RELACION DETALLADA DE INVERSIONES

Anuncio

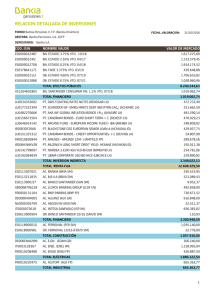

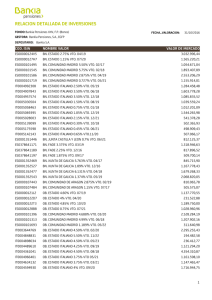

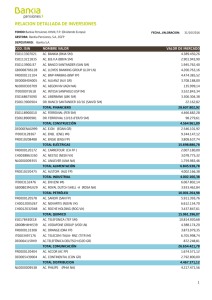

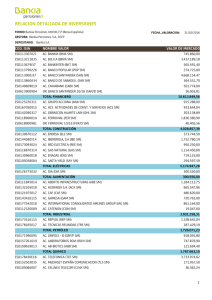

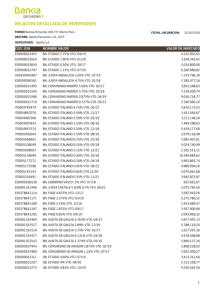

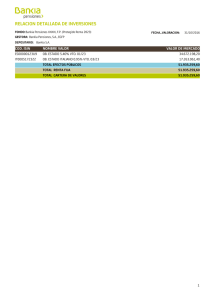

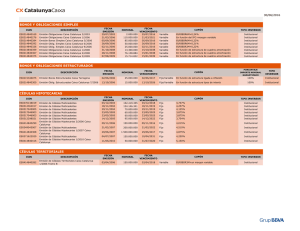

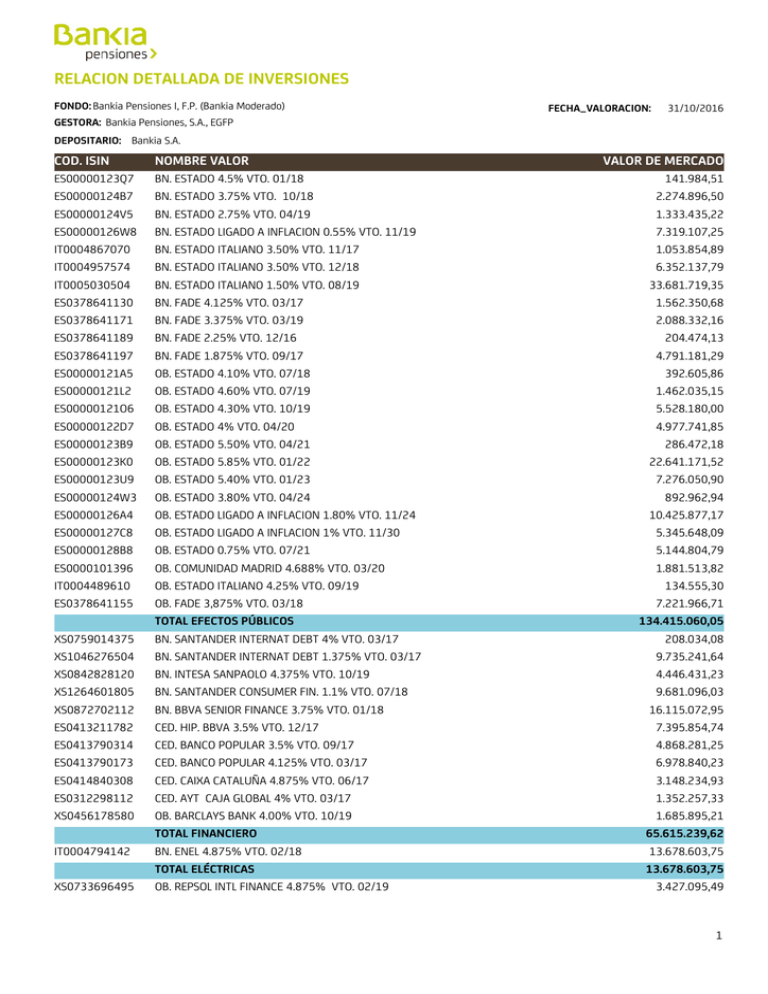

RELACION DETALLADA DE INVERSIONES FONDO: Bankia Pensiones I, F.P. (Bankia Moderado) FECHA_VALORACION: 31/10/2016 GESTORA: Bankia Pensiones, S.A., EGFP DEPOSITARIO: Bankia S.A. COD. ISIN NOMBRE VALOR ES00000123Q7 ES00000124B7 ES00000124V5 ES00000126W8 IT0004867070 IT0004957574 IT0005030504 ES0378641130 ES0378641171 ES0378641189 ES0378641197 ES00000121A5 ES00000121L2 ES00000121O6 ES00000122D7 ES00000123B9 ES00000123K0 ES00000123U9 ES00000124W3 ES00000126A4 ES00000127C8 ES00000128B8 ES0000101396 IT0004489610 ES0378641155 BN. ESTADO 4.5% VTO. 01/18 BN. ESTADO 3.75% VTO. 10/18 BN. ESTADO 2.75% VTO. 04/19 BN. ESTADO LIGADO A INFLACION 0.55% VTO. 11/19 BN. ESTADO ITALIANO 3.50% VTO. 11/17 BN. ESTADO ITALIANO 3.50% VTO. 12/18 BN. ESTADO ITALIANO 1.50% VTO. 08/19 BN. FADE 4.125% VTO. 03/17 BN. FADE 3.375% VTO. 03/19 BN. FADE 2.25% VTO. 12/16 BN. FADE 1.875% VTO. 09/17 OB. ESTADO 4.10% VTO. 07/18 OB. ESTADO 4.60% VTO. 07/19 OB. ESTADO 4.30% VTO. 10/19 OB. ESTADO 4% VTO. 04/20 OB. ESTADO 5.50% VTO. 04/21 OB. ESTADO 5.85% VTO. 01/22 OB. ESTADO 5.40% VTO. 01/23 OB. ESTADO 3.80% VTO. 04/24 OB. ESTADO LIGADO A INFLACION 1.80% VTO. 11/24 OB. ESTADO LIGADO A INFLACION 1% VTO. 11/30 OB. ESTADO 0.75% VTO. 07/21 OB. COMUNIDAD MADRID 4.688% VTO. 03/20 OB. ESTADO ITALIANO 4.25% VTO. 09/19 OB. FADE 3,875% VTO. 03/18 TOTAL EFECTOS PÚBLICOS BN. SANTANDER INTERNAT DEBT 4% VTO. 03/17 BN. SANTANDER INTERNAT DEBT 1.375% VTO. 03/17 BN. INTESA SANPAOLO 4.375% VTO. 10/19 BN. SANTANDER CONSUMER FIN. 1.1% VTO. 07/18 BN. BBVA SENIOR FINANCE 3.75% VTO. 01/18 CED. HIP. BBVA 3.5% VTO. 