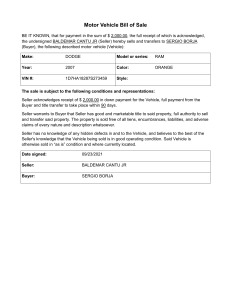

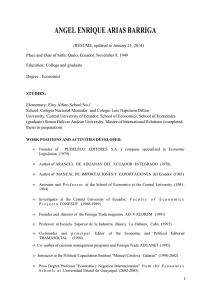

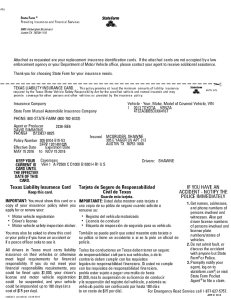

Taxes should be increased for people who have higher salaries in Ecuador Quito, November 29, 2021 David Toapanta Serrano Currently in Ecuador people pay around 35% income tax according to how much they declare annually. This, for many people is not something equitable, since it does not really represent what people earn and spend. For this reason, taxes should be paid according to how much is earned or according to the salary that people have to avoid that people who do not earn much money are not affected by this. Likewise, people who spend much more must pay more taxes on what they spend, such as, for example, someone who buys a much larger and more luxurious vehicle must pay much more tax for this vehicle, than the person who buys a much cheaper vehicle; Cases like this explain how fundamental it is to be fair in these respects. It is important to understand that not all people who earn more should do so since some of them simply, for their work, their effort, their dedication, etc., receive much more money for their employment, but they do not spend their money buying luxuries. For this reason, and as a conclusion, this law should be implemented only for goods but not for wages, and in the same way an option is to start collecting this tax on a monthly basis so that people are a little more aware and understand that If they really want to spend, they must pay their taxes.