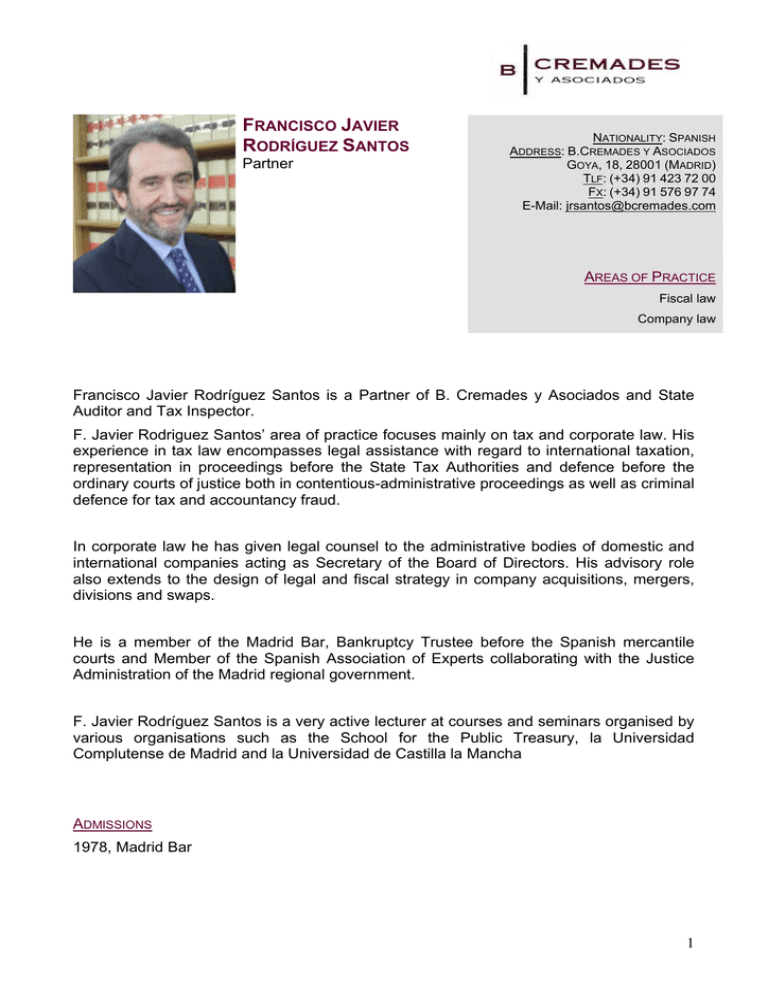

1 FRANCISCO JAVIER RODRÍGUEZ SANTOS Partner Francisco

Anuncio

FRANCISCO JAVIER RODRÍGUEZ SANTOS Partner NATIONALITY: SPANISH ADDRESS: B.CREMADES Y ASOCIADOS GOYA, 18, 28001 (MADRID) TLF: (+34) 91 423 72 00 FX: (+34) 91 576 97 74 E-Mail: jrsantos@bcremades.com AREAS OF PRACTICE Fiscal law Company law Francisco Javier Rodríguez Santos is a Partner of B. Cremades y Asociados and State Auditor and Tax Inspector. F. Javier Rodriguez Santos’ area of practice focuses mainly on tax and corporate law. His experience in tax law encompasses legal assistance with regard to international taxation, representation in proceedings before the State Tax Authorities and defence before the ordinary courts of justice both in contentious-administrative proceedings as well as criminal defence for tax and accountancy fraud. In corporate law he has given legal counsel to the administrative bodies of domestic and international companies acting as Secretary of the Board of Directors. His advisory role also extends to the design of legal and fiscal strategy in company acquisitions, mergers, divisions and swaps. He is a member of the Madrid Bar, Bankruptcy Trustee before the Spanish mercantile courts and Member of the Spanish Association of Experts collaborating with the Justice Administration of the Madrid regional government. F. Javier Rodríguez Santos is a very active lecturer at courses and seminars organised by various organisations such as the School for the Public Treasury, la Universidad Complutense de Madrid and la Universidad de Castilla la Mancha ADMISSIONS 1978, Madrid Bar 1 EDUCATION Universidad Autónoma de Madrid. Degree in Law, 1978 Centro de Estudios Constitucionales. Diploma in Constitutional Law and Political Science, 1980. LANGUAGES Francisco Javier Rodríguez is fluent in Spanish, French and English PUBLICATIONS F. Javier Rodriguez Santos is author and co-author of numerous books and articles on doctrine. His most important publications include the following: Books FISCALIDAD FINANCIERA Y BURSATIL. Editorial CISS, Valencia, 1993 MANUAL DEL IMPUESTO SOBRE SUCESIONES Y DONACIONES. Editorial CISS, Valencia, 1993 MANUAL DEL IMPUESTO SOBRE LA RENTA DE LAS PERSONAS FISICAS Y DEL IMPUESTO SOBRE EL PATRIMONIO. Editorial del Instituto de Estudios Fiscales, Madrid, 1995 THE TAXATION OF PRIVATE INVESTEMENT, A EUROPEAN GUIDE. Editorial EIFAPM, Geneva Switzerland, 1995 MANUAL DE FISCALIDAD INTERNACIONAL, Editorial del Instituto de Estudios Fiscales, Madrid, (2001, 2004 y 2007) ESTUDIOS SOBRE FISCALIDAD INTERNACIONAL Y COMUNITARIA, Editorial del Centro Internacional de Estudios Fiscales de la Universidad de Castilla la Mancha, Madrid, 2.005 EL IMPUESTO SOBRE SOCIEDADES Y SU REFORMA PARA 2007, Editorial Thomson Civitas, Madrid, 2.006 EL IMPUESTO SOBRE SOCIEDADES. Editorial Thomson Reuters Civitas, Madrid, 2.010 Articles ASPECTOS DE LA TRIBUTACION DE LOS DOCUMENTOS MERCANTILES, En “Crónica Tributaria”. Número 65, Instituto de Estudios Fiscales, Madrid. 1.993 LA SUSPENSION DE LOS ACTOS DE LIQUIDACION TRIBUTARIA SIN PRESTACION DE GARANTIAS En “Actualidad Tributaria”, número 33. Editorial Actualidad Editorial, S.A. Madrid, 1.995 LOS PRESTAMOS PARTICIPATIVOS. En “Crónica Tributaria”, numero 81, Editorial del Instituto de Estudios Fiscales, Madrid 1997 2