Centros comerciales británicos

Anuncio

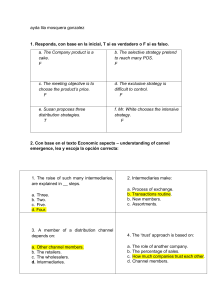

Marks and Spencer [Name of the writer] [Name of the institution] Marks and Spencer SWOT Analysis Strengths Market leadership Marks and Spencer is the UK's largest clothing retailer and footwear by both value and volume. In the clothing market, M&S has 12% market share and, is sixth largest in the food market with a 3% share. In value terms, M&S has 10.5% market share in UK's women's wear market. It also has 9.5% of menswear, 24.1% lingerie and 4.1% of children's wear markets in the UK. M&S has over 450 stores located throughout the UK. In addition, the company has 150 stores worldwide, including over 130 franchise businesses, operating in 30 countries. Market leadership enhances its brand image and provides M&S with a competitive advantage. Improved profitability Operating margins of M&S improved from 8% in 2005 to 10.9% in 2006. In fiscal 2006, the company's operating profits increased by 42.1% against revenue growth of only 4.2%. This was achieved through a continued tight control of costs, improved management of stock commitments and better buying. The company's average operating margin for the five year period ending March 2006 at 8.3% compares well with the industry average of 5.7%. Improved profitability indicates the efficient nature of the company's operations. Strong brand image The M&S has been a strong brand for decades. It stands for high quality products at reasonable prices. Moreover, it is a well recognized brand in retailing in the UK and also in the international markets. In addition to the mother brand, M&S has a strong portfolio of private brands including: Autograph, Blue Harbour, Per Una, Body and Cellozione. The strong brand image of the company aids customer loyalty and helps promote repeat purchases. In addition, the company leverages its brand strength to easily expand into new lines. Weaknesses Geographic concentration M&S derives a majority of its revenues from the UK market. The company derived 93.3% of its revenues from the UK in fiscal 2006. In contrast, competitors such as Wal−Mart have global operations, which provide them with a better revenue profile and economies of scale in purchasing. Weak economic conditions in the UK resulted in weak revenue growth of 4.1% in fiscal 2006. Geographic concentration of revenues makes M&S vulnerable to market conditions in the UK and makes the company relatively uncompetitive compared to global retailers such as Wal−Mart. Low return on assets and equity 1 M&S has recorded weak returns on assets and equity in the last few years. Its return on assets and return on equity for the five year period ending March 2005 were 6.4%, and 8.7%, respectively, lower than the industry averages of 6.9% and 10.4% for the same period. Weak returns reflect the inability of the management to deploy assets in profitable avenues, and this could result in decreasing investor confidence. Limited online transactions Though M&S has had a transactional website for a few years now, its service is inferior to many other retailers in a number of respects. Food cannot be ordered online and delivered to home from its website. Only a selection of general merchandise product is available. M&S does not deliver to customers overseas. Delivery is either via the Royal Mail, or White Arrow courier service, rather than by independent couriers, which offer higher services levels. Limited online transactions could put the company at a competitive disadvantage. Opportunities New acquisitions In January 2006 M&S expanded its already successful 'Simply Food' format with the acquisition of 28 stores on a leasehold basis from Iceland Foods for a consideration of £38 million. The stores, which average around 5,000 square feet, are all in prime locations for the 'Simply Food' brand throughout the UK. There are currently 143 Simply Food stores in the UK, Republic of Ireland and the Channel Islands. Following the acquisition, M&S will have 171 Simply Food stores throughout the UK. This acquisition would increase the company's presence in food market while boosting its revenues. Competitive pricing M&S has implemented price restructuring across product categories and brands in fiscal 2006. As a result, about 30% of its products are now at 'Opening Price Points' (entry level pricing), as compared to 12% in 2004. In fiscal 2005, M&S was the most expensive when compared with its competitors such as Debenhams, Next, BHS and Matalan. It was marginally more expensive relative to the average of this group. After the implementation of price restructuring, M&S is now nearly 10% cheaper than Debenhams and a little cheaper than Next. In food pricing, M&S is 2% cheaper than Tesco's 'Finest'. Competitive pricing might help in generating more revenues. Increasing online spending Online consumer spending worldwide is forecast to rise from $137 billion in 2004 to $228 billion in 2007. Significant growth in online sales is forecast for all categories of consumer goods. The online market is the