results indicate that total sales increase chances of carrying out these activities. As for external R&D, it is possible to find a negative, statistically significant and robust effect in the medium sized firm. On the other hand, using public support tends to increase the probability of having a formal R&D department or laboratory in the firms. The results presented in Table 10 show that the impact of public support is positive and significant in all estimated specifications. Cooperative actions again have a positive and statistically significant effect. Firms belong to medium-high-technology industry have a positive, statistical significant and robust effect on the probability of having an R&D department. The acquisition of external knowledge has a positive effect on the probability of having an R&D department, while the purchase of machinery, equipment and software adversely affects this probability. In addition, the results indicate that total sales and exports increase chances of having an R&D department. 6. Conclusions There is no doubt that innovation is a fundamental pillar of economic growth, which is why in Chile many public programs have been created to encourage and promote this activity. However, there is little evidence of the actual effect of these programs. Therefore, this study evaluates the impact of public support on various innovative and R&D activities carried out by Chilean firms during the period of 2007–2014. This information is useful because it can provide suggestions for redesigning public policies that currently promote innovation and R&D in Chilean firms. Using binary choice models with pseudo-data, it is concluded that public support encourages internal and external R&D, demonstrating its effectiveness in promoting this type of activity. Financial support also increases the probability that firms will have a formal R&D department or unit, allowing firms to conduct research activities and develop innovations autonomously. However, it is not possible to demonstrate that public support affects product, service, process, logistics, marketing and organizational innovations since the coefficients are not robust in magnitude, sign or statistical significance. These mixed results are coincident with Guo, Guo, and Jiang (2016) who point out that the empirical evidence on the effects of public financing on R&D activities is inconclusive since some studies identify positive effects, while other studies find limited or no effects on spending on innovative R&D and outputs. The study also shows that collaborative action with various public and / or private actors has a positive impact on the realization of all types of innovation and stimulates internal and external R&D activities. These results provide important policy implications since one way for public innovation programs to be more successful would be to promote cooperation among different actors. Finally, it is important to mention that the acquisition of patents, licenses and know-how agreements has a negative effect on the different types of innovation (except marketing innovation). It is interesting to highlight this result given that several public programs that seek to boost innovation in Chile provide financing to carry out patent procedures. As a future extension of this study, it would be interesting to identify the effect of public funding on inputs and outputs from innovative process performed by Chilean firms and include new versions of the Innovation Survey to increase temporal period coverage. Notes 1. It is not necessary for the firm to carry out all types of mentioned innovations to be considered innovative. 20 C. MARDONES AND A. ZAPATA 2. In the early 1990s, public instruments for the promotion of innovation were scarce, and existing funding was mainly directed at academic research and technological institutes. However, in recent years, Chile has experienced an accelerated learning process by building a complete and comprehensive portfolio of instruments targeting firms and institutions across all economic sectors (OECD 2007). 3. According to the Oslo Manual (OECD 2005), innovation policy is an amalgamation of science and technology policy with industrial policy. 4. The questionnaire of the innovation survey conducted in Chile follows the guidelines established in the OSLO Manual (OECD 2005). 5. The uses of various public programs that seek to promote the country’s innovative activity have been consulted in the different versions of the Innovation Survey (i.e. CORFO, FIA, INNOVA CHILE, INNOVA BIO-BIO and FONDEF). However, as the format of this survey has varied over time, it is not possible to obtain specific information on the use of each of these programs in each version of the survey. Therefore, this study assesses the joint effectiveness of these programs to determine if they are really encouraging innovation and R&D in Chilean firms. 6. Eurostat uses a disaggregation of the manufacturing industry according to technological intensity (high-technology, medium-high-technology, medium-low-technology and low-technology). Following a similar approach Eurostat defines the following sector as knowledge-intensive services (Knowledge-intensive market services excluding high-tech and financial services KIS1, High-tech knowledge-intensive services KIS2, Knowledge-intensive financial services KIS3 and Other knowledge-intensive services KIS4) or as less knowledge-intensive services (Less knowledge-intensive market services LKIS1, Other less knowledge-intensive services LKIS2). 7. Eurostat classification of economic activities according to technological intensity and based on NACE Rev. 2 at 2digit level. 8. Goldberg and Palladini (2008) mention CORFO’s activities are based on the idea that the State should only intervene when there are clear market failures and that all programs should be driven by demand, which is demonstrated through ownership and co-financing of the private sector, therefore CORFO does not discriminate between economic activities or geographical regions in the allocation of its resources. 