12/17 CED. BANCO POPULAR 3.5% VTO. 09/17 CED. BANCO POPULAR 4.125% VTO. 03/17 CED. CAIXA CATALUÑA 4.875% VTO. 06/17 CED. AYT CAJA GLOBAL 4% VTO. 03/17 OB. BARCLAYS BANK 4.00% VTO. 10/19 TOTAL FINANCIERO BN. ENEL 4.875% VTO. 02/18 TOTAL ELÉCTRICAS OB. REPSOL INTL FINANCE 4.875% VTO. 02/19 XS0759014375 XS1046276504 XS0842828120 XS1264601805 XS0872702112 ES0413211782 ES0413790314 ES0413790173 ES0414840308 ES0312298112 XS0456178580 IT0004794142 XS0733696495 VALOR DE MERCADO 141.984,51 2.274.896,50 1.333.435,22 7.319.107,25 1.053.854,89 6.352.137,79 33.681.719,35 1.562.350,68 2.088.332,16 204.474,13 4.791.181,29 392.605,86 1.462.035,15 5.528.180,00 4.977.741,85 286.472,18 22.641.171,52 7.276.050,90 892.962,94 10.425.877,17 5.345.648,09 5.144.804,79 1.881.513,82 134.555,30 7.221.966,71 134.415.060,05 208.034,08 9.735.241,64 4.446.431,23 9.681.096,03 16.115.072,95 7.395.854,74 4.868.281,25 6.978.840,23 3.148.234,93 1.352.257,33 1.685.895,21 65.615.239,62 13.678.603,75 13.678.603,75 3.427.095,49 1 COD. ISIN XS0326230181 US87938WAQ69 XS0462999573 XS0907289978 XS0934042549 LU0034353002 FR0010037234 LU0177222394 LU0482270666 LU0156671504 LU0646914142 IE00B3DS7666 LU0151325312 FR0010830844 IE00BH3WKV28 LU0141799097 FI0008800511 LU0192064839 ES0113307021 ES0113211835 ES0113900J37 GB0008706128 FR0000131104 DE0008404005 FR0000130809 NL0000303709 IT0000072618 ES0113056008 ES06139009O4 ES0118900010 ES0618900981 DE000ENAG999 IT0003128367 FR0010208488 ES0132945017 DE0007236101 FR0010220475 IT0003132476 GB00B03MLX29 NOMBRE VALOR TOTAL PETRÓLEO BN. DSM 5.25% VTO. 10/17 TOTAL QUIMICO BN. TELEFONICA EMISIONES 3.192% VTO. 04/18 OB. TELEFONICA EMISIONES 4.693% VTO. 11/19 OB. TELEFONICA EMISIONES 3.961% VTO. 03/21 OB. TELEFONICA EMISIONES 2.736% VTO. 05/19 TOTAL COMUNICACIÓN PT. DWS FLOATING RATES NOTES (RENDGAR LX) PT. LYXOR ETF EUROMTS 3-5Y (FR) (MTB FP) PT. SCHRODER ISF- EMRG MRKTS DEBT ABS RTRN-CAC¿ (SCHEMEC LX) PT. AXA WF-GLOBAL INFLATION