Marbella Hotel Market Review

Anuncio

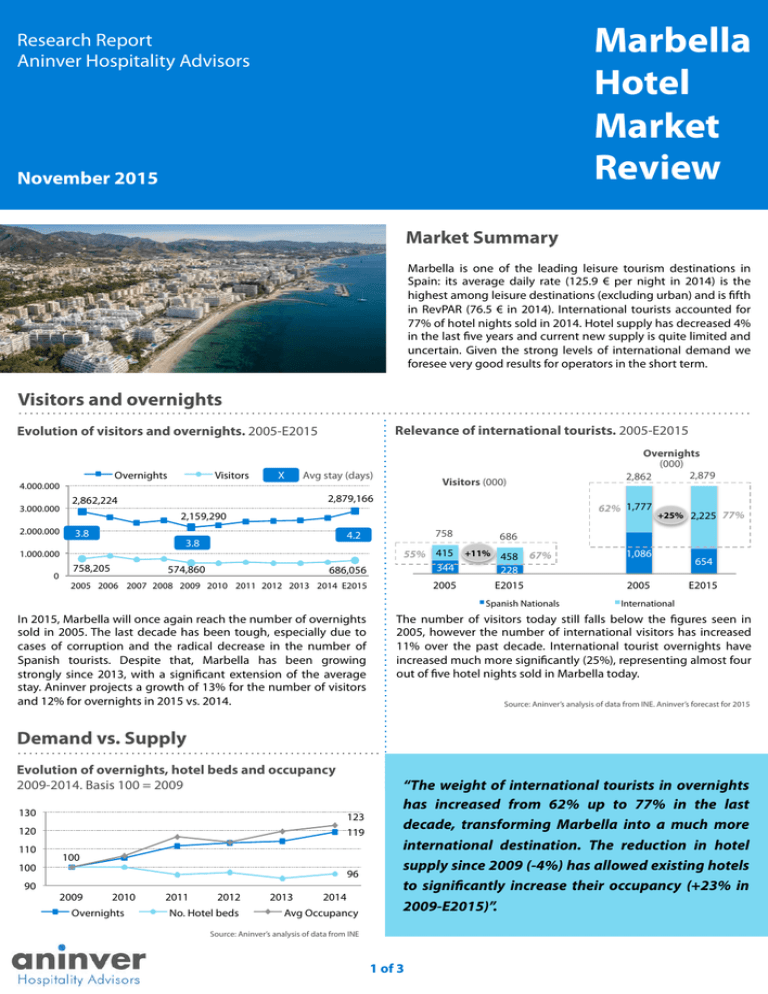

Marbella Hotel Market Review Research Report Aninver Hospitality Advisors November 2015 Market Summary Marbella is one of the leading leisure tourism destinations in Spain: its average daily rate (125.9 € per night in 2014) is the highest among leisure destinations (excluding urban) and is fifth in RevPAR (76.5 € in 2014). International tourists accounted for 77% of hotel nights sold in 2014. Hotel supply has decreased 4% in the last five years and current new supply is quite limited and uncertain. Given the strong levels of international demand we foresee very good results for operators in the short term. Visitors and overnights Relevance of international tourists. 2005-E2015 Evolution of visitors and overnights. 2005-E2015 Overnights Visitors X Avg stay (days) Visitors (000) 4.000.000 3.000.000 2.000.000 2,879,166 2,862,224 758,205 758 4.2 3.8 1.000.000 0 62% 1,777 2,159,290 3.8 574,860 686,056 2005 +25% 2,225 77% 686 55% 415 +11% 458 67% 344 228 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 E2015 E2015 Spanish Nationals In 2015, Marbella will once again reach the number of overnights sold in 2005. The last decade has been tough, especially due to cases of corruption and the radical decrease in the number of Spanish tourists. Despite that, Marbella has been growing strongly since 2013, with a significant extension of the average stay. Aninver projects a growth of 13% for the number of visitors and 12% for overnights in 2015 vs. 2014. Overnights (000) 2,879 2,862 1,086 2005 654 E2015 International The number of visitors today still falls below the figures seen in 2005, however the number of international visitors has increased 11% over the past decade. International tourist overnights have increased much more significantly (25%), representing almost four out of five hotel nights sold in Marbella today. Source: Aninver’s analysis of data from INE. Aninver’s forecast for 2015 Demand vs. Supply Evolution of overnights, hotel beds and occupancy 2009-2014. Basis 100 = 2009 130 123 120 119 110 100 100 96 90 2009 2010 Overnights 2011 2012 No. Hotel beds 2013 2014 Avg Occupancy “The weight of international tourists in overnights has increased from 62% up to 77% in the last decade, transforming Marbella into a much more international destination. The reduction in hotel supply since 2009 (-4%) has allowed existing hotels to significantly increase their occupancy (+23% in 2009-E2015)”. Source: Aninver’s analysis of data from INE 1 of 3 Research Report Aninver Hospitality Advisors November 2015 Profitability – Top Spanish Leisure destinations ADR (€) Marbella (Malaga) Sitges (Barcelona) Chiclana de la Frontera (Cadiz) Tarifa (Cadiz) Eivissa (Ibiza) Sant Josep de Sa Talaia (Ibiza) San Bartolomé de Tirajana (Las Palmas) Estepona (Malaga) Conil de la Frontera (Cadiz) Santa Eulalia des Rius (Ibiza) Occupancy (%) Yaiza (Lanzarote) Arona (Tenerife) Adeje (Tenerife) Teguise (Lanzarote) Tías (Lanzarote) Muro (Mallorca) Llucmajor (Mallorca) Mogán (Las Palmas) Santanyi (Mallorca) La Oliva (Fuerteventura) 125.9 113.2 108.4 108.2 107.5 102.9 97.4 97.3 95.8 94.3 2014 Figures. 3 to 5 star hotels only 88.7 87.4 86.2 86.0 85.5 84.4 83.5 82.8 82.7 82.6 RevPar (€) Eivissa (Ibiza) Adeje (Tenerife) San Bartolomé de Tirajana (Las Palmas) Sant Josep de Sa Talaia (Ibiza) Marbella (Malaga) La Oliva (Fuerteventura) Arona (Tenerife) Chiclana de la Frontera (Cadiz) Muro (Mallorca) Santa Eulalia des Rius (Ibiza) 84.1 80.6 79.4 78.0 76.5 75.5 74.6 74.5 74.0 71.9 Source: Aninver’s analysis of data from Exceltur Current hotel supply Current hotel supply in Marbella consists of 79 hotels and 16,578 hotel beds (in low-season the number of open hotels falls to 59 with approx. 