9. https://techcrunch.com/2016/10/16/a-look-into-chiles-innovative-startup-government/ Disclosure statement No potential conflict of interest was reported by the authors. Funding This work was supported by Corporación de Fomento de la Producción (CORFO) [INNOVA CHILE N° 15||PES-44389, 2016]. ORCID Cristian Mardones http://orcid.org/0000-0002-9389-7368 References Acosta, M., D. Coronado, and C. Romero. 2015. “Linking Public Support, R&D, Innovation and Productivity: New Evidence from the Spanish Food Industry.” Food Policy 57: 50–61. Afcha, S. 2012. “Analyzing the Interaction Between R&D Subsidies and Firm’s Innovation Strategy.” Journal of Technology Management & Innovation 7: 57–70. Agosin, M., N. Grau, and C. Larrain. 2010. “Industrial Policy in Chile”. No 4695, Research Department Publications, InterAmerican Development Bank, Research Department. Álvarez, R., C. Bravo-Ortega, and L. Navarro. 2011. “Innovation, R&D Investment and Productivity in Chile.” Cepal Review 104: 135–160. Álvarez, R., C. Bravo-Ortega, and A. Zahler. 2015. “Innovation and Productivity in Services: Evidence from Chile.” Emerging Markets Finance and Trade 51 (3): 593–611. Álvarez, R., G. Crespi, and C. Conrado. 2012. “Public Programs, Innovation, and Firm Performance in Chile.” 2 InterAmerican Development Bank, N° IDB-TN-375, 1–43. Antolín-López, R., J. Céspedes-Lorente, N. García-de-Frutos, J. Martínez-del-Río, and M. Pérez-Valls. 2015. “Fostering Product Innovation: Differences Between New Ventures and Established Firms.” Technovation 41-42: 25–37. Baltagi, B. 2005. Econometric Analysis of Panel Data. 3rd ed. England: John Wiley & Sons Ltd. Benavente, J. 2005. “Investigación y desarrollo, innovación y productividad: un análisis econométrico a nivel de la firma.” Estudios de Economía 32: 39–67. ECONOMICS OF INNOVATION AND NEW TECHNOLOGY 21 Benavente, J., and G. Crespi. 2003. “The Impact of an Associative Strategy (the PROFO Program) on Small and Medium Enterprises in Chile”. University of Sussex, SPRU - Science and Technology Policy Research, SPRU Electronic Working Paper Series. Benavente, J., G. Crespi, and A. Maffioli. 2007. “Public Support to Firm-Level Innovation: An Evaluation of the FONTEC Program.” OVE Working Papers OVE/WP-05/07. Inter-American Development Bank. Berubé, C., and P. Mohnen. 2009. “Are Firms that Receive R&D Subsidies More Innovative?” Canadian Journal of Economics/Revue canadienne d’économique 42: 206–225. Bravo-Ortega, C., J. Benavente, and Á González. 2014. “Innovation, Exports, and Productivity: Learning and Self-Selection in Chile.” Emerging Markets Finance and Trade 50: 68–95. Cappelen, A., A. Raknerud, and M. Rybalka. 2012. “The Effects of R&D Tax Credits on Patenting and Innovations.” Research Policy 41: 334–345. Crepon, B., E. Duguet, and J. Mairessec. 1998. “Research, Innovation and Productivity: An Econometric Analysis at the Firm Level.” Economics of Innovation and New Technology 7 (2): 115–158. Crespi, G., A. Maffioli, and M. Melendez. 2011. “Public Support to Innovation: The Colombian COLCIENCIAS’ Experience.” Inter-American Development Bank N° IDB-TN-264: 1–22. Dai, X., and L. Cheng. 2015. “The Effect of Public Subsidies on Corporate R&D Investment: An Application of the Generalized Propensity Score.” Technological Forecasting and Social Change 90: 410–419. Deaton, A. 1985. “Panel Data from Time Series of Cross-Sections.” Journal of Econometrics 30: 109–126. Geldes, C., C. Felzensztein, and J. Palacios. 2017. “Technological and Non-technological Innovations, Performance and Propensity to Innovate across Industries: The Case of an Emerging Economy.” Industrial Marketing Management 61: 55–66. Goldberg, M., and E. Palladini. 2008. “Chile: A Strategy to Promote Innovative Small and Medium Enterprises.” The World Bank, Policy Research Working Paper 4518. González, X., and C. Pazó. 2008. “Do Public Subsidies Stimulate Private R&D Spending?” Research Policy 37: 371–389. Guan, J., and R. Yam. 2015. “Effects of Government Financial Incentives on Firms’ Innovation Performance in China: Evidences from Beijing in the 1990s.” Research Policy 44: 273–282. Guo, D., Y. Guo, and K. Jiang. 2016. “Government-Subsidized R&D and Firm Innovation: Evidence from China.” Research Policy 45 (6): 1129–1144. Hall, B., and A. Maffioli. 2008. “Evaluating the Impact of Technology Development Funds in Emerging Economies: Evidence from Latin.” NBER Working Paper N° 13835. Huergo, E., M. Trenado, and A. Ubierna. 2015. “The Impact of Public Support on Firm Propensity to Engage in R&D: Spanish Experience.” Technological Forecasting & Social Change. In Press. King, M., and E. Woolley. 2014. “Estimating the Effect of UK Direct Public Support for Innovation.” Bis Analysis Paper Number 04. Department for Business Innovation & Skills: 1–25. Lee, C. 2011. “The Differential Effects of Public R&D Support on Firms R&D: Theory and Evidence from Multi-Country Data.” Technovation 31: 256–269. Moffitt, R. 1993. “Identification and Estimation of Dynamic Models with a Time Series of Repeated Cross-Sections.” Journal of Econometrics 59: 99–123. OECD. 2005. “Oslo Manual: Guidelines for Collecting and Interpreting Innovation Data, 3rd Edition, The Measurement of Scientific and Technological Activities.” OECD Publishing, Paris. OECD. 2007. “OECD Reviews of Innovation Policy Chile”. Stock, J., and M. Yogo. 2005. “Testing for Weak Instruments in IV Regression.” In Identification and Inference for Econometric Models: A Festschrift in Honor of Thomas Rothenberg, edited by Donald W. K. Andrews and James H. Stock, 80–108. New York: Cambridge University Press. Tan, H. 2009. Evaluating SME Support Programs in Chile Using Panel Firm Data. Policy Research. The World Bank Working Papers N° 5082. 1: 1–41. Verbeek, M., and T. Nijman. 1992. “Can Cohort Data Be Treated As Genuine Panel Data?” Empirical Economics 17 (1): 9–23. World Bank. 2008. Chile: Toward a Cohesive and Well Governed National Innovation System. Washington, DC: World Bank. Young, E., and B. Cheol. 2010. “The Effect of Risk-Sharing Government Subsidy on Corporate R&D Investment: Empirical Evidence from Korea.” Technological Forecasting and Social Change 77: 881–890.