BONDS I-R-¿ (AXAGIRE LX) PT. CANDRIAM BONDS - EURO SHORT TERM- I- C (DEXESTI LX) PT. ARCANO FUND - EUROPEAN INCOME FUND I- IBA (AREIIBA LX) PT. BLACKSTONE GSO EUROPEAN SENIOR LOAN-A (HCMLOAA ID) PT. CANDRIAM BONDS - CREDIT OPPORTUNITIES- I- C (DEXHISI LX) PT. AMUNDI - AMUNDI 12M- I (AMTR12I FP) PT. MUZINICH LONG SHORT DRDIT YIELD- HEAANE (MLSHEAN ID) PT. NORDEA 1-EUR HGH YLD-BI-EUR (NIMEHYB LX) PT. EVLI SHORT CORP BOND-B (EVLEBFB FH) PT. UBAM-CORPORATE USD BD-IHCE (UBCIHCE LX) TOTAL INVERSION INDIRECTA TOTAL RENTA FIJA AC. BANKIA (BKIA SM) AC. B.B.V.A (BBVA SM) AC. BANCO SANTANDER (SAN SM) AC. LLOYDS BANKING GROUP (LLOY LN) AC. BNP-PARIBAS (BNP FP) AC. ALLIANZ (ALV GR) AC. SOCIETE GENERALE (GLE FP) AC. AEGON NV (AGN NA) AC. INTESA SANPAOLO (ISP IM) AC. BANCO MARE NOSTRUM (8186084Z SM) DR. BANCO SANTANDER 10/16 (SAN/D SM) TOTAL FINANCIERO AC. FERROVIAL (FER SM) DR. FERROVIAL 10/16 (FER/D SM) TOTAL CONSTRUCCIÓN AC. E.ON (EOAN GR) AC. ENEL (ENEL IM) AC. ENGIE (ENGI FP) TOTAL ELÉCTRICAS AC. TUBACEX (TUB SM) AC. SIEMENS (SIE GR) AC. ALSTOM (ALO FP) TOTAL INDUSTRIAL AC. ENI (ENI IM) AC. ROYAL DUTCH SHELL -A (RDSA NA) VALOR DE MERCADO 3.427.095,49 158.027,05 158.027,05 3.732.218,30 5.306.982,91 1.175.676,00 2.369.924,99 12.584.802,20 8.434.518,81 6.802.307,25 8.589.091,88 8.694.273,73 8.411.252,67 4.343.224,91 8.182.902,98 4.587.482,12 5.034.088,60 5.421.624,40 7.320.806,80 8.508.046,63 5.857.961,96 90.187.582,74 320.066.410,90 2.360.079,89 5.028.374,49 60.654,40 3.000.256,09 4.912.904,68 3.992.330,00 533,40 128.704,85 3.021.211,94 784.774,62 687,74 23.290.512,10 7.730.882,83 170.101,23 7.900.984,06 2.068.320,00 7.084.604,24 3.576.778,72 12.729.702,96 486.146,90 99.312,00 4.347.609,37 4.933.068,27 3.509.223,29 3.823.410,18 2 COD. ISIN FR0000120578 ES0109659013 ES0178430E18 FR0000133308 IT0003497168 FR0000120404 DE0005439004 JP3359600008 NL0000009538 FI0009000681 US02079K3059 ES0105025003 US78462F1030 US4642872349 FR0007054358 