fastest growing sector of the UK retail at present, accounting for almost half the cash growth in retail spending in 2005. Though it has limited online service, M&S' is planning to re−launch its website with added services in the near future. This could reduce the company's operating costs and further improve margins. Threats Intense competition One major threat facing the company comes from the intense competition that exists in the UK food retailing market. Although the company has a 3% share of the UK food market, it remains a significant distance behind food retailers like Tesco, Sainsbury and ASDA. The intense rivalry that exists between such competitors has led to a price war within many areas of the food industry. The increasing dominance of Wal−Mart and companies like it are adding to the growing pressures facing the traditional supermarket channel and are also 2 reshaping the interactions between manufacturers and retailers in all markets, including food, apparel and financial services. The continued expansion of such companies in 2006 and 2007 is likely to affect the operations of M&S. Increasing labour wages in the UK Labour costs are rising in the UK. The UK government increased the adult minimum wage rate from £5.05 to £5.35 per hour in October 2005. The rate for those aged 18 to 21 years will be increased from £4.25 to £4.45 per hour and the rate for workers aged 16−17 years would increase from £3 to £3.3 per hour. The full year effect of this increase would be evident in fiscal year 2007. An increase in labour costs could adversely impact the company's margins. Weak retail sales in the UK Consumer spending in the UK, in fiscal 2006, remained under pressure amid worries about house prices, taxes, interest rates and the sharp rise in utility and fuel bills. As a result, the number of people shopping decreased over the year by 2.1%, exacerbated in city centres by the terrorist attacks in London last summer. Although the Bank of England cut interest rates in August 2005, interest rates still remain at a high of 4.5% at the end of January 2006. If the situation continues, it could adversely affect consumer spending which in turn could depress the revenues of M&S. New regulations for EU nations The EU imposed quotas on imports of certain Chinese textiles in 2005, which led to UK retailers re−assessing their sources of supply. In April 2006, provisional duty also came into effect on leather footwear imports. M&S sources 17% of clothing materials from India and 44% from the Far East. Though the UK retail sector is lobbying the EU against these and other potential trade defense measures, import regulations could affect retailers like M&S by affecting their supply of raw materials and increasing operating costs. Answer # 2 Growth in food, decline in clothing, transition in home Food sales rose by over 2% in 2004, and market share in this sector was broadly maintained. In food, the company focused on innovation and newness, simplifying ranges and emphasising quality and uniqueness. Food sales continued to benefit from additional footage as the company extended its offer through the Simply Food format. During 2004 the company opened 31 Simply Food stores of which 13 stores were in partnership with Compass. Clothing sales declined by 3% in 2004, largely due to poor sales of womenswear. Sales of lingerie reportedly suffered from having an over complex range, and all product groups reportedly suffered from inconsistent price structure. Sales of home products fell by 21% in 2004 as operations in this sector had a year of transition as the company closed Lifestore and refocused on the traditional areas of bedroom, bathroom, kitchen and dining.Answer # 3Marks & Spencer's strategy in developing its Simply Food business has been founded on its ability to pioneer new concepts. The company's reputation for quality, innovation and convenience has helped to maintain leading market shares in segments such as ready meals. In food, there has also been a focus on product and increased innovation. The company introduced the Eat Well sunflower on 700 products, added 40 new lines in the Cook! range and introduced Gastropub meals. Furthermore, the company has removed slow lines and simplified ranges to provide a clearer, simpler offer. It has also started to emphasise the quality and uniqueness of its food both in−store and through advertising. Recent concerns over food safety have caused the company to implement strict policies on ingredients used and to market its products accordingly. Marks & Spencer was the first retailer in the world to appoint a team of food technologists who were responsible for quality and safety, and the first to appoint an in−house team of animal welfare specialists, who work closely with farmers, suppliers and customer organisations.BibliographyAnnual Report, 2006Kay, John A. (2003). Foundations of Corporate Success: How Business Strategies Add Value. Oxford University Press.Mail, Western (2004). Has Marks &Amp; Spencer Lost Its Spark? (Cardiff, Wales)!Marks and Spencer 3