9,200 hotel beds). Over the past few years, the number of hotel beds has decreased (-4% in the period 2009-14). Main hotel chains with presence in the city are: Playa Senator (3 hotels / 656 hotel rooms), Hoteles Globales (2/563), Fuerte Hoteles (2/489), Melia (2/422), H10 Hotels (1/400), Roc Hotels (1/332 – new opening), Bluebay (1/315) and Marriott (1/288). Tryp Alameda 4* Salles Malaga Centrum 4* San Cristobal 3* Gran Melia Don Pepe 5* Ibis Malaga 2* Suite Novotel Malaga 4* Senator Marbella 4* Hotel del Golf La Quinta 5* Barcelo Malaga 4* Monarque El Rodeo 3* Tribuna Malaga 3* Vincci Posada del Patio 5* NH Malaga 4* NH Marbella 4* Amare 4* Room Mate Larios 4* Alanda 4* Palacio del Sol 3* Atarazanas 3* Marbella Club 5* Guadalmedina 4* Petit Palace Plaza 4* H10 Andalucia Plaza 4* Marbella Los Monteros 5* Alanda Club Puente Romano 5* Playa Don CurroPrincesa 3* Bluebay Banus 4* Gallery Molina Larios 4* Iberostar Coral Beach 4* Fuerte MarbellaAC 4* Malaga Palacio 4* Vincci Estrella del Mar 5* Room Mate Lola Sisu Boutique 5* Melia Marbella Banus 4* 4* El Faro 3* Don Carlos 5* NH San PYR Marbella Oh Marbella Inn 3* Pedro 3* Park Plaza Suites Marriott Marbella Beach 4* Silken Puerta Malaga 4* Guadalpin Banus 5* Barcelo Marbella 4* Globales Pueblo Andaluz 3* Globales Cortijo Blanco 3* Guadalmina 5* Source: Aninver’s analysis Projects Hotel projects and potential locations “New supply is very limited with a high degree of uncertainty on new and potential projects, especially No. Rooms Category Magna H&R 373 5*GL LaBajadilla Bluebay 200 5*GL Guadalmina* Unknown 178 5* proving to be a safer investment and current levels of hotel transactions will surely foster new operator RocLasChapas* Roc Hotels 330 4* changes and major refurbishments. The development of ExIncosol Potential project ≈200 n/a GuadalpinBanusland Potential project Unk. n/a Project/loca+on Hoteloperator ExDonMiguel given the constant changes in urban planning regulations. The refurbishment of existing hotels is the “Golden Triangle” (Marbella-Estepona-Benahavis) is presenting new development opportunities”. * Refurbishment Source: Aninver’s analysis 2 of 3 Research Report Aninver Hospitality Advisors November 2015 Marbella as a luxury tourism brand There are 16 5* and 5*GL hotels in the Marbella area Marbella has a long tradition of being a luxury tourism destination on a global scale. The so-called “Golden Triangle” area, comprised of the Marbella, Estepona and Benahavis municipalities, hosts 16 5-star and 5-star GL (“gran lujo”) hotels. Assets such as Finca Cortesin or Villa Padierna, although not located in Marbella itself, show in practice how the “Marbella” brand is expanding to cover a larger territory. Marbella Club Melia La Quinta Villa Padierna Vincci Estrella del Mar H H Guadalpin Banus H H H H Finca Cortesín Guadalpin H H H H H H H Marbella H H H Don Carlos Elba Senator Banus Kempinski Healthouse Las Dunas Puente Romano Melia Marbella Banus Los Monteros Melia Don Pepe Key project: new Magna Palace Hotel Source: Magna Hotels&Resorts website In 2012, Foundation Magna Invest, based in Luxembourg, acquired the 550-room 5-star Don Miguel resort in Marbella. The group is working on the refurbishment of the asset which will open its doors as “Magna Palace 5*GL”. The new hotel will have 300 deluxe rooms and 73 sea-view suites. Several restaurants, a business center, a 5,000 sqm spa, a shopping center and a new 62,000 sqm aquatic park will complete the range of services provided by the new complex. Construction work has yet to begin. About us • Aninver Hospitality Advisors is a boutique advisory firm working for institutional investors, hotel chains and independent hotel owners on multiple kinds of consulting assignments: strategy, international expansion/business development, asset and project management, special projects and asset divestments. • We are part of Aninver InfraPPP Partners, a business advisory and market intelligence group based in Malaga but working globally for relevant public and private clients. • If you are interested in discussing this market report or any potential business opportunity please contact our team. Contacts Jose de la Maza Managing Partner jm@aninver.com +34 639 90 63 48 Alvaro de la Maza Partner ama@aninver.com +34 661 24 97 63 Marina Ruiz Business Analyst marinars@aninver.com 3 of 3 OFFICE C/ Puerto 14 2-5 Malaga 29016 (Spain) aninver@aninver.com +34 951 76 79 73