LU0278093082 FHTTPZ600104 FUTECZ211212 FHTESZ600108 FUTRPZ617988 FHTHGZ622335 WZZ600000033 DE2229652669 FHTVODH19128 FUTZM4000117 ES0126404039 IE00BLP5S791 ES0170457032 ES0108904030 ES0177043033 ES0161855038 ES0147557039 NOMBRE VALOR TOTAL PETRÓLEO AC. SANOFI (SAN FP) AC. AB-BIOTICS (ABB SM) TOTAL QUIMICO AC. TELEFONICA (TEF SM) AC. ORANGE (ORA FP) AC. TELECOM ITALIA (TIT IM) TOTAL COMUNICACIÓN AC. ACCOR (AC FP) AC. CONTINENTAL (CON GR) AC. SHARP CORP (6753 JP) TOTAL DISTRIBUCION AC. PHILIPS (PHIA NA) AC. NOKIA (NOKIA FH) AC. ALPHABET - A (GOOGL US) TOTAL TECNOLOGIA AC. MERLIN PROPERTIES SOCIMI (MRL SM) TOTAL INMOBILIARIO PT. S & P 500 (SPY US) PT. ISHARES MSCI EMERGING MARKETS ETF (EEM US) PT. LYXOR ETF DJ EURO STOXX 50 (FR) (MSE FP) PT. VONTOBEL FUND - EMERGING MARKETS EQUITY- I (VONEMJA LX) TOTAL INVERSION INDIRECTA TOTAL RENTA VARIABLE FUT. TOPIX VTO. DEC 16 (TPZ6) FUT. EURO / USD VTO. DIC 16 (ECZ6) FUT. S & P 500 EMINI VTO. DEC 16 (ESZ6) FUT. EURO / GBP VTO. DEC 16 (RPZ6) FUT. STOXX 600 HEALTHCARE VTO. DEC 16 (HGZ6) FUT. EUROSTOXX TELECOMMUNICATIONS VTO. DEC 16 (WZZ6) FUT. DJ EURO STOXX 50 VTO. DEC 16 (VGZ6) FUT. VODAFONE VTO. DIC 16 (VODH=Z6) FUT. FTSE 100 IDX VTO. DEC 16 (Z=Z6) TOTAL PRODUCTOS DERIVADOS DEPOSITO BANKIA 0.20% VTO. 01.02.2017 DEPOSITO BBVA 0.15% VTO. 23.02.2017 DEPOSITO BANCO SANTANDER 0.21% VTO. 20.02.2017 DEPOSITO BANCO SANTANDER 0.13% VTO. 26.04.2017 DEPOSITO BANCO SANTANDER 0.13% VTO. 12.05.2017 DEPOSITO BANCO CAMINOS 0.30% VTO. 28.06.2017 TOTAL DEPOSITOS PT. DIANA I, FCR PT. OLD MUT GB EQY ABS RE-IEURHA (OMEIEHA ID) PT. BARING IBERIA II, FCR PT. ALTAMAR BUYOUT EUROPA FCR PT. ALTAMAR BUYOUT GLOBAL II FCR PT. MCH IBERIAN CAPITAL FUND II FCR PT. PORTOBELLO CAPITAL FUND II , FCR VALOR DE MERCADO 7.332.633,47 3.409.415,12 305.674,56 3.715.089,68 5.875.099,60 4.131.078,00 3.709.722,43 13.715.900,03 6.251.792,11 3.927.375,00 534.990,87 10.714.157,98 5.377.217,20 3.165.729,80 8.126,33 8.551.073,33 10.385.930,24 10.385.930,24 3.039.059,79 4.166.943,35 35.225.470,00 8.604.047,59 51.035.520,73 154.304.572,85 9.337.998,78 32.821.695,70 11.119.743,68 7.872.365,93 7.859.090,00 3.048.550,00 34.437.840,00 9.139.836,70 8.961.578,77 124.598.699,56 34.050.847,33 25.025.781,59 50.073.332,53 5.003.347,02 5.003.044,25 6.006.158,32 125.162.511,04 416.847,84 4.225.017,12 448.263,79 3.332.151,12 10.706.482,68 667.804,05 81.481,24 3 COD. ISIN NOMBRE VALOR ES0109933038 ES0124162035 CAPITALRIES4 GB00B1VMD022 LU0490769915 LU0095623541 FR0010760694 ES0175444035 IE00B3TH3V40 DE0009802314 DE000A0CARS0 LU0227384020 ES0180660039 FR0010362988 LU0210282827 IE00B1TQ1T17 IE00BN8SY486 IE00B7WC3B40 IE00B4Z6MP99 LU0372181205 PT. ARCANO CAPITAL I, FCR PT. CORPFIN CAPITAL FUND III, FCR PT. FONDINVEST VII CAPITAL FCR PT. M&G OPTIMAL INCOME - C- EUR- A (MGOICEA LN) PT. HENDERSON GARTMORE - UK ABSOLUTE RET-I¿ AH (GAUKARI LX) PT.JPM INV-JPM GLBL MAC OPP-C EUR (JPMECAC LX) PT. CANDRIAM LONG SHORT CREDIT- C (DEXLSCC FP) PT. SEGURFONDO INVERSION FII (SEGUINV SM) PT. BNY MELLON- ABSOLUTE RETURN EQUITY- ¿TH (BAREETH ID) PT. SEB IMMOPORTFOLIO TARGET RETURN (SEBIPTR GR) PT. KANAM SPEZIAL GRUNDINVEST FONDS (KANSPGF GR) PT. NORDEA 1- STABLE RETURN- BP ¿ (NABSRBE LX) PT. BBVA CAPITAL PRIVADO FCR PT. LODH PRIVATE EQUITY- EURO CHOICE III, FCPR PT. AVIVA INVESTORS CENTRAL EUROPEAN PROPERTY FUND PT. GREFF GLOBAL REAL ESTATE FUND OF FUNDS-B¿ PT. BLACKSTONE DIVERSIFIED MULTI-STRAT- I ¿ ACC (BXDMSIE ID) PT. TRAD FD-F&C RE EQ L/S-BEA (TFREEUB ID) PT. BNY MELLON GL-GLOBAL REAL RETURN E-CA (BNGRRCE ID) PT. PIONEER FUNDS-ABS RT MS-IAE (PABEEIA LX) TOTAL OTROS TOTAL CARTERA DE VALORES VALOR DE MERCADO 5.358.534,95 644.227,52 1.783.348,38 1.601.462,34 12.732.542,69 16.006.906,97 291.824,16 635.464,62 6.362.763,72 561.533,54 1.136.704,12 16.212.505,58 902.615,40 1.463.722,74 11,84 988.889,95 5.732.999,93 4.167.226,51 12.209.890,59 12.621.362,92 121.292.586,31 845.424.780,66 4